What is the percentage-of-sales method?

The percentage-of-sales method is a financial forecasting model that assesses a company’s financial future by making financial forecasts based on monthly sales revenue and current sales data.

Income accounts and balance sheet items, like accounts receivable (AR) and cost of goods sold (COGS), are analyzed to determine the percentage they contribute to total sales.

Say you’re hosting a party and you want to work out how many refreshments you’ll need based on when you’ve hosted before. You’d look at how many guests you had over, how many food and drinks you needed, and what kind of delectable dishes you’d be serving.

The percentage-of-sales method works just like that. It looks at the financial statements to find the expenses and assets that can predict future financial performance, relying on accurate historical data to make the future forecasted sales work.

Percentage-of-sales method example

For example, if current revenue is $100,000, COGS is $50,000 (50%), and revenue is projected to be $200,000 next year, then the percentage-of-sales method would project the cost of goods sold to increase to $100,000—maintaining the 50% percent of sales.

If you want to make financial planning decisions based on your business’s historical performance, then the percentage-of-sales method is your new best friend.

It’s a useful forecasting tool for accurate budgets because it builds forecasts on key financial items like revenue, expenses, and assets, so companies can ensure the right amount of money goes to each department.

That also makes it handy for working out in the forecasted financial statements what’s performing well and what isn’t, and by extension setting financial goals for the company.

It’s also useful for risk management as it helps anticipate any financial challenges on the horizon, giving companies enough time to change course or correct any errors.

So it’s not just a nice-to-have in your financial arsenal—it’s a necessity.

Benefits of the percentage-of-sales method

Why use the percentage-of-sales method?

Here are three big benefits:

Accessible to use

The best part of this method is it doesn’t need loads of data to work, just the prior sales and a calculator (or software, if you want to make life easier).

That makes it an accessible forecasting method for less experienced business owners.

Quick to perform

It’s a quicker method because of its simplicity, so some businesses prefer it to other, more complex techniques.

That’s also the reason why it’s relatively easy to update with new historical sales data as it comes through.

Easy to compare across businesses

Because the percentage-of-sales method uses common financial ratios and percentages, it’s a good tool for quickly comparing how a company is doing compared to its competitors or the wider market.

Drawbacks of the percentage-of-sales method

Not every business model suits this forecasting method.

Here are some of the reasons the percentage-of-sales method might not be for you.

Historical data is less reliable for fast-growing companies

For example, if a company is small and growing rapidly, its sales data might become out of date much quicker than a more mature business.

As a result, its historical data wouldn’t accurately represent its future performance.

Changes in operational structures make historical data less accurate for forecasting

But even for bigger companies, the percentage-of-sales method may not work as well if they’ve had a big change in operations or structure that’s taken place to drive more sales.

The old data won’t take into account any big new changes so the results wouldn’t be particularly useful.

Not useful for non-sales items

Because the percentage-of-sales method works closely with data from sales items, it’s not the best forecasting method for things like fixed assets or expenses.

It also can’t consider other financial changes like future bad debts that might impact sales.

So it’s not a perfect metric, but for those businesses that use it, the percentage-of-sales method can be a useful predictor of future sales revenue.

If you want a more accurate view of the company’s financial health, then the percentage-of-sales method can form part of a more detailed financial outlook statement.

Balance sheet items

To get an accurate forecast, you need anything that directly relates to sales on the income statement—anything else won’t give an accurate look at the finances. Some examples would include:

- Inventory

- Cash

- Net income

- Accounts receivable

- Cost of goods sold

Improve the percentage-of-sales forecasting with accounts receivable to sales ratio

The accounts receivable to sales ratio measures a company’s liquidity by determining how many sales are happening on credit. The business could run into short-term cash flow problems if the ratio is too high. For this reason, it’s an important additional ratio to consider when running a percentage of the sales forecast.

Lenders also find this to be a useful metric for determining how much external financing a business can reasonably pay back.

The ratio is simple to work out:

Accounts receivable to sales ratio = (accounts receivable / sales) x 100

Let’s see it in action with a local electronics store that offers credit sales for its customers. If the store had $20,000 in credit sales and the accounts receivable show $5,000 outstanding at the end of the month, we can now calculate the ratio:

Accounts receivable to sales ratio = ($5,000 (accounts receivable) / $20,000 (sales)) x 100 = 25

Tracking the ratio is helpful for financial analysis as the store might need to change its credit sales policy or collections process if the ratio gets too high. Sorry, would-be laptop purchasers.

Step-by-step of the percentage-of-sales method

Time for the student to become the master. For the percentage-of-sales method, you need the historical goods sold sales percentage and the other relevant percentages based on past sales behavior.

Then you apply these percentages to the current sales figures to create a financial forecast, which includes the income and spending accounts. Easy peasy.

Here’s the percentage-of-sales method formula you need for calculations:

Forecasted financial item = Historical percentage relationship x Projected sales

Let’s implement that in the steps below, using that electronics store from earlier.

Get the figures together

Time for the electronic store’s owner to sit down with a cup of coffee and look at the relevant sales data. The business owner also needs to know how much they expect sales to increase to get the calculations going.

Not every balance sheet item is directly related to sales. Most business owners will want to forecast things like cash, accounts receivable, accounts payable and net income.

Calculate the percentages

Onto the most important bit. The store owner needs to look at each line item on the financial statement and work out the percentage in relation to revenue.

Say Jim runs a retail running shoe store, and has the following line items he wants to forecast.

Revenue: $250,000

Cash: $25,000

Cost of goods sold: $100,000

Inventory: $25,000

Accounts receivable: $7,000

Net income: $50,000

First, Jim needs to work out the percentage that each of these line items represents relative to company revenue.

Revenue: $250,000

Cash: ($25,000/$250,000) x 100 = 10%

Cost of goods sold: ($100,000/$250,000) x 100 = 40%

Inventory: ($25,000/$250,000) x 100 = 10%

Accounts receivable: ($7,000/$250,000) x 100 = 2.8%

Net income: ($50,000/$250,000) x 100 = 20%

Now Jim has the percentages, he can estimate his sales for next year, and apply them to each line item to get a rough idea of what each of them will look like. Say for example that Jim believes he can increase company revenue (sales) to $400,000 next year.

He would then apply those percentages to $400,000, rather than the $250,000 from this year.

Projected Revenue: $400,000

Projected Cash: $400,000 x 10% = $40,000

Projected Cost of goods sold: $400,000 x 40% = $160,000

Projected Inventory: $400,000 x 10% = $40,000

Projected Accounts receivable: $400,000 x 2.8% = $11,200

Projected Net income: $400,000 x 20% = $80,000

Other percentage methods

When the percentage-of-sales method doesn’t cut it, there are a couple more ways to determine a business’ financial outlook.

The credit sales method

Companies with credit sales will want to keep tabs on their accounts receivable to ensure bad or aged debt isn’t building up. This method just focuses on accounts receivable and can complement the percentage-of-sales calculations.

A business would need to forecast the accounts receivable or credit sales using the available historical data. Understanding how quickly customers pay back credit sales over different periods, such as 30, 60, and 90 days, also helps.

Multiplying the forecasted accounts receivable with the historical collection patterns will predict how much is expected to be collected in that time period.

The percentage of receivables method

This takes the credit sales method a step further by calculating roughly how much a company can expect not to be paid back from customers if they haven’t paid their credit sales after 90 days.

It’s a similar approach to before. Reviewing historical data of uncollectible accounts and the industry benchmark for bad debt expenses can work out the percentage needed for the forecast.

Multiply the total accounts receivable by the historical uncollected accounts percentage to predict how much these bad debts might cost for the time period.

Checking up to see how the actual figure is progressing against the predicted one helps to manage accounts receivable accordingly and tighten collection processes for businesses. Not a bad day’s work for one (hopefully small) percentage.

Conclusion: all about the percentage-of-sales method

Now you know all about the percentage-of-sales method.

How to use it.

When it's best.

And even its shortcomings.

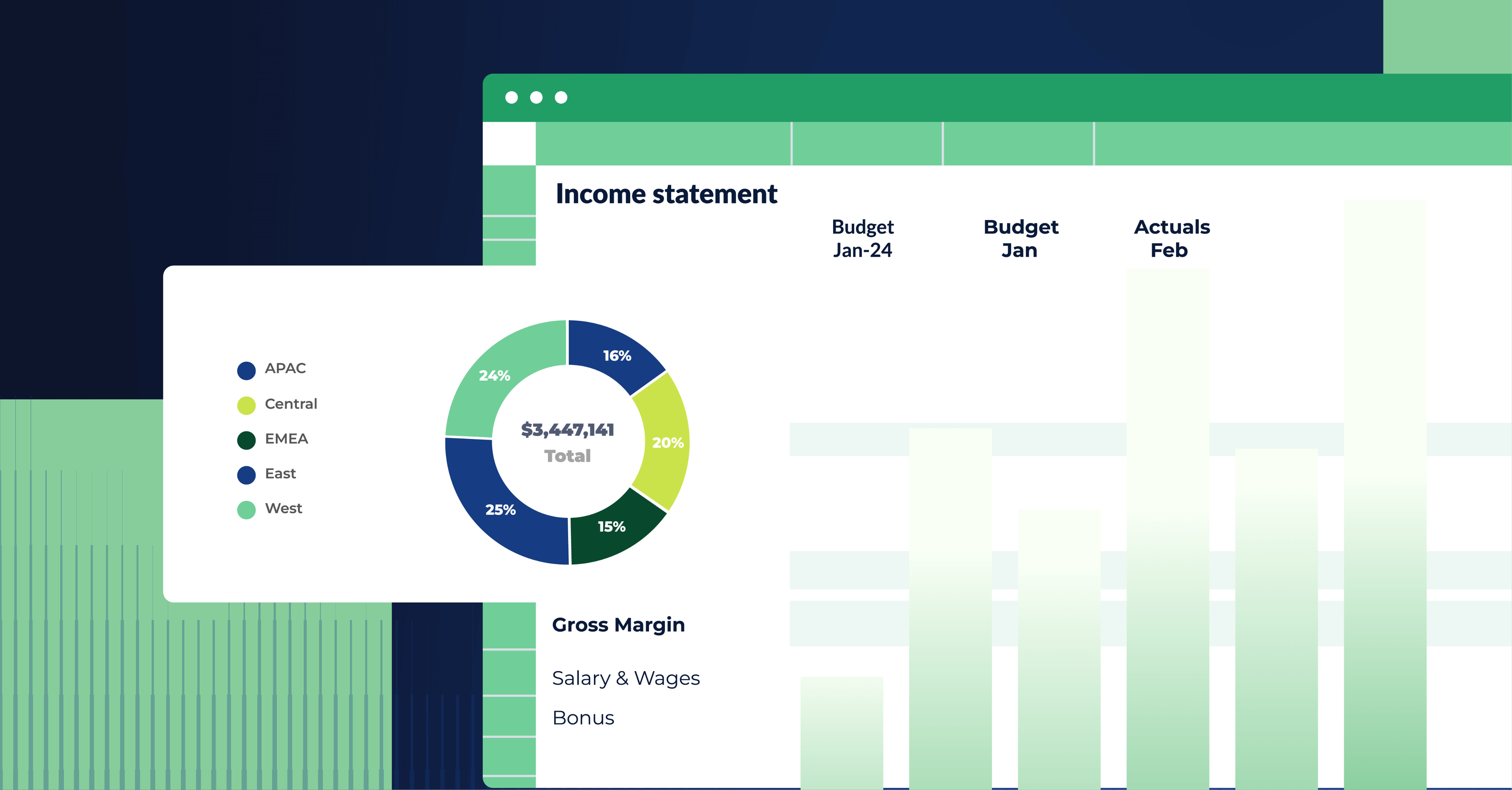

But did you know that Cube can help you forecast better?

Cube integrates with your source systems and sits natively in Excel, so it's easy to learn and use.

And Cube's scenario manager makes it easy to create multiple scenarios and forecasts.

Plus, implementation time is easy: most customers are up and running within 2 weeks.

Sound intriguing?

Click the button below to request a free demo with Cube today.

.png)

.png)