How does financial statement software work?

Financial statement software allows a business to automate financial data collection and track trends that may impact the overall business goals.

The software manages the flow of information between cash flow statements, income statements, and balance sheets. Plus, it crunches numbers, analyzes data, and checks for errors across financial statements organization-wide.

The best platforms can produce both financial statements and supportive analysis that provide visibility and insight into the workings of their business.

Benefits of financial statement software

Whether you’re a small business or an enterprise, financial statement software can optimize your financial planning & analysis and reporting processes. These platforms support:

Financial statement automation

With financial statement software, you can automate the recording of financial transactions and generate and manage financial statements such as your cash flow and income statement.

You’ll have access to financial statement templates and formats that you can customize to fit your business needs.

Automating those time-consuming manual daily tasks allows you to speed up your accounting and have more time to focus on analysis and decision-making.

Consolidated data

Having your financial information spread across multiple Excel sheets or financial management software means you’re more likely to get confused and make errors while preparing your financial statement.

Financial statement software, however, can integrate with all your financial information sources, allowing you to consolidate all data on a centralized platform that you can access anytime.

Consolidated data also gives you better visibility over your operations and lets you draw insights faster to inform your decision-making.

Fewer repetitive tasks

Let’s say you’ve made a sale. You must record it in different financial statements, such as journals, income statements, and sales reports.

With financial statement software, you only need to enter this sales information once, and the software will automatically update it across all relevant statements.

This reduces the need to do certain accounting tasks repeatedly and ensures consistency and accuracy across all your financial records and statements.

Informed financial decisions

Financial statement software lets you maintain up-to-date and accurate financial records on a consolidated platform.

This means you always have insights into your current financial health and positions. You can easily compare actual information in your records to business budgets you’ve created and assess whether you’re on track.

With all relevant information at your fingertips, you can make informed, data-driven decisions about budgeting, expenses, investments, and strategic planning.

Must-have features of financial statement software

Financial statement software has different features depending on who or what it’s built for. For example, software built for small businesses may not have a cash flow feature, as smaller organizations tend not to prepare a breakdown of cash flows.

Regardless, there are certain features that financial statement software must have. They are:

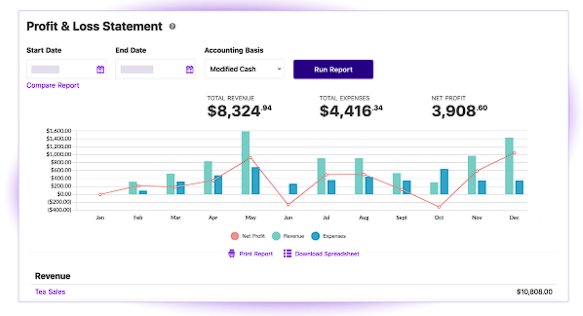

Financial statement, balance sheet, and income statement creation

Financial statement software must be able to create comprehensive reports such as the financial statement, balance sheet, and income statement. These are basic reports that every business needs to prepare.

You should also check that the software allows you to use custom calculations and modify rows or columns in these financial statements so that the information in the statements fits your business needs.

After covering these basic features, you might want to check that the software is flexible and scalable enough to accommodate other business tools you might need, such as forecasting and budgeting.

Custom dashboards and reports

Custom dashboards and reports let you determine your view of financial data. With dashboards, you can create personalized interfaces of key metrics, graphs, and charts that answer questions you have about your business.

For example, if you want to see whether your sales have increased or decreased over the months, you can easily do that with a custom dashboard. Reports let you generate and share detailed analyses or comparisons of financial statements.

This feature supports decision-making and helps you easily communicate business performance to your stakeholders.

Advanced analytics

With advanced analytics, you can gain deeper insights into your financial performance, health, and position. It goes beyond basic financial reporting, allowing you to see current patterns and forecast future performance more accurately.

Your software should offer trend analysis, predictive financial modeling, scenario planning, and more.

This helps you optimize the usage of business resources like cash and inventory and improve your overall business financial health.

Best financial statement software tools

There are a lot of great financial statement software tools out there, so we decided to do some of this initial research for you so you can plan for the financial success of your business in the most effective way.

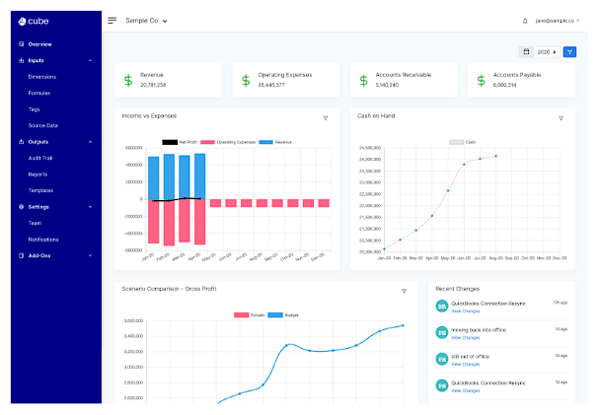

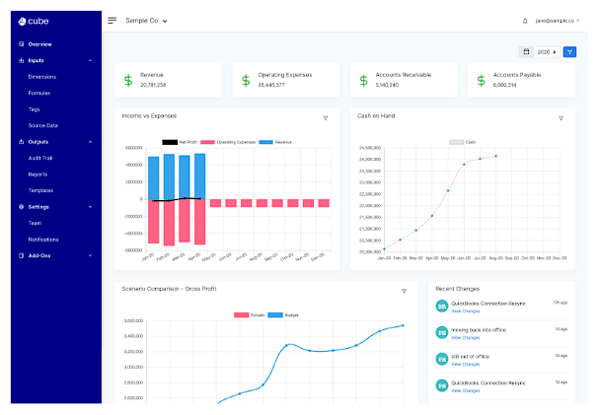

1. Cube

Cube is the first spreadsheet-native FP&A platform that empowers teams to drive better planning and performance without changing how they work. Our cloud-based FP&A software platform helps finance teams work anywhere—we integrate natively with both Excel and Google Sheets—so that they can plan, analyze, and collaborate with the ultimate speed and confidence.

Many high-growth companies (like Masterworks and Novo) use Cube for their FP&A needs.

FP&A teams already know and love spreadsheets. Cube simplifies many of the challenges around creating accurate, timely financial statements—this lets teams accelerate their reporting processes.

Key features:

- Automated data consolidation: Connect data from numerous sources for automated rollups and drilldowns.

- Multi-scenario analysis: Seamlessly model how changes to key assumptions affect overall outputs.

- Endless integrations: Leverage Native integrations for spreadsheets (Google and Excel), accounting & finance, HR, ATS, billing & operations, sales & marketing, and business intelligence.

- Customizable dashboards: Build and share customizable dashboards.

- Native Excel and Google Sheets integration: Access bi-directional integration with Excel and Google Sheets.

- Multi-currency support: Evaluate your financials in both your local and reporting currencies.

- User-based controls: Ensure the correct data goes to the right people at the right time with user controls, validations, and an audit trail.

- Centralized formulas and KPIs: Store all your calculations in a central location and manage from a single source of truth.

- Drilldown and audit trail: Get straight to the transactions and history behind a single data cell in just one click.

➡️See all of our features here.

Pricing:

For: Mid-size and enterprise FP&A teams looking to save time and grow. Cube also works for hyper-growth SMBs who want a solution that will scale with their organization's complexity.

Curious to see if Cube is a fit for your organization?

Book your demo now.

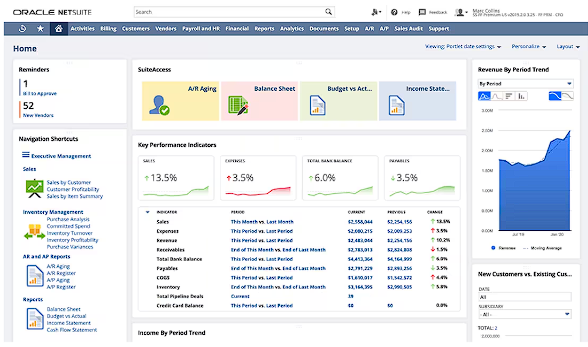

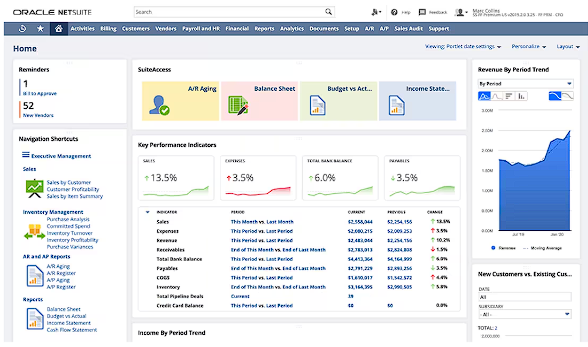

2. Oracle NetSuite

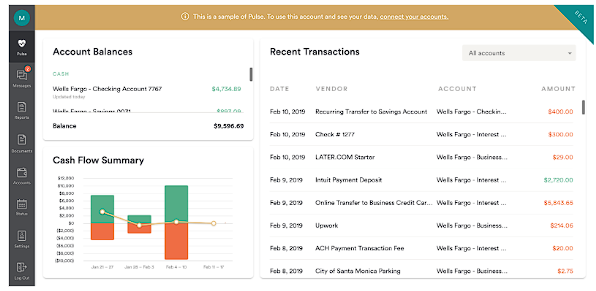

Oracle NetSuite is a cloud accounting software program that provides a complete view of financial performance and cash flow analysis.

With integrated financial, commerce, inventory management, CRM, and more integrated systems, Netsuite automates core processes and provides real-time insights into operational and financial performance.

For: Companies of any size that may need financial management software

Key features:

- Financial reporting: Use pre-configured KPIs, dashboards, and reports to generate insight into company performance.

- Revenue recognition: Create financial reports that comply with accounting standards on revenue recognition.

- Integrates with Cube: Leverage the Cube integration to optimize financial planning and analysis in your organization.

- Financial consolidation: Centralize the management of processes across multiple business units and locations.

Pricing: Pricing is not publicly available.

We're big fans of NetSuite, and so are many of our customers! Check out some of the best NetSuite integrations.

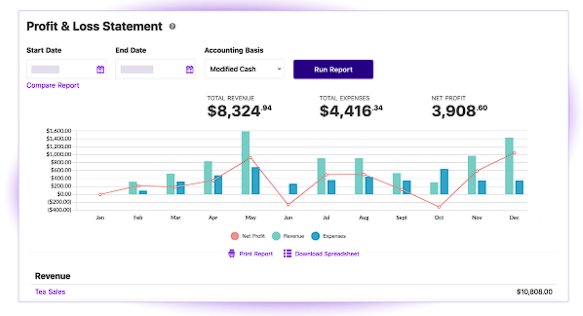

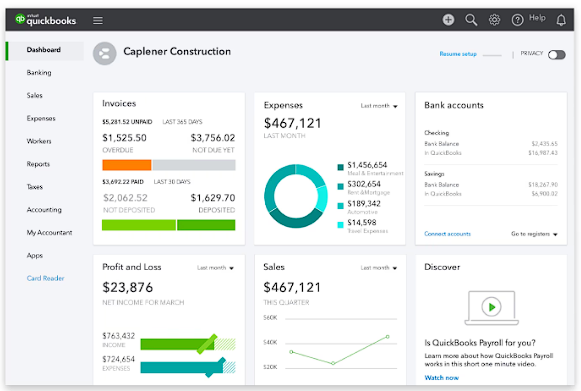

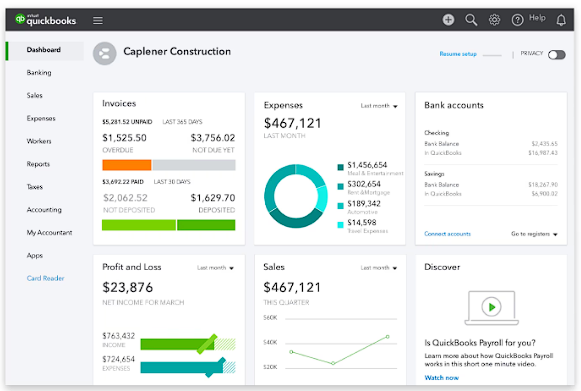

3. QuickBooks

QuickBooks is an accounting software that small businesses and freelancers use to create reports, collaborate, and build better business insights.

The software is easy to use and has features that help users manage their finances and transaction information.

It enables you to track expenses and cash flow, customize invoices, and run reports and receipts in one place.

For: Small businesses looking for accounting support

Key features:

- Free support: Take advantage of free user support for accountants.

- Integration with Cube: Integrate Cube financial software to streamline financial workflows.

- Secure cloud storage: Access business data in real-time and anywhere by storing data in the cloud.

Pricing:

- Simple Start: $30/month

- Essentials: $60/month

- Plus: $90/month

- Advanced: $200/month

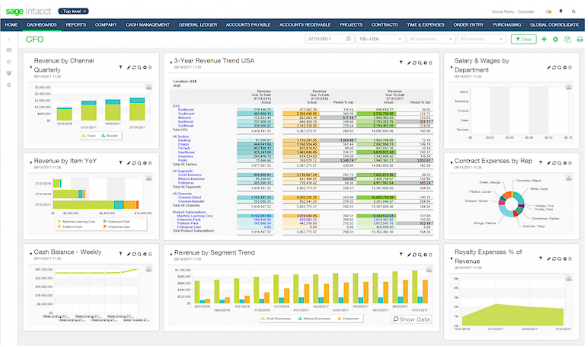

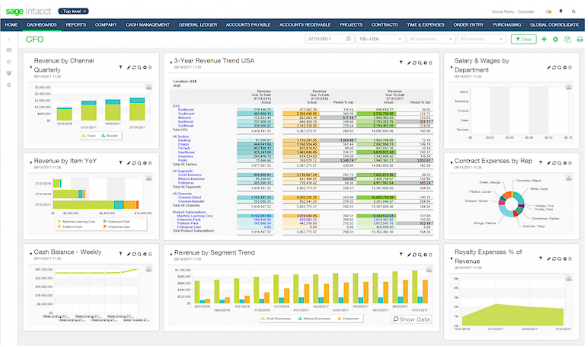

4. Sage Intacct

Sage Intacct is a cloud-based financial management and accounting software program. Their cloud financial management solution manages all core financials, providing professional services to ensure that Sage Intacct features are implemented.

Sage Intacct delivers a range of core accounting applications such as accounts payable and receivable, cash management, and a general ledger.

Users can also manage payments or connect to your bank feeds to eliminate manual data entry and simplify payment acceptances with automatic reconciliation. The features help track purchase orders, debts, late payments, and expenses.

For: Nonprofits, professional and financial services, healthcare, hospitality, wholesale distribution, construction, and real estate.

Key features:

- Accounts payable and receivable: Automate accounts payable, get paid faster, and manage your cash flow.

- Dashboards: Turn data into insights with customizable dashboards.

- Built-in reporting: Generate and share real-time reports with stakeholders.

Pricing: Pricing is not publicly available.

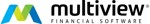

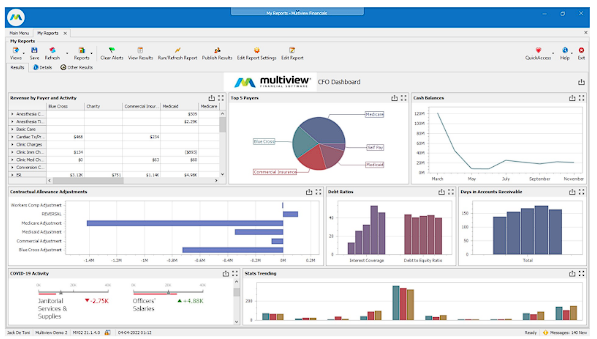

5. Multiview ERP

Multiview ERP is a scalable software program developed and sold by Multiview Financial Software. It offers a variety of integrated suites of financials, as well as a data warehouse and ViewSource 360, to help in the month-end process of financial planning.

For: Scaling businesses, organizations exceeding $6 million in annual revenue, and enterprise-size businesses across varying industries

Key features:

- Accounts payable and receivable: Gain control over payments, expenses, cash receipts, and customer credits.

- Budgeting and forecasting: Create budgets and forecast approval workflows and compare planned and actual results.

- Business intelligence: Use a customizable reporting structure to create multiple reports for departments.

Pricing: Pricing is not publicly available.

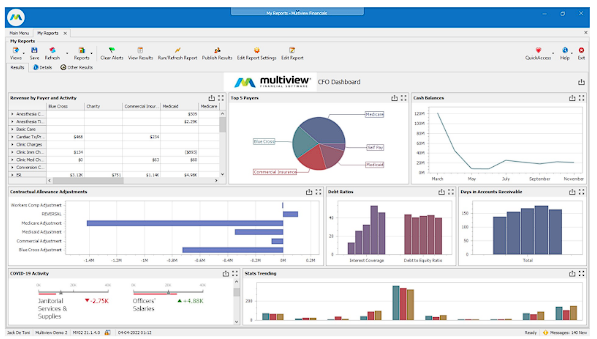

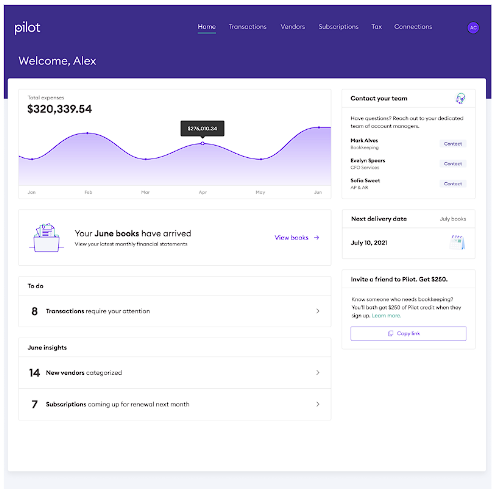

6. Pilot

Pilot aims to take care of your business finances (booking, tax, budgeting, and more) so you can focus on growth. With Pilot, you can work with a team of US-based finance experts that understand business.

Pilot integrates with your financial tech stack like QuickBooks, NetSuite, and more.

For: Startups, e-Commerce businesses, and professional services

Key features:

- Bookkeeping: Generate periodic financial statements for insights into the company’s financial health.

- Financial modeling: Create forecasts and financial models for various scenarios when making decisions.

- Tax management: Get a dedicated tax preparer to assist you while filing taxes.

- Revenue recognition: Prepare revenue reports according to accepted accounting standards.

Pricing:

- Starter: $499/mo

- Core: $699/mo

- Plus: Custom pricing

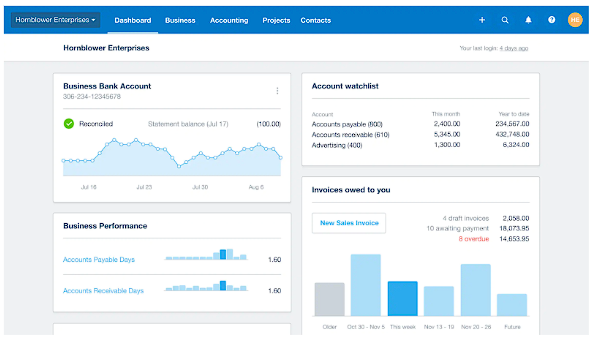

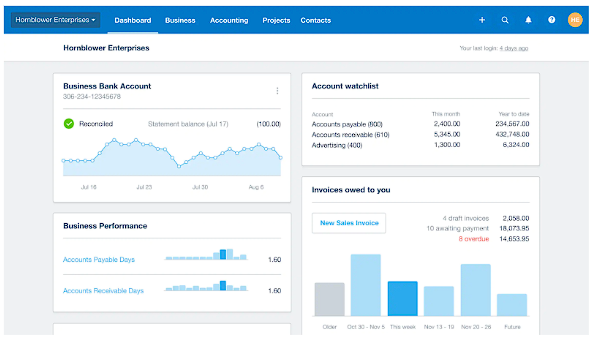

7. Xero

.png?width=150&height=75&name=xero-logo%20(1).png)

Xero aims to take care of your bills and invoices. It works to understand and manage your cash flow and get a view of what bills are due for what payments and which invoices are outstanding or paid.

Xero allows you to schedule payments, batch-pay suppliers, and pay multiple bills with one transaction.

For: Small and medium-sized businesses looking for support with accounting and bookkeeping

Key features:

- Helpful dashboard: Maintain oversights of daily finances, invoices, bills, etc, with the accounting dashboard.

- Approval workflow: Manage compliance workflows like client queries, accounting working papers, and customized work programs.

- Collaboration: Work together with all departments within the organization and clients to stay aligned on business outcomes.

- Integrate with Cube: Leverage the Cube integration to access FP&A tools.

Pricing:

- Early Plan: $15 monthly

- Growing Plan: $42 monthly

- Established Plan: $78 monthly

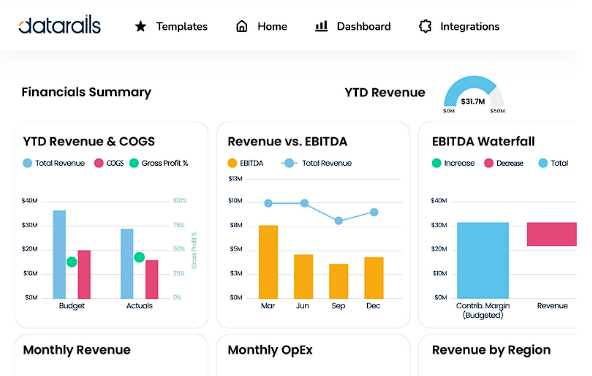

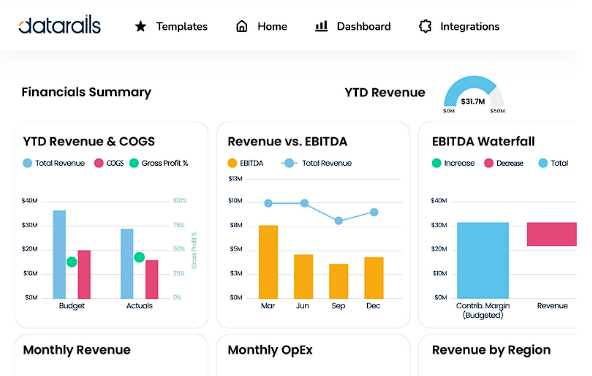

8. Datarails

Datarails is used to organize data for budgeting and forecasting. It estimates finances for future periods and plans operations accordingly based on the data.

Datarails keeps track of capital and operational expenses, tracks capital expenditures, and automates depreciation and amortization calculations.

For: Datarails is best for small and medium-sized businesses that only use Excel.

Key features:

- Financial reporting: Generate financial reports and share them with other teams.

- Data collection: Automate the data flow in your P&L, balance sheet, and cash flow statements.

- Dashboards: Visualize financial data with real-time dashboards integrated with your data sources.

Pricing: Pricing is not publicly available.

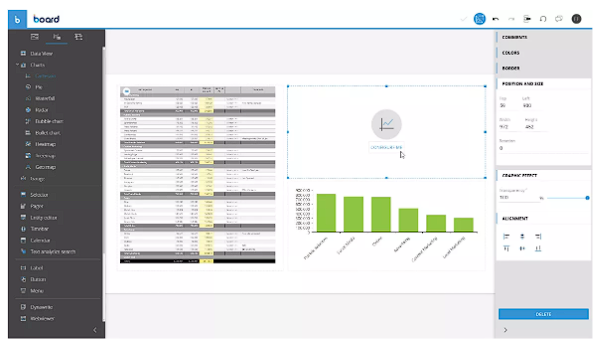

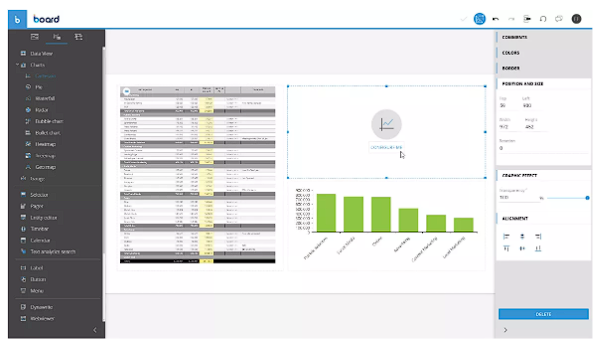

9. Board

Board allows you to manage and control budgeting, planning, and forecasting processes in any department in a wide range of industries.

Board uses BI and predictive analytics capabilities to create analyses for planning and budgeting workflows quickly and easily without any coding or IT help.

For: Larger enterprises

Key Features:

- Reporting & analytics: Analyze business performance and profitability with custom dashboards, and conduct predictive analytics.

- Resource planning: Use cross-functional real-time data to evaluate your yearly capital needs.

- Strategic planning: Create what-if scenarios and long-term actionable plans.

Pricing: Pricing is not publicly available.

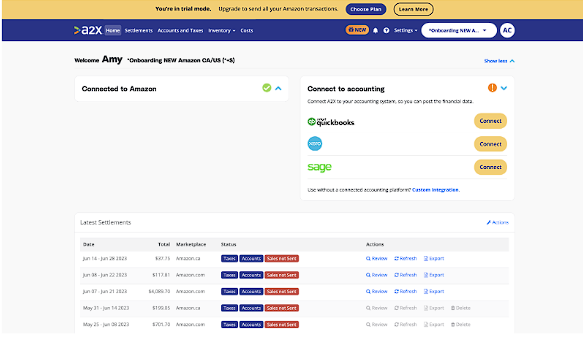

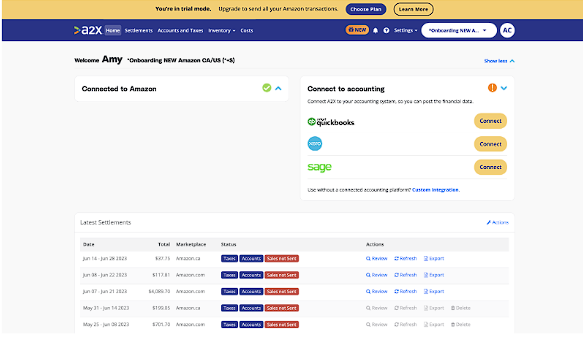

10. A2X

A2X is used to automate ecommerce accounting for Amazon, eBay, Etsy, Shopify and Walmart sellers worldwide. A2X integrates with Xero, QuickBooks and Sage to help streamline your back office and unlock opportunities in the ecommerce space.

For: Amazon, eBay, Etsy, Shopify and Walmart sellers as well as selling getting started in one market

Key Features:

- Templates & checklists: Access resources developed by ecommerce bookkeepers and accountants.

- Cash management: Maintain control over the business cash flow.

- General ledger: Maintain accurate financial statements with automated transaction data flow.

Pricing: Pricing varies for each sales channel but generally starts at $29 per month.

11. Patriot Accounting

Patriot Accounting focuses on online payroll for US small business owners and their accountants, allowing users to run payroll while Patriot handles the payroll tax filing. They offer free direct deposit as well as print paychecks.

For: Small business owners and accountants within the U.S.

Key features:

- 1099 preparation: Create and track 1099 forms for contractors paid during the year.

- Billing and invoicing: Generate, send, and track customer invoices.

- Data import: Connect bank account or credit card to import bank transactions automatically.

Pricing:

- Patriot Basic Accounting: $20/mo for unlimited usage

- Patriot Premium Accounting: $30/mo for unlimited usage

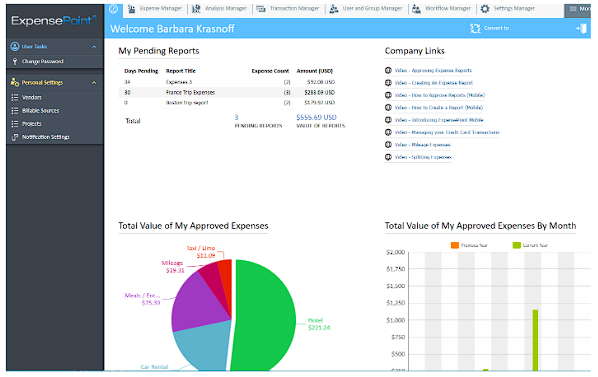

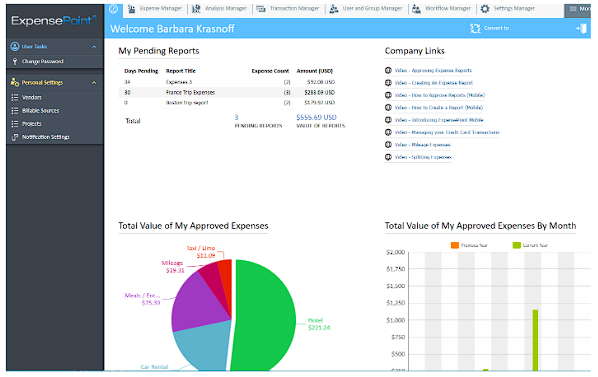

12. ExpensePoint

ExpensePoint automates employee expense report processes for small to larger multinational enterprises. ExpensePoint’s cloud-based platform allows employees to create, submit, approve, and process expense reports.

Once a report is created, each expense can be entered, categorized, and coded as per the organization's requirements. Users can add photos of receipts for each expense. You can also directly upload credit cards into the platform for easy use.

For: Small to large multinational enterprises

Key features:

- Credit card integration: Sync credit card transactions with the platform to automatically import transactions.

- Multi-language and currency: Report expenses in up to 14 languages and access real-time foreign currency exchange.

- Expense tracking: Automate expense management.

- Workflow management: Manage approval workflow with single and multi-level hierarchy approval processes.

Pricing:

- Essentials: $8.50 per user/month

- Premium: $9.50 per user/month or per report

- Premium+: $10.50 per user/month or per report

- Enterprise: Custom

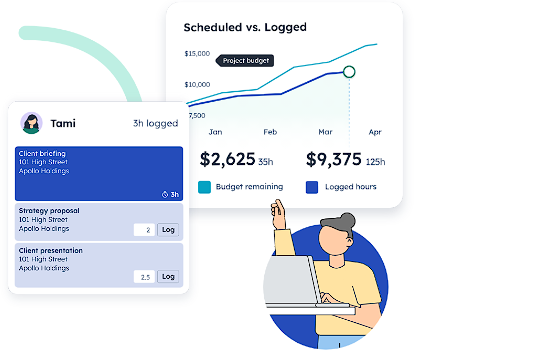

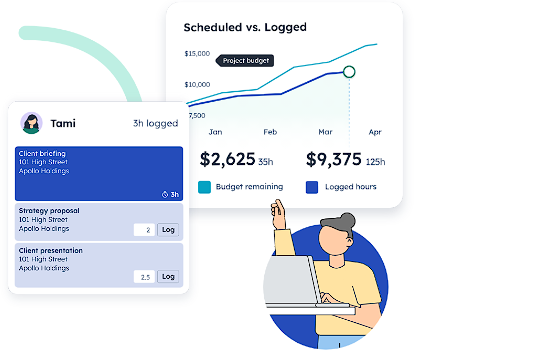

13. Float

Float is a resource management software program that helps keep distribution teams in sync. With Float, teams can schedule tasks in a streamlined, efficient manner.

Float lets you connect with project management programs, calendars, and communications through direct integrations.

For: Distributed teams in agencies, IT services, consulting and architecture

Key Features:

- API: Integrate with in-house and third-party apps to share, create, and upload data to other platforms.

- Availability management: Set custom work hours, location, schedule, and approve time off.

- Budget management: Monitor your budget, utilization rates, and actual costs in real time.

Pricing:

- Starter: $6/month

- Pro: $10/month

- Enterprise: Custom pricing

14. Bench

Bench assists in making bookkeeping for small businesses less of a hassle. Bench takes your data and turns it into tax-ready financial statements every month. Through this, you can monitor your business's financial health.

Bench generates all the information you may need at the year-end to file your taxes.

For: Small business owners

Key features:

- Financial reporting: Stay in control of money with monthly financial statements and expense overviews.

- 1099 reporting: Gain visibility over 1099 transactions by categorizing them according to data, payee name, and details.

- Spend and tax management: Access tax advisory support to prep and file taxes.

Pricing:

- Essential: $249/month

- Premium: $399/month

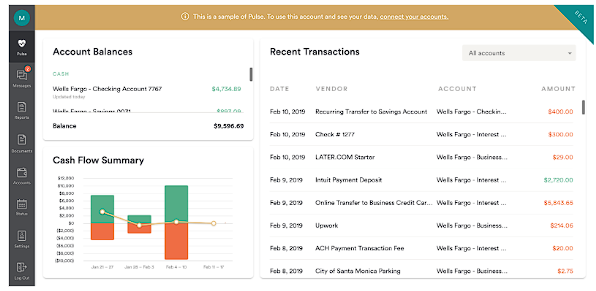

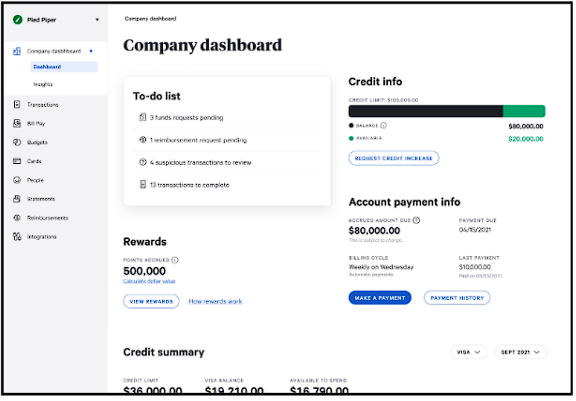

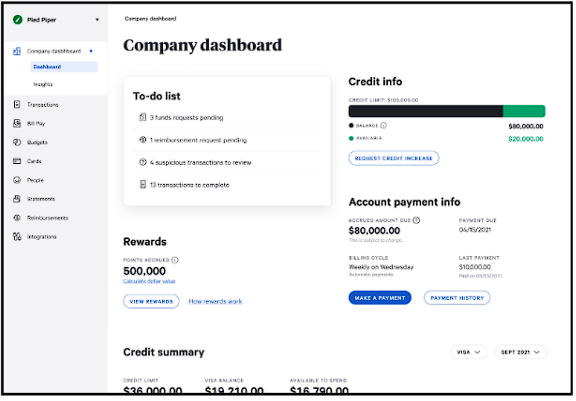

15. Divvy

Divvy is an expense management software program that helps with expense reporting. Divvy includes virtual cards to manage subscriptions, overspend blocking, and security breach protection for both online transactions and physical cards.

For: Companies that need help with expense reports, reimbursements, and receipts

Key Features:

- Accounts payable: Maintain a four-step process for paying business bills and automate data entry.

- Accountant console: Streamline workflows and switch between client’s accounts.

- Invoicing: Create, send, and manage invoices.

- Cash flow forecasting: Get real-time cash flow visibility and plan for future inflows and outflows.

Pricing:

- Essentials: $45/month

- Team: $55/month

- Corporate: $79/month

- Enterprise: Custom pricing

How to choose between the financial statement software on this list

Managing a business's finances can seem complicated. Reliable financial statement software can alleviate some of the stress associated with money flow and financial condition.

But financial statement software programs aren’t all created equal. There are some important features and benefits you’ll want to consider when deciding what software you want to use:

Software capabilities

Of course, the capabilities of financial statement software are essential to examine.

- Does it fit what you are looking for and need?

- Will it optimize your day-to-day work?

- Does it provide solutions for bottlenecks or pain points you may encounter?

The financial statement software you choose should improve the quality of life of you and your team.

Integration options

Integrations may be one of the most critical factors when evaluating key features for financial statement software.

Using financial statement software that offers more integration choices will make it easier to implement, as it can adjust to the changes that may occur.

Most platforms list integrations on their websites, so check those out.

Ease of use

Using software that’s easy to learn will make your everyday work life much easier. Is it hard to navigate?

Will it be difficult to learn?

Look at the product's reviews. If people discuss how it’s positively changed their lives, it’s a good sign!

Onboarding and lead time

The onboarding experience is a critical process.

You don’t want to spend three months finding the perfect solution only to discover that you will have to spend 6 months onboarding and setting up before it’s integrated into your current system.

Having that white glove, done-for-you implementation service, and low lead time will make things much easier for you.

Existing knowledge or experience

Using finance software that allows you to utilize your existing knowledge will help ensure that the tool will be used. If the software requires a particular skill set, you need to consider this because this means you’ll have to be trained on the new skill or source new talent with this specific skill.

We highly recommend picking a tool that enhances your current knowledge and experience.

Software pricing

Pricing is a huge aspect for most users when it comes to finding the right product.

Are you getting a good value for the price?

How many people can use the product?

Does it integrate with the systems you use, and is there additional costs for custom integrations?

Use the right financial statement software tool for your business

There are financial statement software tools with different features that will work best for different teams.

Choosing the right financial statement software tool can make the difference between optimizing your financial processes and not. Keep in mind the basic functionality to look out for, like ease of use, fast implementation, and integration options.

With the right software, you can focus 90% of your time on analysis, eliminate human errors during financial modeling, and cut your reporting time down by half.

If you want to see these benefits in action, book your free demo with Cube.

.png)

.png)

.png?width=150&height=75&name=xero-logo%20(1).png)