What is Net Book Value (NBV)?

Net book value is an accounting principle used to calculate the value of a company’s fixed assets. In its purest form, it represents the carrying value of such assets, as reflected in the balance sheet.

It provides accurate accounting records of the original value of a fixed asset (for instance, a piece of equipment) and adjusts it based on a scheduled loss of value called depreciation.

NBV offers a snapshot of the company’s financial position at a certain time, considering its obligations and what it owns. Knowing an organization’s NBV improves data-informed decision-making, such as where to invest or how much debt is feasible.

Where is NBV reported on the balance sheet?

Since these calculations concern a company’s assets, net asset value is reported on the company’s balance sheet, specifically under long-term or non-current assets. The most common place to find NBV is in the Property, Plant, and Equipment (PPE) section, where it represents the historical cost of these assets minus accumulated depreciation.

On the balance sheet, NBV appears in several ways:

- As individual line items for major asset categories (buildings, equipment, vehicles)

- As a subtotal of all depreciated assets

- With both the original cost and accumulated depreciation displayed

- Sometimes with accompanying notes detailing the depreciation factors

Assets typically represent significant investments—and their values change predictably over time through depreciation. So it’s crucial for companies to maintain detailed records to assess the true value of your assets, changes, efficiency, and new equipment decisions.

Is NBV the same as market values?

Yes and no. Net book value is a determination used for tax and financial reporting purposes. The information is used to estimate the value of the company’s assets, to leverage smart tax strategy, or to outline values for liquidation.

Fair market value refers to an asset's price on the open market. It’s an estimate of the price a buyer would be willing to pay based on larger market influences of supply and demand.

Net book value formula

The net book value of an asset is calculated by subtracting accumulated depreciation from the original purchase price (also called its historical cost).

Here's the NBV formula:

Net book value = original asset cost - accumulated depreciation

In other words, NBV is the original cost of the asset less accumulated depreciation.

Consider asset age, condition, and degree of wear-and-tear or obsolescence as you calculate net book value.

NBV calculation example

Let’s walk through a practical example of calculating net book value for a piece of manufacturing equipment. Say your company purchased an automated assembly line system for $100,000. The equipment has an expected useful life of five years and an estimated salvage value of $10,000.

First, we calculate the annual depreciation:

Total depreciation amount = Original cost - Salvage value

$100,000 - $10,000 = $90,000 total depreciation

Annual depreciation = Total depreciation ÷ Expected useful life

$90,000 ÷ 5 years = $18,000 per year

Now, we can calculate the NBV at different stages. One year’s depreciation would be:

$100,000 (original cost) - $18,000 (one year’s depreciation) = $82,000

By the end of Year 3, the NBV becomes:

$100,000 - $54,000 (three years’ depreciation) = $46,000

Finally, at the end of its useful life (Year 5):

$100,000 - $90,000 (full depreciation) = $10,000

Why is NBV important?

Companies can use NBV to demonstrate their value and estimate their total financial worth. This number is helpful to investors who require context for the value of assets held within the company beyond its cash holdings or debt. It can also identify assets that no longer have a useful life.

Accurate NBV helps with forecasting and making financial decisions about a portfolio's tangible and intangible assets. It also assists the finance department in forecasting future expenses by estimating when equipment will need replacement and outlining the remaining value an asset might have at its end of useful life (also called its salvage value).

How to determine eligibility for depreciation

Depreciating an asset acknowledges that assets and tangible items lose value over time. For instance, a car will have much higher value and more usefulness rolling off the lot than five years (and thousands of miles) later.

Depreciation prevents a company from recording the “brand new” price of an asset indefinitely. Accounting principles and tax laws outline the specific requirements for depreciating assets.

Not every asset is eligible for depreciation. As a general rule, you can depreciate tangible assets if:

- You (or the organization) are the asset owner

- The asset is used for generating revenue

- The asset has at least a year of useful life left

What can and can’t be depreciated?

With the above rules in mind, the following types of fixed assets can be depreciated:

- Machines and production units

- Company-owned vehicles

- Owned office buildings

- Rental properties leased for income

- Intangible assets: patents, copyrights, and software

The following are non-depreciable assets:

- Land

- Cash or accounts receivable

- Investment instruments (stocks and bonds)

- Personal property

- Leased property

Depreciation methods for NBV

The IRS provides taxpayers with guidance on depreciation methods and timelines. There are four methods for depreciating assets: straight-line, double declining balance, sum-of-the-years’ digits, and production units.

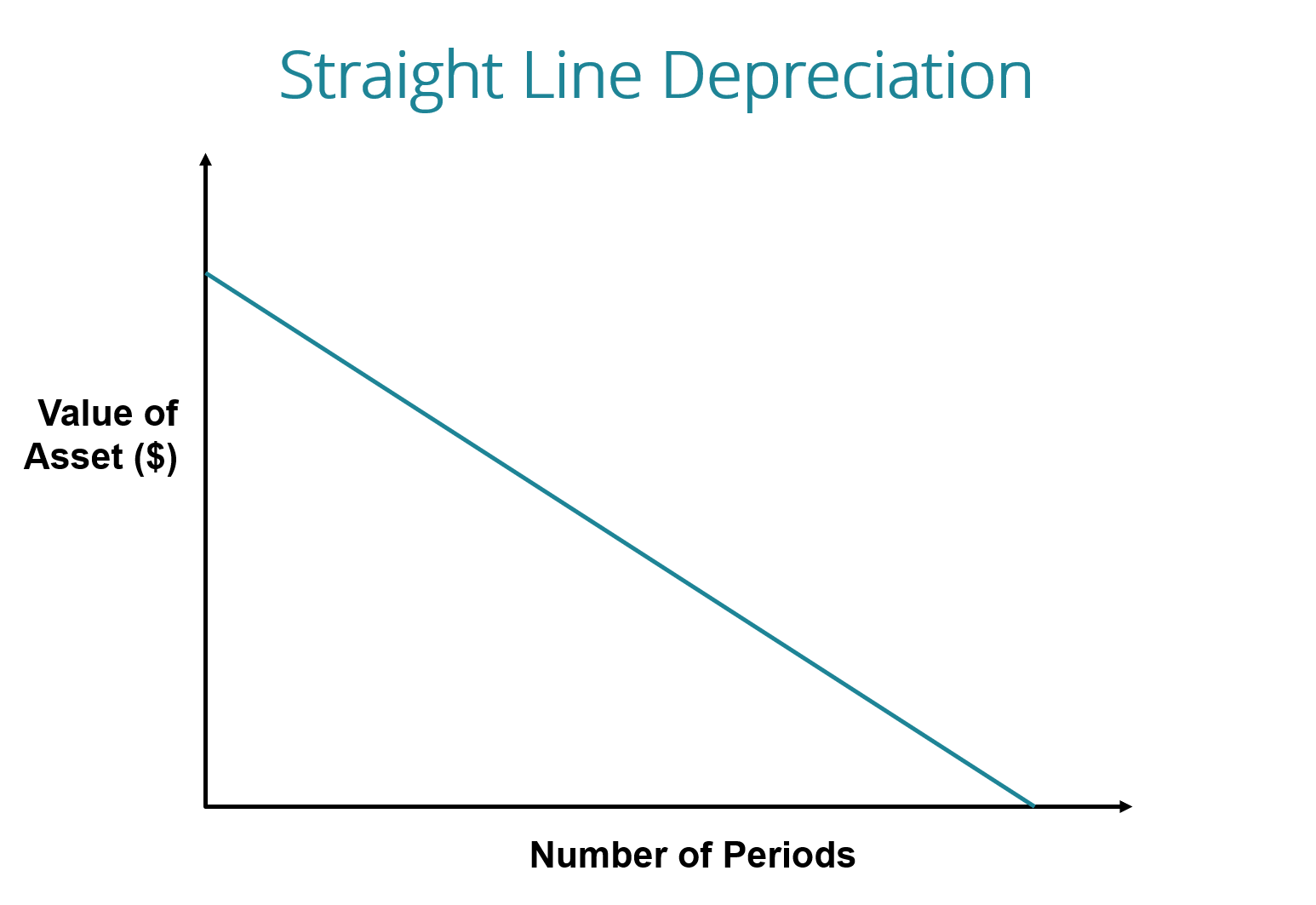

Straight line

The straight-line method is the simplest way to depreciate an asset. Depreciation over the period of service begins with the market value, decreasing consistently until it reaches total depreciation. When graphing the depreciation, it forms a straight line.

Image source: Corporate Finance Institute

Straight-line depreciation is helpful when the original value is known, and the asset depreciates predictably.

Double declining balance

This method accelerates the depreciation to frontload the expense of depreciation losses in its earlier years of service. It applies twice the straight-line rate to the remaining value each year, reflecting how assets typically lose more value in their early years.

For example, if a $10,000 computer has a four-year lifespan, the first year’s depreciation would be $5,000 (50% of value), the second year would be $2,500 (50% of remaining $5,000), and so on. This depreciation method works well for short-lifespan assets like computers and electronics, which lose significant value shortly after purchase.

Sum-of-the-years' digits

This is another accelerated depreciation method. Sum-of-the-years’ digits work as follows:

Take an asset's expected useful life. Add together the digits for each year.

For instance, if the asset has a useful life of five years, add 5 + 4 + 3 + 2 + 1 = 15. Then divide each digit by the sum. This provides the percentage of depreciation for each year.

With this method, the bulk of depreciation occurs in year 1.

In the above example, the depreciation proceeds as follows:

Year 1 = 5/15 = 33%

Year 2 = 4/15 = 27%

Year 3 = 3/15 = 20%

Year 4 = 2/15 = 13%

Year 5 = 1/15 = 7%

Like the declining balance method, this depreciation front-loads depreciation expense in the years the asset will be most useful.

Units of production

Time-based depreciation is great for some assets but not as useful for others. The units of production method calculates depreciation on actual usage rather than time, making it ideal for manufacturing and production machinery.

Here’s how it works:

First, determine the total number of units the asset is expected to produce over its lifetime. Then calculate a depreciation rate per unit by dividing the asset’s cost (minus salvage value) by total expected units. The annual depreciation is then calculated by multiplying this per-unit rate by the actual units produced that year.

For example, if a $100,000 bottling machine is expected to produce one million bottles over its lifetime with a $10,000 salvage value, each bottle represents $0.09 in depreciation ($90,000/1,000,000). If the machine produces 200,000 bottles in year one, that year’s depreciation would be $18,000.

This method is often used for high-wear-and-tear assets that will be most used in their earlier years of operation, as it matches depreciation expenses directly to production output.

What’s the difference between NBV and fair market value?

While NBV and fair market value both measure an asset’s worth, they often tell different stories. For instance, NBV follows a predictable formula based on accounting principles: original cost minus depreciation. On the other hand, fair market value reflects what a willing buyer would actually pay for an asset in the current market.

These values can differ significantly—sometimes by thousands or even millions of dollars. Here’s why:

Market conditions

NBV doesn’t account for market demand, supply chains, or economic conditions. Plus, fair market value fluctuates based on current market dynamics. So some assets may be worth more than their NBV during high demand periods. Lastly, technological obsolescence or market downturns might make the asset worth less.

Real-world factors

NBV uses standardized depreciation methods that might not reflect reality. Fair market value considers factors such as:

- Asset condition and maintenance history

- Technological advances

- Industry changes

- Local market demands

Let’s look at a real example. Consider a truck purchased for $60,000 with a five-year depreciation cycle. After three years, its NBV might be $24,000. However, if the used truck market is strong due to supply chain issues, its fair market value could be $35,000 or more.

Smart finance teams track both values to make better-informed decisions about when to hold, sell, or replace assets. This perspective also helps maximize their return on investment while maintaining accurate books.

Use Net Book Value to better inform your financial decisions

Now you know the basics of net book value and depreciation. We hope this quick guide helps you to make better decisions about the assets in your organization to strengthen your company’s financial position.

Calculating NBV and all your other key figures is easier with the right tools. Cube offers a powerful FP&A platform that allows your team to make sound financial decisions without leaving their spreadsheets.

To see how Cube can help improve your planning and forecasting, schedule a demo to learn more.

.png)

.png)