Key takeaways on financial reporting software

- To cut down on time spent manually entering and checking numbers, financial reporting software automates tasks like data collection and report generation.

- The best financial reporting tools let you create reports and finance dashboards that match your business needs and seamlessly integrate with software you already use, such as spreadsheets or ERP systems.

- Finance teams can use financial reporting software to quickly understand their financial situation and react to changes.

Top financial reporting software: Quick review

Enterprise financial reporting software:

Enterprise financial reporting software is built for scale, complexity, and control. Large organizations need to consolidate data across multiple entities, currencies, and geographies while maintaining audit trails, permissions, and compliance standards. These platforms handle high data volumes, support advanced consolidations, integrate deeply with ERPs and source systems, and give finance leaders confidence that reports are accurate, governed, and repeatable.

They also support more sophisticated use cases like multi-scenario modeling, role-based reporting, regulatory and ESG disclosures, and collaboration across finance, operations, and executive teams. In short, these tools are designed to keep reporting reliable as organizations grow more complex.

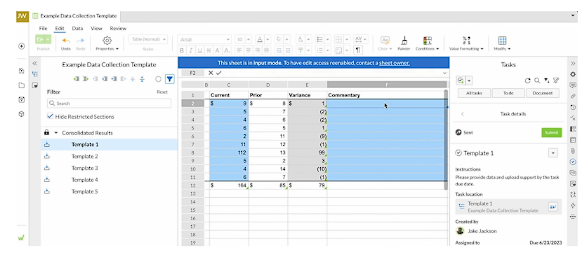

- Cube: Enables finance teams to manage reporting, planning, and forecasting directly within Excel and Google Sheets. Offers AI-powered analysis, smart variance detection, and integrations with ERPs, CRMs, and HRIS systems.

- Oracle NetSuite: Offers financial management and reporting features for global businesses.

- Sage Intacct: Provides flexible reporting tools, dimensional tagging for deeper insights, and automation for consolidations and audit prep

- Insight Software: Focuses on real-time reporting with Excel-based interfaces and integration across major ERPs.

- Workday Adaptive Planning: Combines planning, modeling, and reporting in one cloud-native platform.

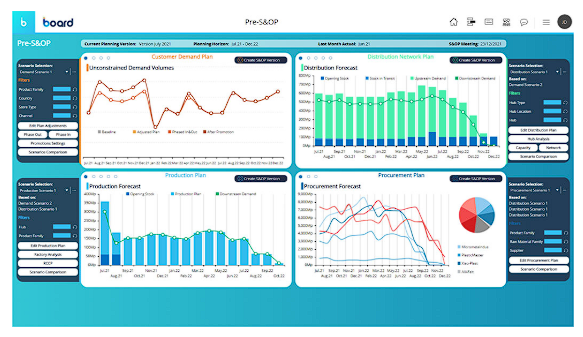

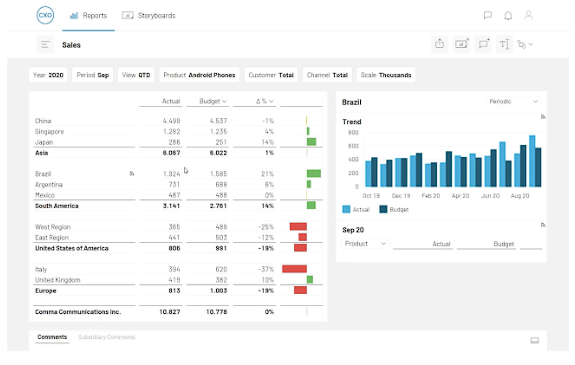

- Board: Combines business intelligence and financial planning tools into a unified platform.

- Planful: Helps large teams streamline reporting and forecasting with automated consolidations, role-based access, and audit capabilities.

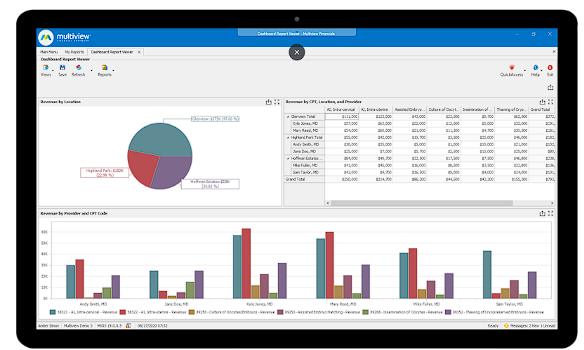

- Multiview ERP: Centralizes financial operations and improves audit readiness.

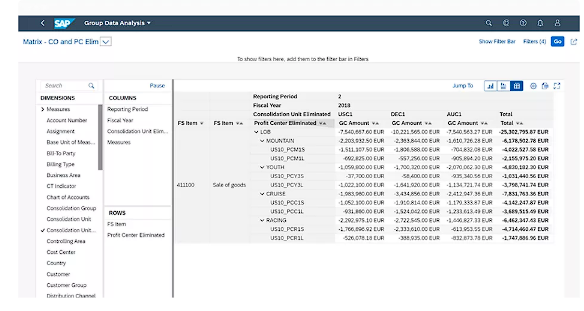

- SAP S/4HANA Finance: Offers advanced analytics, predictive forecasting, and global compliance support.

- Workiva: Centralizes ESG, audit, and financial reporting.

- Jedox: Gives FP&A teams AI-powered forecasting, multidimensional analysis, and Excel-like modeling.

- Microsoft Dynamics 365 Finance: Offers live data insights, workflow automation, and native integrations with Excel and Power BI.

Small business financial reporting software:

Small businesses need financial reporting software that’s easy to adopt, affordable, and flexible enough to grow with them. Unlike enterprise teams, small finance teams often operate with limited headcount, lighter IT support, and heavier reliance on spreadsheets. These tools prioritize simplicity, faster setup, and built-in reporting while still covering essentials like cash flow visibility, budgeting, compliance, and basic forecasting.

Most of these platforms also integrate cleanly with accounting, payroll, and banking tools, reducing manual work and helping founders and finance leads understand performance without needing a dedicated FP&A team.

- Sage 50 Cloud: Support basic financial reporting, budgeting, and tax prep for small businesses.

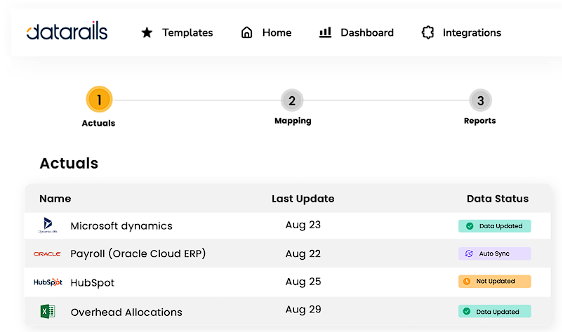

- Datarails: Enhances FP&A in Excel with financial automation and centralized data management.

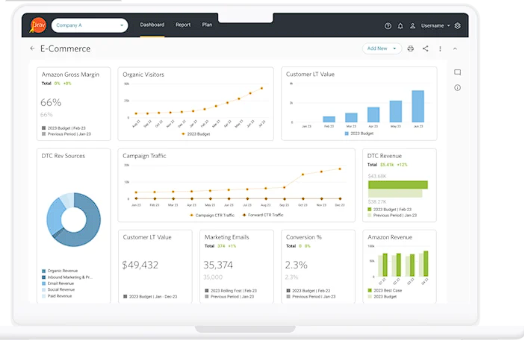

- Jirav: Offers pre-built dashboards, forecasting tools, and Excel-like functionality for fast-growing startups.

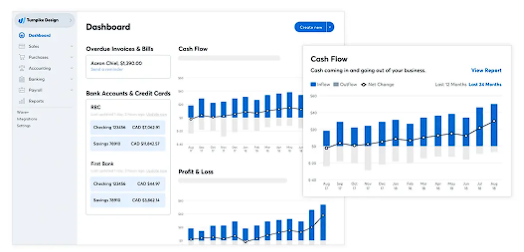

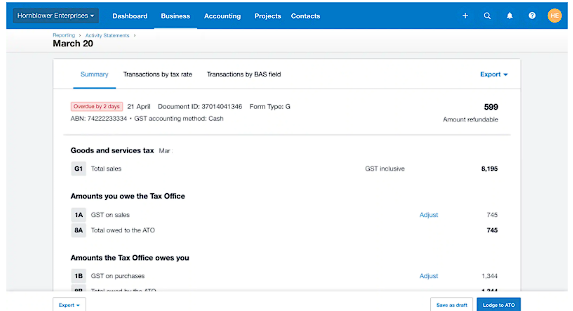

- Xero: Delivers user-friendly reports and real-time financial dashboards.

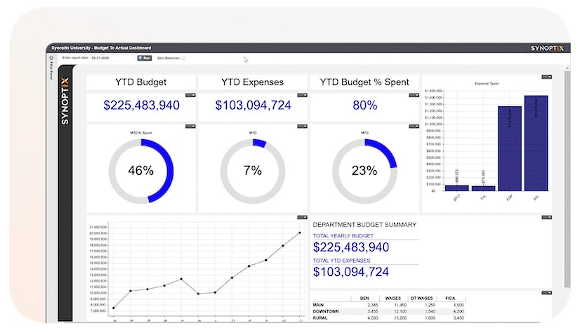

- Synoptix: Provides direct database connections for faster reporting.

- Vena Solutions: Helps small teams automate reports, monitor KPIs, and collaborate on forecasts.

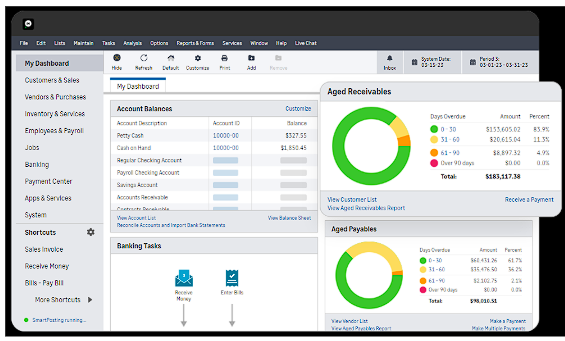

- Intuit QuickBooks: Offers built-in financial reports, real-time dashboards, and integration with payroll and tax tools.

- FreshBooks: Offers simple profit-and-loss reporting, invoicing, and expense tracking in an intuitive interface.

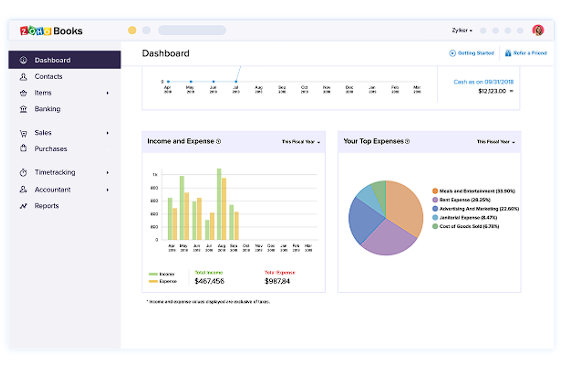

- Zoho Books: Covers invoicing, reporting, and compliance in a streamlined platform.

- Wave: Offers basic financial reporting, invoicing, and expense tracking.

Why is financial reporting essential to a successful business?

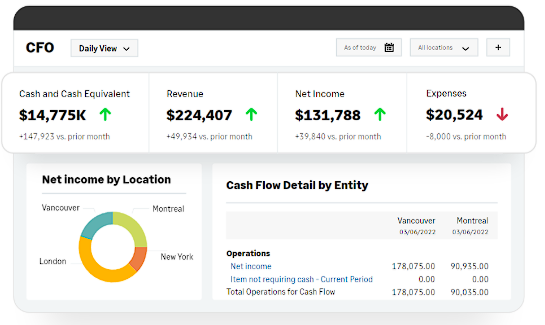

CFOs rely on strong financial reporting to provide key stakeholders with important insights. Typically, businesses generate three main accounting financial statements as part of their reporting process: income statements, balance sheets, and cash flow statements. This data drives informed decision-making and, ultimately, business growth.

Effective financial reporting also promotes real-time, productive discussions within the organization. For example, a CFO can quickly perform ad hoc reporting to assess the potential impact of reallocating funds, ensuring swift and informed decision-making. Financial reporting also creates a consistent source of financial data that leaders can use to compare performance over time, spot issues early, and back decisions with evidence instead of assumptions. That matters because highly data-driven organizations are three times more likely to report significant improvements in decision-making compared to those that rely less on data.

What is financial reporting software?

Financial reporting software speeds up the financial reporting process with automation and analysis. It helps finance teams with these basic accounting tasks:

- Data collection: Pulls financial data from source systems like accounting software, ERPs, payroll tools, and billing platforms. This replaces manual data gathering and ensures reports are built on up-to-date, consistent information.

- Budget alignment: Compares actual financial results against budgets and forecasts, helping finance teams see where performance is tracking ahead or behind plan. This alignment makes it easier to explain variances and adjust spending or strategy as conditions change.

- Reconciliation: Helps match transactions across accounts and systems, such as bank statements, general ledger entries, and subledgers. Automating this process reduces errors, flags discrepancies early, and speeds up period-end reviews.

- Financial close and consolidation: Supports the month-end and year-end close by standardizing workflows, validating data, and consolidating results across entities, departments, or regions. This ensures accurate rollups while maintaining audit trails and controls.

- Financial statement creation: Generates core financial statements, including income statements, balance sheets, and cash flow statements, using structured and validated data. These statements can be produced faster, customized for different audiences, and refreshed automatically as data updates.

Critical features of financial reporting software

Here's what the best financial reporting software solutions offer:

Automation workflows

Financial reporting software automates many routine tasks, such as pulling updated data from your source systems, streamlining the reporting process, and reducing the workload on your finance team. By automating these workflows, businesses ensure that financial data is consistently updated and accurately reflected in reports without manual intervention.

For example, the software can automatically retrieve transaction data from accounting systems, update financial statements, and generate monthly performance reports. This not only saves time but also reduces the risk of errors associated with manual data entry.

Additionally, automated reporting workflows can trigger alerts for anomalies or discrepancies, ensuring that potential issues are identified and addressed promptly. Overall, automated financial reporting workflows enhance efficiency, accuracy, and timeliness in financial reporting, allowing finance teams to focus on more strategic tasks.

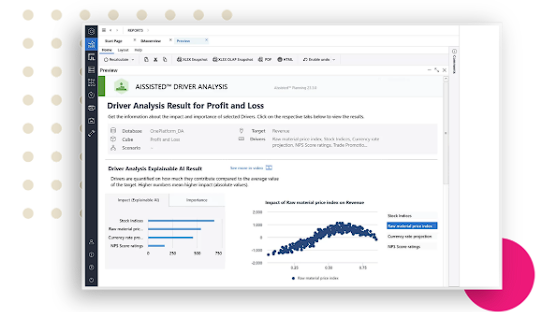

Artificial Intelligence

AI adds a layer of speed and pattern recognition to financial reporting. Instead of only showing you what happened, AI can help explain why it happened, flag issues you may miss in manual reviews, and turn raw numbers into clear takeaways for stakeholders. When it’s paired with clean source data and strong controls, AI tools can reduce time spent hunting for variances and increase confidence in the story your reports tell.

Common AI features in financial reporting software include:

- Anomaly detection: Flags unusual transactions, unexpected spikes or dips, duplicate entries, and outliers that could signal errors or fraud risk.

- Smart variance analysis: Highlights material variances (budget vs. actuals, MoM, YoY) and suggests likely drivers based on patterns in your historical data.

- Forecasting and predictive modeling: Generates rolling forecasts and projections based on trends, seasonality, and leading indicators.

- Natural language queries: Lets you ask questions in plain English like “Why did operating expenses jump in October?” and returns the relevant tables, charts, and explanations.

- Narrative generation: Creates draft management commentary for month-end and board reporting, summarizing key movements and what changed.

- Continuous close support: Identifies reconciliation issues earlier, prioritizes high-risk accounts, and reduces late surprises during close.

- Scenario modeling suggestions: Recommends sensitivity tests and what-if scenarios based on which drivers historically move results.

- Cash flow insights: Uses trends in AR/AP, collections, and spend timing to improve short-term liquidity visibility.

- Data quality checks: Detects inconsistent mappings, missing fields, stale data feeds, and mismatched totals before reports go out.

Financial report creation

Financial reporting software allows for the creation of custom financial reports tailored to an organization's specific needs. Standard reports like balance sheets, income statements, profit and loss statements, and cash flow statements are essential for regulatory compliance, tax purposes, and performance assessment.

However, businesses often require more detailed or specific insights to inform strategic decisions. Custom financial report creation enables organizations to generate reports that reflect their unique financial circumstances and operational priorities.

For instance, a company might need a detailed expense analysis report to identify cost-saving opportunities or a custom revenue report that breaks down sales by product line and geographic region. By providing the flexibility to design and generate bespoke reports, financial reporting software helps businesses gain deeper insights into their financial health, supporting data-driven decision-making and strategic planning.

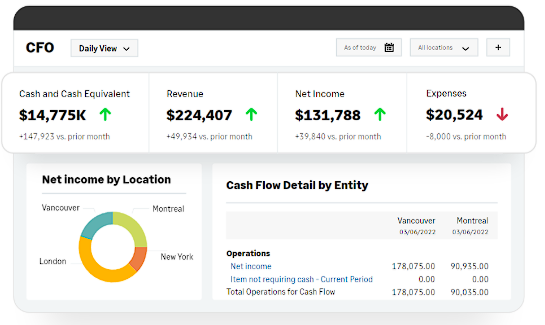

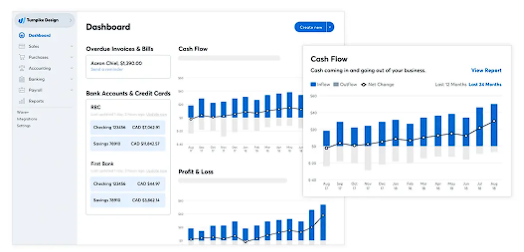

Customizable dashboards

Flexible dashboards allow users to customize their view of financial data, displaying key metrics and reports in an intuitive, easily accessible format. Some features of a flexible dashboard include:

- Customizable layouts

- Real-time data updates

- Interactive visualizations

- Data integration

- User-friendly interface

- Advanced filtering and segmentation

- Collaboration tools

- Alerts and notifications

Easy drill-downs

These tools offer the ability to drill down into financial data, a vital feature of financial reporting software because it enhances the depth, accuracy, and usability of financial data analysis. Here's why this feature is critical:

- Granular data access: Move from high-level summaries to detailed transactions to identify root causes and understand factors driving financial performance.

- Scenario analysis: Explore how different factors affect financial outcomes, aiding strategic planning and risk management.

- Quick insights: Quickly access needed data within the same platform, eliminating the need to sift through spreadsheets or request additional reports.

Data validation and error-checking

Financial reporting software includes data validation and error-checking features to ensure the integrity and reliability of financial data. Here's what these essential features provide:

- Elimination of errors: Automated mechanisms identify and correct errors, ensuring accurate, discrepancy-free reports.

- Consistency: Enforces consistency in data entry and processing, reducing the risk of conflicting or duplicated information.

- Regulatory compliance: Ensures financial reports meet regulatory standards like GAAP or IFRS.

- Audit trails: Creates detailed audit trails for documenting changes and corrections, aiding in audits and maintaining compliance.

- Risk reduction: Minimizes errors to reduce the risk of poor decision-making, enhancing strategic planning and risk management.

Source system integrations

The best financial reporting software integrates with your ERP, HRIS, and other source systems that house critical information about your finances, payroll, and compliance. This integration ensures a seamless flow of data and reduces the need for manual data entry.

Here’s why these integrations are crucial for realistic financial reporting:

- ERP (Enterprise Resource Planning): Integrates financial data with business processes for a comprehensive operational view. (e.g., Oracle NetSuite, SAP S/4HANA)

- CRM (Customer Relationship Management): Links sales and customer data with financial metrics for revenue and profitability insights. (e.g., Salesforce, HubSpot)

- HRIS (Human Resource Information System): Connects payroll and employee data to manage labor costs and analyze HR decisions' financial impact. (e.g., Workday, ADP)

- BI (Business Intelligence) tools: Combines data from various sources for advanced analytics and visualizations. (e.g., Tableau, Power BI)

- Accounting software: Ensures accurate data entry and streamlines financial close processes. (e.g., QuickBooks, FreshBooks)

- Invoicing and payment systems: Tracks receivables and payables for improved cash flow management. (e.g., Stripe, PayPal)

- Tax management software: Automates tax calculations and compliance reporting. (e.g., Avalara, TurboTax)

- Budgeting and financial planning tools: Supports scenario analysis and long-term financial planning. (e.g., Cube, Anaplan, Planful)

- Financial consolidation software: Merges data from multiple entities for a unified financial view. (e.g., Cube, BlackLine, OneStream)

Advanced security

Financial reporting software must be secure, preferably SOC 2 Type 2 compliant, to protect your business's financial information. Advanced security features protect sensitive financial data from unauthorized access and breaches.Critical security features to look for include:

- Full encryption: Ensures data encryption both at rest and in transit.

- Authorization and user management: Customizes controls to provide the right access to the right users.

- Multi-factor authentication (MFA): Adds an extra layer of security with text or app-based authentication.

- Single sign-on (SSO): Simplifies access through multiple apps using SSO.

- Role-based access and permissions: Limits access to sensitive data and provides dimension-based security by department, entity, or territory.

cal security features to look for include:

- Full encryption: Ensures data encryption both at rest and in transit.

- Authorization and user management: Customizes controls to provide the right access to the right users.

- Multi-factor authentication (MFA): Adds an extra layer of security with text or app-based authentication.

- Single sign-on (SSO): Simplifies access through multiple apps using SSO.

- Role-based access and permissions: Limits access to sensitive data and provides dimension-based security by department, entity, or territory.

Best financial reporting software for larger businesses

Larger businesses have more complex reporting needs like consolidating data across entities or complying with strict audit requirements. The tools below are built to support those demands, with features like multi-entity consolidation, audit trails, role-based permissions, and deep ERP integrations.

We chose them by reviewing a mix of third-party sources and product information. We looked at patterns in customer reviews and ratings on trusted review platforms such as G2, Capterra, and Gartner Peer Insights, scanned third-party research and comparisons, and cross-checked core features, integrations, and security details on each vendor’s product pages and documentation. We also weighed practical criteria for larger teams, including consolidation workflows, audit readiness, reporting flexibility, and ease of integration with existing systems.

1. Cube

Best for: FP&A teams that want AI-powered financial intelligence inside Excel and Google Sheets

What customers say: “Cube has saved us a ton of time at month-end for our reporting process.” (Senior Accountant, Financial Services)

Rating: Capterra 4.6/5

Cube is an AI-powered, cloud-based FP&A platform that empowers teams to drive better reporting, planning, and business performance without disrupting typical workflows. Cube integrates with both Excel and Google Sheets, so you can create reports in familiar apps and then share them with your CEO, department leaders, or board members.

Cube offers faster time to value with the help of built-in AI and automations. Its agentic AI tools speed up analysis by spotting variances, explaining drivers, and even building smart forecasts from your data.

Many companies (like Tecovas) use Cube's reporting capabilities to inform their budgeting and planning, saving weeks of work.

Features:

- Real-time data access: Pulls fresh numbers from connected systems instantly, so reports stay current without exports or delays.

- Custom Filtering & Slicing: Lets you filter and slice reports with flexible dimensions to get the exact view you need, refreshed in real time.

- Secure Analysis and Drill-Downs: Enables transaction-level drill-downs while role-based permissions control who can see what.

- Familiar Spreadsheet-Native Interface: Lets you build and update reports in Excel, Google Sheets, or the web without changing your existing formats or formulas.

- Agentic AI analyst: Lets users ask finance questions in natural language inside Slack, Microsoft Teams, or Cube and returns clear answers based on governed data.

- Automated variance analysis: Flags key bidget versus actual shifts, identifies revenue and cost drivers, and drafts variance commentary that finance leaders can refine.

➡️ See more features here.

Pros:

- Reduces financial reporting time by up to 82%, helping teams publish accurate reports faster and with less manual effort

- Helps finance teams spend more than half their time on strategic work instead of cleaning up numbers

- Makes ad hoc and executive reporting more responsive by delivering instant, AI-powered answers in Slack and Teams

- Offers seamless integrations with spreadsheets (Google Sheets and Excel), accounting and finance, HR, ATS, billing and operations, sales and marketing, and business intelligence tools

- Saves time by automating menial tasks

Cons:

- Serves business use only, not personal finance.

- Lacks multilingual capabilities, English only.

Pricing: Custom pricing starts at $30,000 annually.

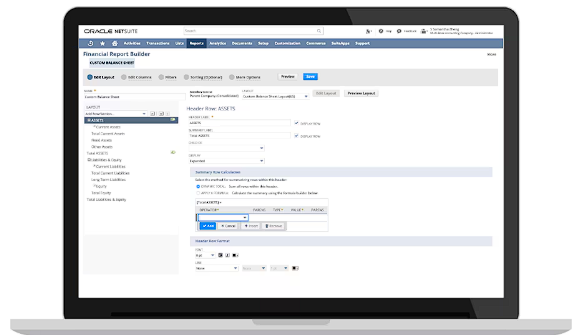

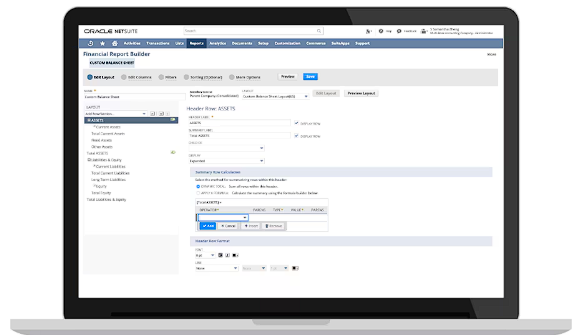

2. Oracle NetSuite

Best for: Teams that want AI-powered business management suite

What customers say: “It's a great tool when collaborating with procurement on things like vendor registration, onboarding and purchase order creation.” (Senior design researcher)

Rating: G2: 4.1/5

Oracle NetSuite features a user-friendly interface where organizations can access real-time analytics and advanced reports. The platform enables serious automation, from data collection and journal entries to account reconciliation. Customers appreciate the cloud function, allowing them to access important financials anywhere.

Features:

- Tax management: Supports tracking and handling of tax obligations across relevant jurisdictions and reporting needs.

- Accounts payable and accounts receivable: Manages vendor bills, customer invoices, payments, and collections.

- Cash management: Tracks cash position and cash activity to support liquidity visibility and cash planning.

- General ledger: Records and organizes financial transactions and supports structured reporting across accounts and periods.

- Payments management: Supports payment processing workflows tied to payables and receivables activity.

- Financial management: Centralizes core finance functions, including reporting, controls, and operational oversight across the finance stack.

Pros:

- Gain real-time insights: Obtain up-to-date information on profitability ratios, margins, tax liabilities, and cash flow.

- Automate administrative processes: Streamline repetitive tasks to save time and reduce errors.

- Integrate with Cube: Seamlessly work with Cube for enhanced functionality.

Cons:

- Lacks a consistent customer support experience.

- Comes with higher costs compared to some competitors.

- Features limited customization options.

Pricing: NetSuite provides custom pricing.

3. Sage Intacct

Best for: Organization that want AI-powered accounting with real-time visibility

What customers say: “Financial reporting capabilities with Sage are good and easy to pick up. Reporting usually runs very quickly. Modifying a report is generally easy once the user knows how to do it.” (Director of financial planning and analysis)

Rating: G2: 4.3/5

Sage Intacct is financial reporting software that prioritizes increased user efficiency and extensive reporting customization. Users can use its drag-and-drop design to create reports based on math functions, aggregations, transaction details, grouping, and other criteria.

This platform works for various industries, like SaaS (software-as-a-service) and hospitality.

Features:

- Multi-entity support: Consolidates reporting across multiple entities, including structured rollups for group-level views.

- Cloud-based access: Provides access to finance data and reporting tools through a cloud environment.

- General ledger with predefined dimensions: Supports dimensional tagging in the general ledger to segment reporting by categories such as department, location, or project.

- Built-in and custom reporting: Includes 150+ built-in reports and tools to create custom reports based on user-defined criteria.

Pros:

- Features a user-friendly interface.

- Tracks key metrics with comprehensive reporting capabilities.

- Makes reports more accessible with visualizations.

- Integrates with Cube.

Cons:

- Some integrations may feel clunky.

- Search functionality may be lacking.

- Comes with a steep learning curve.

Pricing: The platform doesn’t provide pricing online.

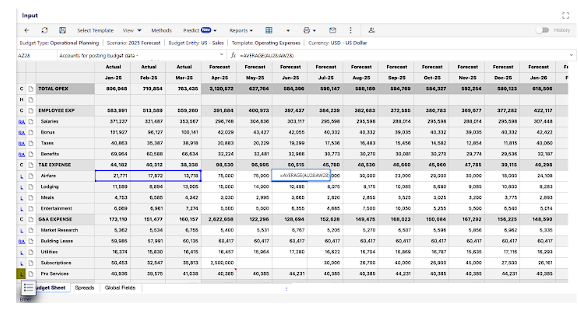

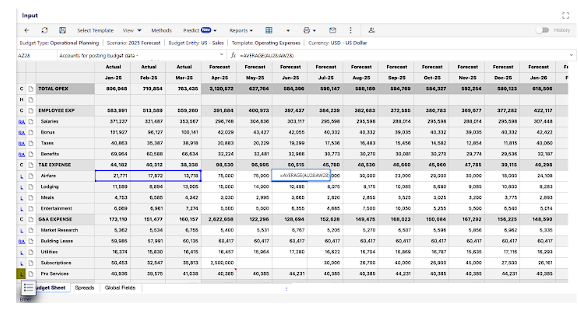

4. Insight Software

.jpeg?width=249&height=70&name=insightsoftware_DETAIL%20(1).jpeg)

Best for: Organizations that want comprehensive solutions for the office of the CFO

What customers say: “Experience has been great, the reports are efficient and work well with our accounting software.”

Rating: Gartner: 4.4/5

A French tech company, Insight Software promises to reduce your closing and reporting times by 50%. It features custom reports and Excel integrations. This company bases pricing on increased features measured by claims of improved efficiency up each tier.

Features:

- Export to Excel: Exports ERP and financial data into Excel for report creation and analysis.

- Spreadsheet server reporting: Generates reports directly from spreadsheets using centralized, controlled report logic.

- Data integration and formatting: Connects to source systems and supports data preparation, formatting, and standardization for reporting.

- Custom reporting: Supports user-defined reports based on selected fields, structures, and reporting requirements.

- System integrations: Integrates with financial and ERP systems to support consolidated reporting workflows.

- Equity management: Supports tracking and reporting for equity-related activity and documentation.

Pros:

- Platform is easy to navigate and use.

- Offers quick training on the system.

- Allows you to drill down into data easily.

Cons:

- Has some occasional bugs and issues.

- Customer service may be lacking.

Pricing: Insight offers custom pricing only.

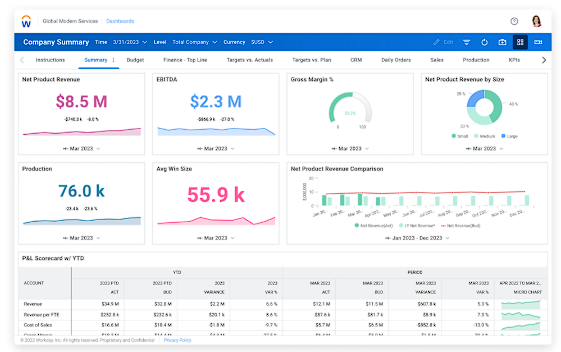

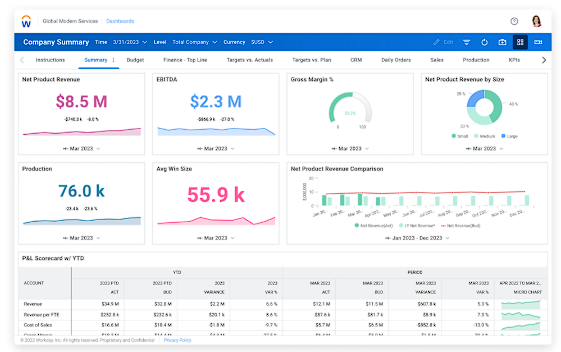

5. Workday Adaptive Planning

Best for: Enterprises seeking unified financial, workforce, and operational planning at scale

What customers say: “Workday Adaptive Planning can be useful for modeling only if your data is very clean. If you are a superuser of Adaptive, you can learn how to navigate and it generally does what you need it to do.” (Verified user in accounting)

Rating: G2: 4.3/5

Workday Adaptive Planning is a planning tool that boasts visible insights at the click of a button. The software is an alternative to Mosaic and other visual planning competitors. Note that Workday Adaptive Planning reviews cite frustration with translating advanced insights to non-finance audiences.

Features:

- Budgeting and forecasting: Supports budgeting workflows and forecasting updates across teams and planning cycles.

- Analytics and reporting: Provides reporting and analytics views to review performance, trends, and plan versus actuals.

- Scenario planning: Supports scenario planning to test how changes in assumptions affect financial and operational outcomes.

Pros:

- Predictive models for planning and forecasting

- Time savings across budgeting and reporting workflows

- Cloud-based access across teams and locations

- Native integration with the Workday product suite

- Integration with Cube for extended reporting capabilities

Cons:

- Initial setup and configuration can be time-consuming.

- Advanced reporting and customizations may require system expertise or external support.

- Integration and data ingestion workflows can feel complex to manage.

Pricing: They offer two different plans with custom pricing.

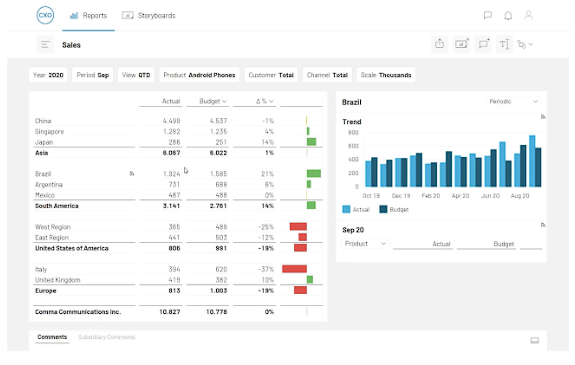

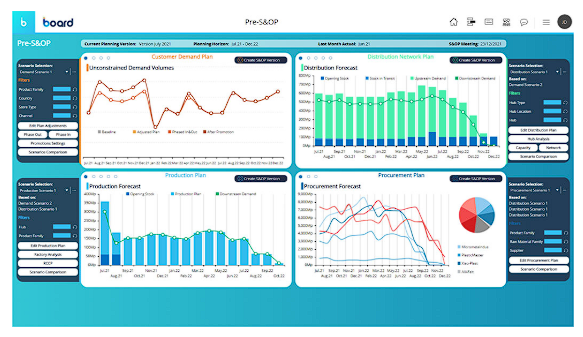

6. Board

Best for: Organizations looking for an enterprise planning platform

What customers say: “Board is an intuitive, all-in-one environment where reporting, analytics, and planning blend into one” (Verified user in banking)

Rating: G2: 4.4/5

Board is a financial reporting software that helps businesses improve financial processes and accounting. It even allows users to create custom planning and analysis applications. The platform unifies metrics, analytics, and reports into one place.

Features:

- Capital needs evaluation: Evaluates capital requirements to support resource planning and allocation decisions.

- AI-driven performance analysis: Applies AI to analyze performance patterns and support predictive insights.

- Real-time financial modeling: Supports real-time modeling to evaluate financial scenarios and assumptions.

- Multi-user data entry: Allows multiple users to input and update data within shared models.

- Adaptive aggregation: Aggregates data dynamically across dimensions such as entities, accounts, and time periods.

- ERP database write-back: Writes approved data and adjustments back to connected ERP systems.

Pros:

- Creates dashboards without technical expertise.

- Provides valuable, actionable insights.

- Adapts the program to your specific needs.

Cons:

- Users report potential privacy concerns.

- Users report that customer service is slow to respond.

- Interface may not be intuitive.

Pricing: Board doesn’t list prices on their website.

7. Planful (formerly Host Analytics)

Best for: Teams that want AI-powered close, consolidation, planning, and reporting software

What customers say: “The system offers a wide range of customization options, allowing businesses to tailor the environment to their unique needs, regardless of industry.” (Verified user in veterinary)

Rating: G2: 4.3/5

Planful, formerly known as Host Analytics, has skilled professionals with enterprise software, HR, and growth experience. While reviews praise the platform's user-friendly interface, some criticism cites issues with accuracy when updating formulas and reports.

Features:

- Excel reporting and integrations: Integrates with Excel to support report creation and ongoing updates within spreadsheet workflows.

- Data visualizations: Generates visual representations of financial data for reporting and analysis.

- Personalized dashboards: Supports configurable dashboards tailored to different roles and reporting needs.

- Forecasting: Supports forecasting processes across financial and operational planning cycles.

- What-if scenario analysis: Enables scenario modeling to evaluate the impact of changes in assumptions.

- Journal entry management: Supports creation, tracking, and management of journal entries within the platform.

- Report consolidation: Consolidates data across entities and accounts to produce unified financial reports.

Pros:

- Offers reliable and responsive support team.

- Gives templates for efficiency.

Cons:

- Reporting and template processing can slow down as data volumes increase.

- Product updates and enhancements may take a long time to roll out.

- Advanced configurations, templates, and write-back workflows can be difficult to manage at scale.

Pricing: Planful's pricing is not publicly disclosed.

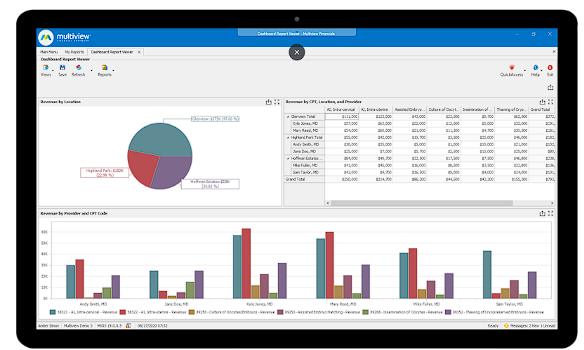

8. Multiview ERP

Best for: Healthcare organizations that want an ERP software

What customers say: “Implementation was an unexpectedly smooth transition because we had exceptional training. The software is highly customizable and we have tailored many of them to make them our own.” (Accounting)

Rating: G2: 4.3/5

Multiview ERP features a team of in-house support along with its financial software. It delivers year-round insights, data visualizations, and customization capabilities through core accounting, business insights, business automation, and inventory management.

Features:

- Asset management: Tracks and manages assets across their lifecycle for accounting and reporting purposes.

- General ledger management: Maintains detailed financial records to support accurate reporting and audits.

- Accounts payable and receivable: Manages vendor payments, customer invoicing, and collections activity.

- Budgeting and forecasting: Supports budgeting and forecasting processes across departments and periods.

- Workflow automation: Automates approval flows and routine finance and operational workflows.

- Business intelligence: Provides reporting and analytics tools to support financial and operational insight.

Pros:

- Efficiently searches for specific data.

- Provides access to strong and responsive support.

Cons:

- Creating custom reports may be challenging.

- Presents occasional glitches and issues.

Pricing: Multiview doesn't list pricing online.

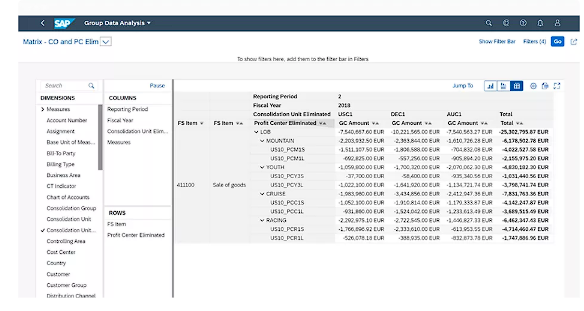

9. SAP S/4HANA Finance

Best for: Finance teams looking for a solution that connects financial close processes and accelerates group consolidation

What customers say: “I appreciate SAP S/4HANA Cloud for its real-time analytics, which provide embedded AI/ML intelligence.” (Technology analyst)

Rating: G2: 4.5/5

SAP S/4HANA Finance is group reporting software from SAP. It's best for businesses that are already entrenched within the SAP ecosystem.

It promises to help streamline financial consolidation and close processes by unifying operational and group reporting.

Features:

- Deployment flexibility: Supports on-premise, cloud, and hybrid deployment models to align with existing SAP environments.

- Unified reporting: Unifies entity-level and group-level reporting to support financial close and and consolidation processes.

- Continuous accounting: Supports continuous accounting by recording and validating financial data in near real time throughout the reporting period.

Pros:

- Gives access up-to-date information in real time.

- Speeds up the financial close process.

- Unifies consolidation and transactional activities.

Cons:

- Lacks robust integrations.

- Customer support response times may be slow.

- Setup and maintenance can be complex.

- Creating customized reports can be challenging.

Pricing: Pricing is not publicly available.

10. Workiva

Best for: Organizations that want to connect their teams data through agentic AI

What customers say: “The automation of Workiva has transformed the way our reporting team works. It has allowed us to integrate our financial reports in a way that flows through all of our deliverables in a quick and smooth process.”

Rating: G2: 4.5/5

Workiva offers a cloud-native platform for assured integrated reporting, combining financial reporting, ESG reporting, audit, and risk management into one environment. It aims to provide data clarity and accuracy while enhancing collaboration and efficiency across various business processes.

Features:

- Integrated reporting: Supports financial, ESG, and regulatory reporting within a unified reporting environment.

- Risk and audit management: Supports audit workflows, controls, and risk management processes.

- Data connectivity: Connects and synchronizes data across internal systems and external sources.

- Collaboration tools: Supports multi-user collaboration, review workflows, and version control across reports.

- Data automation: Automates data refreshes and updates across linked reports and deliverables.

- Security and controls: Applies security controls, permissions, and governance to protect sensitive data.

Pros:

- Uses a secure, centralized reporting platform.

- Integrates across financial, ESG, audit, and risk domains.

- Automates manual tasks to increase efficiency.

- Provides access to real-time data updates.

- Improves collaboration and control.

Cons:

- It may be complex for smaller businesses.

- Comes with potentially high implementation and training costs.

- Requires ongoing management and oversight than other systems.

Pricing: Workiva doesn’t publicly disclose pricing.

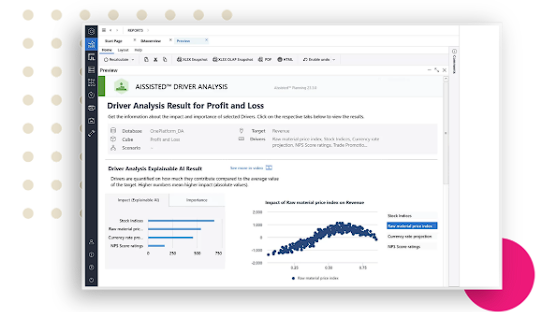

11. Jedox

Best for: Companies that want an adaptable planning and performance management platform

What customers say: “The platform offers great flexibility for frequent changes, a broad range of integration options, and quick support whenever issues come up.” (Verified user in financial services)

Rating: G2: 4.4/5

Jedox is a financial planning and analysis solution recognized for its adaptability and comprehensive planning capabilities. It supports collaborative planning, budgeting, forecasting, and performance management.

Features:

- Financial planning and analysis: Supports planning, budgeting, forecasting, and performance management workflows.

- Integrated business planning: Connects financial and operational planning within a unified planning framework.

- ESG reporting: Supports ESG data collection, reporting, and disclosure requirements.

- Excel-like interface: Provides an Excel-style interface for model building and report interaction.

- AI-driven insights: Applies AI to analyze data patterns and support insight generation.

- Multidimensional data analysis: Enables analysis across multiple dimensions such as entity, product, region, and time.

Pros:

- Offers an Excel-like interface that is easy to navigate.

- Adapts to various business models.

- Integrates data from multiple sources.

- Plans and forecasts in real time.

- Comes with strong collaboration features.

Cons:

- Requires significant customization.

- Integration setup can be complex.

- Users face a higher initial setup and training time.

Pricing: Each plan requires a custom quote.

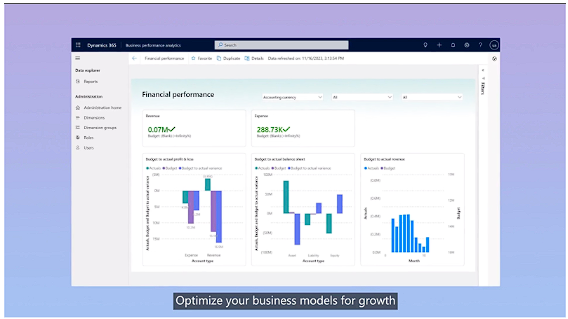

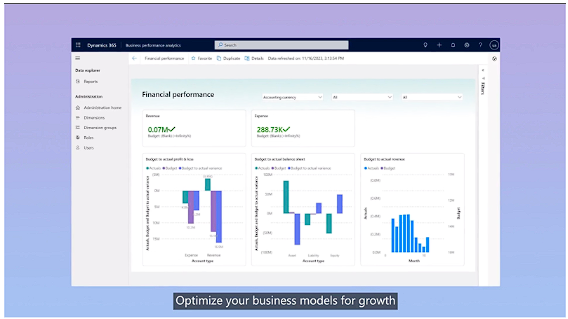

12. Microsoft Dynamics 365 Finance

Best for: Companies that want to be powered by Microsoft Copilot

What customers say: “Microsoft Dynamics 365 is a financial platform that facilitates the administration and management of all your business finances, allowing you to automatically record all income related to your business practices.” (Systems and network analyst)

Rating: G2: 4/5

Dynamics 365 Finance is an enterprise-grade ERP and financial reporting platform built on Microsoft’s Power Platform. It provides finance teams with standard financial statements built on live transactional data. It also connects directly with the wider Microsoft ecosystem—Excel, Power BI, Power Automate, and Dataverse—so teams can refresh reports instantly, embed visuals, or trigger workflows.

Features:

- Financial report builder: Create balance sheets, income statements, and cash-flow reports using over 22 built-in templates

- Drill-through reports: Go from high-level summaries into specific account entries or vouchers to investigate transactions from within your report viewer.

- Report scheduling: Schedule single or grouped reports to run daily, weekly, or monthly.

- Electronic reporting: Generate tax- and regulatory-compliant documents using the Electronic Reporting (ER) tool.

- Embedded analytics: Use Power BI models within Finance to build interactive dashboards that auto-update with ERP data for deeper insight.

Pros:

- Delivers a unified reporting environment with shared authoring, role-based control, and audit logs.

- Native integration with Excel and Power BI makes it easy to visualize and export data in familiar formats.

- Supports automated, on‑schedule report delivery for month‑end and board reporting.

Cons:

- Its ERP-first setup can feel complex and may require IT or consulting help to deploy effectively.

- Custom reports or integrations often need technical resources or partner support.

- Licensing and implementation costs increase as you add modules.

Pricing:

- Dynamics 365 Finance: $210/ mo per user

- Dynamics 365 Finance Premium: $300/mo per user

Best financial reporting software for startups and smaller businesses

Startups and small businesses need simpler financial reporting tools because reporting is often handled by small finance teams or founders who are balancing multiple responsibilities. Software that requires long setup cycles, complex modeling, or ongoing maintenance can slow decision-making instead of supporting it.

We chose these tools by looking for products that reliably support core small-business needs, such as cash flow visibility, basic financial statements, and budget-to-actual reporting, without requiring extensive customization or dedicated technical resources.

1. Sage 50 Cloud

Best for: Small businesses that want cloud accounting features

What customers say: “What I like best about Sage 50cloud Accounting is that it combines the reliability of desktop software with the flexibility of cloud features, making it easy to manage finances securely from anywhere.” (Verified user in accounting)

Rating: G2: 3.9/5

Sage 50cloud Accounting is a small business accounting platform that combines desktop accounting with cloud access and multi-user collaboration. It supports core accounting tasks such as invoicing, bill tracking, bank reconciliation, cash flow management, job costing, and inventory management, with plan-based options for advanced budgeting, multi-company consolidation, audit trails, and role-based permissions. Sage 50cloud also offers integrations through the Sage Marketplace and includes automatic updates, backups, and access from multiple devices.

Features:

- Advanced budgeting and reporting: Supports budgeting and reporting tools for core small-business financial planning.

- Cash flow management: Tracks cash inflows and outflows to support cash position visibility.

- Real-time inventory management: Tracks inventory levels and updates inventory records as transactions occur.

- What-if scenario analysis: Supports scenario changes to test how adjustments affect budgets and financial outcomes.

- Secure data sharing: Supports secure sharing of financial files and reporting access with accountants and advisors.

- Sales invoice management: Supports invoice creation and management, including tracking payments and related expenses.

Pros:

- Seamlessly integrates with Microsoft 365.

- Enables users to customize reports to fit all needs.

Cons:

- Limits permissions to the most expensive plan.

- Presents higher costs for larger teams.

- Advanced reporting only available on higher-tier plans.

Pricing:

- Pro Accounting: $1,362/year

- Premium Accounting: $1,807/year

- Quantum Accounting: $2,654/year

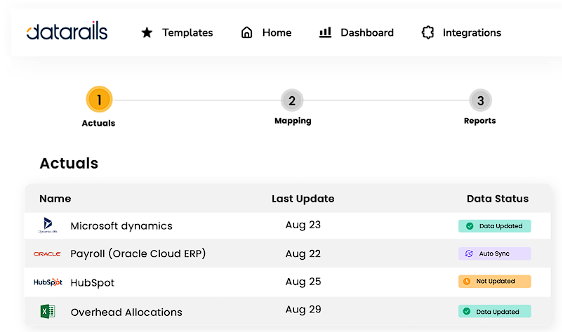

2. Datarails

Best for: Finance teams looking for an AI-powered Excel-native FP&A platform

What customers say: “One of the standout features of Datarails is its ability to consolidate multiple reports from a variety of sources.” (Finance director)

Rating: G2: 4.6/5

Datarails is a cloud-based FP&A platform built for teams that want to keep working in Excel while adding centralized data, automation, and controls. It connects to source systems (including accounting software, ERPs, CRMs, banks, and HRIS tools) and supports consolidation, reporting, budgeting, and planning workflows through its FinanceOS platform. Datarails also offers modules for cash management and month-end close, plus AI capabilities designed to reduce manual work and support analysis.

Features:

- Version control: Tracks and manages spreadsheet and report versions to reduce overwrite and duplication issues.

- Logical version comparison: Compares versions to identify changes across models, assumptions, and outputs.

- Cell drill-down: Supports drill-down from summary outputs into underlying source details at the cell level.

- Error prevention: Applies controls to reduce spreadsheet errors, broken links, and data loss.

Pros:

- Offers user-friendly dashboards.

- Keeps your FP&A team within Excel.

- Utilizes a mix of formulas and coding with a refreshed UI.

Cons:

- Limits functionality on Mac.

- Lacks compatibility with Google Sheets.

- Requires additional licenses for collaboration.

- Uses proprietary formulas and hidden columns in reports.

- Replaces much of your backend, making offboarding difficult.

Pricing: Datarails doesn't disclose prices online.

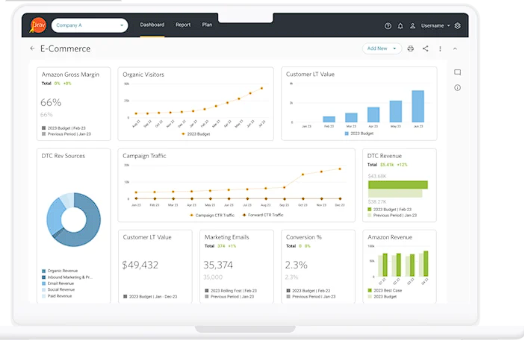

3. Jirav

Best for: Finance teams looking for an AI-powered Excel-native FP&A platform

What customers say: “Jirav's forecasting tool has been extremely useful especially when bringing in new clients with start ups.” (Verified user in accounting)

Rating: G2: 4.7/5

Jirav is a driver-based planning platform that gets FP&A teams out of spreadsheets.

Jirav is a great tool if:

- You're part of the 5% of finance professionals who don't believe advanced spreadsheet skills are essential for FP&A managers

- You prefer a driver-based approach to planning

- You want a strict cloud-based solution

Otherwise, Jirav is probably not the best fit.

Features:

- Driver-based planning: Uses business drivers to structure plans and forecasts across revenue, expenses, and headcount.

- Templated and custom reporting: Provides standard templates and supports custom report creation for different planning and reporting needs.

- Shareable dashboards: Shares dashboards with stakeholders, including users who do not have a Jirav license.

Pros:

- Allows users to access data and tools from anywhere with the cloud.

- Offers more affordable pricing compared to some competitors.

- Shares dashboards easily with others.

Cons:

- Replaces existing Excel models.

- Comes with slower processing

Pricing: Business pricing is not publicly available.

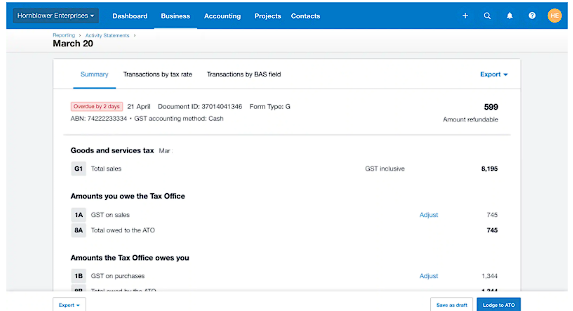

4. Xero

.png?width=318&height=159&name=xero-logo%20(1).png)

Best for: Small businesses and solopreneurs looking for an accounting software

What customers say: “For my small business bookkeeping practice, I value how straightforward Xero is. I can move from one client file to another without stopping to figure out where something lives.” (Small business owner)

Rating: G2: 4.4/5

Xero is a cloud-based accounting platform for small businesses and solopreneurs that supports invoicing, bills and expenses, bank connections and reconciliation, and cash flow tracking. It includes reporting tools for trend analysis and customizable reporting, and it connects with third-party apps through the Xero App Store. Xero also offers tools for automated document capture through Hubdoc and an AI assistant called JAX that can help answer questions, review financial data, and automate routine tasks such as creating and sending quotes and invoices across channels like WhatsApp, SMS, and email.

Features:

- Team collaboration: Supports multi-user access so teams can work in the same account with assigned roles.

- Customizable reports: Supports report creation and customization based on selected fields and reporting periods.

- Budget vs. actuals comparison: Supports budget tracking and comparisons against actual performance.

- Lock dates: Locks accounting periods to prevent changes after review or close.

- Search functionality: Supports search across transactions and records to locate specific entries quickly.

Pros:

- Provides 24/7 customer support.

- Enables users to generate interactive and KPI-specific reports.

- Tracks different business departments effectively.

- Integrates with Cube.

Cons:

- Lacks advanced functionality.

- Integration options with other financial software may be limited.

Pricing:

- Early: $25/month

- Growing: $55/month

- Established: $90/month

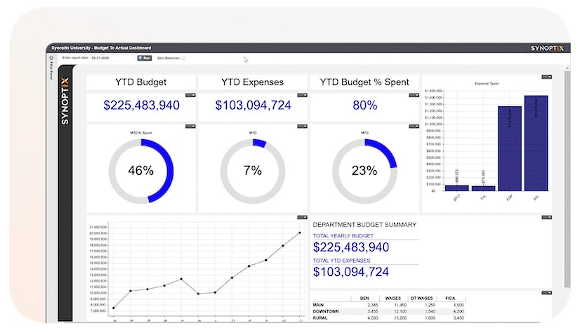

5. Synoptix

Best for: Finance teams looking for a FP&A software that offers real time insights

What customers say: “Synoptix has been useful for the reports we submit to auditors annually and for other reports that don't change. Any statements that are straightforward and don't need very much adjusting each report run are fine.” (Financial analyst)

Rating: G2: 4/5

Synoptix is an FP&A and financial reporting platform that connects to your existing ERP systems and centralizes finance data for reporting, dashboards, and budgeting workflows. It uses a spreadsheet-like interface and includes modules for financial reporting, dashboards and KPIs, and budgeting and forecasting.

Features:

- KPI dashboards: Builds dashboards that display key performance indicators and reporting views.

- Custom reports: Supports custom report creation based on reporting requirements and selected data fields.

- Real-time analytics: Updates reporting and analytics views using live or near real-time data.

- Drill-down functionality: Supports drill-down from summary reports into underlying details for review and validation.

Pros:

- Helps teams create annual financial statements efficiently.

- Software is suitable for a wide variety of businesses.

Cons:

- Lacks some advanced features.

- User interface may be difficult and outdated.

- Updates to the desktop version and online portal may be mismatched.

Pricing: Pricing is not publicly available.

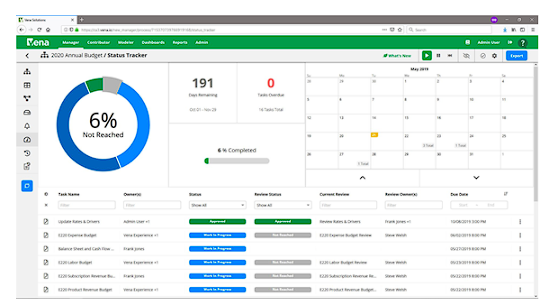

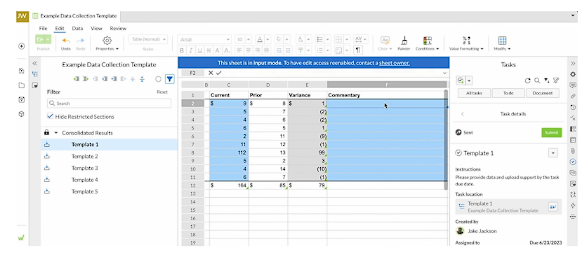

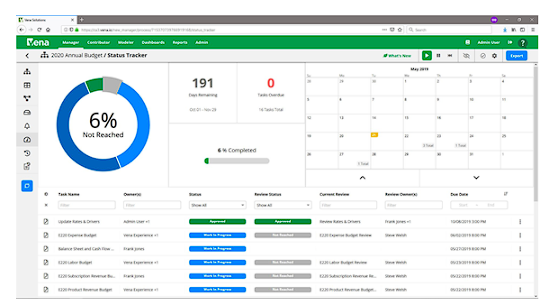

6. Vena Solutions

Best for: FP&A teams using AI copilots in Microsoft ecosystems

What customers say: “Vena has been great to improve our efficiency with financial reporting and budgeting/forecasting.” (Source)

Rating: Gartner: 4.4/5

Vena Solutions is a cloud-based FP&A and financial reporting platform built around Microsoft Excel and the Microsoft 365 ecosystem. It connects Excel-based models with a centralized database to support planning, budgeting, forecasting, financial close, consolidation, and management reporting.

Features:

- Financial management tools: Support finance workflows for managing planning and reporting processes.

- Financial and ad-hoc reporting: Supports standard financial reporting and ad hoc reporting for custom analysis needs.

- Real-time insights: Updates reporting views based on current data to support ongoing review.

- Financial statement templates: Provides templates for common financial statements and reporting packages.

- Ad hoc variance analysis: Supports variance analysis workflows for budgets vs. actuals and period-over-period comparisons.

Pros:

- Provides access to the platform on mobile devices.

- Features an easy-to-navigate interface.

- Seamlessly integrates with Excel.

Cons:

- Loading may require longer wait times.

- Training resources may be limited.

- Customization options may be lacking.

Pricing: Vena Solutions doesn't list prices on its website.

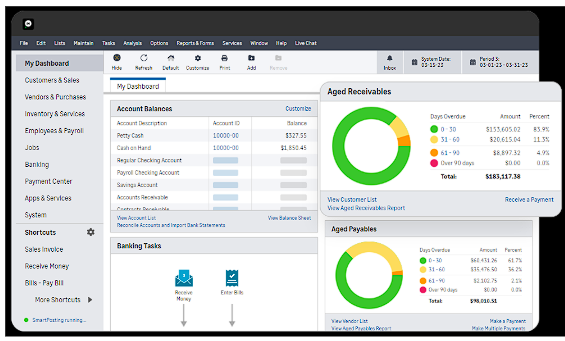

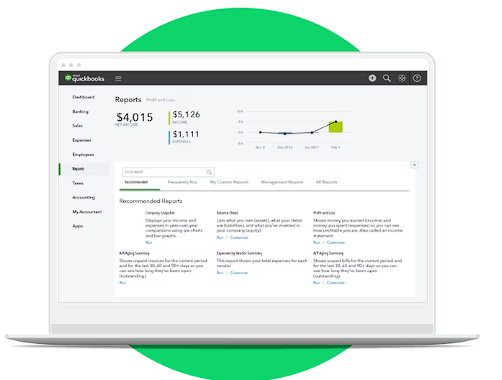

7. Intuit QuickBooks

Best for: Businesses needing core accounting with built-in financial reports

What customers say: “QuickBooks has been a game-changer for managing our finances. It’s user-friendly, efficient, and makes tracking invoices, expenses, and reports simple and organized.” (Operations manager)

Rating: G2: 4.4/5

Intuit QuickBooks is is a cloud accounting platform for small businesses that combines bookkeeping and reporting with invoicing, expenses, payments, and inventory tools in one system. It includes built-in automation through Intuit Assist, such as transaction categorization, anomaly detection, and support for reviewing and approving entries. QuickBooks offers multiple plans with different user limits and reporting controls, including a custom report builder, role-based permissions, class and location tracking, and data sync with Excel on higher tiers. It also integrates with hundreds of apps to connect accounting data with other business systems.

Features:

- Customizable quotes and invoice templates: Creates quotes and invoices using customizable templates and supports conversion from quote to invoice.

- Expense management: Tracks expenses, categorizes spending, and supports expense reporting workflows.

- VAT and GST support: Supports VAT and GST tracking and reporting for tax compliance.

- Inventory management: Tracks inventory levels and updates inventory records, including low-stock alerts where available.

- Reporting and insights: Provides reporting tools and business insights based on accounting activity.

- Multi-currency transactions: Supports transactions in multiple currencies for international activity.

- Financial consolidation: Consolidates financial data to support combined reporting views.

- Bookkeeping automation: Automates routine bookkeeping tasks to support tax preparation and period-end workflows.

Pros:

- Provides user-friendly software.

- Seamlessly integrates with other tools and systems.

- Serves as a cost-effective option for individuals and smaller businesses.

- Integrates with Cube

Cons:

- Offers limited ability to create custom reports.

- Customer support may be lacking.

- May not be ideal for larger companies.

Pricing:

- Simple Start: $30/mo

- Essentials: $70/mo

- Plus: $10/mo

- Advanced: $220/mo

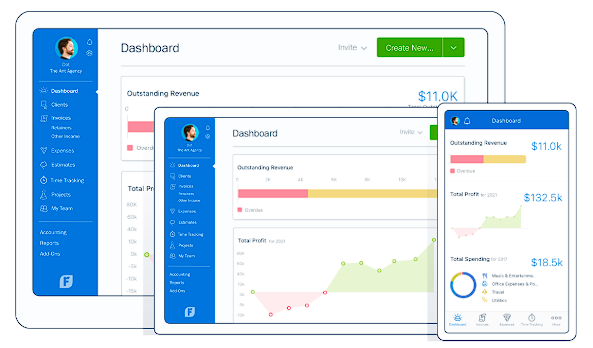

8. FreshBooks

.png?width=375&height=110&name=freshbooks-logo-1%20(1).png)

Best for: Small businesses that want invoice and accounting software

What customers say: “FreshBooks allows me to keep track of multiple clients with multiple projects each in a clean and organized manner.” (Small business owner)

Rating: G2: 4.5/5

FreshBooks is a cloud-based small business platform that combines invoicing, billing and payments, expense tracking, payroll options, and basic accounting in one system. It supports features like time tracking, estimates and proposals, client management, and mobile tools such as receipt scanning and bank imports to capture transactions. FreshBooks also offers reporting tools for common financial needs and integrates with third-party apps through its marketplace.

Features:

- Budget and sales tax summaries: Generates budget summaries and sales tax summaries for reporting and review.

- Profit and loss reports: Generates profit and loss reports across selected periods and categories.

- Accountant access and permissions: Provides accountant access with role-based permissions and controlled visibility.

- Expense reports: Generates expense reports using categorized transactions and spending summaries.

- Balance sheet reconciliation: Supports reconciliation for balance sheet accounts to validate balances and transactions.

- Journal entry tracking: Tracks journal entries, adjustments, and related history within the accounting record.

Pros:

- Serves as a cost-effective option, including a free trial.

- The interface is easy to navigate and use.

Cons:

- Some users experience slow loading times and occasional crashes.

- Primarily focuses on invoicing rather than comprehensive accounting.

- Rigid interface limits flexibility in some features.

- Better suits smaller operations.

Pricing:

- Lite: $21/mo

- Plus: $38/mo

- Premium: $65/mo

- Select: Custom pricing available

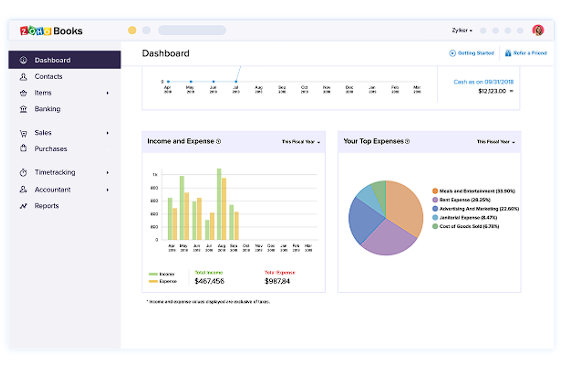

9. Zoho Books

Best for: Businesses that want to generate provincial & federal tax returns

What customers say: “Zohobooks is entirely cloud-based, which means that there is no need for maintaining and backing up data in the source system, and team members can collaborate and update the data easily.” (Chief financial officer)

Rating: G2: 4.4/5

Zoho Books is an accounting platform designed for growing businesses, offering a wide range of features to manage accounting tasks, organize transactions, and ensure tax compliance. It is known for its usability, security, extensibility, and reliability.

Features:

- Invoicing and billing: Creates invoices, tracks billing activity, and manages customer payments.

- Sales and purchase orders: Manages sales orders and purchase orders to support order-to-cash and procure-to-pay workflows.

- Project management: Tracks project activity and related costs and billing where applicable.

- Bank reconciliation: Supports bank reconciliation workflows to match transactions and validate account balances.

- Inventory management: Tracks inventory levels and updates inventory records tied to sales and purchases.

Pros:

- Offers a user-friendly interface.

- Provides strong security features.

- Integrates with over 300 business apps.

- Features cost-effective pricing options.

- Gives users access to reliable customer support.

Cons:

- Limits advanced features compared to competitors.

- Better suits for small to medium-sized businesses.

- Updates occasionally disrupt workflow.

Pricing:

- Free: $0.

- Standard: $20/month

- Professional: $50/month

- Premium: $70/month

10. Wave

Best for: Small businesses looking for money management solutions

What customers say: “It makes it quick and easy for small businesses with basic accounting needs to issue professional-looking invoices.” (Marketing specialist)

Rating: G2: 4.3/5

Wave is a cloud-based accounting and reporting platform that offers core bookkeeping tools like invoicing, bank reconciliation, and financial statements. It organizes reports into categories for financial statements, taxes, payroll, customers, vendors, and detailed transactions, so you can locate the exact insight you need. Wave aims itself towards freelancers, solopreneurs, and small businesses looking for simple setup and reliable reporting.

Features:

- Basic financial statements: Access auto-generated profit and loss, balance sheet, and cash flow reports that update with your banking and transaction activity.

- Bank reconciliation: Connect multiple bank and credit-card accounts with Plaid for auto-imports, categorization, and monthly reconciliation.

- Tax and payroll: Generate basic sales and payroll tax reports.

- Customer and vendor analytics: Track income by client, aged receivables, payables, and vendor spending.

- Transaction exports: Export general ledgers, account balances, and transaction history for deeper analysis or tax prep.

[Source]

Pros:

- Offers unlimited bookkeeping, invoicing, and reporting at zero cost.

- Auto-imports, categorizes, and reconciles transactions without manual entry.

- Presents reports in a straightforward and easy-to-understand way.

Cons:

- Does not support budgeting, custom reports, inventory, or ERP integrations.

- Features like bank auto-imports, payroll, payments, and expert support come at a cost.

Pricing:

Additional financial reporting software options

Here are additional financial reporting software options to consider, especially if you need reporting support tied to planning, consolidation, spend, payables, or ERP workflows:

- Abacum: FP&A platform that supports budgeting, forecasting, and management reporting for finance teams.

- Anaplan: Enterprise planning platform used for connected planning, scenario modeling, and reporting across large orgs.

- CCH Tagetik (CCH): Corporate performance management suite for consolidation, close, regulatory reporting, and planning.

- Fulfil: ERP platform for eCommerce operations that includes inventory, order, and financial reporting capabilities.

- Payouts.com: Payments platform that supports payout operations, reconciliation, and reporting for finance teams.

- Phocas: BI and analytics tool that connects to ERP and finance data to build dashboards and operational reporting.

- Puzzle.io: Accounting system that supports GL reporting, close workflows, and financial statements for startups.

- Ramp: Spend management platform that provides expense reporting, policy controls, and transaction-level visibility.

- Tipalti: AP automation platform that supports payments, supplier onboarding, tax form handling, and payables reporting.

Benefits of using financial reporting software

Using financial reporting software offers numerous advantages that can transform the efficiency and accuracy of your financial operations. Here are some key benefits:

Trend identification

Financial reporting software helps you spot trends by comparing historical results with current performance. About 64% of decisions are data-driven (up 12% year over year), which shows how much teams rely on consistent reporting to catch patterns early.

By tracking changes over time, you get clearer visibility into financial health and market shifts. That makes it easier to plan ahead, identify growth opportunities, and adjust budgets or forecasts before small issues become big ones.

For example, a retail team can use trend analysis to pinpoint seasonal buying patterns, then align inventory and promotions to match demand.

Real-time insights

Financial reporting tools can provide near real-time access to financial data, helping stakeholders make decisions faster. That speed matters when you need to respond to changes in revenue, spend, or cash flow without waiting for the next scheduled report cycle.

One benchmark shows that only 26% of streaming data is analyzed in real time before it lands in a repository, suggesting many teams still operate with delayed visibility. Strong reporting workflows can narrow that gap by keeping dashboards and reports closer to current state performance.

For instance, if sales drop suddenly, real-time reporting can surface the change quickly so teams can adjust pricing, promotions, or outreach while the window to respond is still open.

Time and labor cost savings

Automating financial reporting reduces the time and labor tied to manual data entry and report generation. McKinsey reports that AI can cut the time finance teams spend on data crunching by 20% to 30%, which gives teams more room for planning, analysis, and decision support.

For example, instead of spending hours compiling monthly financial statements, your team can focus on explaining performance drivers, finding cost opportunities, and supporting leadership with faster decisions.

Accurate data and consequently informed business decisions

Automation in financial reporting reduces manual entry and repeat reconciliations, which lowers the risk of inconsistent or incorrect numbers reaching stakeholders. Gartner estimates poor data quality costs organizations at least $12.9 million per year on average, which shows how expensive inaccurate reporting inputs can become.

Accurate data supports better decision-making because leaders can trust performance signals such as margin changes, expense spikes, and cash trends. For instance, reliable cash flow projections help manage liquidity, avoid shortages, and time investments with clearer visibility.

Better collaboration and cohesion across teams

Financial reporting software makes it easier for teams to work from the same numbers by enabling shared access, consistent definitions, and collaborative workflows. McKinsey found that organizations with faster, higher-quality decision making are 2.8 times more likely to be top financial performers, which highlights the value of alignment and shared visibility across departments.

When finance, operations, and marketing analyze the same reports and dashboards, discussions focus on actions instead of reconciling conflicting data. For example, a collaborative budgeting process helps teams align around the same targets and assumptions, reducing misalignment and improving execution.

Smaller chance of human error

Automating data collection and reporting lowers the risk of mistakes that often come with manual entry and spreadsheet-heavy workflows. Gartner reports that 18% of accountants make financial errors on a daily basis, and nearly one-third make errors at least several times per week, largely due to capacity constraints and manual processes.

By standardizing data flows and automating reconciliations, financial reporting software helps ensure numbers are consistent and accurate before reports reach decision-makers. For example, automated reconciliation can surface mismatches early and resolve them before they impact financial statements, improving trust in the data used for planning and decisions.

How to choose the right financial reporting solution

No two finance teams are the same. We can tell you what to look for, but ultimately, it's up to you to decide which financial reporting software fits your needs. As you evaluate options, consider the following:

- Functionality: Talk with your team to list out the features they need most. Do they need customizable reports, real-time data updates, automated data consolidation, or all of the above? The best tools enable you to drill down into data for detailed insights, making it easier to track financial health, analyze performance, and create presentations for stakeholders.

- Integration: Your software should work seamlessly with existing systems, like accounting tools, ERP platforms, or CRM software. Consider how well it syncs with common spreadsheet tools like Excel and Google Sheets, which many teams still rely on.

- Scalability: Think about where your business is headed. Will the software handle increased reporting demands and data complexity as you grow? Look for features that can keep up with your business so you don’t feel the need to upgrade software all over again anytime soon.

- User experience: Even the most powerful software can fall short if it’s difficult to use. Check user reviews for an intuitive interface with clear navigation, easy setup, and training resources. Consider whether it has role-based dashboards that let users see only what’s relevant to their job, which can simplify the experience for different teams.

- Security: Financial data is sensitive, so strong security measures are a must. Look for features that protect against data breaches or system failures.

Current financial reporting software trends

Here are some key trends pushing financial reporting forward:

- AI and automation: Financial reporting software is increasingly incorporating AI to enable automated financial reporting, streamline daily tasks, and analyze data. With AI forecasting capabilities, these tools generate more accurate predictive insights, helping finance teams anticipate future trends and outcomes.

- Real-time data processing: Real-time data processing features are becoming better at providing businesses with the most current financial information, automatically updating reports and dashboards without manual input. Instead of waiting hours or even a day for data updates, finance teams can see changes instantly. This immediate access helps teams respond faster and make more timely, informed decisions.

- Use of blockchain technology for enhanced security: Blockchain technology offers a secure, transparent way to record financial transactions. It can provide an immutable ledger of transactions to reduce the risk of fraud, make audits more efficient, and improve stakeholder trust.

- Cloud-based solutions: Modern businesses are embracing remote work and online collaboration. Cloud platforms provide easy access to reports and data from anywhere with an internet connection. When someone makes an update to the data, everyone with access can see the updates too.

- Customizable dashboards: More platforms are incorporating customizable dashboards to let users tailor reports and visuals to highlight their most important metrics. Different departments and stakeholders care about different aspects of the business and prefer when data is presented in a way that makes sense for their role.

- Continuous close and close automation: More teams are moving toward a continuous close model, using automation and AI to reconcile and analyze data throughout the month instead of waiting for month-end.

- Integrated financial and ESG reporting: Financial reporting platforms are expanding to support ESG and integrated reporting workflows, with stronger audit trails and data connectivity across finance, risk, and sustainability teams.

- Narrative reporting and automated commentary: Tools are increasingly helping finance teams produce management commentary and “what changed and why” narratives alongside tables and charts, often using AI to draft first-pass explanations.

Choose the best financial reporting software for your business

No business became successful without any support. Be it through a team of skilled professionals or machine learning tech, the best organizations offload the busy work so they can spend more time scaling.

By leveraging the right financial reporting software, businesses can streamline their financial processes, gain deeper insights, and make data-driven decisions that drive growth.

If your team is looking for an easier, faster way to create financial reports, multi-scenario forecasts, or conduct sensitivity analyses. Cube may be the solution you’re looking for.

Cube transforms raw data into actionable intelligence, unlocking new opportunities, mitigating risks, and driving sustainable growth. Cube brings agentic AI into a spreadsheet native FP&A platform, so AI accelerates analysis while your team owns the story. Cube’s FP&Agents give finance teams faster answers, deeper insights, and clearer “whys” by mirroring how strategic finance teams think, plan, and lead.

Want to see for yourself how Cube can help your business?

Request a free demo today to see if Cube is the right fit for your business.

.png)

.png)

.jpeg?width=249&height=70&name=insightsoftware_DETAIL%20(1).jpeg)

.png?width=318&height=159&name=xero-logo%20(1).png)

.png?width=375&height=110&name=freshbooks-logo-1%20(1).png)

![10+ Best ad hoc reporting software tools [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Bars%20Pie%20Chart.png)