Best financial forecasting software: Quick review

Before we dive into the details, here’s a quick glance at some of the best financial forecasting software available today:

- Cube

- Workday Adaptive Planning

- Anaplan

- Planful

- Vena Solutions

- Prophix

- Jirav

- Datarails

- Centage

- LivePlan

- Budgyt

- Oracle Essbase

- Oracle Hyperion

- Oracle PBCS

- Oracle Netsuite

- IBM Planning Analytics with Watson

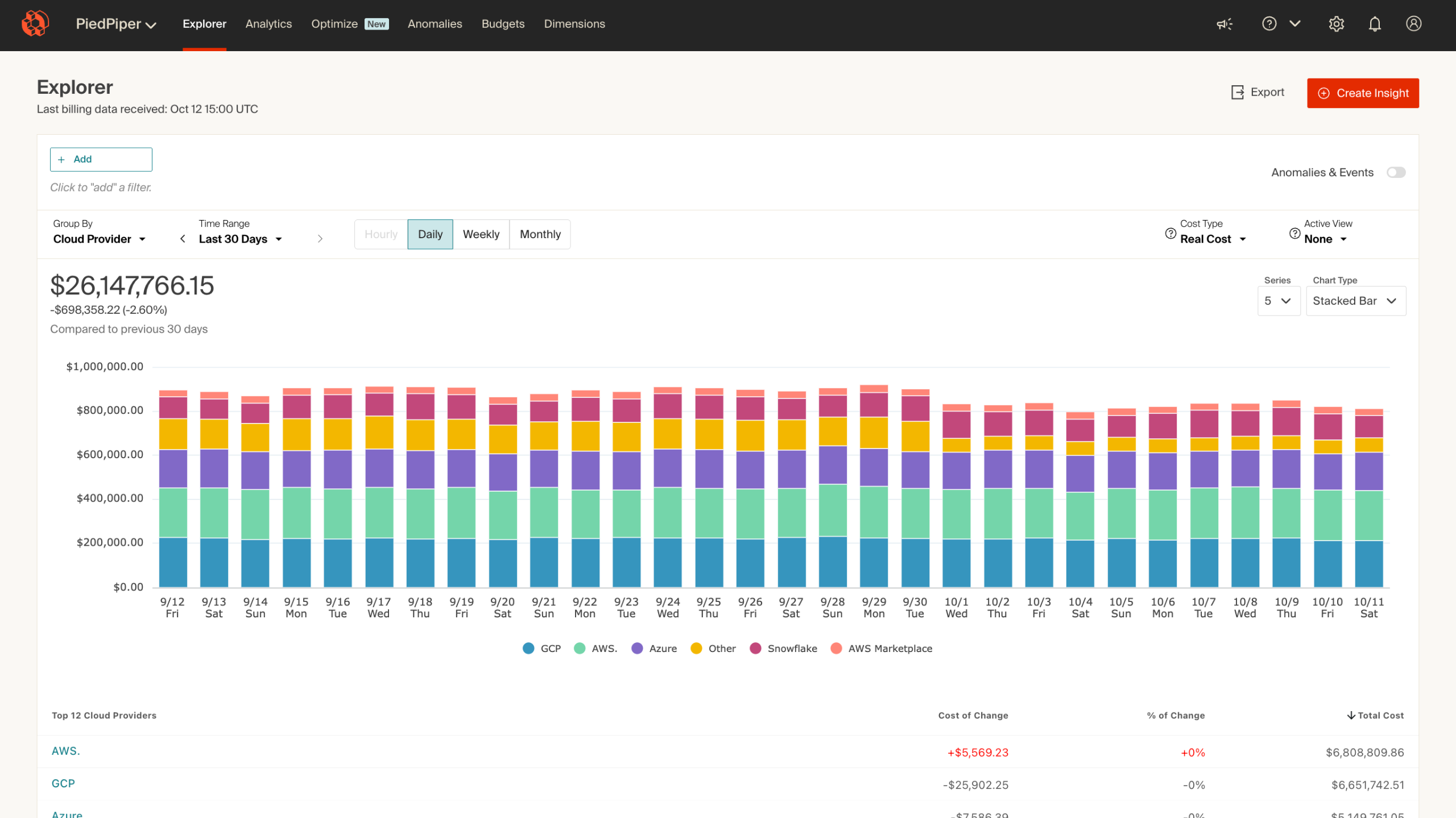

- Cloud Zero

- Baremetrics Forecast+

- Liveflow

- OneStream

- Board

- Mosaic Tech

- Causal

What is financial forecasting software?

Financial forecasting software helps businesses predict future revenue, expenses, and cash flow based on current and historical data. You can create forecasts by adjusting drivers like headcount, pricing, or sales volume and then instantly compare how each scenario affects your bottom line. These tools also let you track actual performance against your plan, so you can adjust quickly when things change.

Forecasting software vs financial planning software vs budgeting software

Forecasting, financial planning, and budgeting involve planning for future business outcomes, and teams often use them together. However, they differ in key areas:

- A budget is a plan. It sets the company's direction and outlines its ideal future state.

- A forecast is a set of expectations. It estimates revenue and income and informs a realistic budget.

- A financial plan is an action guide. It outlines how the business will spend its finances to achieve the budget and forecast.

The budget serves as the baseline against which companies measure their performance, while the forecast estimates future performance (which they measure against the budget) and the financial plan.

This difference in purpose is what separates budgeting software from forecasting software. Budgeting software helps businesses create and manage various budgets and track expenses against predefined limits. It offers features like resource allocation, revenue and expense variance analysis, and approval workflows for budget proposals and revisions.

Forecasting software predicts future financial performance with features like scenario modeling, predictive forecasting, what-if analytics, and risk management tools.

Financial planning software offers budgeting and forecasting capabilities, enabling businesses to manage their finances on a single platform.

Different types of forecasting software

Forecasting tools assist businesses in estimating changes in business activity and thereby aiding decision-making. Several forecasting tools exist, each serving a different function. These tools include:

- Quantitative forecasting tools: Quantitative forecasting tools rely on numerical data and historical trends to estimate future outcomes. They often apply statistical techniques, like regression analysis or time-series analysis, to make predictions. Industries with stable, data-rich environments—such as finance, manufacturing, and retail—find quantitative tools especially useful.

- Qualitative forecasting tools: Qualitative tools rely on non-numerical data, such as expert opinions and focus group insights. These tools are essential when historical data is scarce or nonexistent, like when forecasting demand for a new product or assessing an emerging market. By incorporating expert insights, qualitative tools capture critical factors that quantitative methods may overlook, providing context-driven forecasts that guide businesses through unfamiliar or developing markets.

- Modeling tools: Simulates complex scenarios by automating calculations across multiple variables. These tools are ideal for organizations that need to assess various "what-if" situations before making key decisions. By adjusting assumptions and inputs, businesses can model different scenarios, which helps identify optimal paths in complex processes where changes in one area can affect multiple others.

- Time-series analysis tools: Leverages historical data collected over time to identify trends, cycles, and patterns, making them highly effective in industries with seasonal or trend-based fluctuations. For example, companies use time-series analysis in sales forecasting, stock market predictions, and weather forecasts. By identifying these recurring patterns, businesses can predict future demand, adjust supply chains, or prepare for seasonal changes more accurately.

Benefits of financial forecasting software

FP&A teams have traditionally relied on large, complex, and interconnected offline spreadsheets to develop financial forecasts. No other business function depends more on Microsoft Excel or Google Sheets than FP&A. However, using spreadsheets without a centralized database poses challenges.

Modern, cloud-first, and highly powerful solutions now help FP&A departments perform financial forecasts better, faster, easier, and more confidently. Here are the benefits of using financial forecasting software:

Saves time

How much time do you spend manually entering data, creating complex spreadsheets, and updating your rolling forecasts? According to Asana, most people spend 157 hours yearly on manual recurring tasks.

You could direct that time to actual decision-making.

Without a single source of truth or centralized database, spreadsheets require constant checking of numbers, formulas, cell references, and more.

Forecasting software automates most of this work by connecting all data sources to a single platform with spreadsheet templates and built-in tools for maintaining rolling forecasts.

Improves decision-making process

Forecasting software streamlines your decision-making process and improves the quality of your business decisions. How?

You can analyze larger and more complex data sets than with spreadsheets. Handling more data reduces assumptions and creates forecasts based on proven insights.

The software helps you visualize and model scenarios based on your forecasts. You can compare outcomes of multiple scenarios, test the feasibility of forecasts, and choose the best outcome for the business.

Increases accuracy

Manual spreadsheet processes are vulnerable to human error, version control issues, and outdated data. Financial forecasting software eliminates many of these risks by automatically syncing data from source systems and ensuring everyone works with the latest numbers. Built-in audit trails and validation rules also help FP&A teams catch discrepancies before they become problems.

Allows for easy collaboration between teams

When teams manage spreadsheets individually, sharing, editing, and consolidating data can be slow and frustrating. Financial forecasting software brings everyone into a single, cloud-based workspace. Team members can review, comment on, and update forecasts in real time, regardless of location.

Built-in permissions keep sensitive information secure while allowing the right people to contribute—helping everyone stay aligned and moving forward together.

Scales with growing companies

As organizations grow, so do the number of departments, data sources, and stakeholders involved in forecasting. Financial forecasting software is built to scale alongside your business. You can easily add new users, departments, or reporting entities without rebuilding models from scratch. This flexibility lets FP&A teams keep pace with growth, support new business initiatives, and maintain clarity as complexity increases.

Key features of financial forecasting software

Financial forecasting software helps FP&A teams create financial forecasts.

Here's a few features to look out for in the best financial forecasting software:

- Unlimited scenarios: The best tools let you model multiple outcomes—like best case, worst case, or a plan with different growth assumptions. This way you’re prepared no matter how things shift.

- Excel compatibility: Many teams already build their models in Excel, so native compatibility means you can keep your workflows while gaining the power of automation, data syncing, and audit controls. It also helps onboard teams faster since there’s no need to learn a new system.

- Google Sheets compatibility: If your team prefers working in the cloud, Google Sheets support lets you collaborate in real time, eliminate versioning issues, and centralize feedback directly in the spreadsheet. It’s also very useful for remote teams or cross-department collaboration.

- Intuitive dashboards: Good forecasting software translates all of your important numbers into visuals that anyone can understand. Dashboards help stakeholders track key metrics, compare plans to actuals, and make faster decisions.

- Robust and in-house customer support: Forecasting can get complicated very fast, especially when pulling from multiple systems or building custom logic. Strong, accessible support ensures you get fast answers when something breaks or when you need help modeling something tricky.

Most importantly, the software should integrate with other business tools you use, such as your CRM, accounting software, payroll software, and more.

Best financial forecasting software tools

These are the top financial forecasting software providers, with crucial details on their features, benefits, targets, and more, all evaluated through an FP&A lens.

1. Cube

.png?width=161&height=48&name=horiz-wordmark-ultramarine%20(2).png)

Cube is a cloud-based FP&A platform that helps companies hit their numbers without having to sacrifice their spreadsheets. Cube helps your finance team work anywhere by natively integrating with Excel and Google Sheets so FP&A teams can plan, analyze, and collaborate with ultimate speed and confidence.

Many high-growth companies, like Instride and Figment, use Cube for their FP&A needs, including projects that require coordination across various teams like reporting and top down or bottom up budgeting.

Cube’s AI capabilities let teams ask questions, explain variances, and generate forecasts directly within Cube, Slack, or Microsoft Teams. Every AI insight is grounded in governed data and remains traceable so finance teams can move faster without losing control. Users can spot drivers behind missed targets, generating smart, scenario-ready forecasts, saves hours of manual work while preserving accuracy, and more.

FP&A teams already know and love spreadsheets. Cube simplifies many of the headaches of the often challenging planning process—like collecting actuals from other departments or checking and verifying that your numbers are correct—and lets teams turn their complicated budgeting process into a lean operation.

Users get all the benefits of a robust FP&A tool (like scenario analysis, data consolidation, and multi-currency support) within Excel and Google Sheets.

.png?width=1656&height=711&name=AI-Cube-Hero%20(1).png)

Key features:

- Automated data consolidation: Aggregate and manage all your business financial data on a single accessible platform.

- Customizable dashboards and reports: Use, adjust, and share reusable dashboard and reports.

- Scenario planning and analysis: Model and analyze multiple scenarios to plan better for business outcomes.

- Bi-directional Excel and Google Sheets integration: Leverage integrations with tools you already use for forecasting.

- Drill-throughs and audit trails: View all changes to your data in real time.

- User-based access controls: Customize user permissions and access levels to maintain the integrity of your business data.

- Centralized formulas and KPI: Host all your calculations and formulas in one place for easy access and knowledge sharing.

- AI-powered forecasting: Automatically generate smart forecasts using your own financial data to model faster and tweak assumptions.

- Conversational AI agents: Ask Cube questions in Slack, Teams, or your Cube workspace and get instant, data-backed answers.

- Smart variance analysis: Let Cube’s AI explain why numbers changed with clear, narrative context for your reports.

Integrations: Cube integrates with ERP, CRM, HRIS, and business intelligence systems to create a centralized data hub for financial planning. The platform connects with popular systems like NetSuite, Salesforce, and Microsoft Business Central, and offers native Excel and Google Sheets integration for familiar spreadsheet workflows. Cube also provides an open API for custom integrations and supports connections to accounting software, payroll systems, and other financial data sources.

Pros:

- Quick and specific analysis: Cube allows for extensive, quick data collection, quality assurance, and laser-sharp analysis without human error. Forecasting is easily customizable to answer your business’s unique, burning questions about the future.

- Intuitive and comfortable: Finance teams don’t have to abandon the spreadsheets they use. Cube lets you pull and push spreadsheet data while speeding up analysis.

- Expert support: Connect with Cube’s team of finance professionals to make the most of the software.

Cons:

Pricing:

Custom plans start at $30,000/annually. See detailed pricing for customizable plans.

Best for: Cube’s simple and intuitive experience makes it an excellent choice for mid-market companies that want to start fast with scalable, enterprise-grade technology at a reasonable price.

Want to give Cube a try?

Book your free demo.

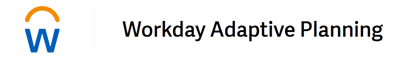

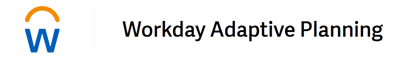

2. Workday Adaptive Planning

Workday Adaptive Planning, formerly called Adaptive Insights, provides enterprise solutions for planning, modeling, budgeting, and forecasting for the financial workforce.

Workday Adaptive Planning for Finance provides large enterprises with explicit financial planning and analytics. Their FP&A solution adds modeling, collaboration, analytics, financial management, board reporting, scenario planning, and financial consolidation capabilities. It also supports integration with other back end enterprise solutions like ERPs.

Key features:

- Rolling forecasts: Organize rolling forecasts to manage OpEX spending.

- Multi scenario modeling: Run multiple what-if scenarios with real time financial data.

- Collaborative forecasting: Leverage integrated workflows and consolidated data to increase team wide collaboration on forecasts.

Integrations: Workday Adaptive Planning supports integration with over 300 unique systems. The platform offers automated integration capabilities that connect with any ERP, CRM, HCM, and other enterprise systems without requiring IT dependency. It also features Custom Cloud Data Source (CCDS) connectors for secure cloud-based integrations.

Pros:

- Supports real-time collaboration and data updates

- Allows users to create customized financial models and forecasts

- Has scalable capacities for mid-sized as well as larger firm sizes

Cons:

- “Workday Adaptive Planning can be complex to set up and configure initially, requiring thorough training and expertise. Additionally, some users may find the interface to be less intuitive compared to other planning tools.” User review

- “The lack of file structure through the menu bar makes navigating the models a little difficult. All sheets appear in the same menu bar regardless of what model they belong to. It would be easier and cleaner to be able to group these sheets into a menu option based on their specific model.” User review

- “Finding comprehensive training and information for Workday Adaptive Planning can be challenging for several reasons. Despite Workday offering official training resources, these may not always meet every user’s specific needs or cover advanced features in depth. Documentation can vary in detail, and users might find that certain troubleshooting information or role-specific training is either limited or scattered across multiple sources.” User review

Pricing: Pricing is not available on their website

Best for: Their strong capabilities outside of finance and FP&A make Adaptive Planning a good choice for large enterprises seeking a transformational, company-wide FP&A solution.

3. Anaplan

Anaplan supports scenario planning, forecasting, and decision-making. Their enterprise-wide solutions connect strategy to outcomes with accountability to a single truth source.

Anaplan specifically provides FP&A solutions to connect people, data, and plans across the organization to get the right decisions.

The solution includes planning, budgeting, and forecasting; specialty finance planning; operational planning, which delivers better and faster decision-making; automated cost management practices; and connected financial and operational plans.

Key features:

- Hyperblock: Leverage Anaplan’s calculation engine to calculate large data sets.

- Scenario modeling: Model scenarios with dimensions such as location, currency, time, and more.

- Data Hub: House data needed to create financial forecasts and maintain a single source of truth.

Integrations: Anaplan provides multiple integration options including native CloudWorks for AWS, Azure, and Google BigQuery. The platform offers both bulk and transactional APIs for custom integrations and features Anaplan Data Orchestrator with pre-built connectors to popular systems like SAP, Salesforce, and Snowflake.

Pros:

- Supports collaboration across business functions

- Enables decision-making in real-time through integrated data connectivity

- Facilitates scenario planning, which is appropriate for fulfilling complex forecasting demands

Cons:

- “Limited documentation and enablement for the new applications. Impossible to choose between Polaris vs Classic engine ahead of the implementation (as a result of an analysis of the data).” User review

- “Models can quickly grow to become unmanageable, especially as business requirements change over time. The tool itself has a learning curve that can take end users longer to learn than expected. The depth of possible inputs or datapoints can lead to uncertainty if data hygiene is not maintained. Implementations may take months and require input from multiple teams across the organization.” User review

- “Need new features to stay up to date with the market—AI components and integration capabilities with ESG and other environments. Quick to implement, but with a modular design, a lot of things can go wrong if not implemented correctly.” User review

Pricing: Pricing for the Anaplan platform is not available online.

Also read: Anaplan vs. Adaptive vs. Planful vs. Vena vs. Datarails vs. Cube

Best for: Anaplan works for large enterprises with strong IT teams that can lead an enterprise-scale business transformation.

4. Planful

Planful offers a cloud-based budgeting software platform covering structured and dynamic planning, consolidation, and reporting. In early 2020, the company rebranded from Host Analytics to focus on mid-market customers.

For FP&A, Planful offers solutions for managing cash flow, workforce reporting, financial reporting, annual operating planning, monthly close and consolidation, and multi-dimensional analysis.

Key features:

- Pre-built templates: Forecast with prebuilt templates and native AI/ML.

- Rolling forecasts: Adapt to change with continuous planning and forecasting.

- Driver-based forecasting: Adjust key drivers when forecasting.

Integrations: Planful offers bi-directional data integration capabilities with ERP, HCM, CRM, data warehouses, and spreadsheets through pre-built connectors to over 100 source systems. It includes Universal CONNECT for enterprise resource planning systems and specialized CONNECT integrations for marketing platforms like Salesforce, Google Adwords, LinkedIn, and Facebook.

Pros:

- Helps in deploying budgets, making forecasts, and reporting in a single unified tool

- Offers customer support during the implementation process

- Provides dashboards that enable users to evaluate company KPIs and metrics at a glance

Cons:

- “I think the support team could be more helpful. Also, formatting can be a huge pain on reports. There are some nuances that can be really frustrating that doesn't make sense to why they don't have that functionality. There is a bit of a learning curve for users to learn how to create reports.” User review

- “The task manager is too simple and does not have a recurring option. The trainers sometimes do not know how to address our questions. The connection requires a middleware to transform data before being absorbed into Planful.” User review

- “More upgrades can be done to the templates to improve the load speed.” User review

Pricing: Planful doesn’t list pricing on their website.

Best for: Planful works for companies with large FP&A teams that want to collaborate more with the business.

5. Vena Solutions

Vena Solutions offers a planning platform designed to bring people, processes, and systems together with pre-built solutions to automate time-consuming tasks.

Specific capabilities include financial planning and analysis, reporting, compliance reporting, and financial close. The platform enables finance teams to do variance analysis, identify discrepancies, and build ad hoc reports for the business.

Vena offers “pre-configured” FP&A software for a prescriptive approach that you can then customize.

Key features:

- Central database: Consolidate data in one place for accurate forecasting.

- Workflow visualization: Use intuitive visual workflow tools to represent forecasts visually.

- Excel templates and integration: Use pre-built Excel templates to turn Excel into a complete forecasting tool with tools like drill-throughs and advanced modeling.

Integrations: Vena Solutions integrates with ERP/GL, HRIS, and CRM systems using pre-built connectors and custom integrations via the Vena API. Vena also connects to thousands of systems including on-premise and cloud storage, homegrown systems, SQL databases, and data warehouses, with Microsoft integration capabilities including Excel, Microsoft 365, Power BI, and Microsoft Teams.

Pros:

- Brings together familiarity with Excel and automation to speed up forecasting

- Provides great management of approval and completion of workflows

- Built-in reporting features help to exchange and collaborate on data easily

Cons:

- “Even with the Excel-based interface, it is still a steep learning curve for mastering all of its features and functionalities and it can take time and effort.” User review

- “The biggest issue about Vena from my point of view is the lack of some data operations and computational efficiency. Sometimes you feel limited in what you can do. And even though there exists a workaround it is sometimes not very computational and time efficient.” User review

- “The initial setup of complex workflows and integrations can take some time, especially for large organizations.” User review

Pricing: Vena doesn’t list the price on its website.

Best for: Vena works for companies that need the rigid process and planning controls of pre-built FP&A processes or want to customize a pre-built solution for their unique needs.

6. Prophix

Prophix sells a corporate performance management (CPM) solution designed to improve profitability and minimize risk by automating repetitive tasks.

The solutions help finance teams forecast, plan, and report with cloud or on-premise solutions. Users can keep all their processes and insights on one platform and use centralized capabilities like user management, workflow, and data integration.

Prophix also has an AI-powered virtual financial analyst that helps users identify and resolve human errors while forecasting.

Key features:

- Predictive forecasting: Create rolling and quarterly forecasts with speed and accuracy.

- Self-service analytics: Leverage AI-driven insights to drill into variances, uncover root causes, track performance, and make data-driven decisions.

- Integrations: Bring HRIS, CRM, and ERP systems on a single platform to simplify data collection.

Integrations: Prophix connects to multiple ERPs, HRIS, and CRMs. Users can access pre-built agents for popular data sources, certified strategic integration partnerships, and native Microsoft 365 integrations with Excel, PowerPoint, and Power BI.

Pros:

- Offers interactive data visualizations

- Enables users to automate financial activities eliminating the manual labor involved

- Provides effective integrated systems that help in enhancing data quality control

Cons:

- “One thing I’d say could be improved is the initial learning curve. While the interface is user-friendly, some of the more advanced features can be a bit tricky to get the hang of without proper training. The setup process can also be a bit time-consuming, especially if you’re trying to integrate it with other systems. Once you’re past that, though, it works really smoothly!” User review

- “I don't believe that Prophix is the easiest software to use. The UI of this system could use some work. Implementation was a long process and I don't believe it was handled correctly with my team, as most team members were not involved in the implementation.” User review

- “Some of the courses for training have significant overlap which makes them take longer to complete.” User review

Pricing: Prophix’s pricing isn’t available online.

Best for: Prophix works for automating slow, manual, repeatable FP&A processes using pre-built functionality.

7. Jirav

Jirav offers financial planning and analysis in the cloud, helping accounting and finance teams budget and forecast without relying on error-prone spreadsheets.

It’s also customizable so you can track, forecast, and share the data that matters most to your business.

The platform has separate solutions for accounting and CFO firms and small businesses, but it's better suited for smaller organizations that want to scale.

Key features:

- Driver-based financial modeling: Create and maintain financial forecast models across three financial statements with customized models or industry-accepted templates.

- Cashflow forecasting: Build what-if scenarios and define working capital assumptions to drive cash flow forecasts.

- Rolling forecasts: Integrate with key business systems, create monthly rolling forecasts, and set plans to roll forward automatically.

-png.png?width=1176&height=744&name=jirav-Dashboard%20(1)-png.png)

Integrations: Jirav offers native integrations with accounting systems including QuickBooks, Xero, NetSuite, and Sage Intacct. They also feature workforce integrations with payroll systems like ADP Run, Paylocity, UKG Pro, and Gusto.

Pros:

- Offers cloud-based planning, budgeting, and forecasting features

- Provides easily usable tools to startups and growing companies

- Has dashboards that help measure the performance of any metric that is considered critical in a company

Cons:

- “Certain assumptions can be difficult to create, such as the equivalent of an IF statement. Occasionally limited by the maximum number of reports or custom tables.” User review

- “The lack of guided training programs such as those offered by ClickUp or Salesforce make for a more difficult learning experience.” User review

- “It takes some time to build the models to talk to each other constantly, something beginners may struggle with.” User review

Pricing: Jirav doesn’t show pricing information on their website

Best for: Jirav is for small businesses that want to automate their financial processes by replacing spreadsheets with a simple tool.

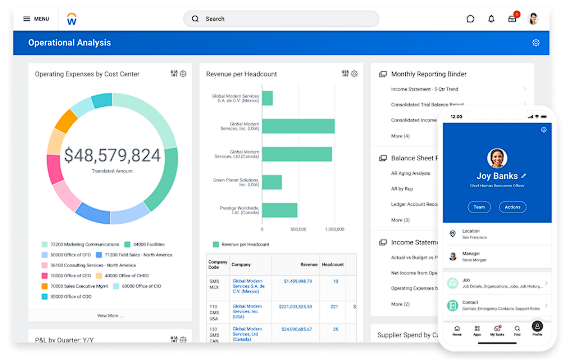

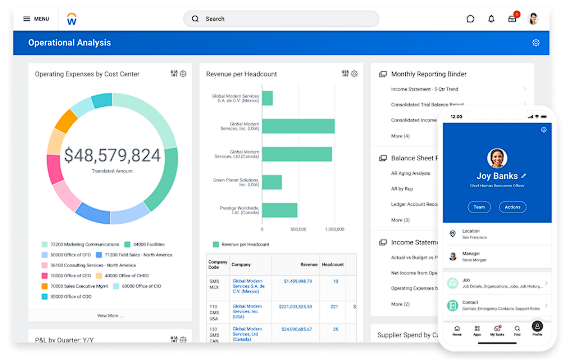

8. Datarails

Datarails offers financial reporting, data consolidation, scenario analysis, and ERP-Excel connectivity.

Their financial management platform empowers finance professionals to collect, report, and analyze data easily. Its FinanceOS enables users to keep building forecasts in Excel with more functionality.

Without changing how you work, Datarails creates a unified database of all your numbers by automating data collection from your organizational systems and spreadsheets.

Key features:

- Profitability analysis: Assess the business’s financial viability by forecasting revenue and expenses.

- Financial analytics: Use AI-powered FP&A tools to analyze patterns and trends.

- Production reporting: Forecast, track, analyze, and report resource allocation.

Integrations: Datarails integrates with accounting software, ERP, CRM, and HRIS systems through its FinanceOS platform and CONNECT tool. It supports systems like QuickBooks, Xero, NetSuite, Salesforce, and cloud storage solutions.

Pros:

- Allows financial planning based on Excel with more features for automation

- Enhances financial reporting by integrating several data sources into one

- Enables users to maintain data integrity through audit trails

Cons:

- “We are still in the implementation process and building the reports. Some fixtures are not intuitive, for example, uploading reports to share with other team members; and building widgets in the dashboard utilizing different data sources (financials and gross margin). I assume this will be resolved once we are done with the implementation.” User review

- “Exporting large volumes of data or directly integrating to BI tools like Tableau could be improved. Permission management is time-consuming and highly detailed. I wish there was a better way to lock an entire version with one or two clicks.” User review

- “My least favorite part is mapping new data and reports” User review

Pricing: Datarails pricing is unavailable on their website.

Best for: Datarails works for smaller companies that run financial processes and financial forecasts on Excel but have trouble finding and organizing data across spreadsheets.

9. Centage

Centage’s Planning Maestro helps users build flexible, driver-based plans, forecast likely financial performance, analyze results, and share critical information across the business.

Finance teams can keep track of assumptions made when forecasting and automatically adjust assumptions with real time data to make better decisions.

Key features:

- Cash flow forecasting: Sync cash flow information with actual budgets and monitor the effect of cash flow from any business operation area.

- Variance reporting: Generate up-to-date variance reports.

- Rolling forecasts: Run continuous yearly forecasts and generate monthly or quarterly re-forecasts as needed.

Integrations: Centage Planning Maestro can integrate with many leading accounting and ERP software solutions through general ledger data connections. The platform features built-in financial logic that automatically pulls GL data to perform budgeting, planning, and forecasting activities, with specific marketplace integrations available for systems like Sage Intacct.

Pros:

- Enables users to create custom calculations

- Offers multiple report-building options

- Supports long-term budgeting and continuous forecasting

Cons:

- “End users would like some functions similar to Excel functions.” User reviews

- “It only updates at the end of the day to actuals in our ERP system.” User reviews

- “Teams want it to function more like Excel.” User review

Pricing:

- Core: $2,250/mo

- Strategic: $3,250/mo

- Performance: $4,250/mo

Best for: Planning Maestro suits FP&A at small businesses looking to drop spreadsheets and enable more complex financial processes. Their solutions target specific industries, such as architecture, engineering and construction, education, and nonprofits.

10. LivePlan

LivePlan is a business planning system that helps startups, enterprises, or businesses in the ideation stage to create forecasts for financial statements investors want to see. It includes an AI assistant tool to generate ideas for plans and access sample plans for their industry.

LivePlan provides guidance from business planning experts through webinars, walkthrough videos, and tutorials. The platform integrates with accounting software like QuickBooks and Xero.

Key features:

- Automated forecasting: Use automated drag and drop forecasting to create sales forecasts, P&L statements, cash flow statements, etc.

- Scenario planning: Forecast scenarios to see how business decisions will impact bottom line performance.

- Custom comparison dashboards: Integrate data from Quickbooks or Xero and use the LivePlan dashboard to compare actual results to forecasts.

Integrations: LivePlan integrates with QuickBooks Online and Xero accounting software. The platform syncs with accounting solutions every 24 hours or upon login and allows users to map their chart of accounts to LivePlan forecasts to compare actual results to predictions through live dashboards and automated monthly reviews.

Pros:

- Works for small businesses and start-ups that focus on building business plans and budgets

- Streamlines the cash flow cycle by providing convenient and creative planning resources

- Provides extensive educational resources for new users

Cons:

- “It would have been great to have a mobile app or mobile friendly site to complete the plans online over mobile devices. Also, it would be helpful to have a course that can take someone through the essentials in completing their business plan. User review

- “It does not have an auto spell check integrated within it. I have found so many misspellings in my plan when looking at it in other forms or using the information as a reference for applications or other things.” User review

- “As a small business owner, I have found LivePlan to be a powerful tool for planning and tracking my business. However, I sometimes struggle with its lack of customization options. While LivePlan's templates are useful for general planning, they do not always cater to the unique needs and strategies of every business. This lack of flexibility can limit the plan's potential. Despite this, LivePlan is an effective tool for many other aspects of business planning and should not be overlooked.” User review

Pricing:

- Standard: $25/month

- Premium: $40/month

Best for: LivePlan works for individuals with a new business idea and startups looking to create fundable business plans.

11. Budgyt

Budgyt is a clean, simple platform for budgeting multiple P&Ls without needing Excel. It helps finance teams organize cluttered formulas and reduce the number of formulas used in financial forecasts.

This cloud-based, multi-department budgeting tool delivers solutions for small and medium-sized businesses, nonprofits, and larger enterprises.

Key features:

- Reforecasting: Use rolling and continuous forecasts in place of annual planning cycles.

- Custom APIs: Import data from other software via APIs.

- Data visualization: Use custom dashboards to compare forecasted vs actual data however you want.

Integrations: Budgyt integrates with all accounting platforms through general ledger CSV transaction detail reports. It also offers direct integration with QuickBooks Online, Xero, and ConnectWise through custom connectors and the Domo platform.

Pros:

- Offers a user-friendly, budget-centered software interface

- Integrates multiple budgets to present a single snapshot of financials

- Provides insightful reporting tools that meet analytical needs

Cons:

- “Seemingly simple tasks could take a longer time than required. I would like to be able to dynamically update the figures without having to upload the figures. A seamless integration will help facilitate the ease of interaction with the system.” User review

- “I wish I didn't have to import headcount into the tool” User review

- “Due to our data size, the refresh after entering data takes long” User review

Pricing: Pricing is not available on the website.

Best for: Budgyt works for small businesses, non profit, and larger enterprises with cost allocation needs.

12. Oracle Essbase

Oracle Essbase allows organizations to rapidly generate insights from multidimensional data sets using what-if analysis and data visualization tools. It’s a business analytics solution that can complement other FP&A tools with deeper analytics and modeling capabilities.

The platform has sandboxing capabilities that enable businesses to test models and determine which ones are appropriate for production. It also has a REST API to automate the management of Essbase tools.

Key features:

- What-if analysis: Model multiple what-if scenarios using business drivers.

- Analytical and calculation query engine: Do forecast calculations with out of the box and prebuilt mathematical functions.

- Excel integration: Build an advanced forecasting interface in Excel.

Integrations: Oracle Essbase supports integration with multiple data warehouses, legacy systems, ERP systems, CRM applications, and web log files through its Essbase Studio suite.

Pros:

- Offers rich data modeling and multidimensional analytics capabilities

- Supports multiple scenario modeling

- Suitable for large organizations with advanced data analytics and visualization

Cons:

- “Initial setup was very tough. Patches are time consuming. New employees…are finding it difficult to…use this product easily.” User review

- “The UI could be more intuitive. It looks similar to SQL dbms” User review

- “The downside of Essbase is the performance of calculation scripts. The script could take minutes if not hours to run and the debugging requires a skillset to understand.” User review

Pricing: Pricing details are unavailable online.

Best for: Oracle Essbase is best for extensive Oracle organizations seeking an analytics and modeling solution.

13. Oracle Hyperion

Oracle Hyperion Planning is part of Oracle’s broader enterprise business planning solutions. It combines financial and operational processes to increase business predictability.

Its capabilities for planning, budgeting, and forecasting align financial plans, models, and forecasts across departments, cost centers, and lines of business.

Oracle Hyperion Planning supports robust integrations and workflow capabilities and is available on desktop, mobile, and Microsoft Office interfaces.

Key features:

- Scenario planning: Model long and short-term business scenarios.

- Narrative reporting: Provide context to forecasted numbers.

- Data management: Reconcile metadata differences across business units.

Integrations: Oracle Hyperion connects with Oracle ERP, SAP, and Microsoft Dynamics systems. Users can also connect to Microsoft Office applications including Excel, Word, PowerPoint, and Outlook through its interface capabilities.

Pros:

- Provides a complete solution for corporate planning

- Aggregates data in real time

- Allows users manage voluminous information and finances and producing reports

Cons:

- “There are a lot of processes that still occur outside of the application that we perform in order to provide our inputs. This has caused some challenges in user adoption as spreadsheets are easier for them.” User review

- “It is not easy and intuitive and needs lots of training and configurations. The most important aspect is the correct implementation of the suite to integrate with Salesforce and other applications and also have a way to add Headcount and commentary details as part of the financial information.” User review

- “Teaching the user how to use the software can be troublesome sometimes because our clients who are not from a technical background find it a bit difficult to use. My team and I face technical glitches a lot when we work on the application simultaneously.” User review

Pricing: Pricing is unavailable online.

Best for: Oracle Hyperion Planning serves large organizations seeking an enterprise-grade performance planning management solution integrated with other Oracle solutions.

14. Oracle PBCS

Oracle Enterprise Planning and Budgeting Cloud Service (PBCS) offers operational planning with flexibility, scalability, transparency, and control.

Their software solution uses built-in best corporate finance practices through a configuration framework that you can use as-is or customize for unique needs.

The software allows users to connect every part of their business with an integrated plan across finance, operations, and other lines of business.

Key features:

- Freeform modeling: Use freeform ad-hoc modeling to model operational what-if scenarios.

- Predictive planning: Validate forecasting assumptions and reduce financial risks.

- Interactive dashboards: Gain insights with interactive, easy-to-read dashboards.

Integrations: Oracle PBCS integrates with ERP systems and supports Microsoft Office integration through Smart View for Excel, Word, Outlook, and PowerPoint. The platform also offers flat-file and Excel-based import/export capabilities with data mapping features.

Pros:

- Available on cloud, and has great budgeting and forecasting functions

- Adds value to enterprise by making it possible for adaptability and growth

- Suitable for organizations that process large quantities of information

Cons:

- “The difficulty of obtaining reports and the time taken to access data as there are other programs in which data access is easier, faster and convenient for all users.” User review

- “Typically requires more IT involvement than previous generation Oracle EPM offerings.” User review

- “At times the Oracle does face server issues which hampers the work.” User review

Pricing: Pricing is not available online.

Best for: Oracle PBCS suits large enterprises that combine financial and operational planning and have existing investments in Oracle solutions.

15. Oracle NetSuite

NetSuite Planning and Budgeting, an enterprise resource management (ERP) tool, offers planning and integrated accounting software.

Users can automate planning and budgeting processes and centralize financial and operational data for companies in specific industries.

FP&A teams quickly and easily create budgets, financial forecasts, what-if scenarios, and reports within one tool. However, more robust demand planners might combine NetSuite with a dedicated financial forecasting tool on this list.

Key features:

- Data warehouse: Simplify data management with a cloud-based storage platform.

- Reporting & dashboards: Use built in real-time reporting and dashboard functionality for actionable analysis.

- Financial forecasting: Reduce forecasting cycle times.

.png?width=594&height=367&name=oracle-netsuite%20(1).png)

Integrations: NetSuite Planning and Budgeting includes prebuilt data synchronization with NetSuite ERP and HCM systems. TIt also supports Smart View integration for Microsoft Office tools including Outlook, Excel, Word, and PowerPoint.

Pros:

- Offers a complete ERP solution for business forecasting

- Provides plug-and-play API capabilities

- Enables users to consolidate their finances and see all data in one place

Cons:

- “Our biggest challenge so far has been the pace of implementation. This is a lengthy process to find out exactly how to make NetSuite fit with our business, but putting in the effort up front will certainly go a long way down the road.” User review

- “The drawback I have seen so far is consistently connecting and interacting with our bank accounts. The account transactions, when imported, exist only on one screen. Unlike Quickbooks, you cannot use them to post to your general ledger - you must create your own NetSuite records to match the bank records. We have also had some connection issues with manually importing CSV files for bank transactions.” User review

- “The least favorite thing is the advanced analytics, saved searches, datasets, etc. Seems like only a computer programmer can figure it out. Even in the training sessions, there are so many tricks, codes, etc. for this portion, it is difficult to do. I have been to 3-4 training sessions on this, and am no closer to figuring it out than when I started. Also, there are lots of bugs in the non-profit reporting module.” User review

Pricing: Pricing is not available on the website or other online sources.

Best for: NetSuite Planning and Budgeting serves large companies in specific industries that already use NetSuite solutions.

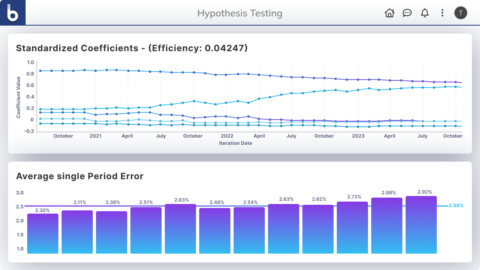

16. IBM Planning Analytics with Watson

IBM Planning Analytics with Watson streamlines and integrates financial and operational planning across the enterprise.

More than just budgeting and forecasting software, the platform uses Watson AI to power your financial forecasting or demand planning process.

Users can analyze fine-grained and large-scale what-if scenarios in real-time. It provides built-in AI capabilities for teams to forecast business outcomes with greater accuracy.

Key features:

- Baseline forecasting: Project future outcomes with historical data.

- Univariate forecasting: Analyze and model forecasts using time series AI algorithms.

- Multivariate forecasting: Analyze past trends across multiple variables.

.png?width=1316&height=987&name=ibm-view-1%20(1).png)

Integrations: IBM Planning Analytics links with ERP, CRM, and HRM systems using standard database connections. It also features direct SAP integration with high-speed data transfer capabilities supporting around 20,000 records per second from various SAP systems.

Pros:

- Integrates with other tools and AWS services

- Enables users to analyze large amounts of data quickly

- Offers a customizable platform that businesses can tailor to their needs

Cons:

- “While Planning Analytics is a robust tool, there are a few downsides or challenges that users often encounter. While the TM1 engine is designed for speed, some users report performance issues with extremely large and complex models which can slow down operations. IBM has invested resources into the database but lacks on the front-end side and it is almost a requirement to leverage other 3rd party tools to cover IDE-like development and web experiences.” User review

- “Most things are just a case of getting used to using the Cloud, and you do lose a level of control around things like software updates. Another problem is that IBM Planning Analytics does not have an app; this means that the users are literally stuck up with their plans. Ways could be designed for internal and external people to ideate easily and then collaborate on those ideas.” User review

- “The UX experience needs a modernized touch.” User review

Pricing:

- Essential: $825/month

- Standard: $1650/month

- Premium: Custom quote

Best for: IBM planning analytics is best for enterprises already using other IBM solutions.

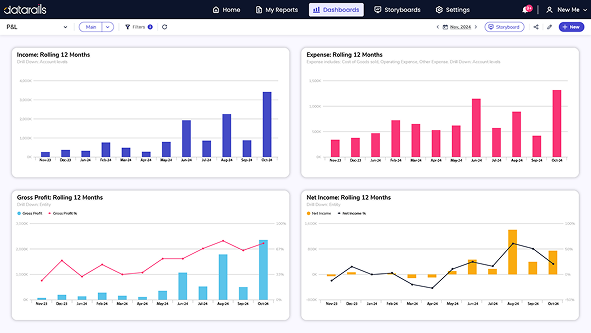

17. Cloud Zero

Cloud Zero is a cloud-based cost intelligence platform that enables businesses to optimize spending and identify savings opportunities.

Its solutions help users forecast and track the cost of business operations lines, like projects, apps, teams, and features. It integrates with cloud platforms including Amazon Web Services, Google Cloud Platform, and MongoDB.

Key features:

- Reporting: Simplify forecast reporting with standard dashboards.

- Anomaly detection: Leverage AI to detect and flag abnormal spending patterns.

- Notifications and updates: Send regular updates to teams about how they’re tracking against forecasts.

Integrations: CloudZero supports AWS, Azure, Google Cloud Platform, Kubernetes, Snowflake, MongoDB, Databricks, Datadog, and New Relic via its AnyCost framework. They also include an AnyCost API for building custom integrations.

Pros:

- Supports businesses that have considerable ongoing cloud infrastructure use

- Provides customizations that make it easier to update business dimensions

- Has dashboard capabilities with data drill down and visualizations

Cons:

- “For the moment the creation of custom report needs Cloudzero help” User review

- “The highly customized features do require a longer learning curve compared with other cloud tools. However, the payoff is well worth what the visualizations are able to produce.” User review

- “It's a hard one. They replatformed from using quicksight to looker internally which broke a few bookmarks I had. The configuration could be more intuitive but they provide great tooling and usually, the AM is doing that anyway” User review

Pricing: Pricing is not available online.

Best for: Cloud Zero suits more technical organizations focused on cost optimization and cost savings.

18. Baremetrics Forecast+

Baremetrics Forecast+ offers FP&A for SaaS companies to perform end-to-end forecasting for their subscription business. It uses a three-statement financial forecasting model. The platform integrates with Xero and QuickBooks, automatically consolidating monthly data and enabling users to generate charts and dashboards in a few clicks.

Baremetrics also supports hiring planning by forecasting current and future employee needs and HR costs.

Key features:

- Scenario planning: Plan for multiple business outcomes.

- Custom reporting: Create forecast to actual reports.

- Hiring planning: Forecast when you can afford to hire and how much to pay.

Integrations: Baremetrics Forecast+ connects directly with QuickBooks Online and Xero to sync actuals for forecasting. It also integrates with Stripe, Braintree, Recurly, Chargebee, Shopify, the Apple App Store, and Google Play. Users can connect additional tools via Zapier, Pabbly, or Baremetrics' public API.

Pros:

- Integrates well with accounting software.

- Enables businesses to view key metrics like revenue, profit, and churn at a glance.

- Integrates with Stripe’s metered usage.

Cons:

- “The developer documentation could use some improvement, and having node packages for advanced integration would be incredibly beneficial.” User review

- “While it has proven to be a great tool for our business, one area where there could be improvement is in the level of customization for certain reports. While the existing reports are comprehensive, having even more flexibility to tailor reports would be beneficial.” User review

- “I would love a way to more easily see total $ churn in certain date ranges. I always have to manually add up the full list of customer churn manually.” User review

Pricing: Pricing starts at $100/mo

Best for: Baremetrics suits SaaS companies with subscription businesses.

19. Liveflow

Liveflow is a financial forecasting tool that streamlines data integration and automation for better financial management. It enables users to automate repetitive finance and accounting tasks, report generation for clients, and data consolidation.

The platform offers spreadsheet integration capabilities that allow businesses to connect accounting software like Quickbooks to Google Sheets or Excel and sync reports in real-time or create interactive dashboards.

Liveflow has customizable templates for budget vs actuals, consolidation, vendor spend, board reporting, and 13-week cash flow forecast. The software also has a benchmarking tool for tracking performance across multiple business units.

Key features:

- Real-time financial data integration: Pull in updated data for an accurate view of financials.

- Customizable forecasting templates: Tailor existing forecasting templates.

- Automation tools: Automate repetitive tasks to save time and reduce manual errors.

Integrations: LiveFlow syncs directly with QuickBooks Online and Xero, to deliver live financials into Google Sheets and Microsoft Excel. It also connects to over 12,000 U.S. banks for live transaction and balance data.

Pros:

- Integrates with accounting software like Quickbooks and Xero

- Integrates with Excel and Google Sheets

- Enables users to categorize and track expenses

Cons:

- “My solitary suggestion for improvement with LiveFlow would be the integration of QBO's custom reports, as opposed to being confined to the pre-existing, pre-populated ones.” User review

- “While LiveFlow does a lot of things well, it struggles with more complex or custom financial reports that need deeper customization. You still end up doing some manual adjustments, which cuts into the efficiency a bit.” User review

- “If there is a cashflow report where we can group chart of accounts with our own metrics. Their cashflow report that is available right now is great but I wish there was a cashflow report that reflect cash movement with P&L and Balance sheet account presented on the same screen.” User review

Pricing: Liveflow offers a custom pricing plan plus a one-time implementation fee of $2,500.

Best for: Liveflow is ideal for medium to enterprise level businesses that need real-time financial insights and automated forecasting solutions.

20. OneStream

OneStream is a financial software solution built specifically for enterprises that need robust financial consolidation and reporting. It provides a unified platform that streamlines budgeting, forecasting, and financial analysis.

The platform enables businesses to reduce overhead through cash management, key performance indicator (KPI) tracking, and bank reconciliation. It integrates with Microsoft Office Suite so users can perform advanced analytics with Excel and other tools.

Onestream has inbuilt artificial intelligence and machine learning capabilities that enable businesses to automate some manual FP&A processes, automatically generate insights from data, and increase forecasting accuracy.

Key features:

- Budgeting and forecasting: Consolidate financial data across departments.

- Financial consolidation: Handle complex financial structures to simplify consolidation.

- Built-in AI and ML: Enhance forecasting accuracy and automate analytics.

Integrations: OneStream users can add connectors via OneStream’s Solution Exchange, extending to ERP, financial consolidation, and reporting systems.

Pros:

- Provides a customizable platform that adapts to specific business needs.

- Grows with the company, making it suitable for large enterprises.

- Improves forecasting precision, giving enterprises a data-driven decision-making process.

Cons:

- “With all the options available in OneStream, the user experience may seem overwhelming without the proper support of the Admins and super users.” User review

- “The UI on the desktop app feels relatively outdated, and the terminology can be difficult to understand. Extendable dimensionality took me a long time to understand even with the training provided online, so it would be nice to see additional basic training to help new users get acquainted with the software.” User review

- “Quick view is not very flexible; also to save the offline version of Excel, I have to refresh data again” User review

Pricing: Pricing is not available on the Onestream website and online sources.

Best for: OneStream works for large corporations that need a comprehensive tool for financial management, forecasting, and reporting.

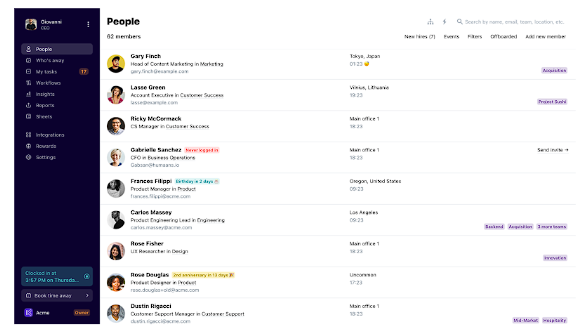

21. Board

Board is a financial forecasting and analytics tool designed to support data-driven decision-making for businesses. By combining robust analytics with customizable forecasting models, the Board enables finance teams to visualize and manage financial data effectively.

The platform supports enterprise-level planning and offers AI-powered financial and operational planning, a 360-degree view of internal and external business data, and enterprise-wide collaboration capability for users to share real-time insights across departments.

Board has a user interface tailored for different roles and supports low/no code development for businesses to build custom solutions. It also provides cloud infrastructure hosted on Microsoft Azure.

Key features:

- Visual data analytics: Use clear, interactive visualizations to simplify data interpretation.

- Collaboration tool: Work with multiple teams in real time for seamless collaboration for improved financial planning.

- Forecasting models: Leverage inbuilt customizable forecasting models.

Integrations: Board integrates two-way with operational and CRM systems, enabling drill-down from board-level analytics into CRM objects (accounts, leads, opportunities). It also supports integrations for file storage through Google Drive, Dropbox, and OneDrive and meeting and collaboration tools like Zoom and Microsoft Teams.

Pros:

- Enables users to understand data better through simple visualizations

- Offers flexible forecasting models users can customize

- Integrates well with existing data systems

Cons:

- “Board is not easy to learn for beginners, requiring quite the introduction to get started. Although offered as a low-code tool, the technical (and analytical) knowledge required is quite present. Building something from scratch can be quite a challenge, often requiring expert guidance in the progress. The licensing model is quite costly also, making it a choice worth considering before diving fully into it.” User review

- “Data hierarchies are confusing for non-technical people.” User review

- “The idea of having a blank sheet from the start can also be a risk for implementations. Customers really need to dedicate their time to the project at the beginning together with the implementation partner to make sure that the basis of the model is robust and well considered. In case this dedication is not present it is very easy to run into problems at a later stage of the model because of design decisions that were made in the beginning.” User review

Pricing: Board offers custom pricing for multiple functions including finance, supply chain, retail, sales, HR, predictive analytics, premium support, and integrations.

Best for: Board is ideal for businesses that need advanced analytics and high-quality visualization tools to enhance their financial planning.

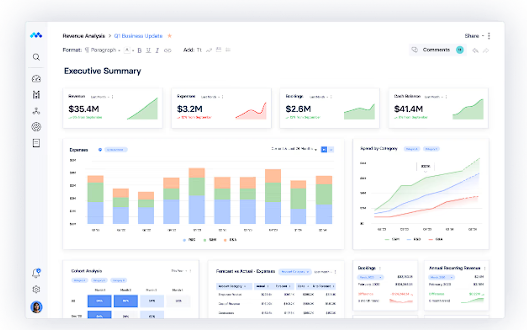

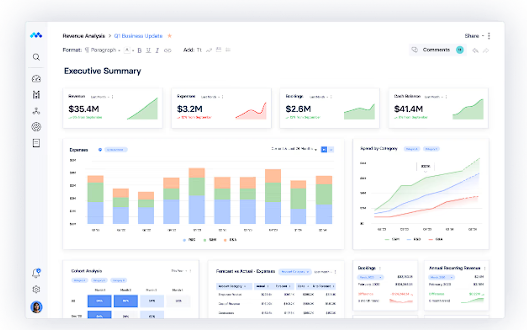

22. Mosaic Tech

Mosaic Tech is a strategic finance platform that focuses on collaborative FP&A and live reporting. It enables finance teams to consolidate ERP, CRM, HRIS, billing, and warehouse data into a centralized system for driver-based forecasting, scenario planning, and visual dashboards. It supports live updates, offers interactive metrics without any technical resources needed, and helps with reporting by automating models and roll-forwards.

Key features:

- Multi-source data syncing: Connect ERP, CRM, billing, and HR tools like NetSuite, QuickBooks, Salesforce, Stripe, and Gusto for up-to-date planning.

- Interactive dashboards: Build live dashboards with 150+ templates for financial reporting, workforce planning, and executive summaries.

- Driver-based forecasting: Create custom financial models with roll-forwards, versioning, and scenario comparisons across metrics.

Integrations: Mosaic connects with ERP systems, CRM platforms, billing tools, HRIS systems, and data warehouses like Google BigQuery. It also supports document and spreadsheet imports through CSV and Google Sheets for comprehensive FP&A data.

Pros:

- Unifies finance, HR, sales, and billing

- Provides live, visual insights with minimal setup

- Scales for strategic planning and mid-market to high-growth teams

Cons:

- “The syntax of the formulas is different from Excel/GSheet.” user review

- “The flexibility with graphical views are limited.” user review

- “Mosaic can be a little tricky to navigate when you want to publish models to use for analysis.” user review

Pricing: Pricing is not publicly available.

Best for: Mosaic tech is best for Mid-market and high-growth companies that need connected, collaborative FP&A across departments.

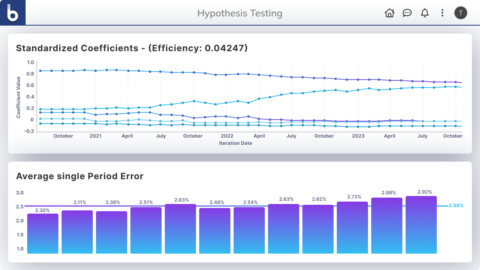

23. Causal

Causal is a modeling-first FP&A tool that helps finance teams build spreadsheet-style financial models with modular logic and clear visual outputs. It combines native integrations with core business systems and an AI component to support advanced scenario planning. Users can drag in their financials, HR metrics, CRM data, or warehouse information directly into their models and instantly view outputs as charts or dashboards.

Key features:

- Live book-to-model sync: Automatically pull P&L and balance sheet data from QuickBooks, Xero, and NetSuite.

- Rolling scenario modeling: Run “what-if” scenarios using real-time HR and CRM inputs.

- Interactive dashboards: Turn models into shareable charts that update as data refreshes.

Integrations: Causal offers native syncing with spreadsheets like Google Sheets, Excel, CSV uploads and accounting/ERP platforms like QuickBooks, Xero, NetSuite. HubSpot workflows can also trigger Causal actions.

Pros:

- Keeps models organized and version-controlled

- Integrates business systems without manual exports

- Supports agile financial planning while minimizing errors

Cons:

- “It could increase the number of integrations.” user review

- “I would like the dashboards to have even more customization options and to be able to set up different dashboards for different stakeholders for one model.” user review

- “It is quite tech-heavy and so it takes some getting used to.” user review

Pricing: Pricing is not publicly available.

Best for: Casual is best for startups, lean finance teams, and analysts needing financial modeling with minimal spreadsheet complexity.

Financial forecasting methods

Determining historical and current financial performance requires FP&A to gather organizational data from the past several years or quarters, depending upon the cyclicality and seasonality of a particular business or sector.

Estimates of future performance, however, vary widely by company and sector. There are several methods of financial forecasting:

Straight-line financial forecasting

Suppose your business operates in a stable industry and has experienced a 3% increase in revenue per quarter for the past several years. You can assume a similar growth rate going forward, barring any economic chaos.

This method is a “straight-line forecast” and is relatively simple. Your FP&A team assumes the organization will continue growing in a straight line.

However, straight-line forecasting is more complex in practice.

New products entering markets, economic uncertainty, pandemics, internal decisions, headcount changes, executive movements, and other factors impact financial forecasts. Your FP&A team must deal with a lot of data.

You need to account for all these factors. Even when using straight-line forecasting, your FP&A team needs a financial software tool or solution to assist.

Moving averages financial forecasting

If your business relies on historical data to develop financial forecasts, moving average financial forecasting incorporates more data and statistics into its projections.

A moving average uses data from several prior periods to estimate the next period’s results. By averaging over an extended series of periods, it reduces the impact of anomalies, one-time changes, or other fleeting factors affecting future forecasts.

While moving average financial forecasting uses straightforward averaging, it can quickly become complex as FP&A teams forecast more granular details beyond just revenue or profits.

Equip your FP&A team with a modern tool for financial forecasting if your organization has complex product lines, multiple regions, and other factors.

Times series financial forecasting

If you operate in a sector or industry with less predictable financial results, your FP&A team may choose to employ a time series method of financial forecasting.

Time series forecasting is particularly helpful for industries that experience cyclical or seasonal changes, such as winter sports apparel companies or lawn mower manufacturers.

This method benefits organizations that frequently experience market, competitive, or other changes and cannot rely on years of historical data. In these cases, FP&A teams may limit historical data usage to only recent months or quarters.

Time series financial forecasting typically requires more computing power than standard straight-line forecasting.

However, this method aims to accurately estimate similarly cyclical, seasonal, or fast-changing financial results in the short term.

When using time series financial forecasting, your FP&A team will benefit from the help of a modern, capable FP&A software tool.

Linear regression financial forecasting

Linear regression models the relationship between a dependent variable (the influenced variable) and an independent variable (the influencer).

This method of financial forecasting will help you see the effect on profits, for example, based on taking an action, say adding additional sales reps.

Financial forecasting using more complex linear regression may consider many dependent and independent variables to determine how those factors affect future financial performance.

Your FP&A team can use linear regression financial forecasting to create forecasting models based on differing assumptions to focus on a final likely forecast. But, as the number of assumptions and variables increases, these forecasts quickly become complex.

Employing linear regression financial forecasting with spreadsheets can quickly add undue confusion, complexity, and manual effort, requiring FP&A teams to find a dedicated financial forecasting solution.

Read our guide to cash forecasting for SaaS companies.

|

Technique

|

Use

|

Data needed

|

|

Straight-line

|

Constant growth rate

|

Historical data

|

|

Moving averages

|

Repeated forecasts

|

|

Simple linear regression

|

Compare one independent variable with one dependent variable

|

10-20 data points per independent variable

|

|

Multiple linear regression

|

Compare multiple independent variables with one dependent variable

|

How to conduct financial forecasting for FP&A teams

Organizations must understand their internal performance, strategy, goals, investments, market trends, etc, to create more accurate and agile financial forecasts.

This requires lots of data and assumptions, which can quickly overwhelm FP&A relying on spreadsheets and manual effort.

Here’s a streamlined way to conduct financial forecasts:

1. Collect and analyze data

Your FP&A team must work with other teams to locate, collect, aggregate, understand, and analyze financial data. Ensuring the accuracy and relevance of the collected data is crucial.

FP&A teams often face the challenge of consolidating data spread across different platforms, such as accounting software, CRM, ERP, HRIS, and business intelligence tools.

You can solve this by using financial forecasting software that integrates with your existing tech stack. This approach makes financial data from those platforms available in real-time on the forecasting software, creating a single source of truth for FP&A.

2. Collaborate across teams

Effective collaboration helps all key stakeholders and teams understand the financial goals and outcomes achieved with the financial forecasts. It ensures your FP&A team doesn't work in a silo and receives enterprise-wide inputs.

Establish easy-to-access communication and collaboration channels between your FP&A team, sales, the business, and executives so they understand outside influencers and account for their impact on financial forecasts.

Use forecasting software that provides a cloud-based platform where everyone involved in the forecasting process can work together, see progress, and be accountable for their respective inputs.

3. Research external data

While forecasting typically requires you to make a healthy amount of assumptions, relying on assumptions where you can use actual data is a recipe for disaster.

Research external data and rely on third-party forecasts and analyst reports to estimate the impact of market forces and economic realities on potential future performance.

You can also engage communities of financial professionals like consultants and advisors with experience in financial forecasting to get industry-specific knowledge, valuable insights, and benchmarking data.

4. Analyze historical trends

Historical trends give you insights into past performance and performance drivers, which is great, especially when creating driver-based forecasts.

Analyze all corporate activities and past periodic performance to evaluate how different actions have impacted past financial forecast accuracy. Also, this is where you can apply methods such as linear regression and moving averages to see underlying patterns.

You can collect data from past forecasts, actual cash flow statements, P&Ls, and balance sheets and visualize it using charts or graphs. Then, create new forecasts and validate them using scenario analysis.

5. Provide management reporting

Management reporting presents the outcomes of your forecasts to stakeholders who monitor business performance and make decisions that guide operations.

Provide detailed financial forecasts and decision guidance to the business, executives, board of directors, and others. These reports include executive summaries, KPI dashboards, and performance comparison reports.

This process gives management all the information they need to assess the organization’s financial health and current trends, compare forecasts to actuals, and make data-driven decisions.

Pro tip: Use forecasting software with prebuilt reporting templates and automated report generation to give your stakeholders the reports they need whenever they need them.

6. Communicate financial forecast reports

Publish financial forecast reports and communicate the organization’s overall financial projections, estimations, and granular details to internal and external parties.

This helps you keep everyone aware of what goals they’re working toward and any assumptions you’ve made. You can use visualizations such as dashboards and charts to make your forecasts clear and easy to understand.

Encourage questions and feedback from internal and external stakeholders during this stage to foster buy-in and ensure alignment.

7. Leverage financial forecasts to achieve objectives

What do you do now that you’ve created financial forecasts that all stakeholders have bought into?

Use forecasts to guide teams in achieving set objectives. They provide daily, monthly, and quarterly to yearly projections of the organization's position, ensuring everyone understands the needed outcomes for these periods.

Guide planning, budgeting, modeling, and scenario planning with financial forecasts. Inform the allocation of assets and investments to achieve corporate financial goals and business objectives.

How to choose between the best forecasting software

When selecting forecasting software for your business, it’s essential to consider key factors such as your company size, customer base, and operational needs. Here's a breakdown of what to prioritize:

Ease of use and implementation

Opt for software that’s intuitive and user-friendly to ensure a smooth adoption process. This reduces the learning curve for your finance team and encourages faster onboarding.

Implementation time is another critical factor. Most forecasting tools take six to twelve months from purchase to rollout, so you’ll want a solution that balances functionality with deployment speed.

When evaluating ease of use, make sure to:

- Schedule product demos to assess usability.

- Check implementation timelines on the provider’s website.

- Read user reviews on platforms like Capterra, G2, and Gartner for real-world insights.

Integration capabilities

The forecasting software you choose should integrate seamlessly with the tools you already use, such as ERP systems, accounting platforms, and HR software. Strong integration capabilities streamline data aggregation and provide a centralized view of your business operations.

Seamless integrations create a single source of truth, simplify collaboration, and support complex workflows like workforce planning, rolling forecasts, and operational planning.

Address specific forecasting needs

Not all forecasting software is created equal. While basic tools can analyze historical data and predict outcomes, more advanced options can account for market volatility, evolving trends, and other dynamic factors.

How to choose the right fit for your business:

- For stable environments, prioritize simple tools that focus on core forecasting needs.

- For rapidly changing markets, look for software that incorporates real-time data and advanced predictive analytics.

Scalability and adaptability

Scalability is critical to ensure your forecasting software remains effective as your business grows. A robust solution should handle increasing data volumes, user demands, and system integrations without compromising performance.

Switching software later due to scalability issues can be disruptive and costly. Choose a solution that aligns with your growth trajectory—for example, if you’re scaling from 50 to 500 employees, opt for software designed to handle enterprise-level operations.

Upcoming trends in forecasting software

AI and automation have become essential in modern forecasting solutions. AI forecasting tools can analyze vast layers of data to detect business insights faster and with greater accuracy, enhancing the reliability of business intelligence.

AI-driven tools leverage machine learning (ML) to improve over time by learning from new data. This continuous adaptation increases forecasting accuracy as the system independently identifies trends, seasonality, and unique patterns.

Automation further boosts productivity by reducing the time spent on routine tasks, such as report preparation and data entry. With less manual work, finance teams can shift their focus to strategic planning while AI-powered tools take on decision-support tasks. AI and automation represent the future of forecasting, providing cost-effective, high-speed solutions that meet the demands of accurate financial planning.

Choose the best financial forecasting software

Which financial forecasting software solution is best for you?

If you’re in FP&A at a mid-market company, you need easy-to-use and scalable forecasting software with robust features that let you maintain your spreadsheet experience while leveraging the power of an advanced cloud platform.

This article provides a list of software options, but you can always research further by reading reviews on trusted sites like G2 and Capterra.

Book a free demo with Cube to see how the software works in real life.

.png)

.png)

![Best financial forecasting software solutions [2026 review]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Dashboard.png)

.png?width=1656&height=711&name=AI-Cube-Hero%20(1).png)

-png.png?width=1176&height=744&name=jirav-Dashboard%20(1)-png.png)

.png?width=594&height=367&name=oracle-netsuite%20(1).png)

.png?width=1316&height=987&name=ibm-view-1%20(1).png)