Key takeaways

- Financial analytics uses statistical analysis to gain insights and make decisions about a business's financial performance.

- Financial analytic skills include financial modeling, data visualization, analysis and reporting, and budgeting and forecasting.

- Financial analytics tools can improve a company's collaboration, efficiency, and decision-making processes.

Best financial analysis software at-a-glance

- Cube: Spreadsheet-native FP&A platform best for mid-sized and enterprise teams that want faster, automated forecasting, reporting, and analysis without leaving Excel or Google Sheets.

- Oracle Essbase: Enterprise database suited for large organizations with complex, high-volume financial modeling and scenario planning needs.

- QuickBooks: Small business accounting tool with basic reporting features and limited forecasting capabilities.

- NetSuite: ERP platform for mid-sized to large businesses managing accounting, inventory, and multi-entity operations in one system.

- Centage Planning Maestro: Budgeting and forecasting software for mid-sized companies seeking structured financial plans and consolidated reporting.

- Anaplan: Enterprise planning platform for global organizations requiring large-scale, multi-department modeling and what-if scenario testing.

- Workday Adaptive Planning: Planning and analytics tool designed for mid- to large-sized companies, especially those already using Workday’s HR or ERP products.

- Sage Intacct: Cloud accounting and financial management software targeted at small to mid-sized businesses with industry-specific compliance requirements.

- Zoho Analytics: BI and analytics platform for small to medium businesses that need flexible dashboards and integrations with multiple data sources.

- Jirav: Cloud-based planning and reporting tool for small to mid-sized businesses looking to connect operational drivers with financial forecasts.

- Finmark: Financial modeling tool for startups and small businesses focused on tracking runway, burn rate, and basic forecasting.

- Jedox: Planning and analytics software for mid-sized to large enterprises that want Excel compatibility with centralized financial data.

- Spotlight Reporting: Reporting and forecasting tool for accounting firms and SMEs that need multi-entity consolidation and visually formatted client reports.

What is financial analysis software?

Financial analysis software transforms raw financial information, such as income statements, balance sheets, and cash flow statements, into actionable insights through advanced analytics, automation, and visualizations.

It enables FP&A teams, CFOs, and analysts to streamline manual processes, reduce human error, and gain real-time visibility into a company’s financial health by automating data collection, centralizing financial information, and offering intuitive tools for reporting, modeling, and forecasting.

Instead of manually pulling data from multiple spreadsheets or disconnected systems, teams can rely on real-time integrations with ERP, CRM, and accounting platforms. These tools continuously sync data, apply validation rules to minimize errors, and present insights through dynamic dashboards, freeing up time for deeper analysis and strategic planning.

Types of financial analysis software

- FP&A software: Focuses on budgeting, forecasting, scenario planning, and financial modeling. It helps finance teams align planning with company strategy and make faster, data-driven decisions.

- Accounting software: Handles day-to-day financial transactions such as invoicing, payroll, general ledger, and compliance. While not always built for deep analysis, many platforms offer basic financial reporting and support for cash flow planning.

- Data visualization: Turns complex financial data into easy-to-understand visuals like charts, graphs, and dashboards. They help stakeholders interpret trends and patterns to make informed decisions.

- Business intelligence: Pulls financial and operational data from across the business to deliver advanced analytics and interactive reporting. They often support drill-down analysis and KPIs across multiple departments.

- Investment research: Provides market data, financial ratios, modeling tools, and benchmarking to support valuation and portfolio decisions.

Financial analysis software skills to know

Financial analysis software is designed to help businesses and financial professionals collect, analyze, and interpret financial data. Here are the key functions and benefits it provides:

- Data analysis and visualization: Sift through large amounts of data to identify trends and present insights in easy-to-understand formats, like graphs and charts.

- Financial modeling: Facilitate the creation of financial models that predict future financial performance based on various scenarios.

- Budgeting and forecasting: Create accurate budgets and forecasts, ensuring that companies allocate resources effectively.

- Accounting and financial reporting: Streamline the accounting process and generate precise financial reports.

- Risk management: Identify, assess, and prioritize risks, and implement strategies to mitigate them.

- Compliance and regulations: Ensure that financial activities comply with relevant laws and standards.

- Project management: Manage financial aspects of projects, including costs, resources, and timelines.

Top financial analysis software tools

This section will review the top financial analytics software tools on the market.

1. Cube

Cube is a comprehensive FP&A solution that helps businesses improve efficiency, accuracy, and financial intelligence across forecasting, budgeting, and accounting operations. As a spreadsheet-native platform, Cube empowers finance teams to make faster, smarter decisions by automating manual processes and reducing the risk of errors—all within the spreadsheets they already use.

With Cube, tasks like financial consolidation, reporting, and variance analysis are streamlined so finance leaders can shift their focus from data gathering to strategic planning and performance. Teams gain centralized access to trusted data and models—fueling better financial visibility and stronger business insights.

Cube also includes Agentic AI, a suite of AI tools built specifically for FP&A. They enhance financial intelligence by delivering instant, data-backed answers, smart forecasts, variance explanations, and intelligent mapping. All outputs are governed and explainable—ensuring speed, trust, and control. You can interact with Cube’s AI Analyst directly in Slack, Microsoft Teams, or your Cube Workspace to get answers without breaking your workflow.

Features:

- Smart forecasting builds AI-powered forecasts from your actual data, allowing faster modeling and assumption testing with full control.

- Easy collaboration allows multiple users to access and work on the same financial data, facilitating collaboration and decision-making.

- Budget control allows for the setting of custom budgets for different departments or projects and track actual financial performance.

- Custom templates quickly generate financial reports and analytics.

- Visualize data in a clear and easy-to-understand format, represented as charts and graphs that are easily exported and shared with others.

- Scenario planning aids in planning and modeling by allowing for the creation and analysis of different scenarios to determine their potential impact on the business's financial performance.

- Role-based permissions grant access to data with custom permission levels for users based on their roles within the organization.

- Conversational agents let users ask questions in Slack, Teams, or Cube to receive instant, data-backed answers—no filters or formulas required.

- Automated analysis spots key variances, explains why they occurred, and adds AI-driven context directly into reports.

Pros:

- Quick to deploy, most businesses are up and running in just a few weeks.

- Enables fast, customized forecasting and analysis without manual errors.

- Built-in FP&A-specific AI delivers instant answers, smart forecasts, and narrative insights.

- Lets teams work in spreadsheets they already know while speeding up reporting.

- Backed by a team of finance experts to support setup, strategy, and success.

Cons:

- Cube doesn't sell to companies outside of the US and Canada at this time.

Pricing:

Custom pricing starts at $30,000/month. See detailed pricing for customizable plans.

Ready to get started? Try Cube today.

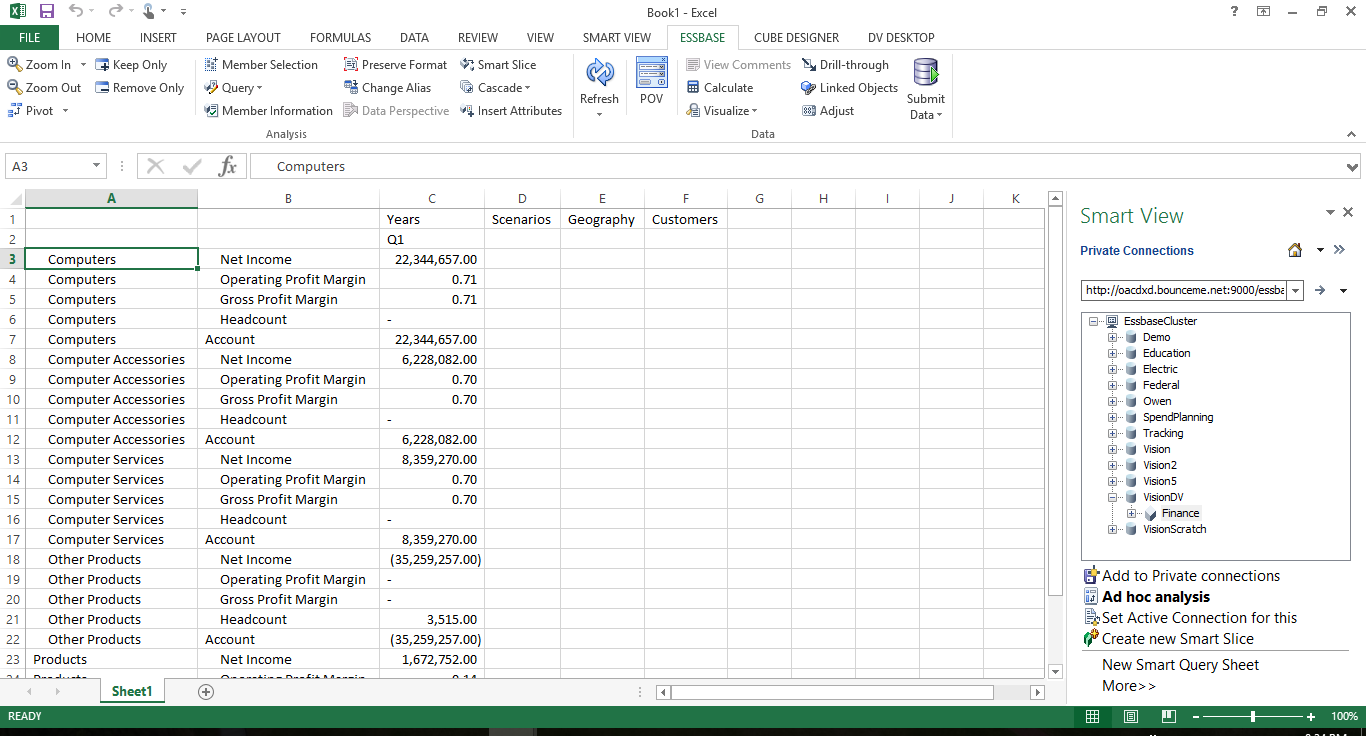

2. Oracle Essbase

.jpeg?width=150&height=75&name=oracle-hyperion-essbase%20(1).jpeg)

Oracle Essbase is a database management system for online analytical processing (OLAP) and business intelligence (BI) applications. It's designed to provide analysis of large, complex data

The tool integrates with other Oracle BI tools, such as Oracle BI Enterprise Edition. Oracle Essbase also includes a query and reporting tool called Smart View, which allows users to create and share reports, pivot tables, and charts.

Key Features:

- What-if analysis for testing and modeling business scenarios.

- Sandboxing and workflow lets teams manage scenario workflows, submissions, and approvals within a single UI.

- Offers automation through REST API, Java API, MaxL, and CLI for advanced control.

- Excel integration through Smart View and Cube Designer.

Pros:

- Analytical engine with over 100 built-in mathematical functions.

- Works with a wide range of data sources from both on-premises and cloud systems.

- Converts Excel spreadsheets into ready-to-use business models.

Cons:

- “Initial setup was very tough. Patches are time consuming. New employees who join the time are finding difficult to develop learning curve to use this product easily.” User reviews

- “The UI could be more intuitive. It looks similar to SQL DBMS.” User reviews

- “The downside of essbase is the performance of calculation scripts. The script could take minutes if not hours to run and the debugging requires a skillset to understand.” User reviews

Pricing:

Oracle Essbase’s price is based on the custom needs of the user, and requires potential clients to reach out for a quote.

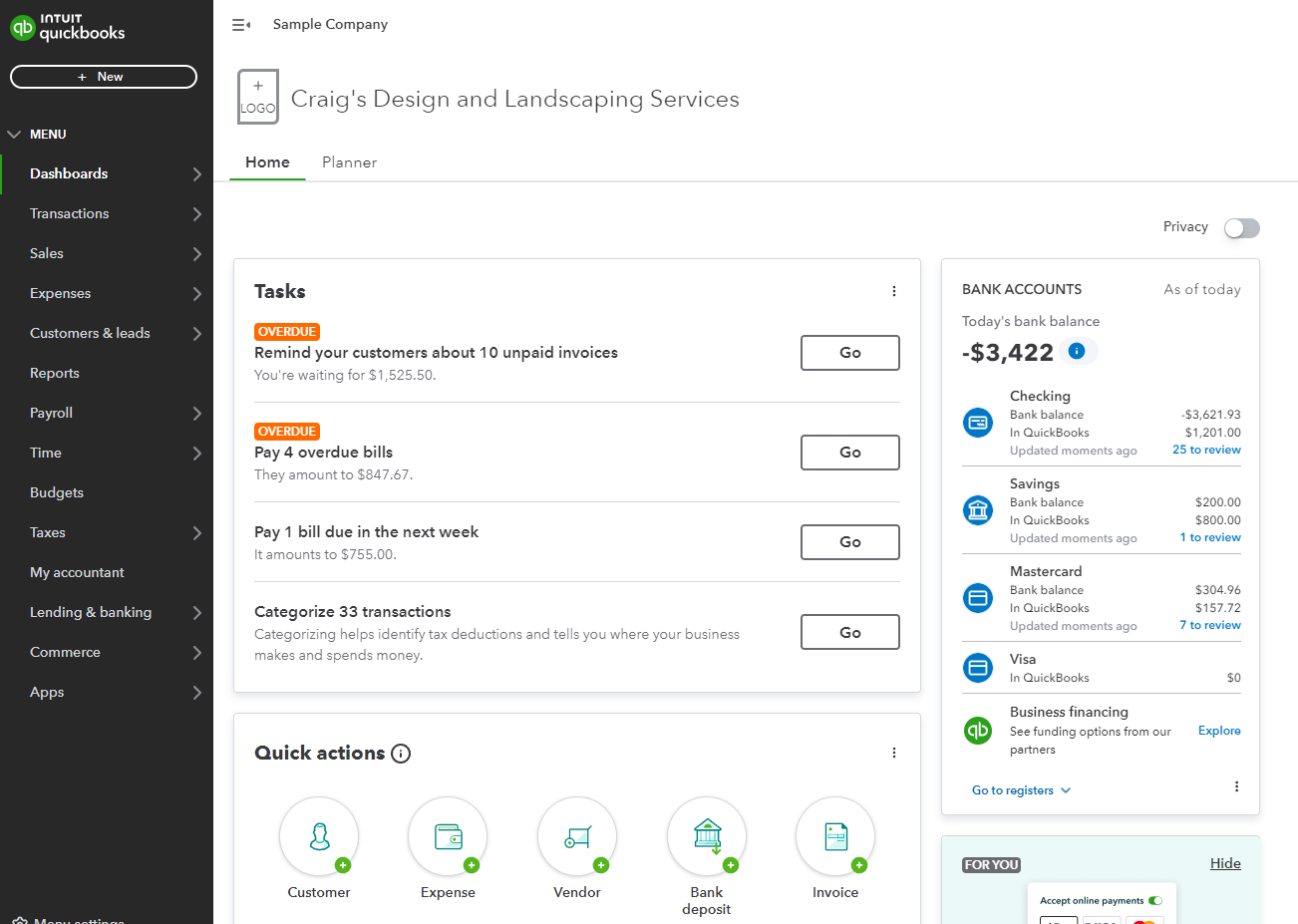

3. QuickBooks

Intuit’s QuickBooks is an accounting software developed and marketed by Intuit. It’s designed for small and medium-sized businesses and offers invoicing, expense tracking, financial reporting, and more to help businesses manage their finances.

As accounting software, QuickBooks can work as a cash planning tool in a pinch. QuickBooks is available in different versions including QuickBooks Online and QuickBooks Desktop. It can also be integrated with other software and services, such as payment processors and e-commerce platforms.

Key Features:

- Track project expenses and billable hours accurately, facilitating project management.

- Monitor finances in real-time and monitor cash flow.

- Run and export reports including profit & loss, expenses, and balance sheets.

Pros:

- Offers multiple pricing tiers to fit different business sizes and needs.

- Allows integration with third-party apps and connects to multiple sales channels.

- Includes access to expert support, tax help, and bookkeeping assistance.

Cons:

- “The pricing model can be frustrating—many advanced features or integrations require higher-tier plans or add-on costs. Customer support can also be hit or miss depending on the issue.” User review

- “The cost structure can add up quickly — especially as you need to add more advanced features, additional users, or integrate third-party apps.” User review

- “I did not like that you couldn't request time off from the system.” User review

Pricing:

- Simple: $35/month

- Essential: $65/month

- Plus: $99/month

- Advanced: $235/month

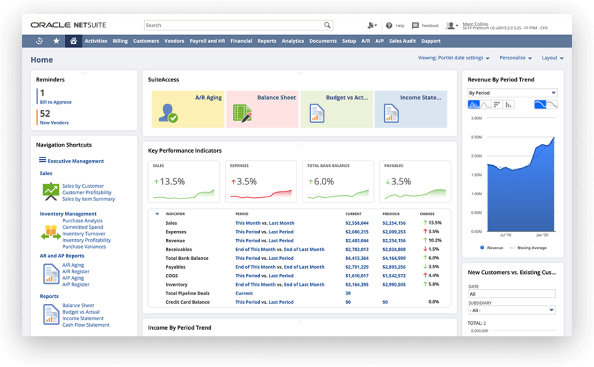

4. NetSuite

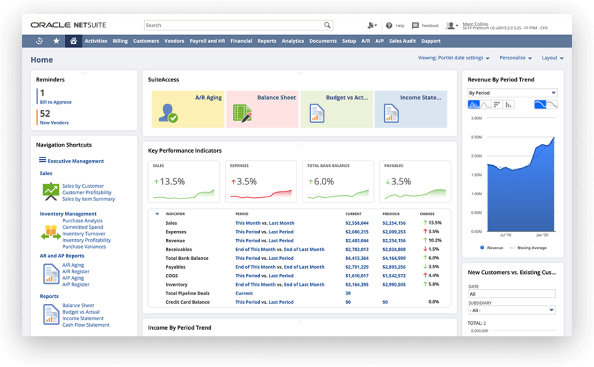

NetSuite is a cloud-based enterprise resource planning (ERP) software for financial management, customer relationship management (CRM), inventory management, ecommerce, and more.

Also, NetSuite enables users to see real-time business insights at the click of a button and uses business intelligence to help with forecasting and scenario planning.

Key Features:

- Supply chain management and manufacturing capabilities optimize operations and reduce costs.

- Human resources and payroll features help ensure compliance and efficiency.

- Business intelligence and reporting provide tools for generating reports and analyzing data.

- Inventory and order management capabilities facilitate accurate inventory levels easing order fulfillment.

Pros:

- Centralizes accounting, project management, and financial reporting in one platform.

- Scales well across departments, subsidiaries, and international operations.

- Offers deep reporting capabilities and strong multi-entity support.

Cons:

- “What I dislike about NetSuite is that some customizations can get a bit tricky and usually need a specialist or consultant to help out.” User review

- “Netsuite is not incredibly user-friendly. And when you want to do something complex, there are many times where the built-in workflow functionality just isn't enough.” User review

- “Its implementation is costly and reliant on external consultant. Its native analysis tool is good but for complex and better reports we have to use third party tools.” User review

Pricing:

Although NetSuite doesn’t list its pricing, sources say that users pay an annual licensing fee (calculated individually), a one-time implementation cost ranging from $25-100,000, plus additional costs for customizations, integrations, and training.

Read the review: NetSuite vs. QuickBooks

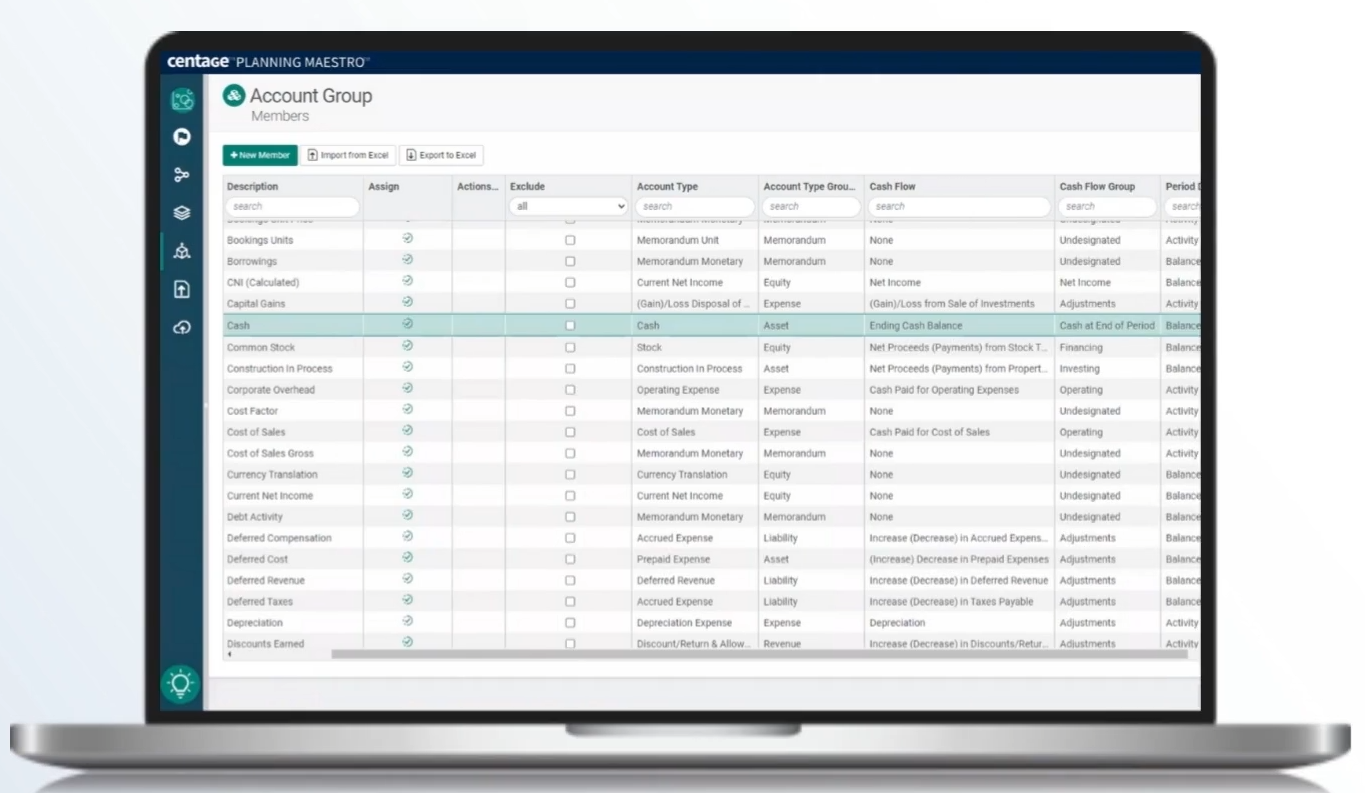

5. Centage Planning Maestro

.png?width=150&height=83&name=centage-vector-logo-2021%20(1).png)

Centage Planning Maestro is a software product developed by Centage Corporation. Centage Planning Maestro is a budgeting and forecasting software designed for businesses to create and manage financial plans.

Financial managers can use Centage to synchronize their balance sheets and cash flow statements, drill down into data, and enforce their chart of accounts.

Key Features:

- Rolling forecasts that adjust automatically based on changes in headcount or payroll.

- Scenario planning to evaluate best-case, worst-case, or custom financial scenarios.

- Consolidated reporting for generating P&L and balance sheets across entities from a single source of truth.

Pros:

- Provides responsive and knowledgeable customer support.

- Supports multiple budget versions, version locking, and driver-based updates.

- Offers granular budgeting and forecasting tailored to industry needs.

Cons:

- “The only downside I see with Centage is the delay in posted entries to when they are reflected in the financials.” User review

- “Slow in implementing the updates. It will be helpful to have those new features sooner rather than later.” User review

- “End users would like some functions similar to Excel functions.” User review

Pricing:

- Core: $1750/month

- Strategic: $2500/month

- Performance: $3500/month

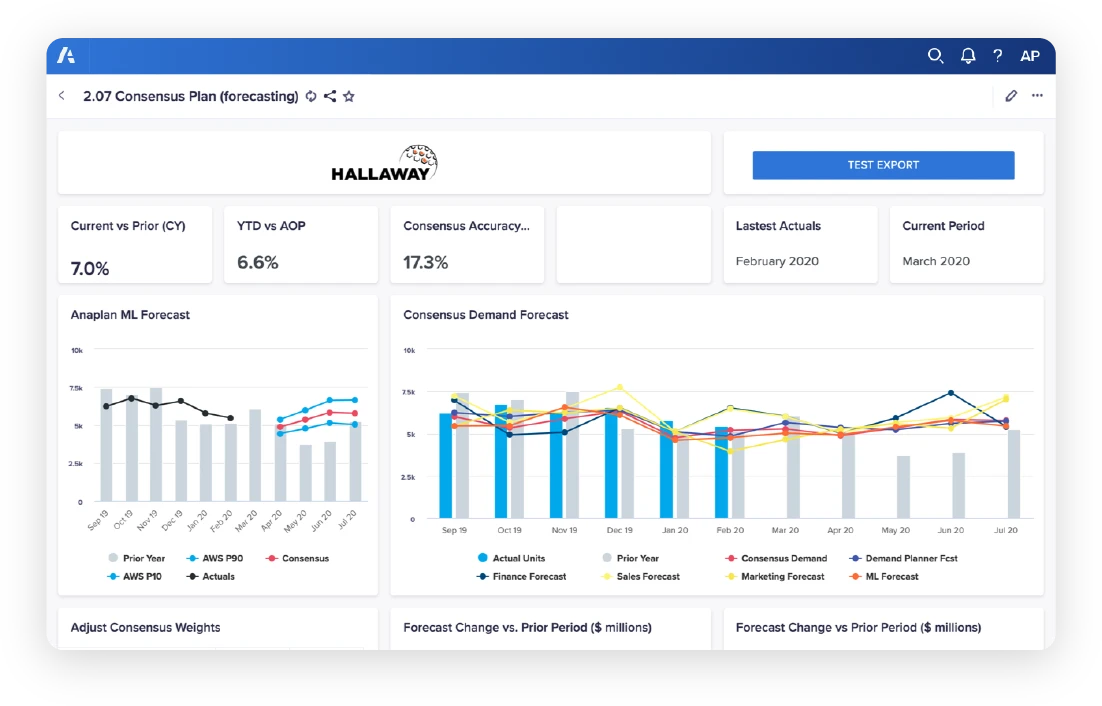

6. Anaplan

.png?width=150&height=33&name=Anaplan_logo%20(1).png)

Anaplan is an enterprise-grade planning platform that enables companies to connect, model, and optimize their business processes. It’s designed for finance teams and business users who need to build robust models for embedding comprehensive financial, sales, HR, and supply chain plans.

The solution includes an application platform that enables organizations to create or modify financial planning, and Anaplan utilizes its proprietary Hyperblock technology and enables businesses to build what-if scenarios.

Key Features:

- Modeling capabilities allow users to create intricate business models with tailored specifications.

- Data management tools ensure data accuracy, integrity, and accessibility.

- Collaboration capabilities include real-time sharing and editing of planning models.

Pros:

- Offers multidimensional modeling and scenario planning capabilities.

- Supports collaboration and centralized access.

- Provides built-in tools for workflow, version control, and role-based access.

Cons:

- “Anaplan's primary drawback is its steep learning curve, especially for new users unfamiliar with its modeling language or advanced functionalities.” User review

- “Anaplan's customizability can also be a double-edged sword. Although there are more and more out-of-the-box solutions being built and provided by Anaplan and 3rd parties, an organization will most likely have to expend significant resources to implement.” User review

- “The limitation of workspace. Sometimes end users require to see reports in very detailed granular level, but due to the limitation of workspace, we couldn't build that level.” User review

Pricing:

Pricing for Anaplan isn’t available on its website.

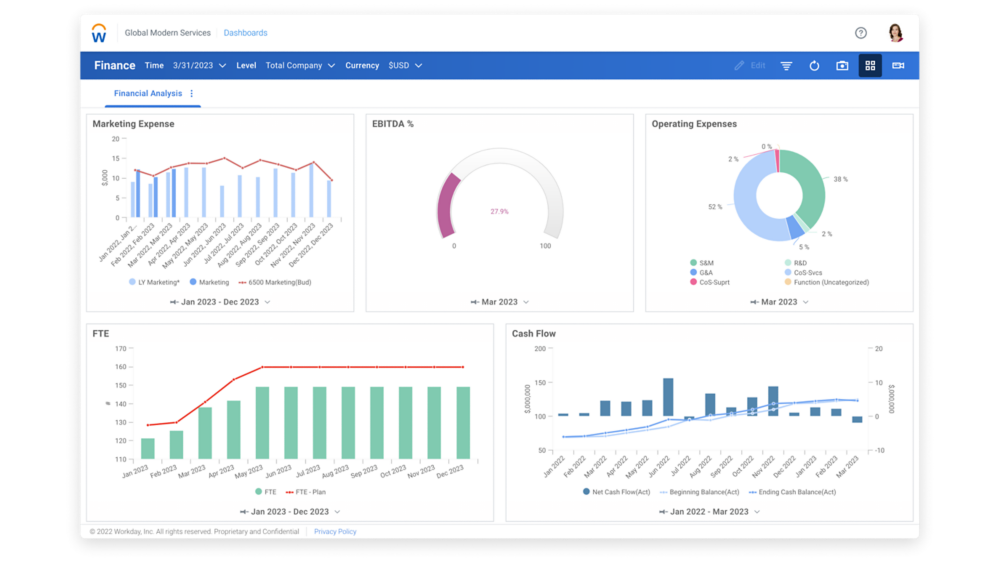

7. Workday Adaptive Planning

Workday Adaptive Planning is a financial planning and analytics tool for budgeting, planning, and reporting. The software automates and streamlines financial processes, allowing for real-time collaboration and reporting.

It integrates with other systems such as ERP, Salesforce automation (SFA), customer relationship management (CRM), and more. Workday Adaptive Planning is best suited for companies who already use other Workday solutions.

Key Features:

- Membership and event management features aim to facilitate efficient resource allocation and planning.

- Financial planning with AI-driven budgeting, forecasting, and scenario modeling.

- Workforce planning to align hiring needs with finance, HR, sales, marketing, and IT strategies.

- Operational planning for collaborative, companywide planning using real-time data.

Pros:

- Provides quick data updates and supports dynamic, rolling forecasts.

- Enables real-time collaboration across departments.

- Consolidates budgeting, forecasting, and reporting in one centralized platform.

Cons:

- “The pricing might be a bit steep, especially for smaller companies. It could be challenging for businesses with tighter budgets that still need robust planning features.” User review

- “Formulas and calculations can be tricky to manage. You need one or two administrators that have a strong knowledge of these as well as triggers.” User review

- “Limited Excel functionality within the tool.” User review

Pricing:

Workday Adaptive Planning does not provide pricing information on its website, and requires potential users to contact them for a quote.

Read the full review: Anaplan vs Adaptive vs Planful vs Vena vs Datarails vs Cube.

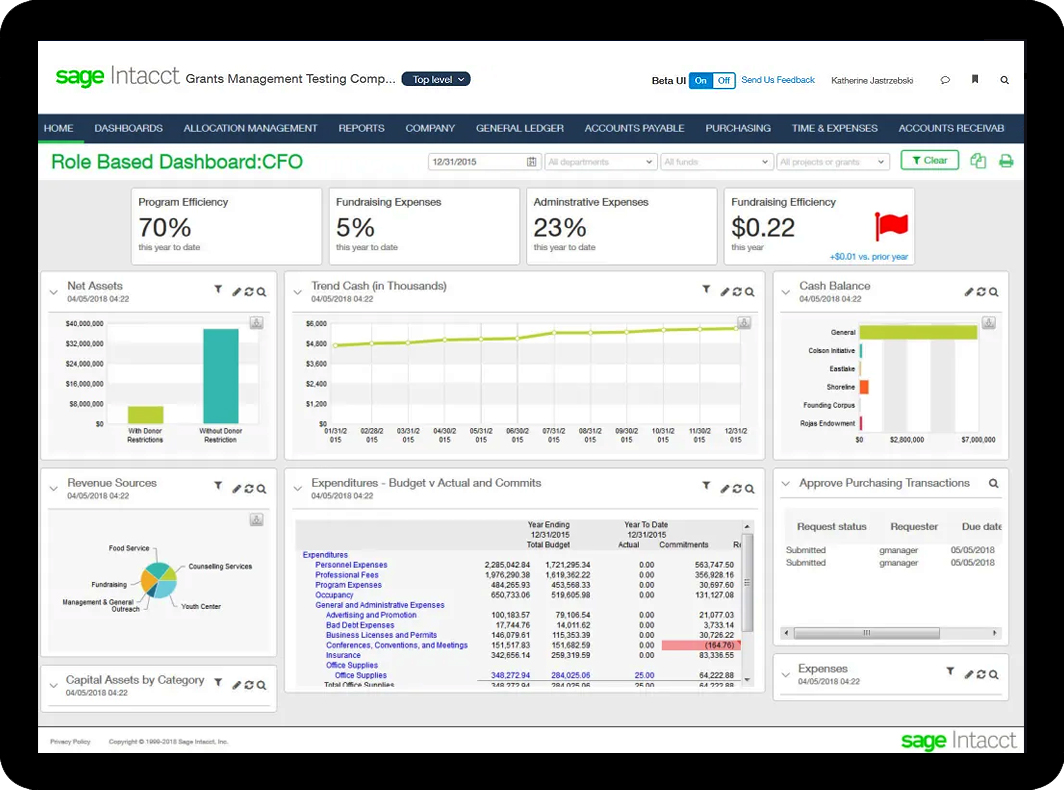

8. Sage Intacct

Sage Intacct is a financial management and accounting software that caters to small to midsize businesses. The platform streamlines core accounting tasks including accounts receivable and payable, budgeting, financial reporting, and cash flow forecasting.

Sage Intacct offers reporting capabilities that enable users to access real-time insights into their financial health and user-defined dashboards that enable users to gain visibility into their business.

Key Features:

- Vendor management features help streamline procurement processes.

- Invoice customization allows the tailoring of invoices to their specific needs and branding.

- Reporting and analytics capabilities enable users to generate customized reports and analyze financial data.

Pros:

- Offers comprehensive training materials.

- Provides real-time reporting and dashboards.

Cons:

- “The user interface can feel outdated and unintuitive at times, especially for new users.” User review

- “One drawback we've encountered with Sage Intacct is that the permissions system can be quite complex and difficult to navigate. This often leads to challenges when training new staff, as it can be confusing to set up and understand the appropriate access levels.” User review

- “It is very costly compared to other ERP software. It is also sometimes time consuming.” User review

Pricing:

Pricing isn't available on its website.

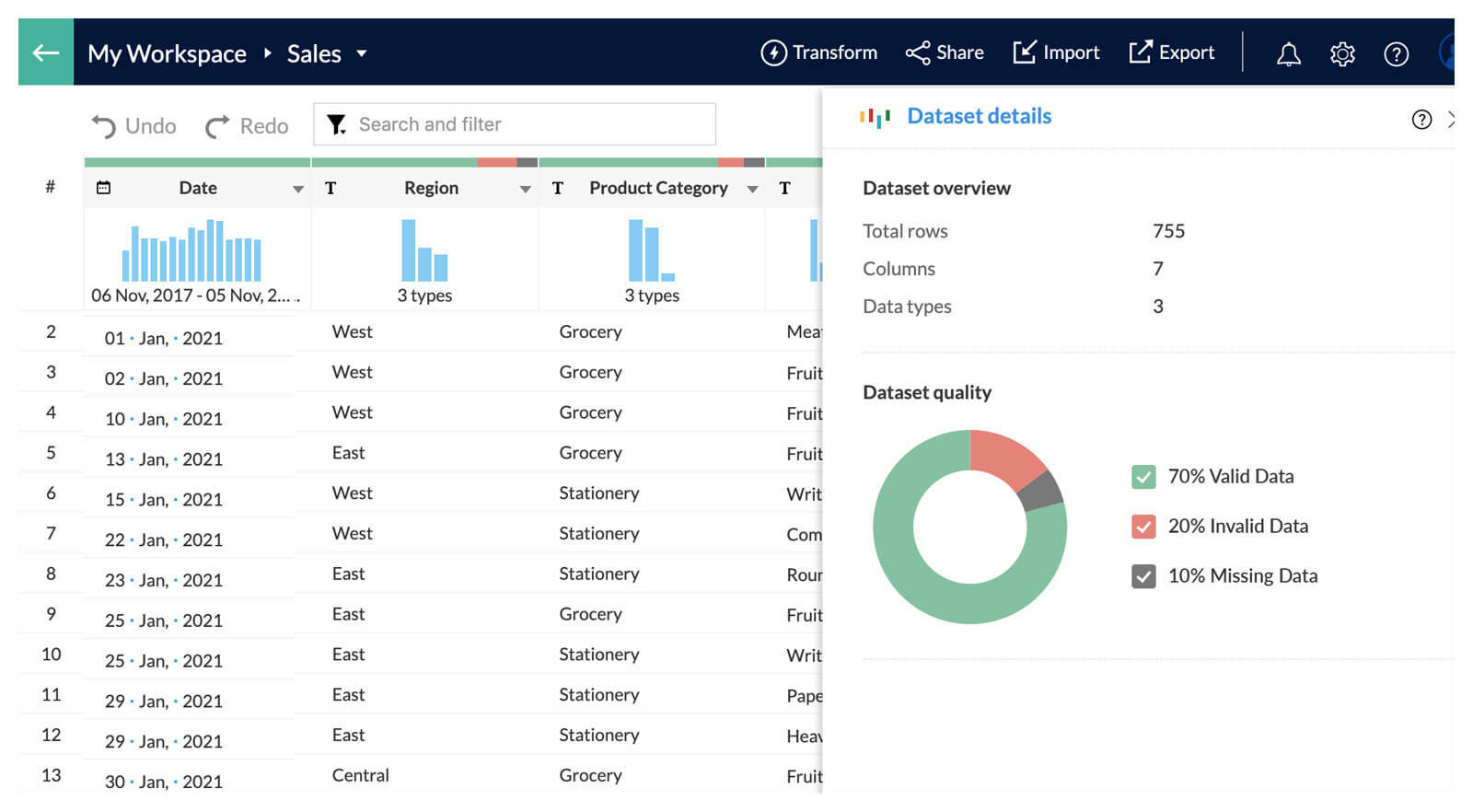

9. Zoho Analytics

Zoho Analytics allows businesses to collect, store, and analyze data, create and share reports, and perform complex data analysis.

It integrates with other Zoho products and third-party applications and includes data visualization tools and real-time collaboration.

It also offers a self-service option so users can create reports and dashboards without coding.

Key Features:

- Data import and integration from various sources ensure a unified view of business data.

- Data preparation tools cleanse, transform, and enrich data for analysis.

- Advanced analytics, including predictive analytics and statistical modeling, extract insights from data.

Pros:

- Offers drag-and-drop dashboard building.

- Supports embedded analytics with low-code/no-code development.

- Offers both public cloud and on-premise deployment options with full scalability.

Cons:

- “Although Zoho Analytics is highly effective, the platform can experience occasional delays in syncing data across multiple sources. It would be great if the integration process was even smoother for faster updates, especially when dealing with larger datasets.” User review

- “While Zoho One is powerful, the learning curve can be steep, especially when integrating multiple apps or creating complex automations.” User review

- “Steep learning curve for advanced formulas or custom SQL queries. Occasional syncing delays with external data sources. Limited real-time data—most integrations update hourly or daily.” User review

Pricing

- Basic: $24/month

- Standard: $48/month

- Premium: $115/month

- Entreprise: $455/month

- Custom pricing available by quote

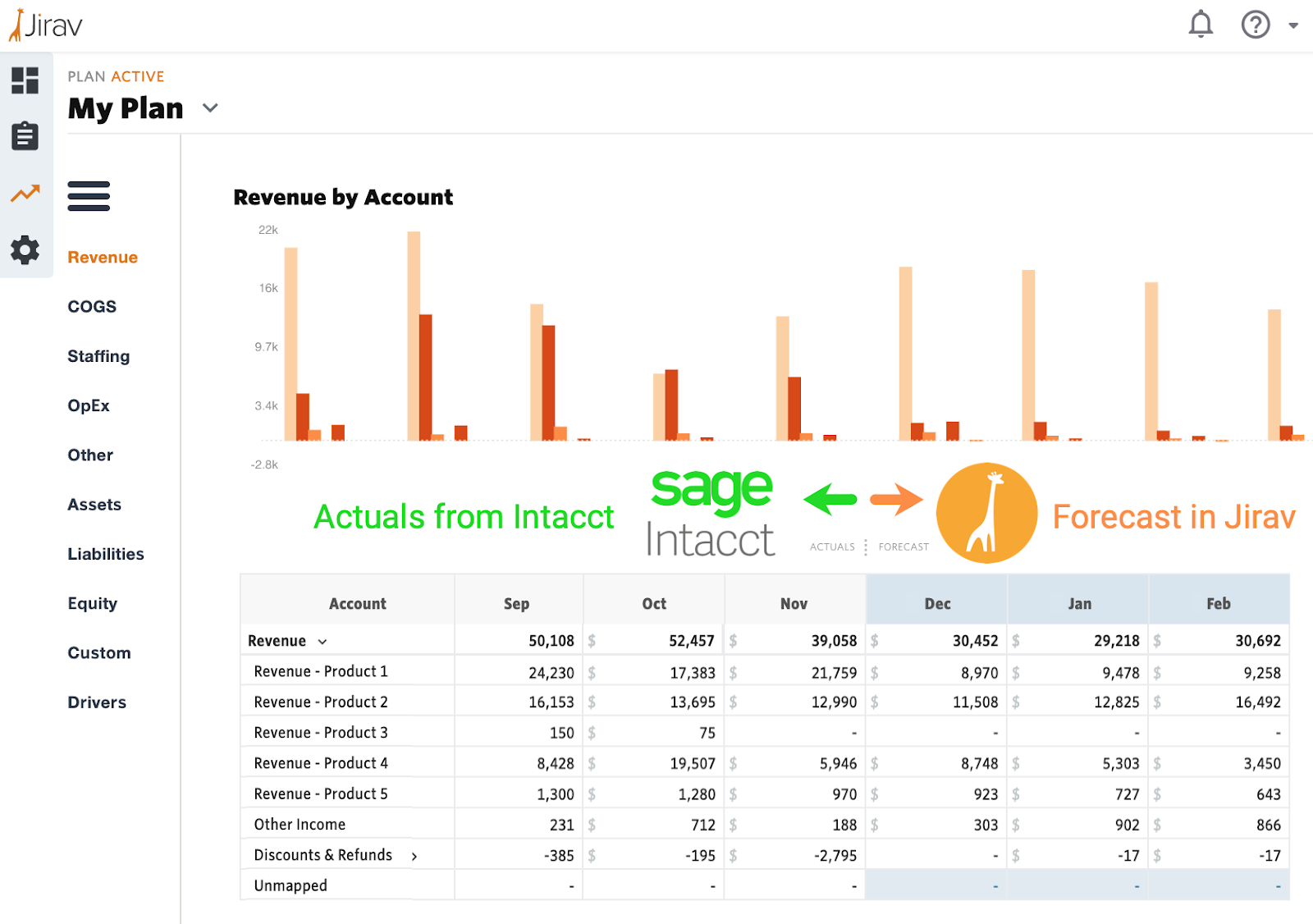

10. Jirav

Jirav is a financial analytics software offering budgeting, forecasting, reporting, and dashboarding. The Jirav platform provides financial insights to support strategic decision-making and reduces manual planning thanks to its integration options.

Key Features:

- Driver-based planning enables users to align financial forecasts with key operational drivers.

- Profit/loss statements provide visibility into revenue, expenses, and profitability metrics.

- Custom dashboards allow tailoring to users’ specific needs, consolidating relevant financial metrics and KPIs for monitoring and analysis.

Pros:

- Integrates with key systems like QuickBooks, Excel, Sheets, and NetSuite.

- Supports rolling forecasts and scenario planning to assess shifting market conditions.

- Offers highly customizable dashboards and reports.

Cons:

- “The lack of guided training programs such as those offered by ClickUp or Salesforce make for a more difficult learning experience.” User review

- “If anything, it's not as intuitive as other products in the marketplace” User review

- “Certain assumptions can be difficult to create, such as the equivalent of an IF statement. Occasionally limited by maximum amount of reports or custom tables.” User review

Pricing:

- Controller essentials: $50/month

- CFO enterprise: $150/month

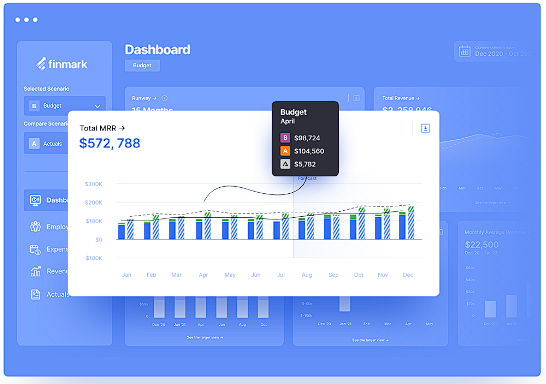

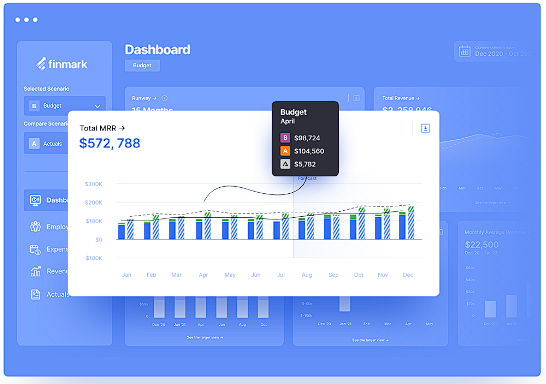

11. Finmark

Finmark is a strategic finance platform for financial analytics.

It automates data, analyzes business performance, and provides insights to support decision-making.

Finmark allows users to test assumptions with scenario planning, access insight into runway and burn rate metrics, and share financial models with team members and investors. It’s geared toward SMB and accounting professionals. It’s geared toward SMB and accounting professionals.

Key Features:

- Real-time data analysis brings marketing, sales, and financial data together.

- Scenario planning allows testing of various financial scenarios.

- Centralized budgeting allows users to bring expenses, analysis, and budget forecasting to one location.

- Automated hiring planning forecasts future staffing needs.

Pros:

- Intuitive and flexible UI.

- Offers real-time data sync and analysis.

- Centralizes collaboration with built-in sharing and permission controls.

Cons:

- “Incorrect projections sometimes. I hope the projections are more accurate in the future.” User review

- “The ability to input debt injections for a single month doesn't seem to exist at the moment. The initial setup can be a long process but I don't see how it can be made more efficient.” User review

- “Some features are buggy, and there is a bit of a learning curve on where to go to tie things together correctly.” User review

Pricing:

Finmark’s pricing starts from $50.00/month, and increases based on your company’s annual revenue.

12. Jedox

Jedox is designed to help organizations accelerate their financial planning and analysis activities. The software leverages artificial intelligence and machine learning to provide data cleaning, forecasting, and smart commentaries. It also integrates with familiar tools such as Excel, Qlik, Power BI, and Tableau.

Key Features:

- Automated data handling automates the export, preparation, and consolidation of financial and non-financial data.

- Fast and detailed analysis provides opportunities to identify correlations and discrepancies in the data.

- Pre-built models and accelerators streamline financial planning and analysis processes.

- Rolling forecasts allow users to stay updated with the latest financial trends and respond quickly to changes.

- Visualizations of analyses and reports aim to allow organizational members to understand and utilize financial insights.

Pros:

- Excel-compatible interface.

- Customizable dashboards and workflows.

- Knowledgeable support and training resources, including video tutorials and live assistance.

Cons:

- “Presenting detailed reports via a browser not too user friendly when streaming across sites. Could be a fault on our end relying on a report to do it all.” User review

- “One area that could be improved is tracking changes within the tool, as it’s not as intuitive as it could be, making it harder to see what’s been adjusted and when.” User review

- “It's a new technology compared to existing tools, so movement from Excel to Jedox was a bit painful, but it still results in a great upgrade.” User review

Pricing:

Pricing isn't listed on its website

13. Spotlight Reporting

Spotlight Reporting is a comprehensive financial reporting, forecasting, and consolidation software designed to enhance decision-making for businesses and streamline advisory services for accounting firms.

By presenting data in a visually engaging format, Spotlight Reporting aims to allow users to uncover valuable insights and make informed strategic decisions. The platform integrates with accounting systems like Xero and MYOB.

Key Features:

- Multi-entity consolidation allows consolidation from up to 500 entities, with multiple currencies, and performs eliminations to aggregate and benchmark performance across networks and industry verticals.

- High-level dashboards give overviews of key business metrics using drag-and-drop dashboard creation.

- KPI reporting tracks both financial and non-financial KPIs with a wide selection of displays and charts.

- Client-specific reporting generates tailored reports and forecasts.

- Flexible forecasting rules utilize three-way cash flow forecasting with customizable rules and outputs suitable for banks and boards.

Pros:

- Supports reporting, forecasting, consolidation, and ESG in a single platform.

- Integrates with accounting systems such as Xero and QuickBooks.

- Includes industry-specific templates for reporting consistency.

- Provides user training, templates, and onboarding resources as part of the subscription.

Cons:

- “The only downside as an accounting partner is having to pay for 20 organizations upfront as part of their business model. From the perspective of a small firm, it takes time to onboard clients, and I would like this to scale up instead.” User review

- “Lack of customisations on reports eg rearranging columns, adding custom reports that includes both P&L & BS items (eg to show distributable profits)” User review

- “Took some time to get the P&L and Balance sheet customized for our needs, but overall it wasn't too bad since it is a one-time process.” User review

Pricing:

- Basic: $295

- Super VCFO 25: $495

- Super VCFO 75: $995

Features to look for in financial analysis software tools

Financial analysis software offers a comprehensive suite of features designed to enhance the efficiency, accuracy, and strategic value of financial management. These key features empower finance teams to make informed decisions, streamline operations, and drive business growth.

Multi-scenario modeling

Multi-scenario modeling enables businesses to evaluate the potential impact of various financial decisions and market conditions. Companies can assess risks, forecast outcomes, and develop contingency plans by creating and analyzing multiple financial scenarios.

This feature is crucial for strategic planning, as it allows organizations to visualize how different variables—such as changes in revenue, costs, or market conditions—affect their financial performance. As a result, businesses can make more informed decisions and prepare for a range of potential futures.

Budgeting

The budgeting feature helps businesses create, manage, and track budgets with precision. Financial analysis software streamlines the budgeting process by automating data collection, validation, and aggregation from various departments and sources. This ensures that budgets are comprehensive, accurate, and up-to-date.

Additionally, the software allows for real-time budget monitoring, enabling businesses to compare actual performance against budgeted figures. This continuous oversight helps identify variances early, allowing for timely adjustments to keep financial goals on track.

Forecasting and planning

Forecasting and planning tools allow businesses to predict future financial performance based on historical data, current trends, and projected market conditions.

These tools use advanced algorithms and predictive analytics to generate accurate financial forecasts, helping companies plan for future growth, manage cash flow, and allocate resources efficiently. By incorporating various factors and assumptions, forecasting tools enable finance teams to create detailed financial plans that support long-term strategic objectives.

Customizable dashboards

Customizable dashboards offer visual representations of key financial data and metrics, tailored to the needs of different users. These dashboards provide at-a-glance insights into financial performance, with interactive charts, graphs, and tables that can be adjusted to display specific information.

Users customize their dashboards to highlight the most relevant data, making it easier to track key performance indicators (KPIs), monitor trends, and identify areas that require attention. The ability to visualize data in a clear and intuitive manner enhances decision-making and communication across the organization.

Real-time reporting and analytics

Real-time reporting and analytics enable businesses to access and analyze financial data as it is updated. This feature eliminates the delays associated with traditional reporting methods, providing instant insights into financial performance.

Real-time analytics tools process and present data continuously, allowing finance teams to monitor key metrics, identify trends, and respond swiftly to emerging issues. This immediate access to accurate information supports proactive decision-making and enhances the overall agility of the organization.

Integration capabilities

Integration capabilities allow financial analysis software to connect seamlessly with other business tools and systems, such as ERP, CRM, and HR platforms. This integration ensures that all relevant financial data is captured and consolidated in one place, providing a comprehensive view of the organization’s financial health.

By integrating with other systems, the software eliminates data silos, reduces manual data entry, and enhances data accuracy. This interconnected approach supports more efficient financial processes and enables better-informed decision-making across the business.

Benefits of financial analysis software programs

These are some of the many benefits of using financial analysis software:

Centralize financial management

Financial analysis software centralizes financial management by consolidating diverse financial processes and data into a unified platform. It aggregates data from multiple sources, such as accounting systems, ERP systems, spreadsheets, and databases, creating a single source of truth for financial information.

This centralization facilitates comprehensive and consistent financial reporting, as the software generates consolidated reports that incorporate data from various departments and business units, offering a holistic view of the company's financial health.

Identify trends

Centralizing data allows financial analysts to view all relevant financial information in one place, facilitating more accurate and holistic trend analysis.

The software employs advanced analytical tools and statistical algorithms to sift through the data, identifying patterns and trends that might not be immediately apparent. It presents this data in an easily understandable format, using charts, graphs, and tables. This visualization capability enables analysts to quickly spot trends, such as revenue growth, expense patterns, and changes in profit margins, and to understand the underlying factors driving these trends.

Manage risk

The software uses advanced analytics and predictive modeling to identify potential risks. It analyzes historical data and current financial trends to forecast future performance and detect early warning signs of financial instability.

Through scenario planning and what-if analysis, businesses can simulate different financial situations and assess the impact of various risk factors, such as market fluctuations, operational disruptions, or regulatory changes. This proactive approach enables companies to develop contingency plans and strategies to mitigate identified risks.

Report in real time

Financial analysis software enables instant access to up-to-date financial information. With real-time data integration, financial reports reflect the most current information, eliminating the delays and inaccuracies associated with manual data entry.

The software's advanced analytics capabilities process this data continuously, updating financial metrics and key performance indicators (KPIs) in real time.

Moreover, financial analysis software automates the generation of financial reports, reducing the time and effort required to produce them manually. Reports can be scheduled to run automatically or generated on demand, ensuring that stakeholders always have access to the latest financial insights.

Improve accuracy and precision

Financial analysis software improves accuracy and precision in financial operations by automating data collection, processing, and reporting. By integrating with various financial systems and consolidating data into a single platform, the software eliminates the errors associated with manual data entry and disparate data sources. This centralization ensures that all financial information is consistent and up-to-date, providing a reliable foundation for analysis.

Advanced algorithms and analytical tools within the software further enhance accuracy by performing complex calculations and financial modeling with high precision. These tools can identify patterns, trends, and anomalies in the data that might be missed by manual analysis.

Optimize operations for scalability

Financial analysis software helps businesses optimize operations for scalability by streamlining financial processes, enhancing data management, and providing actionable insights. By integrating with existing financial systems and consolidating data into a unified platform, the software ensures seamless access to accurate and up-to-date financial information. This centralization eliminates data silos and enhances collaboration across departments, fostering a more efficient and cohesive operational environment.

The software automates routine financial tasks such as data entry, reconciliation, and report generation. This automation reduces the burden on financial teams, allowing them to focus on strategic activities rather than time-consuming manual processes. As a result, businesses can scale their operations without a corresponding increase in administrative overhead.

Best financial analysis software for different industries

Need more specific software options? Check out these categories.

Financial analytics tools for small businesses

- Cube

- Zoho

- Jirav

- Finmark

- Vena Solutions

Financial analytics software for banks

These software solutions are designed to handle the complex financial analysis requirements of banks.

- Cube

- QuickBooks

- NetSuite

- Oracle Essbase

Financial analytics platforms for investors

- Cube

- Anaplan

- Centage Planning Maestro

- Sage Intacct

Choose the best financial analysis software

Selecting the best tool for financial analytics is crucial for optimizing your FP&A processes. Each tool mentioned in this article offers unique features and capabilities designed to enhance data analysis, financial modeling, budgeting, forecasting, and reporting. By understanding your specific needs and the strengths of each software, you can choose the one that best fits your business requirements.

Whether you're a small business looking for cost-effective solutions, or a larger organization needing advanced capabilities there is a suitable financial analysis software for every business.

Book a demo today to see how Cube can help your business.

.png)

.png)

![13+ best financial analysis software for FP&A teams [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20file.png)

.jpeg?width=150&height=75&name=oracle-hyperion-essbase%20(1).jpeg)

.png?width=150&height=83&name=centage-vector-logo-2021%20(1).png)

![The 9+ best OnPlan alternatives and competitors [for 2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Pie%20Chart.png)

![The 11+ best Oracle Essbase alternatives [updated for 2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Pie%20Dashboard.png)