CPM vs EPM

Corporate performance management (CPM) refers to the methodologies, metrics, processes, and systems that enterprises use to monitor and manage business performance. It covers various activities such as budgeting, forecasting, and financial reporting. The finance department owns this software.

Enterprise performance management (EPM) applies performance management concepts across the entire enterprise, including finance, sales, marketing, services, manufacturing, and supply chain. EPM also extends to educational institutions, government agencies, and non-profits, providing a holistic approach to performance management.

Benefits of corporate performance management software

Performance management and financial budgeting can be stressful, especially for large businesses. You can invest in CPM software to avoid mismanaging finances and incurring avoidable costs.

Here’s how CPM software can help you:

Optimizes decision making

Rather than reviewing multiple documents and creating reports manually, which slows decision-making, CPM software provides accurate financial information in real time. You can view business performance at a glance and draw in-depth insights from available metrics.

Additionally, CPM software lets you generate custom reports showing KPIs and business performance metrics. You can send these reports to key stakeholders whenever they need to make important decisions.

Enhances collaboration

Many teams work in silos, which affects an organization’s bottom line. To achieve set goals, it’s crucial for all teams to be aligned and focused on effective collaboration.

CPM software fosters collaboration by providing data consolidation, automation, and real-time progress tracking on a single, centralized platform that’s accessible to everyone. This way, teams have a clear view of their capacity and responsibilities and can easily plan activities, schedule tasks, and balance workloads, keeping everyone aligned.

Provides detailed data analysis

Manual data analysis prevents you from having an accurate feel of the data. To get the most out of your business data, you need CPM software that allows you to analyze advanced data to identify trends, patterns, and insights.

CPM software makes analytics easier by integrating your various data sources and providing tools like dashboards, performance scorecards, visualization tools, and predictive analytics to see performance at a glance and plan for the future.

Improves accountability

CPM software helps you build a culture of accountability through progress visibility and real-time performance monitoring. To encourage a sense of responsibility among departments, you can maintain a structured framework specifying which team owns which processes and operations.

CPM software also supports continuous monitoring, so you can regularly track and evaluate each team's performance against set goals and provide feedback and support when needed.

What to look for in corporate performance management software

These are the features to look out for when choosing CPM software:

Remember: No two companies are the same, which means no one CPM software solution is right for every business. Therefore, when considering your selections, be sure to think about your goals (finance vs. strategy), deployment type, reporting, and usability to accurately assess which software solution is right for you.

Best corporate performance management software for CFOs

There are many CPM software solutions on the market, all offering tools that could prove useful to many businesses. However, as we mentioned before, not every tool is meant for every business type.

So, how can you determine which software is right for your business? Let’s look at the best CPM software CFOs can use to optimize their daily workflow:

1. Cube

.png?width=150&name=horiz-wordmark-ultramarine%20(2).png)

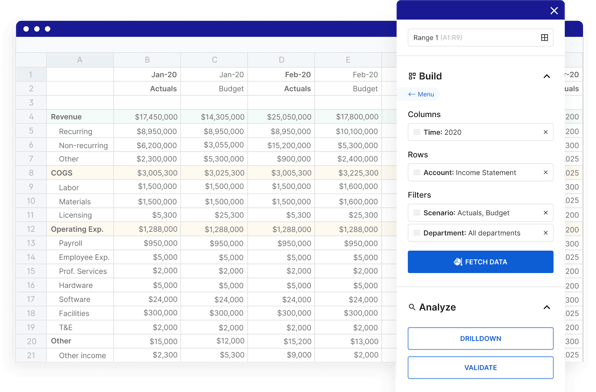

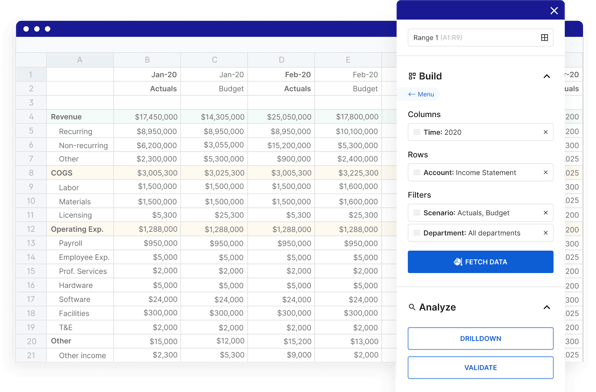

Cube is a cloud-based FP&A platform that helps companies hit their numbers without having to sacrifice their spreadsheets.

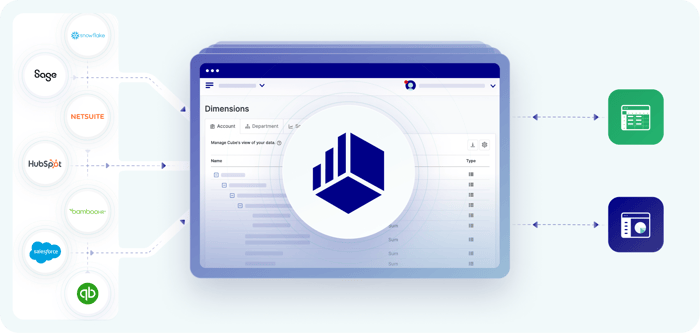

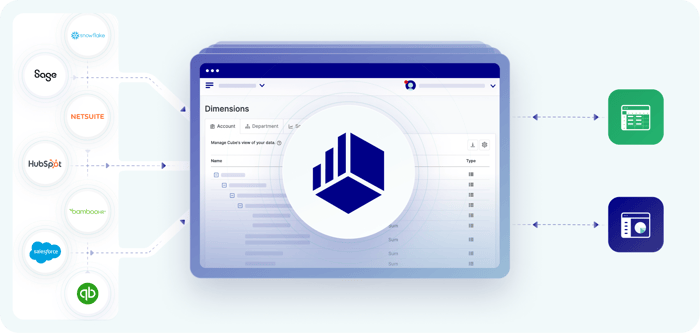

Our cloud-based software helps finance teams work anywhere. The platform natively integrates with Excel and Google Sheets so that FP&A teams can plan, analyze, and collaborate across departments. Cube's single source of truth makes it easy to perform financial consolidation, combining data from multiple Excel spreadsheets and sharing it with leadership over Google Docs.

Many successful companies (like Masterworks and SmugMug) use Cube for their CPM needs.

FP&A teams already know and love spreadsheets. Cube simplifies many of the headaches of the often challenging planning process—like collecting actuals from other departments or checking and verifying that your numbers are correct—and lets teams turn their complicated budgeting process into a lean operation. Users get all the benefits of a robust FP&A tool (like scenario analysis, data consolidation, and multi-currency support) within Excel and Google Sheets.

Key features:

- Automated data consolidation: Connect data from numerous sources for automated rollups and drilldowns.

- Multi-scenario analysis: Seamlessly model how changes to key assumptions affect overall outputs.

- Endless integrations: Integrate data from accounting and finance, HR, ATS, billing and operations, sales and marketing, and business intelligence.

- Customizable dashboards: Build and share customizable dashboards.

- Native Excel and Google Sheets integration: Leverage compatible and bi-directional integration with any spreadsheet.

- Multi-currency support: Evaluate your financials in both your local and reporting currencies.

- User-based controls: Use controls, validations, and an audit trail to ensure the correct data goes to the right people at the right time.

- Centralized formulas and KPIs: Store all your calculations in a central location and manage from a single source of truth.

- Drilldown and audit trail: Get straight to the transactions and history behind a single data cell in just one click.

Sound like a fit? Book your demo with Cube today.

Pros:

- Powerful reporting and KPIs that help automate and analyze important data

- Integration with dozens of applications

- Proper, native Excel integration with all versions of Excel, requiring no coding or formulas

- Reliable performance during sophisticated Excel calculations

- Standard implementation time that's 5x shorter than the competition

- User-friendly user interface and controls

- Easy permission management

Cons:

- Works best for mid-sized and commercial businesses—it’s not a personal finance app

- Built for finance professionals and is not a solution for learning FP&A for the first time

- Pricing is not designed for pre-series A startups

Pricing:

- Cube go: $1,500+/month

- Cube pro: $2,800+/month

- Enterprise: Custom quote. See detailed pricing for customizable plans.

Best for: Mid-size and enterprise FP&A teams looking to save time and grow, and startups or SMBs looking to scale quickly.

2. SAP Analytics Cloud

SAP Analytics Cloud helps FP&A teams optimize workflow using artificial intelligence and machine learning technology. It offers generative AI for users to automate reporting, discover insights, and develop business plans.

Its BI capabilities provide pre-built business content, letting users deliver industry-specific analytics and support enterprise collaborative financial, supply chain, and operational planning.

SAP Analytics Cloud integrates with other business performance management tools such as SAP business planning and consolidation, SQL, and Google BigQuery.

Key features:

- Augmented analytics: Reduce reliance on data specialists and empower users to perform analysis easily.

- Data exploration and visualization: Identify trends, patterns, and anomalies by presenting data in understandable formats.

- Self-service data modeling and preparation: Minimize the time and cost associated with traditional data modeling processes.

- What-if simulation: Explore multiple scenarios by altering variables to predict outcomes.

Pros:

- Integrates well with other SAP solutions

- Offers in-built predictive analysis

- Includes smart features like smart edit and smart insights

Cons:

- Complex to set up and configure

- Relatively expensive compared to other solutions

Pricing: Pricing is not available online

Best for: SAP Analytics Cloud works best in a business environment already standardized on other SAP products or businesses otherwise familiar with data science languages and integration.

3. Board

Board is a corporate performance management (CPM) and business intelligence (BI) software that allows users to combine Business Intelligence with CPM for efficient enterprise planning.

The Board Toolkit offers multi-dimensional analysis, ad-hoc queries, and advanced reporting so users can better plan, budget, and predict possible corporate financial outcomes.

For FP&A teams, Board provides a platform where they can work within their spreadsheets and use advanced formulas and dashboards for budgeting, planning, forecasting, CAPEX planning, etc.

Key features:

- Cloud or on-premise setup: Access data whenever you want from anywhere, whether onsite or remote.

- Hybrid Bitwise Memory Pattern technology: Enjoy greater precision and efficiency in data manipulation.

- Multi-language support: Create financial models and reports in multiple languages.

- Single logical view of corporate data: Enjoy unified access from multiple sources through a single interface.

Pros:

- Has an easy drag-and-drop interface

- Offers self-service analytics

- Highly customizable platform

Cons:

- Steep learning curve

- Cost-intensive (and users might incur additional costs)

- Users with large databases might encounter performance issues

Pricing: Pricing details are unavailable online

Best for: Board works best for small to mid-sized businesses with prior experience with Business Intelligence tools.

4. Prophix

.png?width=157&height=37&name=prophix-logo%20(1).png)

Prophix is a cloud-based financial planning software that helps users automate tedious FP&A tasks, such as data gathering, cleaning, dashboard building, and report generation.

It helps users eliminate the errors involved in manual data collection by combining data sources and automatically matching data to relevant financial documents.

Prophix also provides an AI-powered virtual assistant that detects unfamiliar transactions and human errors and alerts users when data is incorrect.

Key features:

- Integrations with Microsoft 365 and Microsoft PowerBI: Leverage familiar tools for enhanced productivity and data visualization.

- Automation and workflows: Automate repetitive tasks and create custom workflow to minimize the risk of errors.

- Trust-security compliance: Protect sensitive data and comply with regulations.

- Artificial intelligence with anomaly detection: Automatically detect anomalies and optimize business performance.

Pros:

- Automates repetitive tasks

- Offers a unified platform

- Supports data import and export

Cons:

- There can be performance issues with large data sets

Pricing: Pricing details are unavailable online, but there is a free trial available.

Best for: Prophix works for financial analysts and accountants.

5. Sisense

Sisense is an analytics platform that lets users build AI-powered analytics in their applications with no-code, low-code, and pro-code capabilities.

It offers data visualization and analysis tools that simplify complex data into actionable intelligence, letting users deliver personalized and dynamic insights. Sisense has an SDK for developers and integrates with other data analytics tools like Paldi and QBeeQ.

Key features:

- Connectivity to access data from anywhere: Provides access to critical business information.

- Scalable analytics: Use software that can grow with the business, handle increasing data volumes, and reduce the need for frequent upgrades.

- Visualization tools: Leverage intuitive visualization tools to present data.

- Multiple data sources integration: Integrate and link multiple data sources to create a comprehensive data model.

Pros:

- Seamless data integration

- In-depth data analytics

- Customizable dashboards and user-friendly interface

Cons:

- Complex initial setup

- Performance issues with large data sets

- Expensive to use for small businesses

Pricing: Pricing details are unavailable online, but there is a free trial available.

Best for: Sisense is best for enterprise-level companies with a large amount of data and multiple user feeds.

6. Jedox

Jedox is an enterprise performance management (EPM) platform for financial, sales, and integrated business performance management. It’s commonly used in human resources and sales industries and enables FP&A teams to automate processes and reduce manual analysis.

Jedox employs an in-memory online analytical processing (OLAP) database that supports integrated business planning, ESG reporting, OpEX, and CapEX planning.

Key features:

- Excel-friendly: Integrate Excel with the platform and work with a tool you’re familiar with.

- Intelligent AI-assisted planning: Use AI to enhance your planning process with predictive analysis and make better decisions for your business.

- Centralized value chain control: Use end-to-end visibility to streamline operations and improve efficiency.

- Optimize value creation step-by-step: Refine your strategies and operations for maximum profitability.

Pros:

- Flexible modeling capabilities

- Powerful data integration

Cons:

- Customization challenges

- Limited advanced analytics features

Pricing: Pricing details are unavailable online

Best for: Jedox would be best used by pre-revenue startups and small to mid-sized companies needing integrated business planning support.

7. Sage Intacct

Sage Intacct is cloud-based financial management and accounting software for financial reporting, budgeting, and operational planning.

It enables users to manage financials and keep track of fund movements with tools like accounts payable and receivable, a general ledger, improved purchasing and reporting tools, and order management dashboards.

Sage Intacct integrates with other business applications, such as Salesforce, and provides developers with documentation to build custom financial solutions.

Key features:

- Real-time, multi-dimensional reporting: See live reporting on different aspects of your business at once.

- CFO dashboard: Maintain an overview of planned versus actual performance using customizable dashboards.

- AI-powered financial management: Automate repetitive financial planning tasks and free up time for more strategic thinking.

- Analytics: Make data-driven decisions using instant predictive insights.

Pros:

- Seamless integration with ERP systems

- Automation of financial processes

- Has a user-friendly interface

Cons:

- The cost of ownership is relatively high

Pricing: Pricing details are unavailable online, but there is a free trial available.

Best for: Sage Intacct works for a wide range of companies, from growing startups to public companies looking for web-based solutions for their CPM software.

8. Axiom

Axiom is a financial planning and data solution for financial, healthcare, and higher education institutions. It is an EPM offering industry-specific tools for budgeting, forecasting, scenario planning, reporting, etc.

For finance teams, Axiom provides an analytics-based solution that supports driver-based financial planning. This enables them to gain visibility into what products, customers, and segments drive value in the organization and plan for the future.

Axiom also has a relationship profitability and pricing tool for teams to measure profitability for each customer and accurately price products.

Key features:

- Financial planning: Use driver-based budgeting and forecasting to plan for the future.

- Reporting and analytics: Leverage streamlined analytics and reporting for actionable insights and decision-making.

- Funds transfer pricing: Gain visibility into products, customers, and segments that drive value.

- Long range planning: Speed up initial creation and updating plans with historical forecast data and budgets.

Pros:

- Supports detailed budgeting and scenario planning

- Protects sensitive financial data

- Enhances decision making

Cons:

- Limited third-party integration

- Might require IT support

- Slow performance with large data sets

Pricing: Pricing is not available online

Best for: Axiom’s software focuses on regulatory requirements and reporting. Companies with high regulatory requirements, auditing necessities, and reporting compliance can benefit from Axiom use, with compliance reports available immediately for regulatory bodies.

9. Budgyt

Budgyt is a financial budgeting tool that delivers solutions for small—to medium-sized businesses, non-profits, or larger enterprises with complex needs, such as cost allocation.

The platform enables finance teams to automate manual processes and replace them with real-time consolidation and user-friendly dashboard navigation.

Budgyt enables users to reduce their formulas when managing cashflow forecasts and P&L budgets and automates business formulas' auditing. It integrates with software like Asana, SAP, Trello, and NetSuite.

Key features:

- Custom APIs: Import data from other software via APIs.

- Multi P&L budgeting: Consolidate P&L budgeting by department, sub-department, or entity in a hyperlinking platform.

- Data visualization: Use custom dashboards to view data.

Pros:

- Custom onboarding and has a 5-10 day deployment

- Affordable

Cons:

- Slow load time on certain integrations (like QuickBooks)

- Limited reporting capabilities

Pricing: Pricing details are not available online

Best for: Budgyt works for small to large non-profits or businesses in the market for simple budgeting software.

10. Jirav

Jirav offers cloud-based financial planning and analysis, helping accounting and finance teams budget and forecast without spreadsheets.

Jirav allows users to track and report expenses and also offers multi-user access to improve collaboration.

Jirav also integrates with several tools such as Salesforce, SAP, Hubspot, and Microsoft Excel.

Key features:

- Roll forward forecasts and data without spreadsheets: Automate forecast updates, eliminating manual spreadsheet work.

- Integrations: Integrate with existing accounting tools to centralize financial data.

- Driver-based forecasting models: Model and predict future performance with more accuracy.

- KPI monitoring: Create dashboards and reports using industry-specific metrics and store them in a KPI library.

Pros:

- 14-day free trial for the starter plan

- Visually appealing reports and graphs

Cons:

- No multi-currency capabilities

Pricing:

- Industry Safari: $20,000+

- Strategy Safari: Custom pricing

Best for: Jirav works best for smaller businesses and organizations without international clients due to its lack of multi-currency capabilities.

11. Vena

Vena Solutions integrates natively with Microsoft 365 to provide a comprehensive planning platform. The software assists with business budgeting and financial forecasting by automatically generating forecasts and insights from data.

Vena enables FP&A teams to analyze variance, identify discrepancies, and build ad-hoc reports for your business.

It allows users to assess a company’s financial health by slicing and dicing data across different entities.

Key Features:

- Excel templates and integration: Use pre-built Excel templates to turn Excel into a complete forecasting tool with tools like drill-throughs and advanced modeling.

- Central database: Integrate your data sources into one source of truth.

- Workflow visualization: Represent forecasts visually with intuitive visual workflow tools.

Pros:

- Integrates natively with Microsoft 365

- Free trial available

- Customizable models and templates

Cons

- Clunky report writing

- Slow load time on large complex workbooks

Pricing: Pricing details are unavailable online

Best for: Vena suits companies that require the structured process and planning controls of pre-built FP&A processes or need to customize a pre-built solution to meet their unique requirements.

12. Mosaic Tech

Mosaic Tech offers a comprehensive suite of tools to enhance performance management accuracy, featuring tools for real-time reporting for more accurate financial forecasting.

The platform streamlines the data aggregation process by consolidating data from various sources. It offers improved financial planning and analysis, enhanced reporting, and strategic decision-making.

Mosaic Tech also offers a comprehensive suite of tools designed to enhance accuracy featuring tools for real-time reporting for more accurate financial forecasting. It integrates with various CRM and ERP systems.

Key features:

- Robust integrations: Connect with other enterprise apps for comprehensive data access and consolidation.

- Data customization: Personalize data, dashboards, and reports to meet specific needs.

- Analytics: Get valuable insights to improve decision-making.

- Permissions and access control: Adjust permissions and specify who has access to what to safeguard sensitive information.

Pros:

- Customizable dashboards

- Easy onboarding

- Easy to track and compare multiple forecasts

Cons:

- Needs several clicks to report functionality

- Data importation and integration can be time-consuming

Pricing: Pricing details are unavailable online, but there is a free trial available.

Best for: Mosaic is best for SaaS companies. However, the tool has a known learning curve and ultimately replaces spreadsheets, so if you need models or forecasts in Excel format, Mosaic might present you with some tech headaches.

13. Anaplan

Anaplan is a cloud-based platform that aligns users' strategic, operational, and financial plans through AI, predictive algorithms, and machine learning. Users can centralize their work on a single platform and collaborate in real-time with their team.

It offers real-time dashboards, insights, and advanced data visualization to support the decision-making process. This financial planning software uses artificial intelligence, predictive algorithms, and machine learning to help users avoid potential pitfalls.

Anaplan integrates with various ERP and CRM systems, such as Salesforce, SAP, Oracle, Netsuite, etc., to ensure seamless data flow.

Key features:

- Modules: Use detailed modules to view business data from edge to edge and examine every aspect of your business.

- Revenue planning: Gain visibility into your key drivers and forecast revenue across all departments.

- Long-range planning: Evaluate the best long-term objective for your business with scenario modeling and planning.

- Headcount planning: Keep a check on headcount expenses and align it with overall headcount decisions and operating plans.

Pros:

- Supports several use cases including planning, collection, and forecasting

- Allows real-time calculation driven by human-readable formulas

Cons:

- Poor user license management

- Reports of bugs in newer features

- Some key features are not free

Pricing: Pricing details are unavailable online.

Best for: Anaplan focuses on large and fast-growing businesses, so it may not be the best choice for smaller business models. Feature-rich options can be overwhelming without a dedicated team.

14. Workday Adaptive Planning

Workday Adaptive Planning is a cloud-based financial planning and analysis software that streamlines the financial planning, budgeting, forecasting, and reporting process for non-profit businesses.

It offers built-in AI and ML-powered analytics with flexible structures and models that users can adapt to fit their business model and structure.

The platform also has an AI and ML for finance certificate course where finance teams can learn how to do effective financial planning and performance management in an AI-powered business environment.

Key features:

- Finance and HR consolidation: Combine your finance and HR tools and data in a single platform.

- Top-down and bottom-up budgeting: Create and manage budgets for the entire organization or specific teams/departments.

- Project planning: Build driver-based models and what-if scenarios to compare project profitability and impact.

- Analytics and reporting: Report using any dimension internally and externally, ROI and profitability insights, granular expense, and revenue details.

Pros:

- Easy hypertext link reporting

- Fast data importation

- Drag and drop functionality

Cons:

- Lengthy loading time

- Mastering data for reporting takes time

Pricing: Pricing details are unavailable online, but there is a free trial available.

Best for: Workday Adaptive Planning can be most beneficial for businesses that have to deal with a lot of change.

15. Planful

Planful streamlines financial budgeting, forecasting, and reporting processes and facilitates data import and export, simplifying business performance management across platforms.

It provides users with prebuilt templates, intuitive collaboration tools, and workflow management tools that help align corporate strategy with business execution.

Planful helps businesses evaluate the impact of plans on overall business performance through custom KPIs and metrics dashboards that alert users when they’re not aligned with set targets.

Key features:

- Agile planning: Build collaborative plans aligned with available business resources and company-wide objectives.

- Scenario modeling: Model multiple scenarios simultaneously to determine optimal adjustments and adapt as your business changes.

- Inventory and operations sync: Fully connect sales, inventory, and operations teams for any product or SKU.

- Dashboards: Use a drag-and-drop calculation builder to update dashboards, templates, and reports automatically.

Pros:

- 30-day money-back guarantee

- Allows flexible budgeting

- Supports multiple user input

Cons:

- Some processes are manual

- Poor platform training resources for users

- Reliance on third party for some features

Pricing: Pricing details are unavailable online.

Best for: Planful works best for finance and accounting departments for companies interested in streamlining and automating reporting and tracking processes. Restrictions may exist within their learning curves.

16. Datarails

Datarails is financial planning and analysis software that offers ad hoc reporting, asset lifecycle management, budgeting and forecasting, and drag-and-drop data imports.

It provides users with error-free information at a glance and supports Excel-based planning and reporting, enabling users to better estimate finances for future projects, track expenses, and streamline amortization and depreciation tallies while working in Excel.

Datarails integrates with Excel, Netsuite, QuickBooks, SQL databases, and more.

Key features:

- Excel integrations: Connect with Excel for enhanced functionality while working on spreadsheets.

- FinanceOS: Optimize your analysis, forecasts, financial processes, and reports using an operating system for finance.

- Monthly reports: Generate and share custom monthly reports.

- Data visualization: Build customizable dashboards integrated with your data sources in real time to visualize financial data.

- Financial analytics: Analyze patterns and trends using AI-powered financial planning and analysis tools.

Pros:

- Direct integration with Excel makes it easy to use

- Able to create and store multiple files on one platform

- Seamless integration with other enterprise software

Cons:

- Limitations to the type of data imported

- Complex file mapping

- Difficulty working well with very large data sets

Pricing: Pricing details are unavailable online.

Best for: Datarails is suitable for finance teams in small or medium companies not planning to scale. The platform focuses solely on Excel, so larger companies that utilize other data collection and manipulation (like Google Sheets) may not find this product best for them.

Read our full Datarails review here.

17. Oracle Cloud ERP

Oracle Fusion Cloud ERP is cloud-based software that offers end-to-end guidance for SMBs that need business performance software support.

It provides users with real-time alerts, notifications, a detailed budget, and forecasting tools to help them better manage their business. Users can handle complex expense management through advanced data interpretation.

Oracle Fusion Cloud ERP integrates with other Oracle applications and data integration tools such as Microsoft Azure, AWS, Oracle HCM Cloud, and Oracle BI Publisher.

Key features:

- ERP analytics: Self-service data discovery, augmented analytics, and KPI management

- Enterprise data management: Hierarchy management, change data visualization, and enterprise data governance

- Tax reporting: Enterprise tax and financial reporting for compliance and visibility

- Profitability and cost management: Flexible models for profitability analysis

Pros:

- Good web page response time

- Simple pricing plan

- Multi-dimensional analysis

Cons:

- User interface is not friendly

- Limited availability in regions

Pricing: Pricing details are unavailable online

Best for: Oracle Cloud ERP is an ERP system designed for large businesses on an enterprise scale. Because of its ERP functionalities, it’s best used with FP&A software.

18. IBM Planning Analytics

IBM Planning Analytics helps small and larger businesses better manage their finances through ad hoc reporting, advanced budgeting and forecasting, a user-friendly dashboard, and predictive analysis.

The platform enables users to automate repetitive tasks like data refreshes, consolidations, and report generation.

Its planning analytics platform lets users access data from multiple sources via an Excel interface or web interface and analyze big data with an in-memory database. However, users unfamiliar with this type of software may find it has a difficult learning curve.

Key features:

- Web-based interface: Facilitate teamwork and collaboration through an accessible online platform.

- Integration with IBM’s ‘Watson’: Leverage AI-powered performance management by integrating with IBM’s AI solution.

- Sandboxes: Develop and test ideas in isolated, risk-free environments.

- Performance scorecards: Assess business performance by comparing actual results to benchmarks.

Pros:

- Customizable platform with a free trial

- Premium consulting and integration services

Cons:

- Relatively expensive

- Complex rule writing interface

Pricing:

- Essential: $825/month

- Standard: $1650/month

- Premium: Custom quote

Best for: IBM Planning Analytics with Watson is a useful platform for businesses of all sizes and you can tailor it to fit your company's needs.

19. OneStream

OneStream enables modern corporations to gain a clearer perspective into the company’s financial needs using advanced data analysis and Microsoft Office Suite integration.

The platform helps with bank reconciliation, cash management, and key performance indicator (KPI) tracking, enabling businesses to reduce overhead.

It helps users unify financial consolidation, data reporting, planning, analytics, and machine learning through guided workflows that simplify processes.

Key features:

- Financial close and reporting: Automate and accelerate the financial close and reporting process.

- Scenario modeling: Model and manage multiple scenarios at once.

- Compliance: Access data integrations, validations, certifications, and audit trails.

- Profitability analysis: Analyze revenue and cost and gain insights into key drivers of profitability.

Pros:

- Reliable customer support

- Excellent data visualization

Cons:

- Complex drill-down functionality

- Does not do well with large data sets

Pricing: Pricing details are unavailable online.

Best for: Upper mid-market to the largest enterprise-class customer with financial planning and reporting complexities. Setting up OneStream can be difficult and requires a professional, which may deter smaller companies or companies without a dedicated tech team.

20. Quantrix

Quantrix is a business financial modeling and analytical platform that allows users to create agile financial models, improve throughput analytics, and share critical business insights.

It offers a flexible and robust system that allows for long-term financial planning at every project stage.

Quantrix has built-in data import and export functionality so users can maintain up-to-date data and create financial models that are automatically updated to reflect new data.

Key features:

- Scenario Analysis: Do a detailed analysis of various assumptions and likely outcomes for scenario planning.

- Data Integration: Integrate with various tools to ensure data consistency and streamline the modeling process.

- Multidimensional Modeling: Create multidimensional models that can handle complex datasets for detailed financial analysis.

Pros:

- Timely alert system

- Users can have modified access to the cloud

- Quick turnaround time for modified reports

Cons:

- Poor customer support

- Glitchy border lines and grey space in outline layout

Pricing: Pricing details are unavailable online. There is a free trial available.

Best for: Quantrix works well for any size business across all industries. However, reviews mention that this software may be challenging to learn for inexperienced finance professionals.

21. Hubble

Hubble is real-time analytics and reporting software that provides real-time financial and operational data insights. Its dashboard and reporting tools let users drill down into transactions and automate report distribution.

The platform lets users handle large datasets analysis and create reusable report inquiries to generate reports.

Its data sources include SAP, Oracle, Microsoft, Deltek, and MRI software. It also integrates with other ERP and EPM systems and supports custom integrations.

Key features:

- Data visualization: Identify trends and monitor performance by leveraging analytical dashboards.

- Data automation: Connect all your enterprise systems and automate data gathering.

- Budgeting and planning: Consolidate budgets and plans across departments in the organization.

- Business intelligence: Dive into your data with embedded analytics, self-service tools and AI & ML integration.

Pros:

- Quick data retrieval

- Flexible customization

- Detailed audit trails

Cons:

- Not all processes get automated

Pricing: Pricing details are unavailable online, but a free trial is available.

Best for: Hubble is best for companies using Oracle and JDE EBS.

22. Centage

Centage’s Planning Maestro is web-based financial forecasting software that offers workforce planning and scenario analysis.

Users can automate data integration and consolidation in real time and use automated and instantaneous reporting to do more advanced planning and budgeting.

Centage planning maestro integrates with various accounting and ERP systems to streamline data flow and ensure data accuracy.

Key features:

- Forecasting: Generate predictions with logical, data-based selections for businesses.

- Scenario planning: Use what-if scenario planning to evaluate the impact of various assumptions and outcomes.

- Data visualization: Review easy-to-read dashboards and visuals.

Pros:

- Budgets with segmentation

- Integrated with Netsuite

- Handles complex calculations

Cons:

- Slow in handling complex processes

- Does not have an undo button

Pricing: Pricing details are unavailable online.

Best for: Centage is best suited for large and enterprise-level businesses that are okay with sophisticated software and higher price point.

23. Oracle Essbase

Oracle Essbase is a business analytics solution in the form of a multidimensional database management system. It allows users to shift their financial data in Excel to the cloud, making it easier to manage complex hierarchies.

It supports what-if analysis and tools for data visualization and streamlines the decision-making process by offering real-time data analysis insights.

The platform also integrates with a wide range of Oracle products as well as CRM systems like Hubspot and Salesforce.

Key features:

- Microsoft Office integration: Access seamless Integration with Excel.

- Scenario planning: Provides the resources needed to achieve set goals and predicts future financial performance.

- Multidimensional models: Users can perform complex analysis as well as create graphs and charts to analyze data across multiple metrics.

Pros:

- Easy creation of ad hoc reports

- Provides detailed task list to help new users

Cons:

- Workspace Hyperion is slow and can be difficult to upgrade

- Expensive for smaller companies

Pricing: Pricing details are unavailable online.

Best for: Essbase is best for mid-range companies. Most users exist in the insurance sector, with the next highest being in the financial sector. Essbase may not be best for companies that have little database experience.

How various industries harness CPM software

By leveraging CPM platforms tailored to their specific needs, businesses can drive operational excellence, achieve

strategic objectives, and deliver value to stakeholders in their respective industries. Here's how:

Finance and banking

Finance and banking use CPM software to manage financial performance, risk assessment, regulatory compliance, budgeting, forecasting, and financial reporting.

These institutions consolidate financial data from all enterprise software on the CPM to assess actual performance against forecasted targets and draw insights into the key drivers behind profitability.

CPM software allows financial institutions to maintain eagle-eye visibility on cost centers, profit centers, and the specific profit that products and services bring.

Retail and e-commerce

Retailers and e-commerce companies use CPM software to boost sales, optimize inventory, and enhance customer satisfaction.

This software analyzes sales trends, identifies product preferences, and forecasts demand, aiding in informed inventory planning and pricing strategies.

Also, by integrating data from various channels like online sales and social media, CPM software provides insights into customer behavior, enabling targeted marketing campaigns and personalized experiences.

Manufacturing and supply chain

Manufacturers use CPM platforms to track production metrics, monitor equipment performance, and allocate resources effectively to boost productivity.

CPM software helps with real-time monitoring of inventory levels, supplier performance, and logistics operations in the supply chain. This enables proactive decision-making, streamlining operations, and meeting customer demand efficiently.

Healthcare and pharmaceuticals

Healthcare and pharmaceutical providers use CPM software to analyze patient outcomes, optimize resource utilization, and manage costs efficiently.

Additionally, pharmaceutical companies track drug development, ensure regulatory compliance, and optimize sales and marketing efforts.

Leveraging CPM software enables these organizations to enhance patient care, foster innovation, and achieve sustainable growth amidst changing regulations and market dynamics.

Technology and IT services

Technology firms and IT service businesses utilize CPM software to innovate, optimize projects, and boost client satisfaction. These platforms track project performance, allocate resources, and forecast revenues accurately.

Moreover, by analyzing customer feedback and market trends, CPM software helps align product development and sales strategies with evolving customer needs, driving competitive advantage and sustainable growth.

Innovations shaping corporate performance management

Driven by the need for greater agility, intelligence, and user-centricity in managing corporate performance effectively, these trends show the evolving landscape of CPM software.

Expansion of integrated planning and analysis capabilities

The boundaries between traditional CPM, enterprise resource planning (ERP), and business intelligence (BI) functionalities are blurring as CPM software evolves to offer more comprehensive planning and analysis capabilities.

Modern CPM platforms are integrating with ERP systems, BI tools, and data warehouses to provide end-to-end visibility into financial and operational performance. This means even faster and more affordable business processes, as several databases will not be necessary to run multiple systems. A single network will be sufficient.

Shift towards cloud-based solutions

Cloud-based CPM solutions are gaining popularity due to their scalability, flexibility, and accessibility. Organizations are increasingly adopting cloud-based CPM software.

They streamline data management, reduce infrastructure costs, and enable remote access for distributed teams, which simplifies enterprises' day-to-day operations.

Additionally, cloud-based CPM platforms offer seamless integration with other business applications, facilitating data exchange and workflow automation across the organization.

Focus on user experience and accessibility

User experience (UX) design and accessibility are becoming key priorities for CPM software vendors and users.

As businesses strive to empower users across different departments and skill levels to leverage CPM tools effectively, intuitive interfaces, personalized dashboards, and interactive visualization capabilities are gaining prominence.

Moreover, CPM software is increasingly being designed to support mobile devices, ensuring that users can access critical performance data anytime, anywhere.

Choose the right CPM software for your business

The right CPM software will make it easier for your business to gain visibility and control over performance. You’ll be able to drill down into data to see exactly what you’re doing right, and what processes you might need to change to meet your targets.

And if you’re a business with teams that work in disconnected silos, you’ll also give all departments in your business a centralized platform to work on, enabling them to remain aligned.

Simply put, CPM software ensures you see important business metrics at a glance while also maintaining agile teams locked into your business goal. But you’ll only get this if you invest in the right CPM software for your business.

Want to learn how Cube can benefit your business? Schedule a demo today and unlock the full potential of your business performance management.

.png)

.png)

![23 best corporate performance management software solutions [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Pie%20Chart.png)

.png?width=150&name=horiz-wordmark-ultramarine%20(2).png)

![12+ Best FP&A software for small businesses [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Lines%20Chart.png)