Product

Solutions

Resources

Company

About Cube

Explore our vision and team

Careers

Help shape the future of FP&A

In the News

Cube featured in top publications

Security

Enterprise-grade, cloud security

Newsletter

.png)

A newsletter for finance pros—by finance pros. Get practical, strategic finance insights from those who’ve been there—straight to your inbox.

financial services

fp&a for financial services

Intelligent financial planning at your fingertips

Plan ahead for whatever the markets throw at you.

From risk assessment to workforce planning, Cube's fully-loaded FP&A platform helps you compare plans to actuals and drive profitability.

How Cube Works

-

Loved by finance pros at

-

-

-

Powering 1,000s of finance professionals in every industry.

Why leading financial service providers choose Cube

drive stability

Assess the impact of market fluctuations on financial health across your client portfolios, ensuring stability in uncertain times.

strategize effectively

Stay a step ahead. Model what-if scenarios based on interest rates, originations, run-offs, and defaults.

plan ahead

Drive profitability with detailed risk models and insightful analysis, empowering leaders to take decisive action at a moment's notice.

Manage FP&A Your Way

Annual Budgets

CapEx/OpEx Planning

Ad-Hoc Reporting

Financial Modeling

What-If Analysis

Multi-Scenario Planning

Balance Sheets

Impact Analysis

Compliance Reporting

Finance teams trust Cube to transform their FP&A

Cube is core on the FP&A side. Everybody on the team uses it in some way.

Nigel Glenday

CFO

What I love the most is Cube's flexibility. It doesn't tell me how to manage my organization; rather, it provides me the flexibility to manage our processes how we see fit.

Nicholas Jacoby

Vice President

See cube in action

With Cube, finance teams can focus on what matters—guiding the business forward with speed, precision, and confidence.

What is Cube and how does it support financial services planning in Excel and Google Sheets?

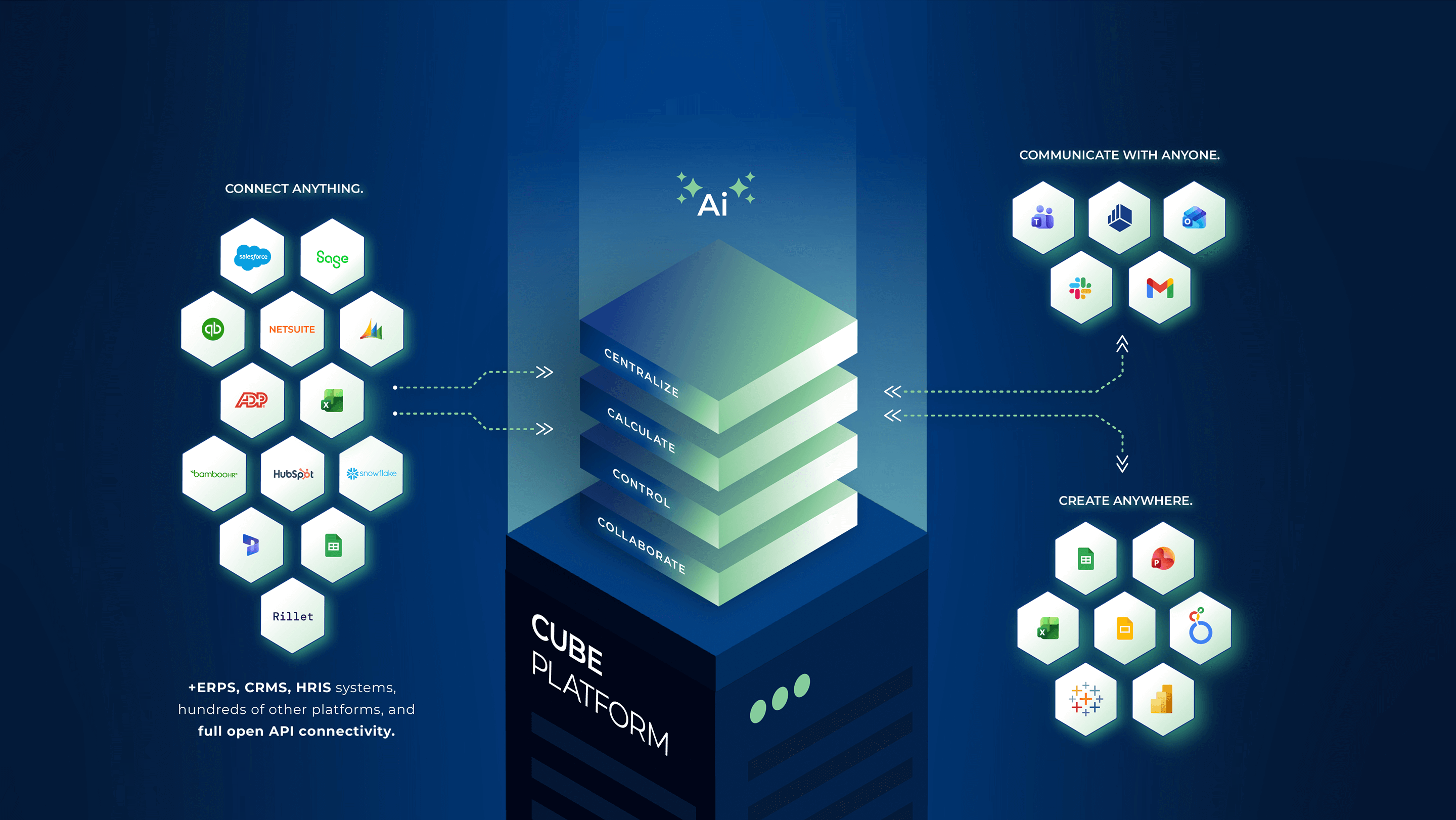

Cube is a no-code FP&A platform that integrates directly into Excel and Google Sheets, Slack, and Teams on both Macs and PCs. Financial services firms can keep their existing workflows while benefiting from centralized data governance, one-click syncs, and automated planning processes.

How does Cube help with business unit or portfolio-level performance tracking and forecasting?

Cube provides a centralized, multi-dimensional model that connects to your core data sources and supports live reporting. Finance teams can drill down into performance by business unit, product line, or client segment to forecast revenue, analyze profitability, and monitor KPIs like AUM, ROE, or net interest margins all with real-time data.

Can Cube support scenario planning for market shifts, interest rate changes, or new business strategies?

Yes. Cube allows you to create and compare multiple scenarios for key variables like interest rates, fee structures, client acquisition pace, or operating expenses. Run forecasts against actuals or model best- and worst-case conditions to drive more agile decision-making.

How does Cube enable driver-based planning for financial services firms?

Cube links operational and market drivers such as client growth, revenue per advisor, headcount, or AUM directly to your financial forecasts. This lets teams model outcomes like compensation, margin, and cost-to-serve based on real business inputs.

What data integrations does Cube offer for financial services FP&A teams?

Cube integrates with ERP, CRM, HR, and portfolio or billing systems to unify your planning environment. Its no-code ingestion and data mapping capabilities streamline planning across entities, business lines, and currencies, without the need for manual workarounds or complex formulas.

How secure is Cube for large financial services organizations?

Built on AWS, Cube is SOC 2 Type II certified and GDPR compliant. It offers granular access controls, audit trails, versioning, and encryption both at rest and in transit- addressing enterprise-level security needs.

What financial services KPIs and variance insights can Cube support?

Cube’s Smart Analysis helps you monitor plan vs. actuals across key financial services metrics like client churn, AUM growth, operating leverage, and expense ratios. Drill down into variances, investigate root causes, and share dashboards directly via Excel, Sheets, or Slack/Teams.

How does Cube support collaboration between finance, strategy, and client-facing teams?

Cube streamlines collaboration through shared spreadsheet templates, audit trails, and centralized version control. All teams, from relationship managers to finance leaders, can work together in the same models without overwriting each other or compromising compliance.

Does Cube support workforce and compensation planning for financial services?

Still have questions?

.png)