Product

Solutions

Resources

Company

About Cube

Explore our vision and team

Careers

Help shape the future of FP&A

In the News

Cube featured in top publications

Security

Enterprise-grade, cloud security

Newsletter

.png)

A newsletter for finance pros—by finance pros. Get practical, strategic finance insights from those who’ve been there—straight to your inbox.

business services

fp&a for business service providers

Streamline FP&A processes and maximize profitability.

Cube enables budgeting and forecasting processes that empower better, faster decision-making, boosting operational efficiency and driving profitability.

How Cube Works

-

Loved by finance pros at

-

-

-

-

Powering 1,000s of finance professionals in every industry.

Why leading business service providers choose Cube

Stonger collaboration

Discover real-time collaboration and streamlined ad-hoc reporting so everyone on your team can have the data they need to support your customers.

Greater flexibility

Adapt to changing project portfolios and evolving customer needs. Cube's reliable, easy-to-use interface allows for enhanced planning, forecasting, and reporting flexibility.

Streamlined data insights

A single source of truth for your financial data makes it easy to access and use the financial information you need, regardless of reorganization and turnover.

Manage FP&A Your Way

Annual Budgets

Gross Margin ROI (GMROI)

Driver Based Planning

Income Statements

Cash Flow Reporting

Market Trend Analysis

Strategic Initiative Evaluation

Cost-Benefit Analysis

Sales Forecasting

Finance teams trust Cube to transform their FP&A

We’re spending more time partnering with the business and analyzing how changes affect revenue across all three entities.

Morgan Rafferty

Senior Finance Manager

We've saved 10 hours per week and more than $300,000 annually with Cube.

Ethan Kutner

Director of FP&A

See cube in action

With Cube, finance teams can focus on what matters—guiding the business forward with speed, precision, and confidence.

What is Cube, and how does it support business service financial planning in Excel and Google Sheets?

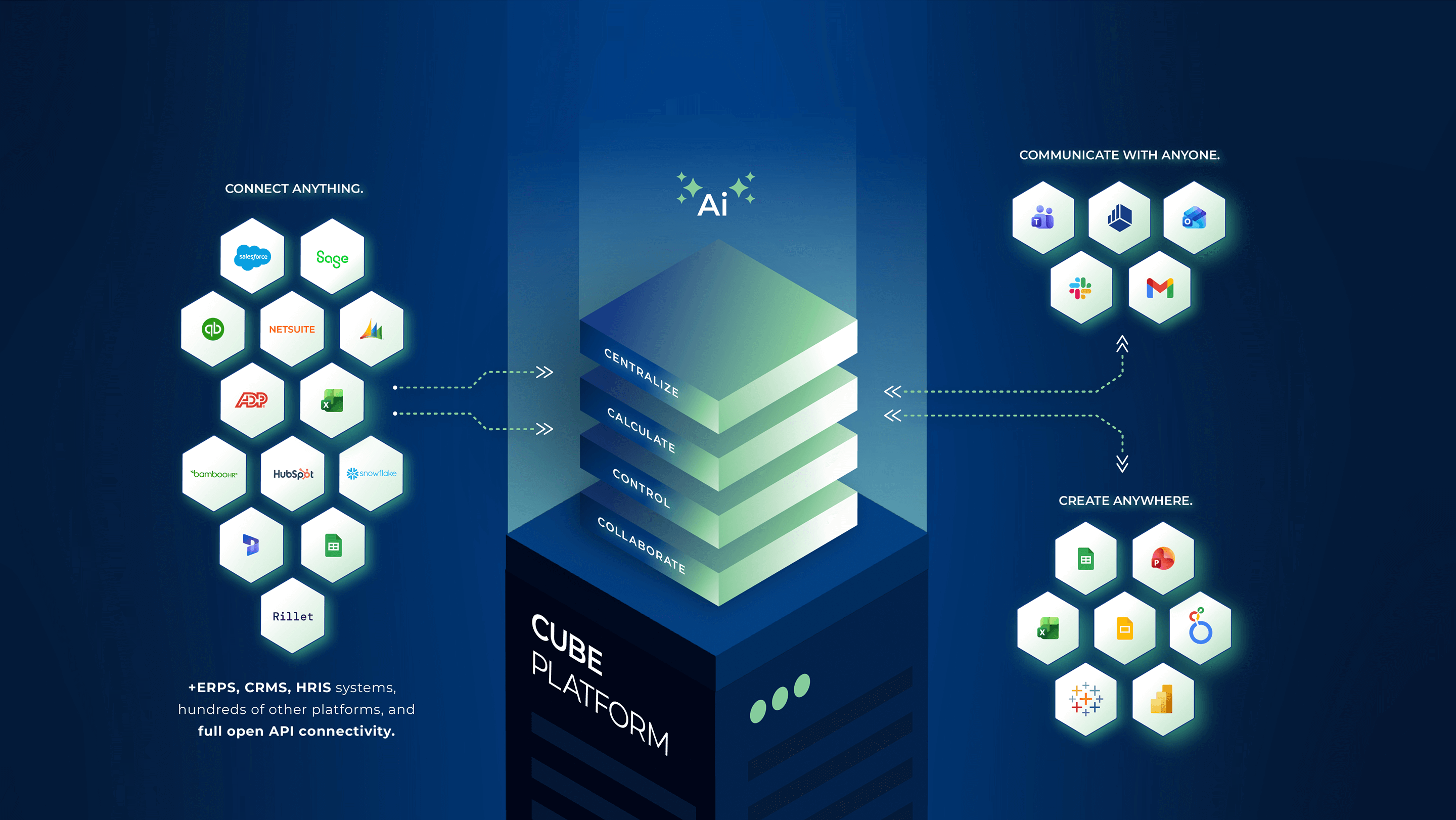

Cube is a no-code FP&A platform that integrates directly into Excel and Google Sheets, Slack and Teams, on Macs and PCs. Business Service finance teams can continue using familiar tools while benefiting from centralized data governance, one-click data syncs, and automated workflows.

How does Cube help with performance tracking and forecasting?

Cube provides a centralized, multi-dimensional model connected to your most important data sources, and offers live reporting and real-time data access to customized granular levels.

This lets business service teams build financial and KPI-rich operational reports, analyze performance, and forecast margins and business needs with dynamic scenario drivers.

Can Cube support scenario planning for changes in client demand or resource availability?

How does Cube enable driver‑based planning for business service finance teams?

Cube supports driver‑based planning by linking operational drivers like billable hours, utilization rates, or headcount, directly to financial outcomes in your models. This empowers teams to forecast revenue, labor costs, and project profitability with precision.

What data integrations does Cube offer for business service FP&A teams?

Cube integrates with ERPs, CRMs, HRIS tools, spreadsheets, and more. It offers no-code ingestion, mapping, and cleansing across multiple entities, departments, and currencies, eliminating manual imports and formula errors like VLOOKUPs.

How secure is Cube for large business service organizations?

What business service KPIs and variance insights can Cube handle?

Cube offers AI-powered Smart Analysis for variance reporting. Track plan vs. actuals on metrics like revenue per consultant, utilization, project margins, or overhead spend. Drill into top outliers, analyze root causes, and share findings directly in Excel, Sheets, Slack, or Teams.

How does Cube support collaboration between finance, operations, and client delivery teams?

Cube centralizes workflows with version control, task management, audit trails, and controlled spreadsheet publishing. All teams, from finance to operations to service delivery, can work together in shared Excel or Google Sheets while maintaining transparency, control, and alignment.

Does Cube support workforce and headcount planning for business services?

Absolutely. Cube provides tailored headcount and workforce planning templates that integrate HRIS and financial data. You can model staffing levels, contractor costs, billable vs. non-billable headcount, and ramp-up timelines directly in spreadsheets or sync to Cube’s Workspace.

Still have questions?

.png)