Key takeaways on budgeting and forecasting software

- Budgeting and forecasting software helps businesses create detailed budgets and accurate financial forecasts using past and present data.

- Finance teams can reduce errors and save time with tools that automate manual tasks like data collection and report generation so they can focus on strategic activities.

- The best tools offer integration with other systems so businesses can adapt quickly to changes and scale faster.

- Businesses can integrate these tools to keep all relevant stakeholders informed on current and projected financial health.

Budgeting software vs. forecasting software

A budget determines resources for each part of a company, from salaries to office supplies. It focuses on cash position, including expected revenues and expenses, to set specific financial goals for the future.

Financial forecasts, on the other hand, show potential futures. Teams examine possible economic outcomes based on current drivers and assumptions, commonly using what-if analysis from Excel.

Software exists for both processes:

- Budgeting software helps businesses create and maintain budgets by assessing past budgets, reviewing expenditures, and detecting overspending.

- Forecasting software projects long-term and short-term financial performance. These tools use historical data, transaction and purchase history, competitor analysis, and market trends to make profit predictions and inform business decisions.

Businesses often buy budgeting and forecasting software together in a single platform that handles both processes, keeping business outcomes aligned. For instance, a budget might assume $10M in revenue, but the forecast might reveal only $8M. The business would then adjust variable costs and expense plans to meet cash targets.

(Need a refresher on the difference between budgeting, planning, and forecasting? Head here.)

Types of forecasting software

Forecasting software comes in various forms to address different aspects of a business’s needs. Types of forecasting software may include:

- Budgeting and forecasting software helps businesses create budgets and predict future financial performance using past and present data. It helps financial teams set reasonable targets, manage expenses, and predict future revenue. For example, if sales are lower than expected this year, a small business can use this software to adjust next year’s budget and stay aligned with realistic income projections.

- Sales forecasting software helps businesses predict future sales by analyzing past sales trends, current market conditions, and customer behavior. They use these predictions to make decisions on hiring, inventory, and marketing. For instance, a clothing store can use this software to choose which winter items to stock up on before the cold season begins.

- Demand forecasting software predicts how much of a product or service customers will want in the future. These tools analyze sales data and consumer trends to help businesses avoid having too much or too little inventory. For example, a bakery can use demand forecasting to prepare just enough pastries for upcoming holidays based on past holiday sales to reduce food waste and maximize profits.

- Capacity and workforce forecasting software can predict the number of people and resources a business needs to meet expected work demands. It helps managers plan schedules and allocate the right amount of staff. For instance, a hotel can use capacity forecasting to schedule enough housekeeping staff during peak tourist season.

- Enterprise resource planning (ERP) software combines data from sales, inventory, finance, and more to offer complete forecasting capabilities. This helps businesses plan resources, budgets, and production needs. For example, a manufacturing company can use ERP software to forecast how much raw material it needs based on projected product orders to prevent overstock or shortages.

Types of budgeting software

There are two main categories of budgeting software:

- Business budgeting software helps companies track and plan their spending, revenue, and other financial metrics. It uses data from income, expenses, and cash flow to build realistic budgets that align with business priorities.

- Personal budgeting software is designed for individuals or households to manage their income, expenses, and savings goals. They allow people to set spending limits, track bills, and see how their money is spent over time.

What is budget forecasting software?

We’ve covered budgeting software and forecasting software, but what is budget forecasting software?

Budget forecasting software brings these two functions together so businesses can create detailed budgets based on past data while predicting future performance.

This reduces the need for finance teams to juggle multiple apps, cutting down on errors. With everything in one place, processes move faster, and teams make smarter decisions with less hassle.

Key features in forecasting and budgeting software

Without effective forecasting and budgeting, it’s tough to scale your business. The software you use throughout these processes determines the quality of your budgets and forecasts, so it’s crucial to select the right technology.

Consider the following features when choosing forecasting and budgeting software (these apply regardless of your business size or workflow):

Easy automation and AI-powered workflows

Budgeting and forecasting software automates manual and repetitive tasks, saving time and boosting productivity and efficiency. Features like drag-and-drop interfaces, prebuilt templates, and customizable processes enable easy automation without much technical expertise.

AI can enhance automation even further by learning from historical data to provide predictive insights and smarter recommendations. AI can automatically detect trends, spot data inconsistencies, and run automated financial reports. The right software will allow your finance teams to focus on strategic, high-impact tasks rather than mundane data management.

Rolling budgets and forecasts

Many large businesses regularly revise their financial projections to reflect changes in their business environment, future demand, competition, and other economic factors.

If your budgeting and forecasting process works this way, you’ll need software that supports driver-based budgeting and rolling forecasts so you can update budgets and forecasts as needed.

With this software, you can avoid the stress of updating data across multiple plans. It automates calculations, data updates, and financial analysis.

Integration opportunities (especially for Excel and Google Sheets)

Some forecasting and budgeting software includes enterprise tools like CRM, ERP, accounting, and business intelligence software. However, these tools may not be robust enough for all your financial needs.

Look for budgeting and forecasting software that integrates seamlessly with other business tools. This is especially important for Excel and Google Sheets, where you might build financial models, scenarios, and budgets.

Seamless integration eliminates the need for manual data input. It also ensures real-time sync between all platforms where you store financial data.

Financial reporting analysis

A financial reporting analysis tool in your budgeting and forecasting software gives you visibility into key financial metrics like revenue, cost, and cash flow.

This tool can generate custom reports based on specific metrics, analyze the outcome of your budgets and forecasts, and help you track progress toward periodic goals.

Financial KPI dashboards

Financial KPI dashboards give you a clear view of your daily, monthly, and yearly financial performance at a glance.

KPI dashboards help you access, filter, and visualize data quickly. You can understand how your business is doing compared to the benchmarks set during budgeting and forecasting.

You can drill down into data to see more specific information. You can also compare performance across time periods or departments to identify patterns in performance.

Financial planning

To make the best business decisions, your budgeting and forecasting software should handle all types of financial planning. This way, you can see the full picture of your financial health and make informed, strategic choices about where to go next.

When evaluating software, consider tools that support the following types of financial plans:

- Financial statement: Provides a snapshot of the company's revenues and expenses over a specified period

- Balance sheet: Summarizes assets, liabilities, and equity to give an overview of the business's financial standing at a specific point in time

- Cash flow projection: Forecasts incoming and outgoing cash so businesses ensure liquidity and plan for short-term and long-term needs

- Personnel plan: Projects staffing needs including salaries, benefits, and hiring schedules and when it’s time to bring on more team members

- Business ratios: Tracks key metrics like profit margins, debt-to-equity, return on investment, accounts payable turnover, assets to sales, working capital, and total debt to total assets

- Sales forecast: Predicts future sales based on historical data, market trends, and current customer behavior to aid in inventory and workforce planning

- Income projections: Estimates future income streams to guide investment decisions

- Assets and liabilities: Offers a detailed view of current and projected assets and liabilities

- Break-even analysis: Calculates the point at which total revenues equal total costs

Financial modeling

Look for tools that allow you to create detailed representations of your business’s financial performance. This will help you analyze past data, project future outcomes, and test different scenarios to understand how potential decisions might affect growth or profitability.

With the right platforms, you can explore “what-if” scenarios—like hiring new staff or adjusting prices—and see the potential impact before taking action.

Benefits of budgeting and forecasting software

Budgeting and forecasting is a complex process, especially in big businesses with a lot of data and teams involved.

Businesses can easily lose track of their overall outcomes and incur unnecessary costs during this process. Investing in budgeting and forecasting software is important to avoid these pitfalls.

This software gives your teams a more structured approach, making processes more effective. Here’s how:

Saves time and eliminates tedious manual processes

According to Asana, employees spend 60% of their work hours on repetitive manual tasks, leaving them with 40% of their time to choose forward-looking strategies and complete value-adding tasks. Not to mention repetitive tasks tend to increase the risk of human error and reduce productivity.

Budgeting and forecasting software can automate tedious manual processes like data entry, cleansing, and verification, financial data reconciliation, and financial statement consolidation.

This saves time and allows anyone creating budgets or forecasts to focus on more productive processes like financial planning, scenario modeling, and strategic decision-making.

Promotes transparency and collaboration

Research shows employees working on digital collaborative platforms complete tasks more effectively. Collaboration makes sharing information easy, supports joint problem-solving, and increases transparency throughout workflows.

The best forecasting and budgeting software provides a single centralized platform. All teams involved can work together and track their progress in real time, helping everyone stay aligned on the overall business goal.

Budgeting and forecasting require input from key teams in your organization. Providing them with a platform to share information, stay aligned, and take responsibility for their inputs enhances your team’s budgeting process.

Prepares businesses for presentations and audits

Budgeting and forecasting software have inbuilt tools that help you create customizable financial reports and interactive dashboards quickly.

You don’t have to scramble through multiple documents to create reports. The software allows you to present your business's financial progress and health in an easy-to-read manner to investors, board members, or partners.

This software also streamlines your auditing process. It helps you comply with regulatory standards and gives auditors access to accurate, real-time financial information throughout the year.

Best forecasting and budgeting software

Whether you’re a small or large business, here are the best forecasting and budgeting software options to consider:

1. Cube

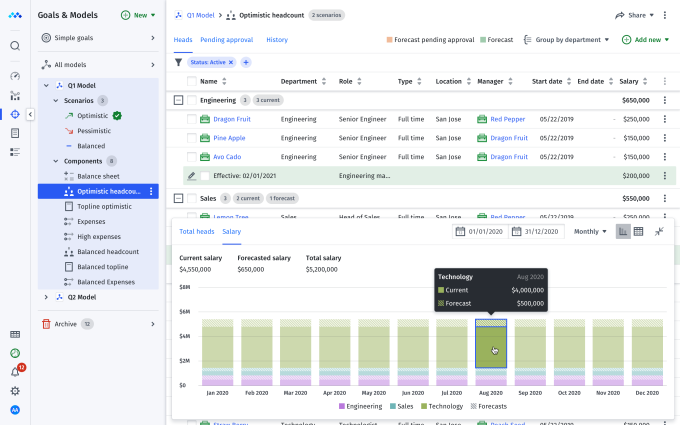

Cube is the world’s first spreadsheet-native, AI-powered forecasting and budgeting platform for businesses of all sizes—but it does much more than just forecasting. As a cloud-based FP&A solution, Cube empowers finance teams to work from anywhere. It integrates natively with both Excel and Google Sheets, so teams can plan, analyze, and collaborate across departments without leaving their trusted workflows.

Cube connects your financial and operational data in one place, making it easier to build and maintain dynamic budgets and rolling forecasts. Teams can model different scenarios, track performance against plan, and adjust quickly as business conditions change.

.png?width=1656&height=711&name=AI-Cube-Hero%20(1).png)

Key features:

- Smart forecasting: AI-generated forecasts help teams identify trends, predict outcomes, and uncover risks before they impact performance.

- Conversational insights: Ask Cube’s AI Analyst questions directly in Slack, Microsoft Teams, or your Cube Workspace and get instant, explainable answers.

- “What-if” and multi-scenario analysis: Access specific forecasts with easily adjustable models. See how outputs change with more hires, productivity lags, and more.

- Customizable dashboards: Use, adjust, and share reusable templates and dashboards.

- Abundant integrations: Link Cube with endless HR, accounting, sales, or business intelligence software, like Salesforce or ADP—and of course, it’s compatible with any spreadsheet.

- Multi-currency support: Create rich reports with local and foreign currencies, perfect for North American companies with international clients.

- Centralized formulas and KPIs: Host all your calculations and formulas in one place for easy access and knowledge sharing.

Pros:

- Quick deployment: Most businesses only need a few weeks to implement Cube, while other software can eat up months of onboarding time.

- Quick and specific analysis: Cube allows for extensive, quick data collection, quality assurance, and laser-sharp analysis without human error. Forecasting is easily customizable to answer your business’s unique, burning questions about the future.

- Intuitive and comfortable: Finance teams don’t have to abandon the spreadsheets they use. Cube lets you pull and push spreadsheet data while speeding up analysis.

- Expert support: Connect with Cube’s team of finance professionals, including its former-CFO founder, to make the most of the software.

Cons:

- It’s not for individual business owners: Cube works best for mid-sized or enterprise businesses.

Pricing:

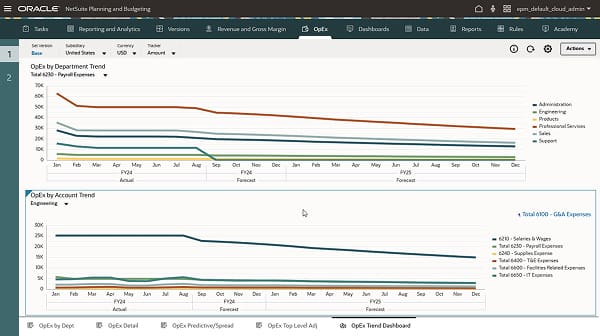

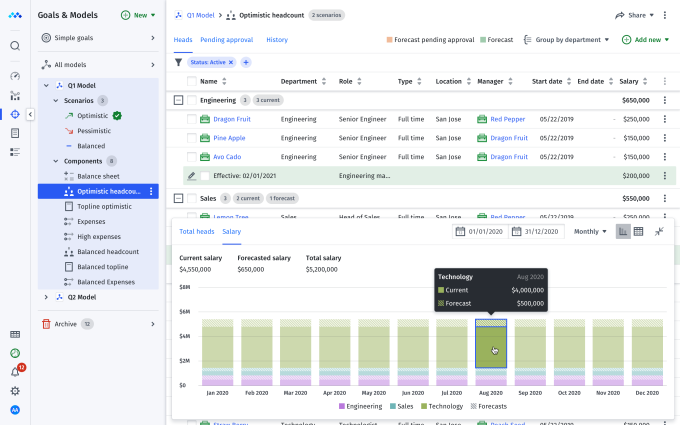

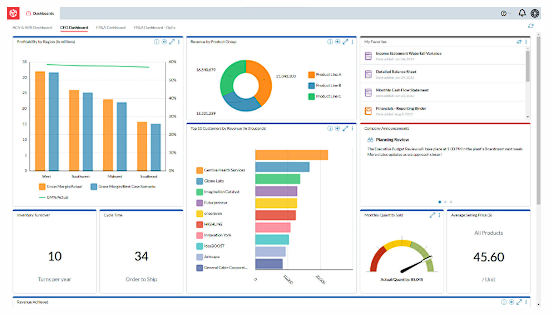

2. NetSuite

NetSuite Planning and Budgeting helps finance teams automate financial processes and create accurate, accessible reports. Users can collaborate using customizable templates and workflows. NetSuite automates manual planning and budgeting processes and centralizes company financial and operational data, allowing you to perform forecasting and budgeting from a single point.

The platform’s data synchronization capabilities reduce manual processes and offer a more unified and transparent approach to financial processes.

Image source

Key features:

- Financial management: Reduce forecasting and budgeting cycles and ensure compliance with regulations.

- Workforce planning : Streamline shift scheduling, capture attendance, and calculate wages across your workforce.

- Data synchronization: Sync data in real-time across multiple business tools.

- Dashboards: Use customizable dashboards to gain oversight of your business and drill down into business performance.

Pros:

- Allows easy comparison of budgets and actuals for decision-making

- Enables users to generate thorough reports

- Provides access to custom templates and workflows

Cons:

- Bulky implementation process

- Not user-friendly

- High learning curve

- Might not be cost-effective for smaller organizations

Pricing: Annual licensing fees vary depending on users and add-ons, but exact pricing isn’t available on their site. Other sites report steadily increased pricing.

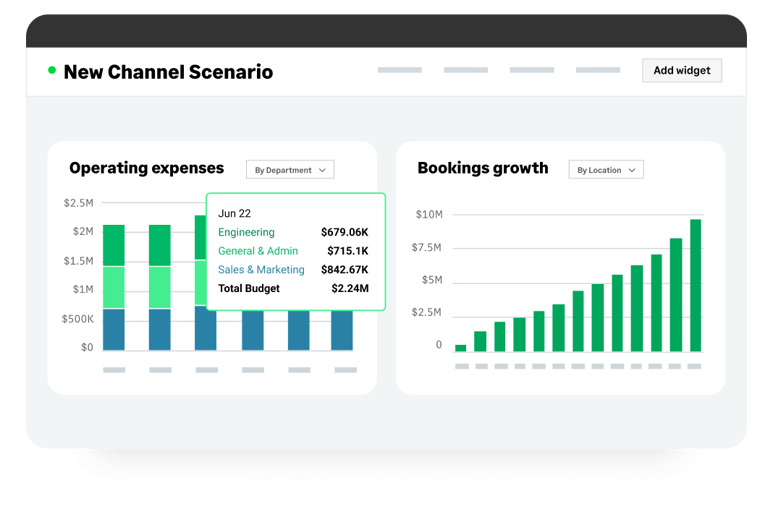

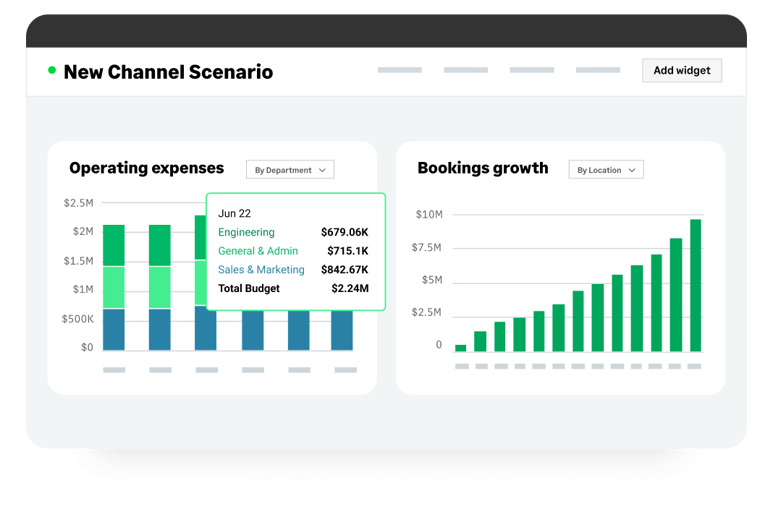

3. Anaplan

.png?width=150&name=Anaplan_logo%20(1).png)

Anaplan is a planning, forecasting, and financial management platform for finance and FP&A teams. It's an expensive enterprise solution for large companies. Anaplan lets users connect people, data, and plans to intelligently budget and forecast business outcomes for the entire organization.

Anaplan helps businesses move faster and make complex decisions with input and visibility for all stakeholders. But without a native Excel integration, it can be challenging to adopt.

Image source

Key features:

- Personalized dashboards: Create dashboards based on metrics you want to see.

- Cost and profitability analysis: Connect internal and external costs and profitability data to assess financial performance.

- Scenario modeling: Do scenario modeling with dimensions such as location, currency, time, etc.

- Automated financial reporting: Use AI to generate custom financial reports.

Pros:

- Supports multiple use cases, like marketing, finance, supply chain, and more

- Has a user-friendly interface

Cons:

- Limited performance for giant data sets

- Not suitable for ad-hoc reporting

Pricing: Pricing for the Anaplan platform is available by contacting the company.

Also read: Anaplan vs. Adaptive vs. Planful vs. Vena vs. Datarails vs. Cube

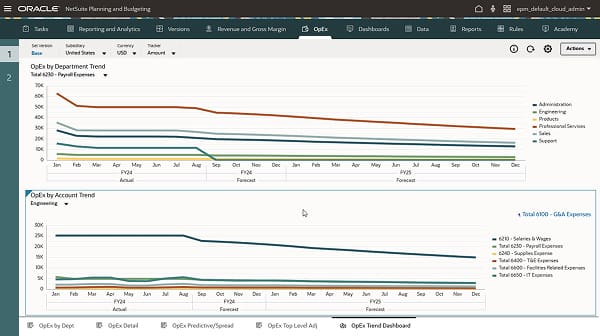

4. Workday Adaptive Planning

Workday Adaptive Planning offers budgeting and forecasting software that covers financial, workforce, operational, and sales planning.

The platform provides scalable and flexible financial planning for any size organization. It enables budgeting and forecasting teams to consolidate financial plans in real-time.

Customers praise the platform’s user-friendliness and customization options but lament the lack of training and support resources.

Image source

Key features:

Pros:

- Users can leverage dynamic budget models directly linked to financial data

- It’s easy to change data and reflect changes in reports

- Provides comprehensive discovery offers multiple KPIs, trends, projections, and breakdowns

Cons:

- It’s incompatible with Google Sheets

- The software is costly and implementation is time-consuming

- It has inconsistent flexibility across tools

Pricing: Pricing is not available on their website.

5. Planful

-jpeg.jpeg?width=256&height=135&name=Planful-Social-Card-dc025794d4b83bd77fe9208b65b99100%20(1)-jpeg.jpeg)

Planful is budgeting and forecasting software that helps companies minimize costs and save time. It allows users to see real-time data, identify issues, and take action to improve financial performance and employee productivity.

Some customers express satisfaction with the company’s responsive customer support and regular improvements. However, others feel frustrated with the slow analysis of large data volumes and report data inaccuracies.

Image source

Key features:

- Data consolidation: Combine financial data from multiple sources into a single view.

- Drill-down analysis: View and analyze specific areas of your financial data.

- Cash flow and rolling financial forecasts: Predict and manage your cash flow and make future projections you can adjust.

- Long-term financial planning: Use pre-built templates for long-term financial planning.

Pros:

- Suitable for companies of every size

- Supports integrations including NetSuite, Microsoft, and Excel

Cons:

- Convoluted security settings

- Difficult to set up a report template

Pricing: Planful doesn’t list pricing on their website, but users report the platform to be more expensive than others.

6. IBM Planning Analytics

IBM Planning Analytics helps businesses collect and analyze thousands of financial data points to support forecasting and budgeting needs. It provides built-in AI capabilities and what-if planning functionality so that teams can create budgets faster and forecast business outcomes with more accuracy.

The AI-powered software bridges department silos to help organizations manage their finances. Users can also connect with dedicated IBM experts to strategize financial goals.

Image source

Key features:

- AI forecasting: Use on-demand, multivariate, and baseline forecasting to make data-driven decisions.

- Performance scorecards: Assess business performance by comparing actual results to benchmarks.

- Drag and drop Excel interface: Organize data within Excel sheets without manually arranging cells.

Pros:

- Offers free trial

- Provides real-time data insights

- It has an easy-to-use interface

Cons:

- It can be tricky to implement without coding knowledge

Pricing:

- Essential: $825/month

- Standard: $1650/month

- Premium: Custom quote

7. Oracle Essbase

.jpeg?width=150&name=oracle-hyperion-essbase%20(1).jpeg)

Oracle Essbase allows users to optimize Excel spreadsheet data in the cloud, which makes complex hierarchies easier to manage.

The platform enables users to analyze multi-dimensional data using data visualization tools and what-if analysis. Essbase operates via a web browser interface or Microsoft Office.

Oracle Essbase is not a complete finance solution. It complements the tools FP&A teams use and supports the development of complex analytic applications.

Image source

Key features:

- Microsoft Office integration: Import financial data into Excel sheets to calculate and analyze performance.

- Forecasting and scenario planning: Predict future financial performance and resources needed to achieve set goals.

- Multidimensional models: Use graphs and charts to analyze data across multiple metrics

Pros:

- Offers a rewards program

- Provides extensive training materials and documentation

Cons:

- The interface isn’t user-friendly, heightening the chance of human error

Pricing: Pricing details are unavailable online.

8. Oracle Hyperion Planning

Oracle Hyperion Planning offers dedicated budgeting and forecasting software with a Microsoft Office-based interface. It's part of Oracle’s broader solution for Enterprise Business Planning.

The platform supports enterprise-wide budgeting and forecasting, allowing teams to align budgets and forecasts across all departments for cost-effective planning.

Oracle Hyperion Planning works on desktop, mobile, and Microsoft Office interfaces. It features robust integrations and workflow capabilities. However, some users report dissatisfaction with Hyperion’s templates.

Image source

Key features:

- Profitability and cost management: Build transparent allocation models for profitability analysis.

- Scenario planning: Model long- and short-term business scenarios.

- Financial data consolidation: Leverage built-in compliance functionality to create accurate and transparent reports.

Pros:

- Offers ad-hoc reporting

- Supports flexible budgeting

- Easily customizable operating budgets (percentage increases, dollar increases, etc.)

Cons:

- More suitable for larger organizations, not SMBs

- High complexity system with a high learning curve

Pricing: Not listed or advertised on many sites.

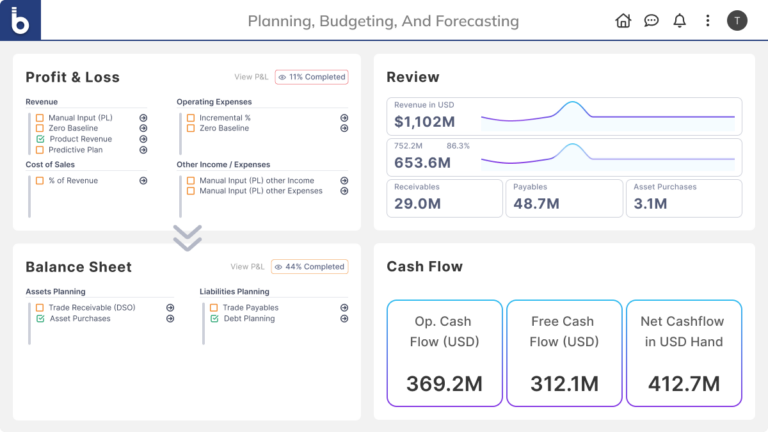

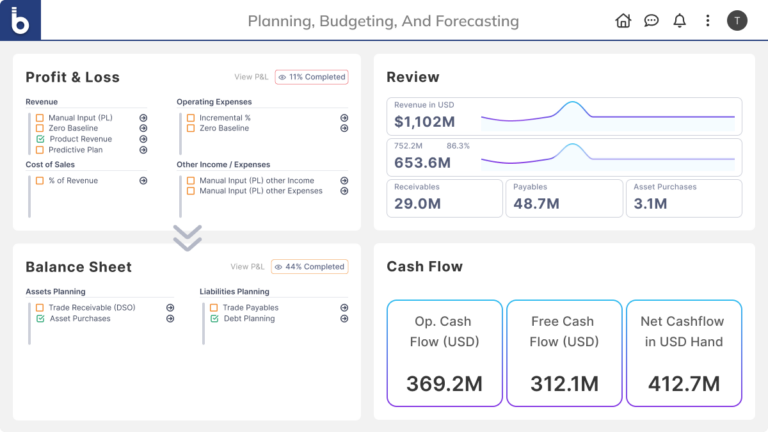

9. Board

Board helps organizations gather financial intelligence and predictive analysis to streamline and transform a business’s financial operations. The company takes pride in unifying departments and adapting to various industries.

The platform provides integrated financial planning functionality, which enables finance teams to manage all business data from multiple sources on a single platform for better visibility over budgets and forecasts.

Teams can unify cross-functional teams during planning and leverage predictive analysis to build agile plans.

Image source

Key features:

- Integrated financial planning: Connect all source systems together to get visibility into all financial statements.

- Data visualization: Gain clarity on complex financial data with clear and easy-to-read visuals.

- Data integrity and security: Maintain the integrity of your financial data with enterprise-level security.

Pros:

- It has multi-language support

- Supports quick analysis without sacrificing security

- It is a no-code platform

Cons:

- It has an outdated user interface

- The platform has a high learning curve

Pricing: Pricing is not listed online, but plans depend on business size, number of user licenses, and customizations.

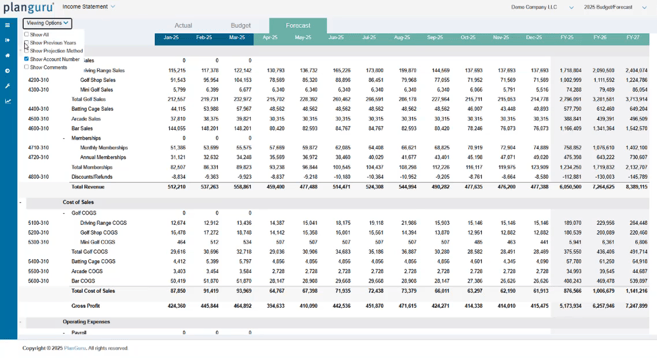

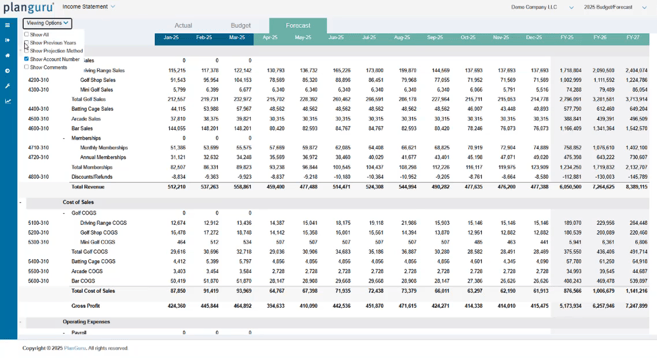

10. PlanGuru

PlanGuru helps organizations improve financial decision-making with easy general ledger importing to create quick analytics. The budgeting flexibility allows businesses of all sizes—SMBs, startups, or corporations—to optimize various processes. Its flexible structure allows users to create consolidated multi-department or simple small budgets.

Planful lets users gain insights into specific areas of their business but while the company offers many features, some users report glitches.

Image source

Key features:

- Forecasting methods: Use various forecasting methods to project business outcomes for up to 10 years.

- Excel importing: Automatically import data from Excel.

- Scenario analysis: Interpret the impact of specific scenarios on your finances.

Pros:

- It has a 30-day money-back guarantee

- Allows flexible budgeting

- It lets users set custom business drivers, even for non-financial data

- It has general ledger import abilities

Cons:

- Users report the platform can be glitchy

- Limited forecasting for multiple years in the future

Pricing:

- Single entity: $99/month

- Multi department: $299/month

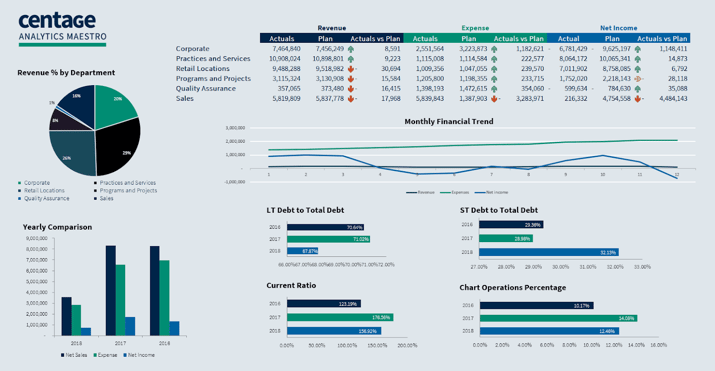

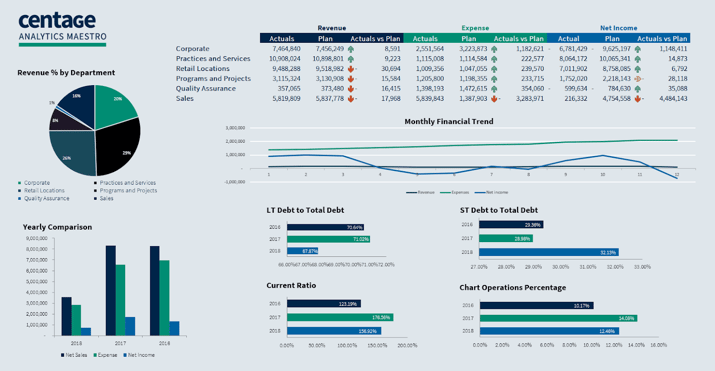

11. Centage Planning Maestro

.png?width=150&name=centage-vector-logo-2021%20(1).png)

Centage Planning Maestro offers budgeting and forecasting software that automates tasks prone to human error. This formula-free FP&A software includes built-in business logic and accounting rules.

The platform uses driver-based budgets and forecasts and also offers workforce planning. Users can automate data integration and consolidation in real-time.

Centage Planning Maestro also has a workflow tool that helps teams collaborate on budgets and forecasts using permission-based workflows.

Image source

Key features:

- Budget comparisons: Build budgets, test multiple scenarios and forecasts, and enforce your chart of accounts.

- Scenario planning: Use what-if scenario planning to create multidimensional budgets showing various scenarios' outcomes.

- Data visualization: Assess financial realities and results with easy-to-read dashboards and visuals.

- Financial forecasting: Futureproof your business with flexible forecasting.

Pros:

- Works for mid-sized businesses

- Its driver-based budgeting tool accommodates many factors, like seasonal trends

- It has multi-planning scenarios

Cons:

- The platform has limited mobile capabilities

Pricing: There are three pricing tiers: Standard, Professional, and Enterprise. Prices aren’t listed, but sources say plans start at $10,000 annually.

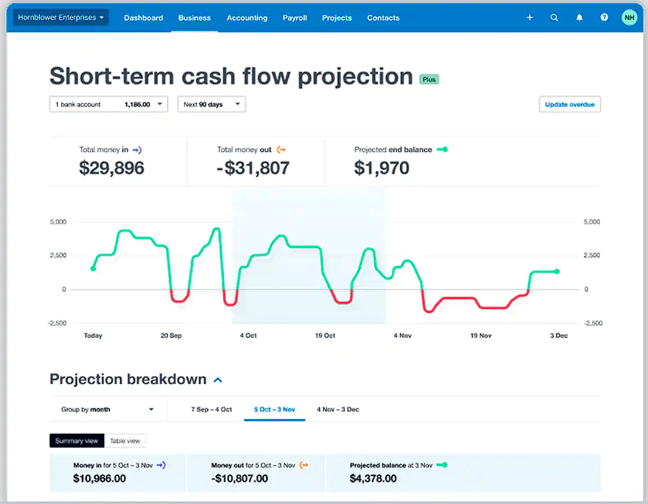

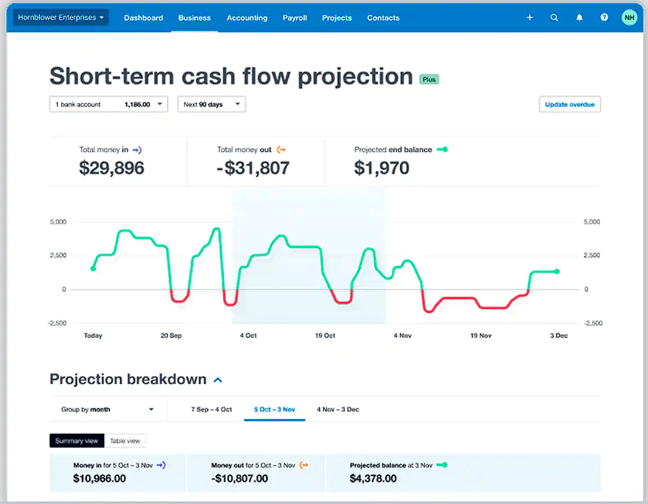

12. Xero

.png?width=150&name=xero-logo%20(1).png)

Xero offers simple accounting software that connects with banks for AI reconciliation. It provides cloud accounting, allowing businesses to centralize their finances and maintain paperless records.

Users can manage their accounting needs from one central, easy-to-use platform, saving time on tedious everyday tasks. Xero works best for small businesses that can’t afford expensive FP&A platforms and for large businesses seeking collaborative budgeting and forecasting.

Image source

Key features:

- Payment processing: Accept online payments via multiple payment methods.

- Expense claims: Manage your spending and submit expense claims.

- Account reconciliation: Compare varying financial records to ensure records are accurate and consistent.

Pros:

- It’s affordable

- It has an accounting dashboard

- It supports efficient bookkeeping

Cons:

- The platform has limited data visualization

Pricing:

- Starter: $15/month

- Standard: $42/month

- Premium: $78/month

13. Prophix

.png?width=150&name=prophix-logo%20(1).png)

Prophix is a cloud-based financial software solution that automates standard business processes like data importing, pre-built functionality, and reporting analytics. It allows users to keep all their processes and insights on one platform and use centralized capabilities like user management, workflow, and data integration.

The platform’s AI-powered virtual financial analyst detects human error and unfamiliar transactions. It also enables teams to arrange disconnected data and have a single source of truth for making strategic decisions.

Image source

Key features:

- Compliance audit prep: Prepare financial records according to accepted audit standards.

- Data collection and analysis: Collect and analyze data to make informed business decisions.

- Driver-based plans and realistic forecasts: Enhance overall business planning with driver-based and realistic forecasts.

Pros:

- Responsive customer service

- Organized workflows

- Supports drill-down analysis

- Extreme flexibility

Cons:

- The graphs could be more robust

- It has slow load times

- Users complain of occasional bugs

Pricing: Users report reasonable pricing, but specific pricing isn’t listed online.

14. Vena Solutions

Vena Solutions is an FP&A tool that helps with business budgeting and financial forecasting by automatically generating forecasts and insights from data. The software loads automatic data into a single source of truth.

Vena provides variance analysis, identifies discrepancies, and builds ad-hoc reports for your business. It analyzes your company’s financial health by slicing and dicing data across different entities.

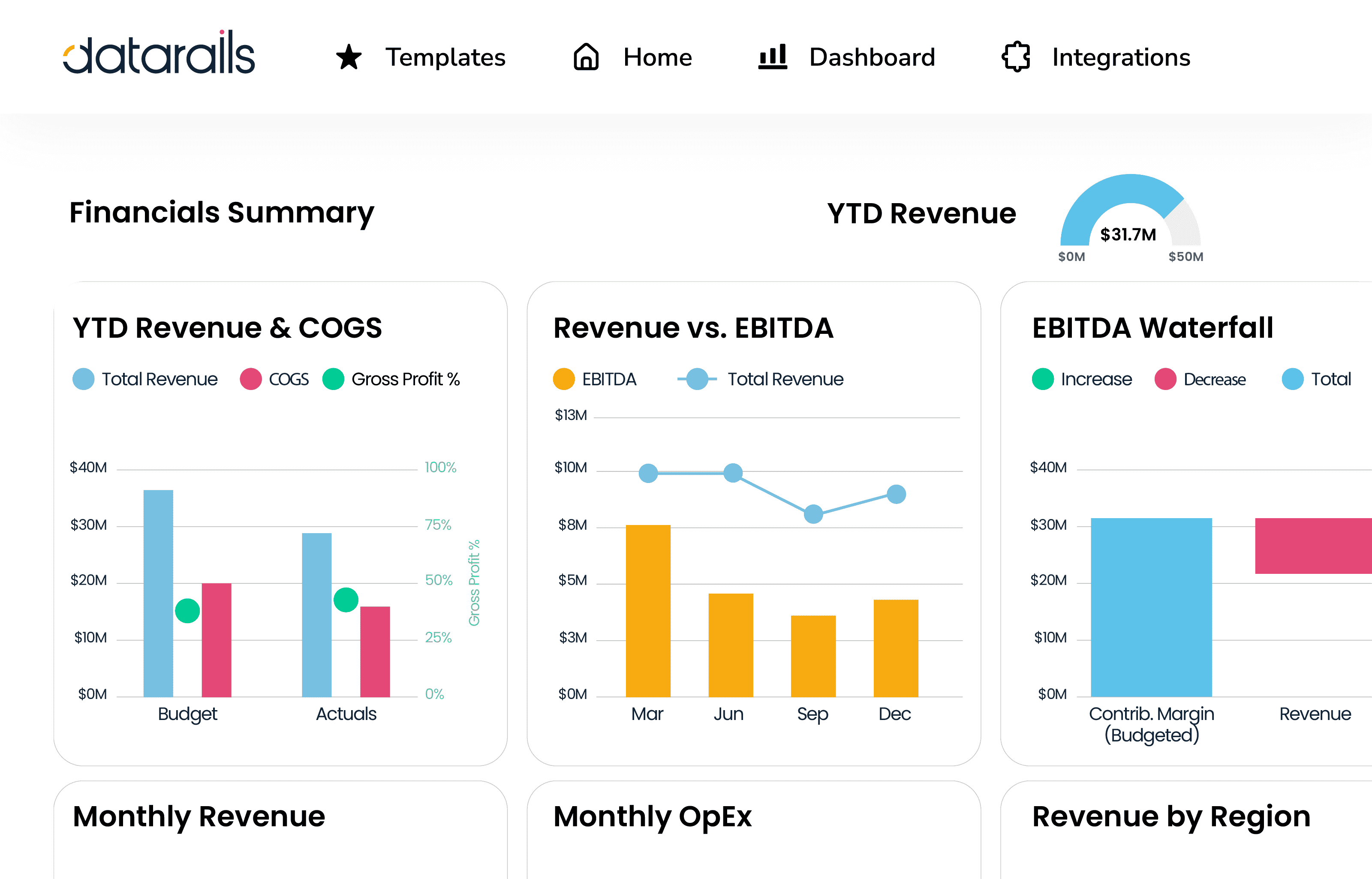

%201.png?width=748&height=354&name=revenueandcogsdashboard%20(1)%201.png)

Image source

Key features:

- Forecasting: Gather market research and historical data on a single platform to make data-driven forecasts.

- Statistical analysis: Identify and understand trends and patterns in data to make strategic decisions.

- Performance metrics: Use quantifiable measures to evaluate the efficiency and effectiveness of your operations.

- Data visualization: Provide a graphical representation of your financial data and performance to stakeholders.

Pros:

- It has flexible models and templates

- It's Excel-based

Cons:

- Report writing can be clunky

- The run/load time on large complex workbooks takes time

- Template automation encounters issues due to certain Excel functions used

Pricing: Vena doesn’t list the price on its website, but customers cite its high price as an issue.

15. Jirav

Jirav offers cloud-based financial planning and analysis, helping accounting and finance teams budget and forecast without spreadsheets. You can customize it to track, forecast, and share data.

Jirav works best for smaller businesses and organizations without international clients due to its lack of multi-currency capabilities.

Image source

Key features:

- Integrations: Integrate with your existing accounting tools to centralize financial data.

- Driver-based forecasting models: Model and predict future performance with more accuracy.

- KPI monitoring: Create dashboards and reports using industry-specific metrics and store them in a KPI library.

Pros:

- It has visually appealing reports and graphs

- It has a 14-day free trial for the starter plan

Cons:

- No multi-currency capabilities

Pricing:

- Industry Safari: $20,000+

- Strategy Safari: Custom pricing

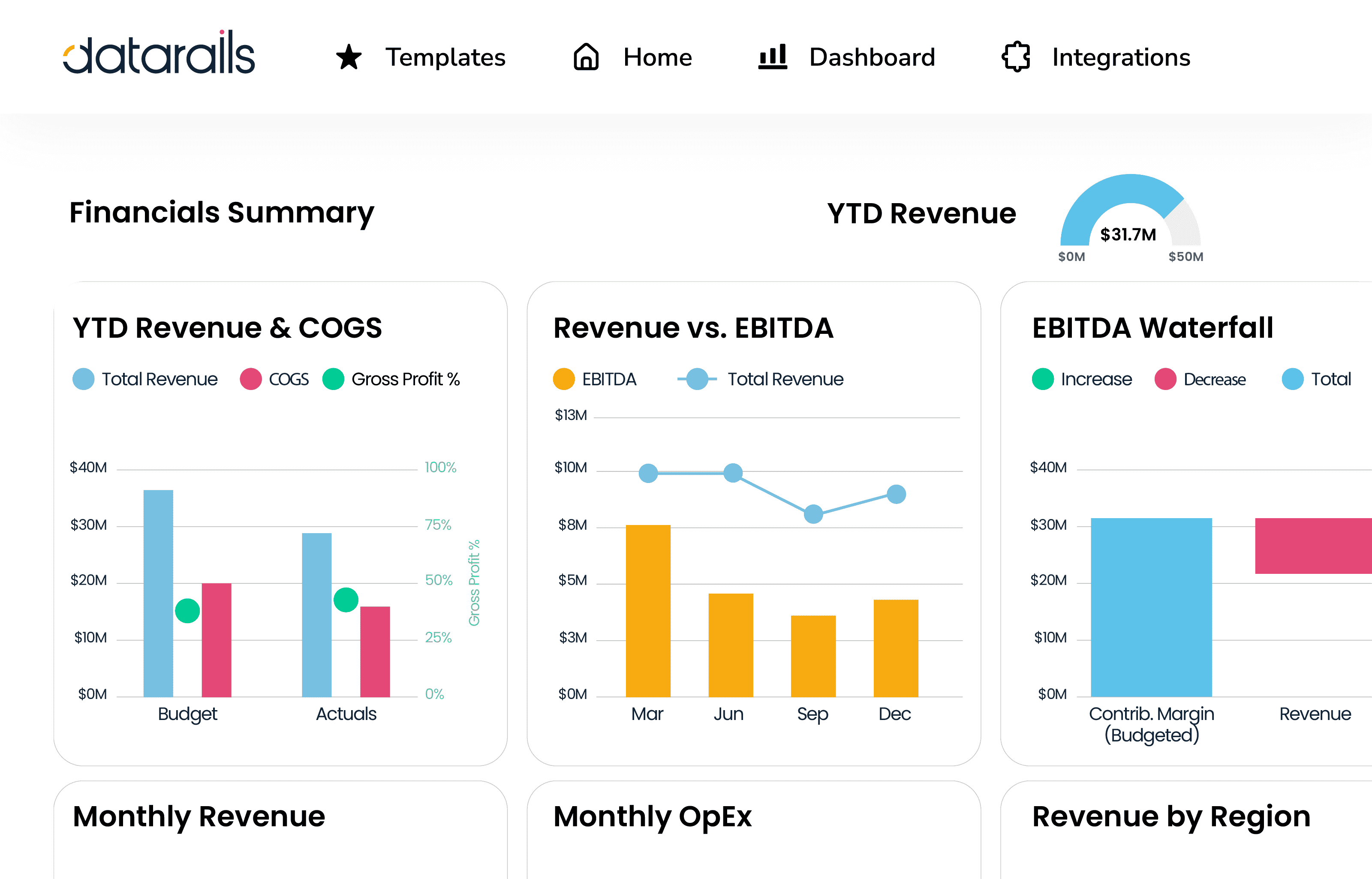

16. Datarails

Datarails uses automated consolidation and reporting to help organizations improve financial decision-making. It integrates with ERPs and CRMS so users can consolidate their financial data.

The platform offers data consolidation, financial reporting, scenario analysis, financial reporting, and ERP-Excel connectivity. It provides automatic consolidation and reporting, letting users focus on the insights that can help their business.

For companies using Excel to build budgets and forecasts, Datarails allows them to keep their Excel financial models and automate processes within Excel.

Image source

Key features:

- Sales commission: Reduce manual sales commission calculation work in Excel.

- Monthly reports: Generate and share custom monthly reports.

- Data visualization: Use dashboards integrated with your data sources in real time to visualize financial data.

- Financial analytics: Use AI-powered FP&A tools to analyze patterns and trends.

Pros:

- It has a great data visualization tool for gaining insights

- It supports improved transparency with audit trails

Cons:

- No integration with Excel 2007 or earlier

- Limited dashboard reporting

- The software can be glitchy or have long load times

- Built for SMBs and difficult to scale

- No Apple or OS X compatibility—Datarails is for Excel users only

Pricing: Not listed or discussed widely on the company site or across other websites.

17. Solver

.png?width=150&name=solver-logo-final%20(1).png)

Solver is a cloud-based corporate performance management software with automated budgeting and forecasting features. Users can forecast financial outcomes weekly, monthly, or annually, accessing critical insights in minutes.

The design allows businesses to analyze large data sets and create enterprise-wide budgets and forecasts, enabling faster decision-making.

It also provides a template marketplace where users can access prebuilt templates for reports, planning, and dashboards.

/Planning%202025%20Screenshots/R248%20Consolidated%20Budget%20.png?width=731&height=345&name=R248%20Consolidated%20Budget%20.png)

Image source

Key features:

- KPI-based or summarized dashboards: Build custom KPI-specific or business performance summary dashboards.

- Trend analysis: Gather data over a period of time to identify business patterns or trends.

- Data warehouse: Integrate financial data from many sources on a single platform.

Pros:

- The report generation resembles Excel

- It has Microsoft BI integration

Cons:

- Limited real-time data

- Limited version control

Pricing: While pricing is not available on their website, reports note it starts at almost $7,000 a year.

18. Budgyt

Budgyt is a cloud-based software tool that offers a solution to replace spreadsheets. It’s a financial budgeting tool that delivers solutions for small to medium-sized businesses, non-profits, or larger enterprises with complex needs like cost allocation.

The platform enables finance teams to automate manual processes and replace them with real-time consolidation and user-friendly dashboard navigation.

It enables users to reduce their formulas when managing cashflow forecasts and P&L budgets, and also automate the auditing of business formulas.

Image source

Key features:

- Custom APIs: Import data from other software via APIs.

- Multi P&L budgeting: Consolidate P&L budgeting by department, sub-department, or entity in a hyperlinking platform.

- Data visualization: Use custom dashboards to view data.

Pros:

- It has a 5-10 day deployment and custom onboarding

- It's affordable

Cons:

- Integrations (like QuickBooks) can be slow to load

- Limited reporting capabilities

Pricing: Pricing is not available online

19. Mosaic Tech

Mosaic is a strategic finance platform that provides real-time analytics, prebuilt templates, advanced assumptions, and flexible drivers to help businesses create budgets and forecasts. It allows finance teams to combine accounting, financial, operational, and workforce data to forecast multiple business scenarios and potential outcomes based on custom inputs.

It’s designed for small to medium companies and allows them to connect their existing tech stack. However, the platform is SaaS-focused, and non-SaaS companies might need an alternative platform.

Image source

Key features:

- Top-line planning: Use real-time data and custom formulas to forecast revenue from the ground up.

- Collaborative budgeting: Shift your budgeting from single-player to multiplayer by creating collaborative workflows and inviting departments to the budgeting process.

- Close and consolidation: Automate the consolidation of multiple subsidiaries into a single chart of accounts.

Pros:

- Automated flux and variance analysis

- Supports foreign currency translations

- Integrates with Salesforce, Google Sheets, Hubspot, Bamboo HR, and more

Cons:

- It’s not suitable for non-SaaS businesses

Pricing: Mosaic offers three pricing plans: Analytics, Foundational, and Growth, but pricing details are not available online.

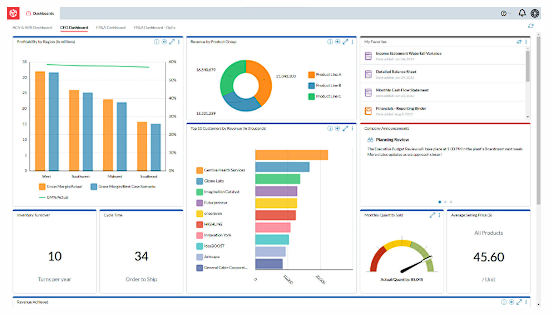

20. Sage Intacct

Sage Intacct is a cloud financial software that lets you build dashboards in minutes. Its general ledger includes eight dimensions, contextualizing transactions, budgets, and operations.

The platform gives users real-time visibility into the data they use for budgeting and forecasting and provides multi-entity functionality for planning across business departments.

Sage Intacct gives users access to their API to build custom solutions for their businesses and also integrate with native business tools.

Image source

Key features:

- Accounts payable and receivable: Automate accounts payable and receivable and manage your cash flow.

- Dashboard and reporting: Get real-time financial visibility and make data-driven decisions.

- Payroll: Unify your payroll, HR, and accounting.

Pros:

- Allows for easy payment approvals

- Provides customizable dashboards and reporting

- It integrates with Cube

Cons:

- Bulky integrations

- Limited training and onboarding

Pricing: Sage Intacct advertises “tailored” pricing and invites you to reach out for a quote. Users report expensive plans compared to competitors.

How to choose the right budgeting and forecasting software for your business

It takes more than just comparing features to choose the best budgeting and forecasting software for your business. As you go through the decision-making process, consider:

- Integrating with your tech stack and workflow: If you're choosing a standalone tool, it should easily integrate with your existing systems. Consider which tools you’re keeping, what you might replace, and how everything will connect to maintain a smooth workflow. Review your current workflows, including what’s working well and what slows you down. For example, if your entire business loves working with Excel, switching to a different spreadsheet app may cause unnecessary interruptions. So consider an app that keeps your team productive.

- Aligning with your growth goals: Choose a tool that scales with your business. If you’re a fast-growing startup, prioritize flexibility and scalability. For established businesses, ensure it handles your current operations without limiting future plans.

- Addressing your specific needs: Be clear about the capabilities you need, such as predictive modeling, scenario planning, or multi-user access. While most software can analyze past trends and predict outcomes, some offer advanced analytics to tackle specific challenges like market volatility.

- Accommodating user access and skill level: Consider who will be interacting with the software day-to-day. What's their level of technical skill? This affects how complex or simple the software’s interface should be and how many licenses you might need.

Trends in budgeting and forecasting software

The future of budgeting and forecasting software is getting better, faster, more accurate, and easier to use. Here’s what we’re seeing in the industry:

- Advanced analytics and AI integration: Modern tools are using AI and advanced analytics to make predictions more accurate. The best AI budgeting tools learn from past data to spot patterns, provide better forecasts, and quickly adjust plans. These make the software smarter and more effective the longer it’s used.

- Real-time data processing: Real-time data processing is becoming a staple feature, letting businesses instantly access and analyze the latest financial data. This quick access allows teams to make faster decisions without waiting for manual updates.

- Enhanced user experience: User-friendliness has become a major focus. Tools now offer intuitive interfaces, drag-and-drop functionality, and customizable dashboards to help finance teams get up and running quickly. A better user experience leads to faster adoption and more efficient finance teams.

- Collaboration tools: Today’s budgeting and forecasting software often includes real-time editing and data-sharing features that let teams work together from anywhere in the world. This increases communication across departments so everyone is on the same page about financial plans and changes.

- Comprehensive integrations: Seamless integration with ERP, CRM, and other business systems ensures consistent data flow across platforms. This reduces manual data transfers and helps everyone work with the same, up-to-date information.

- Advanced scenario planning: Comprehensive scenario planning allows businesses to explore different financial outcomes based on custom factors. This helps companies prepare for uncertainties and make better strategic choices.

- Automation and efficiency: Automation is becoming more advanced in recent updates, reducing manual work for tasks like data entry and report generation so finance teams have more time for strategy.

Choose the best forecasting and budgeting software

The best forecasting and budgeting software makes life easier for your finance teams. It helps you grow and optimize your processes, not replace them entirely.

You can automate repetitive tasks that distract your finance teams and give them more time to focus on crafting strategies and growing your business performance.

The software will provide them with a central platform to collaborate with other teams, key stakeholders, and decision makers to get a holistic view of everything happening in your organization.

Integrating forecasting and budgeting software into your processes is not just about giving your finance team another tech solution to work with. It’s about helping them streamline workflows and make better data-driven solutions to grow your business.

Book a free demo to see how Cube can help you achieve that.

.png)

.png)

![20+ best budgeting and forecasting software solutions [2026 review]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Lines%20Chart.png)

.png?width=1656&height=711&name=AI-Cube-Hero%20(1).png)

.png?width=150&name=Anaplan_logo%20(1).png)

-jpeg.jpeg?width=256&height=135&name=Planful-Social-Card-dc025794d4b83bd77fe9208b65b99100%20(1)-jpeg.jpeg)

.jpeg?width=150&name=oracle-hyperion-essbase%20(1).jpeg)

.png?width=150&name=centage-vector-logo-2021%20(1).png)

.png?width=150&name=xero-logo%20(1).png)

.png?width=150&name=prophix-logo%20(1).png)

%201.png?width=748&height=354&name=revenueandcogsdashboard%20(1)%201.png)

.png?width=150&name=solver-logo-final%20(1).png)

/Planning%202025%20Screenshots/R248%20Consolidated%20Budget%20.png?width=731&height=345&name=R248%20Consolidated%20Budget%20.png)