Key takeaways on AI budgeting software

- Forward-looking finance teams use AI-powered budgeting software to improve their accuracy, speed, and decision-making.

- Key features to look for in AI budgeting software include custom analytics and reporting, agentic AI, automated analysis, and no-code capabilities.

- Security and ethical use of AI are essential. While AI tools offer many benefits to finance teams, businesses must choose software with ethical AI usage and strong data protection policies.

What are AI budgeting tools for businesses?

AI budgeting tools are software that use artificial intelligence and machine learning capabilities to help finance teams manage their budgeting and financial planning processes efficiently.

These tools automate manual budgeting tasks such as data gathering, data cleaning, and other repetitive processes. They can also analyze large volumes of data to deliver real-time insights into the company’s financial health.

Finance teams use them to:

- Automate budget creation and updates in platforms like Excel and Google Sheets

- Spot anomalies and errors in data

- Run what-if scenarios to plan for the best and worst-case situations

- Provide customizable dashboards and reports for key stakeholders

- Generate insights to help predict future cash flow, expenses, or revenue based on historical data

How AI budgeting software tools improve a company’s financial health

A common misconception is that AI will take over certain jobs. However, the reality is closer to saying that AI is a powerful new tool that enhances how people work, especially in finance.

Here’s how AI budgeting tools can make a significant difference in your company’s financial health:

- Better accuracy: These tools analyze your financial data to help you make more accurate budgets and forecasts. By reducing human errors, you get a clearer picture of where your money is going and what you can expect in the future.

- Saving time: AI can automate repetitive tasks that usually eat up time, like data entry or generating budgets. This lets your finance team focus on more important strategic decisions rather than getting bogged down in the paperwork.

- Easier analysis: The right AI tool can give you real-time insights into your finances. Finance teams can ask questions using natural language to query and analyze financial and operational data in budgets using natural language, all without leaving the tools they already rely on, allowing them to make better decisions, faster.

- Greater scalability: AI budgeting tools can handle vast amounts of data. So you never have to worry about keeping everything organized and running smoothly, no matter how many budgets you have to make.

- Strategic planning: AI tools allow you to run different budgeting scenarios to see what might happen if you make certain business decisions. This way, you can better plan for the future, knowing you’ve considered all the possibilities.

Key features to look for in AI budgeting tools

Whether you’re a startup or a global enterprise, AI budgeting tools can help improve your budgeting and enable your finance team to build more accurate budgets. Here are some key features to consider.

Agentic AI

Agentic AI goes beyond traditional automation by acting autonomously and intelligently in financial planning and analysis (FP&A) workflows. Unlike standard AI, which often requires structured prompts and hands-on training, agentic AI understands business context and helps teams analyze financial and operational data using natural language—without having to leave the tools they already rely on.

An AI budgeting tool with agentic capabilities can analyze financial and operational data, identify trends, and suggest actions directly within your team’s existing workflows. These systems continuously learn from user interactions and company data, adjusting forecasts and budgets as new information becomes available—without manual updates or toggling between spreadsheets and dashboards. With built-in permissions and real-time access controls, teams can work confidently, knowing sensitive financial data stays secure while still enabling broad cross-functional collaboration.

Ultimately, agentic AI shifts finance teams from reactive to proactive—streamlining processes, accelerating insights, and supporting smarter, faster business decisions.

Automated analysis

Modern finance teams don’t need to spend hours manually looking through spreadsheet numbers and data to get insights into performance. Your finance team can leverage automated analysis to get real-time insights, surface trends, and flag anomalies.

An AI budgeting software with an automated analysis tool will use your existing data in spreadsheets, ERPs, and other systems to generate contextual explanations of variances and financial performance in company budgets.

For example, the software can automatically highlight factors like increased campaign investments, higher customer churn in reference to variances in the marketing spend for the quarter. Your finance teams can spend less time interpreting numbers and more time working with key decision makers to build strategies.

No-code capabilities

No-code development approach allows nontechnical people to build websites, apps, and automated workflows using drag-and-drop tools. It is especially useful for teams that don’t have the technical expertise or bandwidth to rely on IT or engineers.

The AI budgeting software you choose needs to be built for finance teams, and going for one with no-code capabilities puts technical work in the hands of your finance team.

Finance teams can automate their work in Excel using no-code without writing a single line of code. For example, instead of running a query to get answers from data in Excel, your team can use natural language to ask questions such as “Why did revenue decrease in Q1?” and get a plain data-driven explanation.

Custom analytics and reporting

Custom analytics and reporting allow finance teams to shift from one-size-fits-all templates to building dashboards that reflect business needs and answer important questions.

Rather than relying on static templates, your team can leverage AI to get tailored, detailed insights at a glance, such as tracking budgets by department, analyzing spend by vendor, or forecasting revenue by product line.

The software’s analytics and reporting features should also support different levels of detail based on the audience. For example, a CFO might want a high-level summary of financial performance, while a department manager needs more granular insights into team-level budgets.

The best AI tools and software for budgeting

When it comes to budgeting your company’s finances, having the right budgeting software can make all the difference. Below, we’ve compiled a list of the best AI budgeting tools to help you keep track of your expenses, make informed financial decisions, and plan for the future.

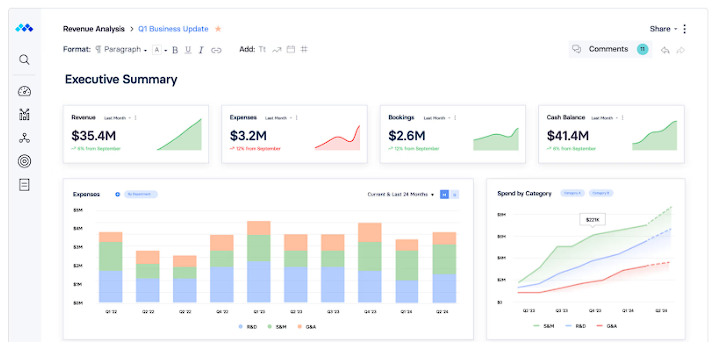

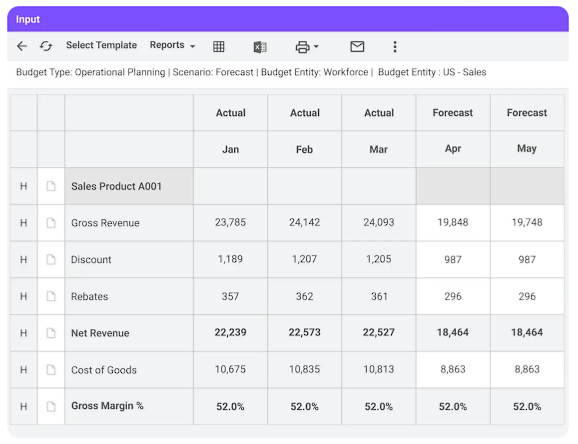

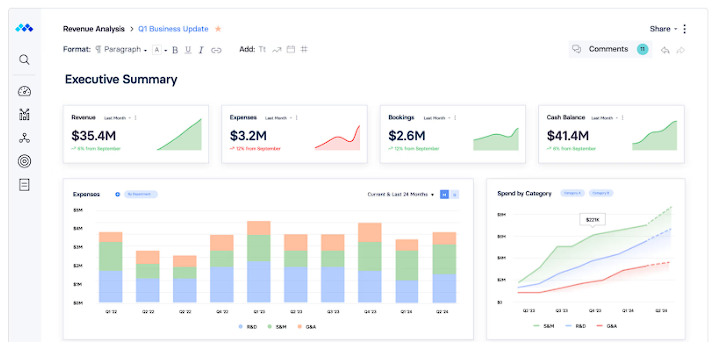

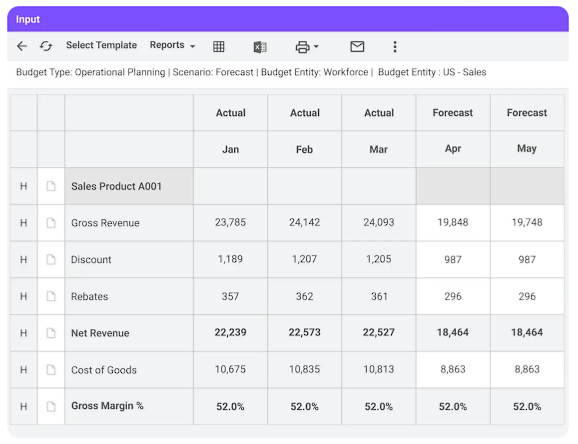

1. Cube

Cube is the best FP&A software tool for budgeting, especially for growing businesses and enterprises. The cloud-based FP&A software uses powerful AI to analyze financial data, generate detailed what-if scenarios, and predict the financial impact of different strategic decisions.

By adjusting variables such as revenue, expenses, or hiring plans, users can see how these changes would affect their financial outcomes to make more informed decisions. It helps companies hit their numbers–without having to sacrifice their spreadsheets.

Cube also provides agentic AI and no-code capabilities. The platform’s intelligent agents help FP&A teams transform and eliminate the friction of their traditional workflows. Your team can access features such as smart variance analysis and smart forecasting to uncover insights, understand performance, and drive action without spending hours in spreadsheets.

Customers love the ease of implementation, responsive customer support, and the vast amount of time saved from daily financial operations.

Best for: AI-powered FP&A

Features:

- Uses powerful AI to analyze historical data and produce accurate budget forecasts

- Uses honor role-based permissions so users only access what they’re authorized to see

- Allows finance teams to collaborate confidently with Slack, Teams, and Excel without compromising control

- Integrates seamlessly with Excel and Google Sheets

- Allows users to create unlimited what-if scenarios to simulate the financial impact of different business decisions

- Empowers teams to generate real-time financial reports with customizable templates

- Supports collaborative work across different departments

- Provides customizable dashboards that offer visual insights into key financial metrics

- Let users drill into drivers, trends, and anomalies in real time, and summarize key takeaways and share them across teams

- Automatically syncs financial data from sources like ERP, CRM, and HRIS systems

- Provides highly responsive customer support to assist users through setup, troubleshooting, and optimization of the platform

Pros

- The implementation team guides quick deployment, while other software can eat up months of onboarding time.

- Allows for extensive, quick data collection, quality assurance, and laser-sharp analysis without human error.

- Integrates seamlessly with Google Sheets and all versions of Excel (no coding or formulas needed).

Cons

- Cube works best for mid-sized and commercial businesses—it’s not a personal finance app.

- Cube is not a solution for learning FP&A for the first time.

2. Datarails FP&A Genius

Datarails FP&A Genius is an AI-powered extension of the Datarails FP&A platform designed for financial planning, reporting, and analysis processes. It leverages conversational AI to automate data consolidation, generate real-time insights, and facilitate scenario modeling in Excel.

Best for: Conversational AI for data consolidation

Features:

- Provides conversational AI to answer financial questions in generating financial reports

- Automatically consolidates financial data from multiple sources

- Supports scenario modeling to explore various financial outcomes

- Integrates with Excel

Pros

- Works best for small and medium-sized business

- Enables users automate tasks within Excel

Cons

- Requires a fair amount of time for onboarding

- Needs technical expertise to customize

Pricing: Datarails FP&A Genius pricing is not publicly available.

3. Mosaic Tech

Mosaic Tech is an FP&A platform that uses AI to enhance financial planning, budgeting, and analysis. The platform’s ARC (Augmented Reality Collaboration) AI capability allows finance teams to automatically summarize data trends and create budgeting scenarios. Mosaic integrates with ERP, CRM, and HRIS systems.

Best for: Data summarization

Features:

- Offers 150+ metrics to report on

- Customizable dashboards and templates for reporting

- Supports what-if scenarios

Pros

- Has a user-friendly, clean interface

- Provides formula syntax that is similar to Excel formulas

Cons

- Lacks some features and integrations as an early-stage software

- Prevents users from editing data directly in data sources

Pricing: Mosaic Tech offers three plans: Analytics, Foundation, and Growth, however, pricing is not publicly available.

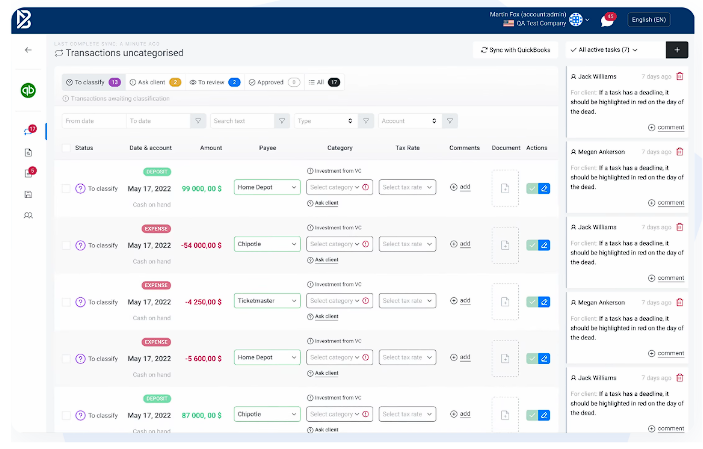

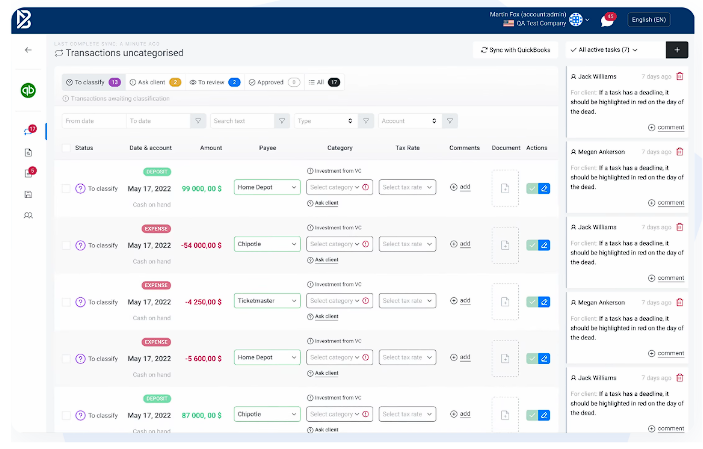

4. Booke.ai

Booke.ai is an AI-driven platform that automates bookkeeping processes for businesses and accounting firms. It can integrate with existing accounting software like Xero and QuickBooks. Booke.ai uses the AI-driven Robotic Bookkeeper to automate categorization and reconciliation.

Best for: Automated bookkeeping

Features:

- Categorizes transactions and reconciles accounts using AI

- Optical Character Recognition (OCR) AI extracts data from invoices, receipts, and bills

- Client portal that allows accountants and clients to share documents and ask questions

- Monitors financial records for inconsistencies and errors

Pros

- Supports small businesses with AI-powered bookkeeping

- Integrates with popular accounting software like Xero and Quickbooks

Cons

- Has a poor user friendliness and user interface

- Offers feature and functionalities that are not suitable for large businesses

Pricing:

- Bookkeeping Platform: $20/month

- AI Bookkeeper: $50/month

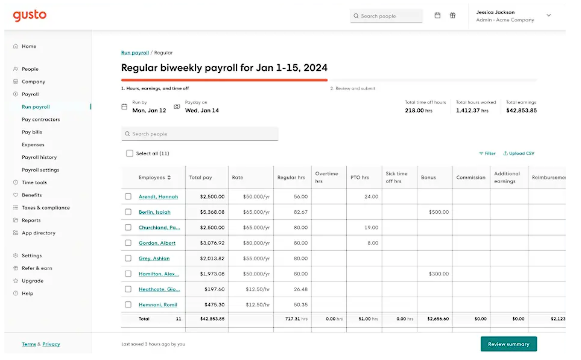

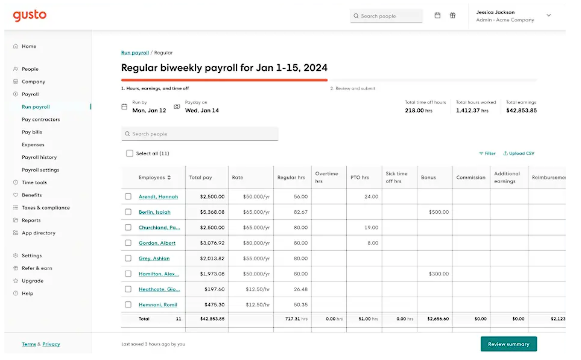

5. Gusto

Gusto is a cloud-based platform designed to handle payroll, benefits, and HR management for businesses.

Beyond its core features, Gusto offers AI-driven tools, including a custom AI report generator that can inform budget decisions for payroll and HR.

Best for: AI-powered payroll reports to support budgeting needs

Features:

- Supports budget planning with insights from payroll and HR data

- Automates payroll processes like tax calculations, filings, and direct deposits

- Manages employee benefits with self-service options

- Offers tools for hiring, onboarding, and managing employees like performance reviews and time-off tracking

- Integrates tools for tracking employee hours, PTO, and holiday schedules

Pros

- Provides a mobile app for users without access to PC

- Allows users manage all their processes on a single platform

Cons

- Inconsistencies between the web app and mobile app versions

- Limits features users can access on the mobile app

Pricing:

- Simple: $49/month (plus $6/month per person)

- Plus: $80month (plus $12/month per person)

- Premium: $180/month (plus $22/month per person)

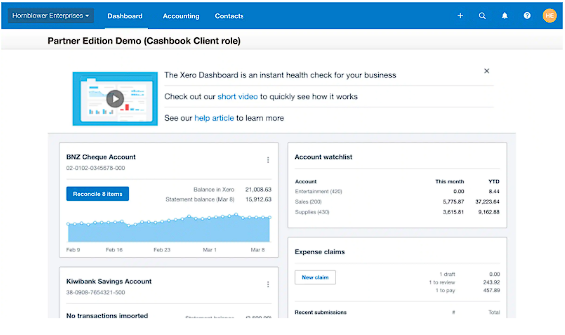

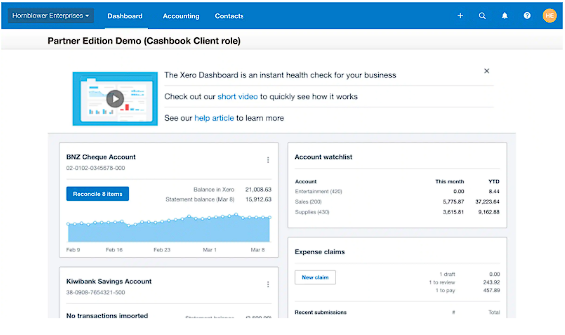

6. Xero

Xero is an accounting software that uses AI to help small businesses manage their financial operations.

It features automated bank feeds, invoicing, and expense tracking. Xero’s AI-powered Analytics Plus allows users to create budgets by predicting future cash flow.

Best for: AI-driven accounting, budgeting, and bookkeeping

Features:

- Uses AI to predicts short-term cash flow based on current and historical data

- Automatically imports and categorizes bank transactions

- Allows for invoice creation with customizable templates

- Offers financial reports for profit and loss statements, balance sheets, and cash flow statements

- Offers expense tracking and reimbursement claims

Pros

- Serves majorly small businesses

- Easy to learn and adopt for nontechnical people

Cons

- Users interface is a bit clunky and outdated

- Provides limited integrations with other software

Pricing:

- Early: $2/month

- Growing: $4.7/month

- Established: $8/month

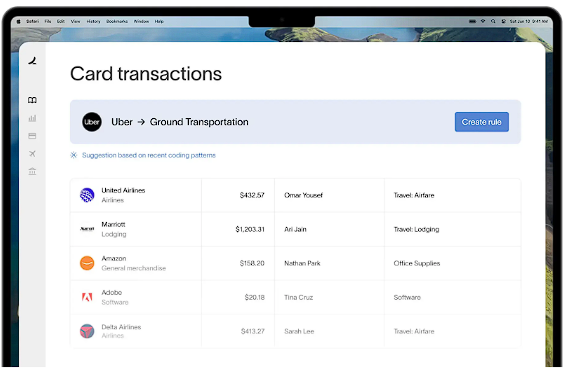

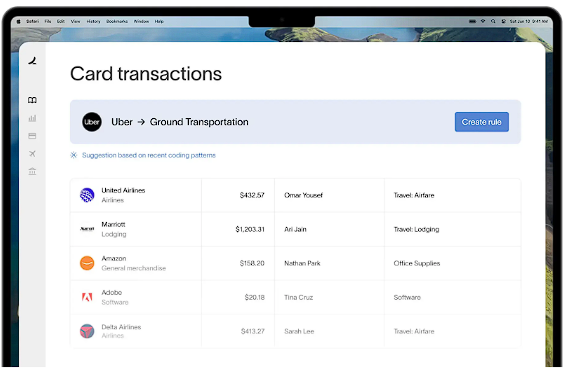

7. Ramp

Ramp is a spend management platform designed to handle expense management, corporate card usage, and accounts payable. Ramp uses AI to verify that invoices match POs to generate a bill and route for approval. The platform also offers a corporate card to track and monitor business spending and manage budgets.

Best for: Automated expense management

Features:

- Uses AI to automatically generate and categorize receipts

- Automatically categorizes and reconciles expenses through the corporate card

- Automates bill payments, approvals, and month-end close

- Offers customizable guardrails to prevent out-of-policy spending

- Issues both physical and virtual corporate cards with built-in spend controls

Pros

- Offers a free version

- Supports collaboration on building budgets and reports

Cons

- Requires users to have a strong understanding of Excel and CSV files to handle integrations

- AI chat supports is not robust

Pricing:

- Ramp: Free

- Ramp Plus: $15/user/month

- Ramp Enterprise: Contact sales

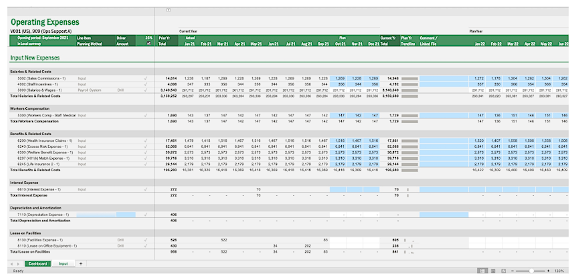

8. Planful

Planful is a cloud-based financial performance management software that supports financial planning, budgeting, and consolidation.

The platform uses AI to automate processes like month-end close and scenario planning. Planful Predict is their AI tool that assists in budgeting by providing predictive insights and automated forecasting.

Best for: Machine learning for predictive insights

Features:

- Uses AI to analyze historical data and predict future financial trends

- Features pre-built templates for budgeting

- Manages month-end close process by automating data collection, consolidation, and reporting

- Integrates with ERP, CRM, and HCM systems

- Offers reporting tools that support self-service capabilities for creating management and ad-hoc reports

Pros

- Handles large quantities of data easily

- Allows users to build custom reports for multiple stakeholders

Cons

- Ships new features regularly which can be overwhelming for users

- Offers only web-based templates for financial modeling

Pricing: Planful pricing is not publicly available.

9. Vena Insights

Vena Insights is a reporting and analytics tool embedded within the Vena platform.

It leverages Microsoft’s AI and machine learning technologies, including Power BI, to provide finance teams with tools for data visualization, scenario analysis, and predictive analytics.

Best for: Data visualization

Features:

- Connects with existing Vena data to provide insights without the need to export data to external applications

- Uses AI and machine learning models to deliver predictive analytics, anomaly detection, and scenario comparisons

- Allows users to create and customize dashboards to visualize data

- Offers role-based permissions and data security so only certain members can access financial information

Pros

- Provides a native Excel platform

- Offers an interactive product tour to people who request demos

Cons

- Has a high learning curve

- Platform’s pricing might be expensive for smaller companies

Pricing: Vena pricing is not publicly available.

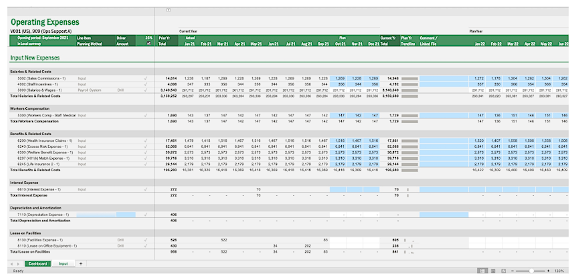

10. Jedox

Jedox is a financial planning and performance management platform designed to support FP&A and integrated business planning across finance, sales, HR, and operations.

The platform uses AI to model business scenarios, integrate data from multiple sources, and assist in cross-organizational planning for global teams.

Jedox assists budgeting with predictive forecasting, which automatically generates forecasts based on historical data.

Best for: AI-driven modeling and planning

Features:

- Uses AI to analyze historical data and predict future financial outcomes to assist in budgeting decisions

- Incorporates AI to allow users to ask questions and receive insights directly within the platform

- Offers an Excel-like interface

- Integrates financial and operational data into a single source of truth

- Enables users to create financial models and forecasts

- Allows users to create customized ESG reports in-house

Pros

- Provides adequate support for technical-related issues

- Integrates with CRM and ERP platforms

Cons

- Requires complex initial setup

- Feels complicated and overwhelming to use for some users

Pricing: Jedox pricing is not publicly available.

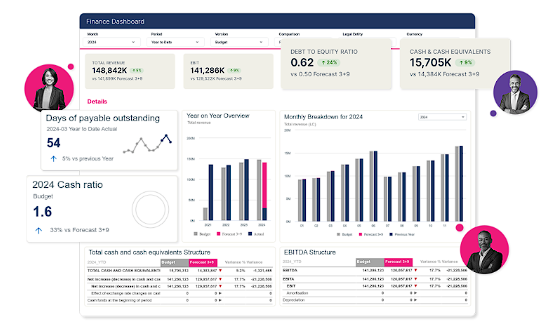

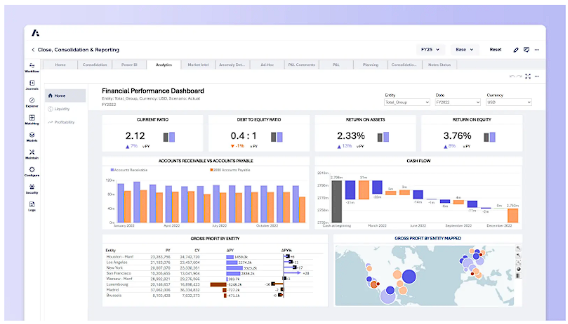

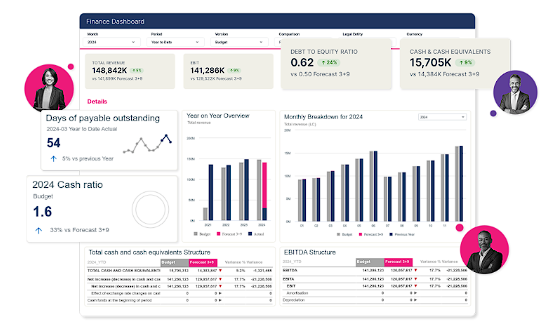

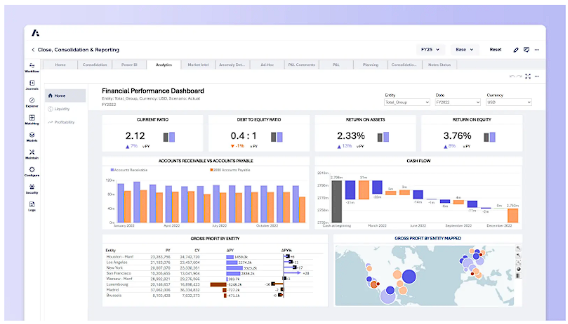

11. Anaplan

Anaplan is a cloud-based financial planning platform designed to support large enterprises in managing planning processes across finance, supply chain, sales, and HR.

It enables real-time collaboration within their custom dashboards. Anaplan integrates AI-driven features through its PlanIQ, which assists budget forecasting accuracy with machine learning and predictive analytics.

Best for: AI-enhanced financial performance management and planning

Features:

- Utilizes machine learning for budgeting, forecasting, and scenario planning

- Integrates financial and operational planning into a single platform

- Uses Hyperblock to power real-time, in-memory calculations that allow users to model large-scale scenarios

- Includes tools for budgeting, forecasting, long-range scenario planning, and financial consolidation

- Supports demand planning and supply chain optimization

- Provides capabilities for headcount planning, compensation modeling, and workforce optimization

Pros

- Provides an online learning centre for users

- Offers a customer care portal with continuous support

Cons

- Does not offer drill down functionality

- Excel-like functionalities are limited

Pricing: Anaplan pricing is not publicly available.

Learn more in this complete Anaplan review.

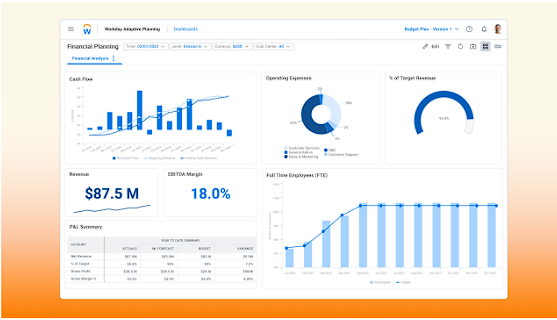

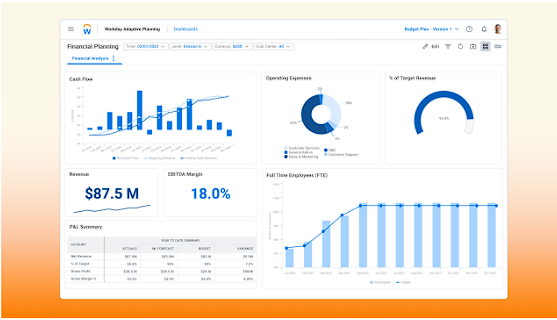

12. Workday Adaptive Insights

Workday Adaptive Planning is a cloud-based EPM software designed for financial planning, modeling, and reporting.

It enables businesses to create financial models, perform scenario analysis, and generate forecasts using AI and machine learning.

Best for: AI forecasting

Features:

- Enables the creation of financial models that incorporate various business drivers

- Allows for unlimited scenario comparisons

- Uses machine learning to power financial forecasts

- Offers real-time insights through customizable dashboards and reports

Pros

- Offers good reporting and analytical capabilities

- Provides a user friendly interface that’s simple to navigate

Cons

- Requires technical support to integrate with non-Workday systems

- Offers lesser customization capabilities compared to other platforms

Pricing: It has two plans: Workday Adaptive Planning and Workday Adaptive Planning Close and Consolidation. Workday offers a free 30-day trial to test out the platform but pricing is not publicly available.

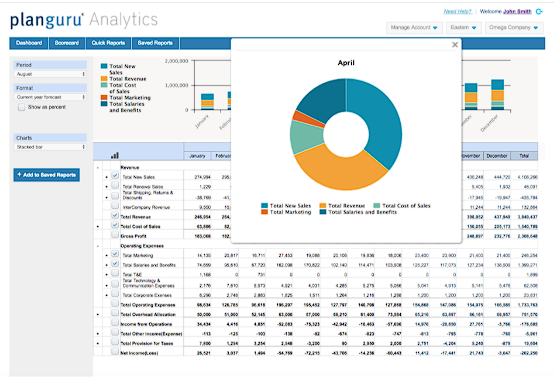

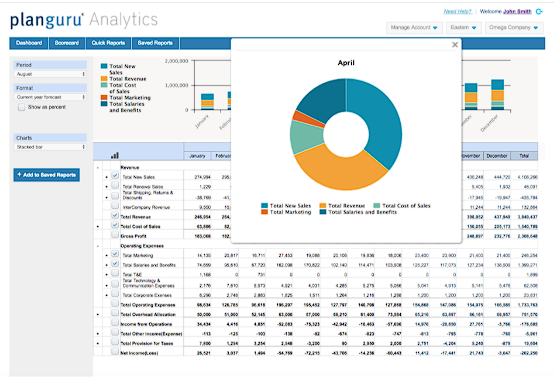

13. PlanGuru

PlanGuru is a financial planning software marketed towards small to medium-sized businesses, nonprofits, and financial advisors.

The platform uses AI to assist with budgeting, forecasting, and financial analysis and allows users to project up to 10 years of financial data.

Best for: AI-powered budgeting and forecasting

Features:

- Uses AI to create budgets and forecasts for up to 10 years, using over 20 pre-built forecasting methods

- Provides a 3-way forecasting structure that integrates income statements, balance sheets, and cash flow statements

- Consolidates financial data from multiple departments

- Allows users to build custom reports and dashboards and export data to PDF, Word, or Excel

Pros

- Integrates financial data from other platforms

- Allows users to automate report building in Excel

Cons

- Requires users to purchase extra licenses for some functionalities

- Makes the initial setup complex

Pricing:

- Single Entity: $83/month, this plan includes one user.

- Multi-department Consolidations: $250/month for three users.

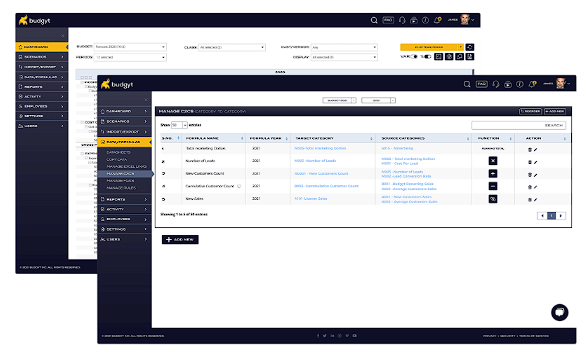

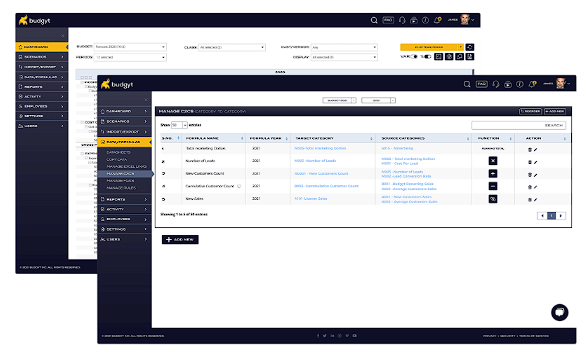

14. Budgyt

Budgyt is an AI-powered budgeting platform with features like multi-department budgeting, customizable dashboards to view data, and real-time data access.

It allows multiple users to work on budgets simultaneously while maintaining control over data access permissions. Budgyt can also integrate with existing accounting software like QuickBooks and Xero.

Best for: Budgeting and planning

Features:

- Allows users to consolidate budgets across multiple entities, departments, or sub-departments

- Users can access historical transactions through hyperlinked data

- Offers dashboards that allow users to view budgets in formats like P&L by cost center, budget comparisons, and other custom reports

- Centralizes all data entry

Pros

- Allows users build custom solutions using an API

- Provides role-based access to restrict usage

Cons

- Offers initial pricing and initial setup costs that may be high

- Some features are not user-friendly

Pricing: Budgyt offers three plans, but pricing isn’t publicly available.

Security and ethical considerations for AI budgeting tools

As AI-powered tools become more accessible and increasingly important for business growth, organizations need to think carefully about the ethical and security impact of bringing AI into their financial processes.

Like any AI platform, AI budgeting tools need access to sensitive data. In this case, that means your company’s financial information. The key concern is how the tool stores, processes, and shares that information. There’s always a risk that it could expose sensitive data to the wrong person. And if the tool isn’t built with enterprise-level security in mind, it can also become a target for cyberattacks or data breaches.

That said, these risks don’t mean finance teams should avoid AI altogether. The benefits are real, but you have to pick the right tool. Look for software that meets industry security standards such as SOC 2 and includes features like role-based access control, strong data governance, data encryption, and multi-factor authentication.

Use the best AI budgeting tool for your business

It’s important to remember that AI tools are not replacing FP&A teams—they’re enhancing them. AI automates the time-consuming tasks and allows finance professionals to focus on strategy and decision-making. As AI continues to evolve, it will play an even more significant role in helping businesses stay agile and responsive to change.

When choosing a budgeting tool, consider your team’s specific needs, existing workflows, and the level of visibility and control you need over your financial data. The right tool should support both day-to-day tasks and long-term planning.

.png)

.png)

![14 best AI budgeting tools and software [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Bars%20Pie%20Chart.png)

![12+ Best FP&A software for small businesses [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Lines%20Chart.png)