Product

Solutions

Resources

Company

About Cube

Explore our vision and team

Careers

Help shape the future of FP&A

In the News

Cube featured in top publications

Security

Enterprise-grade, cloud security

Newsletter

.png)

A newsletter for finance pros—by finance pros. Get practical, strategic finance insights from those who’ve been there—straight to your inbox.

real estate

fp&a for real estate

Invest with confidence

Understanding your portfolio and maximizing your investment potential requires sharp financial insight. Assess asset value accurately, predict income streams, and make strategic decisions while balancing cash flow with Cube.

How Cube Works

-

Loved by finance pros at

-

-

-

Powering 1,000s of finance professionals in every industry.

Why leading real estate providers choose Cube

stay nimble

Get the flexibility you need to plan for growth in a volatile market with a clear picture of portfolio value and the flexibility to change your models as needed.

grow smarter

Streamline expansion and investment planning efforts by enhancing and improving your process, not changing it.

share insights

Give visibility into portfolio performance, deliver ad-hoc reports easily, and share insights with executives using data they can trust.

Manage FP&A Your Way

Annual Budgets

Reforecasting

Driver Based Planning

Income Statements

Cash Flow Reporting

Scenario Planning

Strategic Initiative Evaluation

Cost-Benefit Analysis

Monthly/Quarterly Forecasting

Finance teams trust Cube to transform their FP&A

Cube will help organize your existing chaos and scale as you continue to grow.

Dustin Walsted

VP of Finance, Technology & HR

We’re spending more time partnering with the business and analyzing how changes affect revenue across all three entities.

Morgan Rafferty

Senior Finance Manager

See cube in action

With Cube, finance teams can focus on what matters—guiding the business forward with speed, precision, and confidence.

What is Cube and how does it support real estate financial planning in Excel and Google Sheets?

How does Cube help with property- or asset-level performance tracking and forecasting?

Can Cube support scenario planning for leasing activity, interest rates, or acquisition strategies?

How does Cube enable driver-based planning for real estate finance teams?

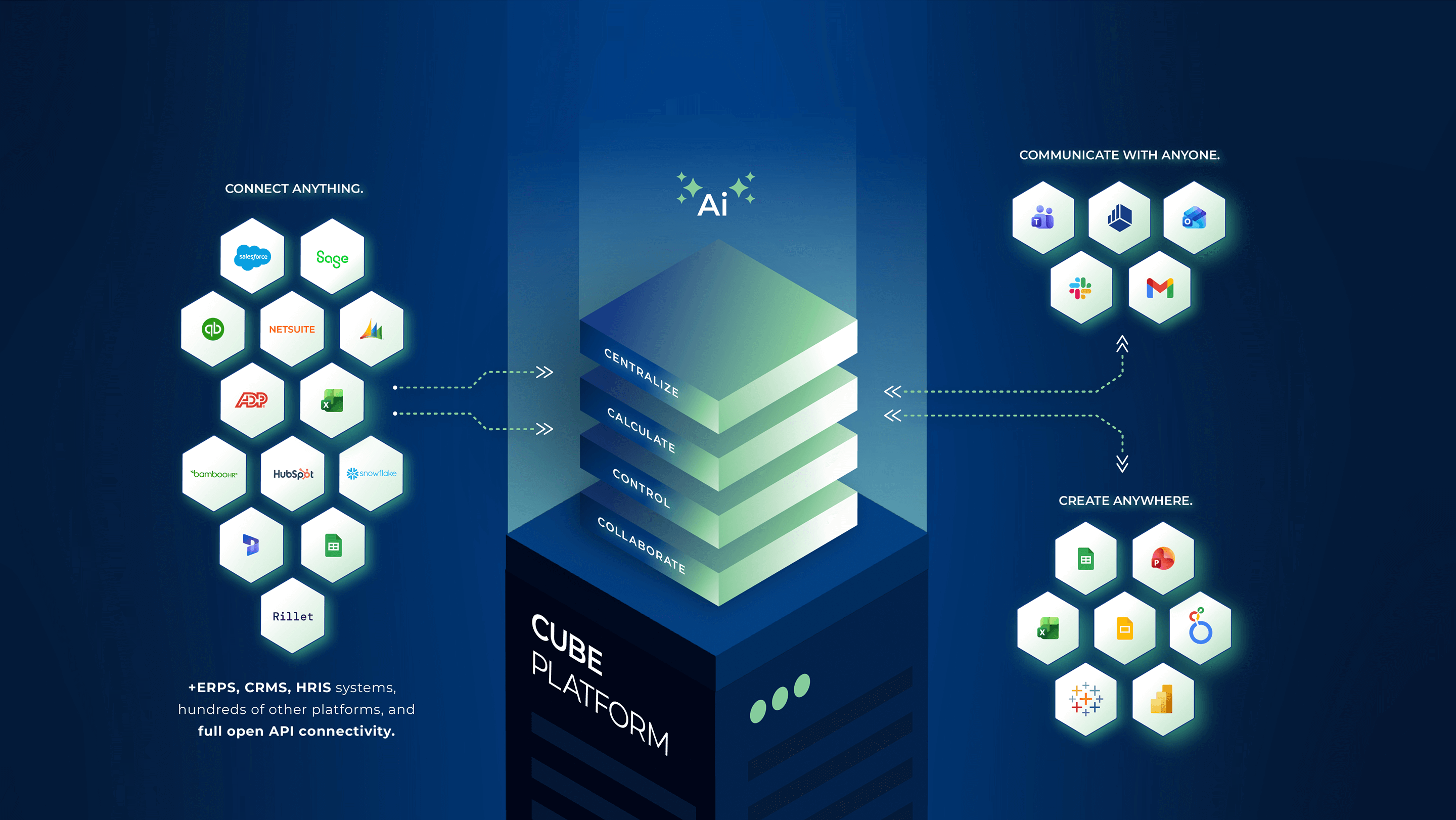

What data integrations does Cube offer for real estate FP&A teams?

How secure is Cube for large business service organizations?

What real estate KPIs and variance insights can Cube support?

How does Cube support collaboration between finance, asset management, and operations?

Does Cube support headcount and workforce planning for real estate companies?

Still have questions?

.png)