Key takeaways

- Datarails keeps teams in Excel and automates consolidation, reporting, scenarios, and dashboards.

- Tradeoffs include fragile formula links, permission/UI overhead, and slower performance on larger models.

- Datarail’s AI (FP&A Genius) adds chat, insights, and storyboards, but payoff depends on clean models, reliable integrations, and sound governance.

- Best fit is Excel-centric SMB and mid-market teams. If you need cross-platform spreadsheets, faster time to value, or easier collaboration, compare alternatives on cost, scale, and support.

What does Datarails do?

Datarails biggest selling point is that they help you automate repetitive processes in Excel. As spreadsheet fans ourselves, we have to give Datarails credit for this. After all, 90% of FP&A teams supplement financial planning platforms with spreadsheets. So you might as well make the spreadsheet your financial planning platform.

.png?width=1200&height=627&name=90%25%20of%20FP%26A%20teams%20supplement%20financial%20planning%20systems%20with%20spreadsheets%20(1).png)

On their website, Datarails lists key use cases like:

How does Datarails deliver on its promise? Let's take a look at some reviews.

Datarails review

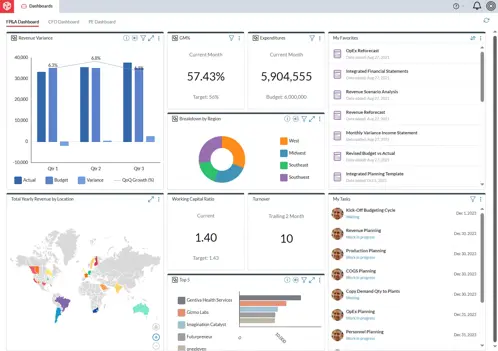

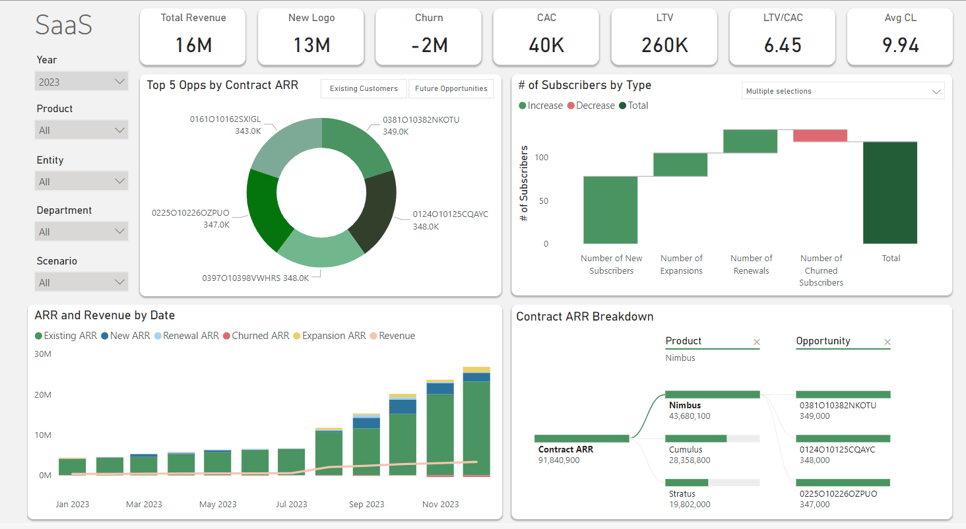

There’s a reason Datarails is popular: It covers all the basic FP&A operations within your regular spreadsheets, so you don’t need to overhaul the tools you use. It’s designed to compile all your data and display it on a single dashboard.

But going deeper into the details, here are some of the most common pros and cons from real users.

Several FP&A professionals indicated that Datarails:

- Offers agile reporting capabilities including dashboards, storyboards, and a customizable report builder to match your needs.

- Speeds up reporting processes, freeing up time for more detailed analysis.

- Keeps users in Excel instead of on a "replace spreadsheets" system that can be expensive and difficult to adapt to.

But like any tool, Datarails has limitations. Reviewers mentioned that:

- The learning curve is pretty steep and, although they have committed to improving their knowledge base and training materials, there’s still a lot of work to be done.

- Dashboards have gaps. Some teams still rely on Excel's built-in charts and custom dashboards, though they hope to move fully to Datarails over time.

- The Excel Add-In can feel cumbersome. Workbooks with many tabs and Datarails references can take a long time to load and refresh. A leaner, more efficient add-on would help.

Who is Datarails for?

When the company launched in 2015, Datarails focused heavily on ambitious SMBs looking to scale up. It now also handles established mid-market businesses and enterprises of over 1000 employees.

No matter the size of the organization, Datarails is for spreadsheet users. That’s good news due to the popularity of spreadsheets among finance professionals, but it’s not just about familiar functionality.

Excel and Google Sheets are incredibly versatile and almost universally recognized. This allows internal stakeholders to follow your progress more easily. When everybody in your company speaks the same language, you can cut out a lot of confusion and misunderstandings between the CFO and the rest of the company.

Datarails key features

- Uses Excel on the front end so you can leverage existing skills and reduce training time

- Creates a single source of truth for consistent data accuracy, version control, and audit tracking across teams and offices

- Provides an AI-powered chatbot, FP&A Genius, to answer questions about budgets, forecasts, variance, and spending

- Helps automate repetitive tasks such as data collection, consolidation, and reporting

- Scenario analysis and monitoring to compare multiple financial outcomes and prepare for best and worst-case scenarios

- Integrations with leading ERP, CRM, and financial data sources to reduce the risks involved in manual data transfers

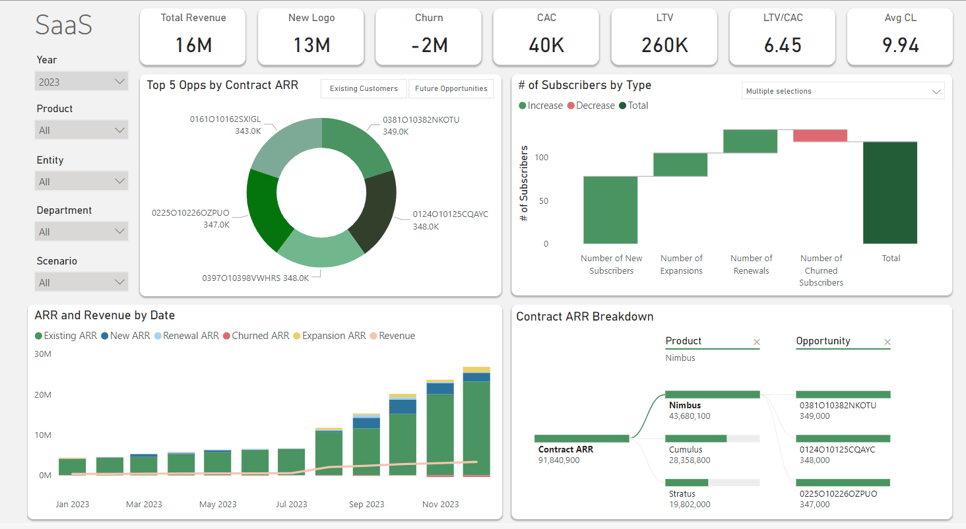

- Customizable dashboards and reporting to present the needs of different stakeholders

- Data security and compliance through user-based permissions, audit trails, and built-in compliance features

Datarails AI

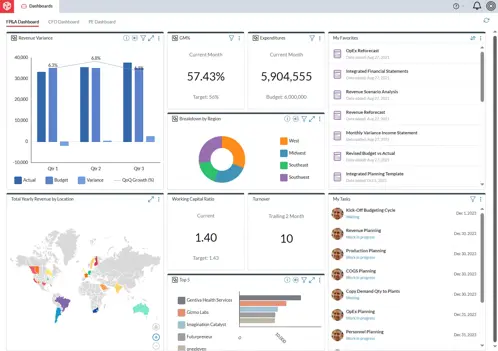

Datarails Genius is a generative AI assistant that runs on a company’s consolidated finance data within the Datarails stack (FinanceOS, FP&A, and Connect). It generates analysis, narratives, and visual outputs directly from governed data models and spreadsheets, with configurable KPIs, cadences, and recipients for automated delivery.

It includes three functions: Insights, which produces scheduled summaries and analyses; Storyboards, which converts finance data into presentation-ready narratives and visuals; and Chat, which answers questions about budgets, forecasts, variance, and spend using the same centralized data.

Datarails pricing

Datarails isn’t transparent about its pricing on its website. It offers custom packages for each business’s specific use cases, making it hard to give a ballpark figure. However, online reviews have said Datarails is more expensive than comparable FP&A options.

Digging deeper: Datarails user reviews

For more information on Datarails, check out these other Datarails reviews:

G2 Datarails customer reviews

4.6/5 from 221 reviews

“Exporting large volumes of data or directly integrating to BI tools like Tableau could be improved. Permission management is time-consuming and highly detailed. I wish there was a better way to lock an entire version with one or two clicks.”

“It integrates well with excel, so using it once the data was imported was easy. A bit tough to learn at first but the implementation consultants are excellent.”

“I have had some frustrations with the lack of support to solve my immediate needs. While the CSM was out the last few weeks, which I was unaware of, my only option has been emailing back and forth with Datarails support, or links to articles that didn't really answer my questions. Datarails is supposed to save me time, not waste it right?”

“Creating dashboards or widgets using data outside of QBO can be challenging. The platform isn’t flexible enough to build tables with multiple columns pulling from different data sources. In addition, when comparing actuals and budgets (e.g., monthly from Jan to Sep), there’s no option to show separate grand totals.”

Software Advice Datarails reviews

4.8/5 from 108 reviews

“Flexibility with Excel is key. I find it easy to use and scalable but integration with Sage is not perfect and requires a workaround.”

“I like the flexibility and how intuitive the Datarail platform is. I only had great experience working with their support team and they answered in a timely manner every time I had questions. However, I would love a Datarails team that could recreate our financial package from our Excel version into Datarail because that part can be very time-consuming.”

“The Excel implementation is great, but the ability to get efficient is labored. Cons include the inability to know what type of user you are and what access you have. You may be trying to accomplish a task and looking for an option that you may not even have access to. Also, the confusion of File Boxes and Data Mapping and integrations and configurations is all jumbled. More concise direction would be appreciated.”

“Losing customer formatting from month-to-month between submitting final versions and downloading the following months filebox work file. I have since found a work-around but it is not as smooth as I would like it to be.”

“There are limitations to the types of dashboards we need to create in the system. Some files we are unable to aggregate because of the data type which is crucial to a number of our reports.”

Gartner Datarails reviews

4.9/5 from 16 reviews

“Planning with DataRails has streamlined our planning and forecasting cycles and helped us to standardize metrics, reporting, and analysis. It makes comparing plans, forecasts, and actuals across the organization easy and requires no training or overhead.”

“I would say that the most difficult part about using this software is managing the requests from management so that it doesn't compromise the value of the software.”

“Can handle multiple systems and locations with ease. It’s flexible, easy to use, and allows for planning at a granular level to improve budgeting.”

Capterra Datarails reviews

4.8/5 from 108 reviews

“There are limitations to the types of dashboards we need to create in the system. Some files we are unable to aggregate because of the data type which is crucial to a number of our reports. The file mapping can sometimes get confusing when there are additional columns that have been added and we need to reconfigure the mapping, but our historical data does not have the exact same data, it has caused issues in the past.”

“I think there are some rough-around-the-edges features that could be tweaked for quality of life, but nothing that is breaking anything. Mainly centered around more options in the widgets and dashboards”

“The Datarails product and support team have been very good to work with. The product has automated several very manual processes that save us time and deliver actionable information more quickly.”

“As the company using Datarails, you must create your own reports. Templates are provided in general, but typically, you must customize your own reports to what you need in particular.”

Datarails pros and cons

After reading the customer reviews, here's a summary of what users feel Datarails does well:

- Provides out-of-the-box templates that simplify the setup process

- Keeps your FP&A team working within Excel, ensuring familiarity and ease of use

- Offers in-house customer support to help resolve any issues quickly

- Enhances the overall user experience with pleasing UI and dashboards

That said, Datarails has several gaps to address. Here are a few areas of improvement:

Datarails can feel rigid for collaborative, remote teams

Recent user reviews highlight friction when many stakeholders need to collaborate across roles and tools, especially in remote settings. As teams juggle real-time edits, permissions, and data pulled from multiple systems, handoffs can slow and coordination feels heavier than expected.

- Permissions and UI concepts add overhead: Elements like File Boxes versus Data Mapping and role setup can slow handoffs between finance and non-finance users.

- Performance can dip on heavier model:. Larger datasets and complex workbooks can cause slowdowns and limit dashboard performance.

- Implementation experience varies: Some teams onboard quickly, while others see time-to-value depend on scope, integrations, and model design.

This is why remote, cross-functional teams may not move at real-time speed in Datarails, particularly when models are large, many viewers are involved, or processes rely on strict role controls.

Datarails's licensing setup creates collaboration and procedural problems

Datarails uses licenses to keep your sensitive financial data on lockdown, so you can't see a report without a Datarails license.

Makes sense, right? After all, that's your company's financial data. It should be secure.

But if that were the case, why not just use something like the Google Drive permissions model? Why require extra seats?

For companies trying to stick to responsible software spending, it's hard to justify extra seats just for viewing reports.

Here's an example:

As a CFO, you want to send your VP of People a hiring budget. You create it in Datarails and share it. You had to buy an additional Datarails license and connection for this use case. The workaround? Use the Datarails-provided templates, formulas, and formatting. Share your budgets and reports within the web portal.

And while that sounds great, it creates procedural problems. If the person without a license makes an edit, it breaks the model. And then you can't see their changes.

You need to learn Datarails-specific formulas, which creates a learning curve and reliance on customer support

Datarails formulas are complex and easy to break. They rely on hidden columns and brittle cell references. So being a Datarails power user requires learning those proprietary formulas.

Alternatively, you can eschew them altogether and use Excel workarounds, which defeats the point of buying FP&A software.

Here's an example of what these formulas look like:

.png?width=1896&height=1018&name=Datatails-proprietary-formula%20(1).png)

The formula in this screenshot from a Datarails video by @DR.YTD takes nine optional arguments.

However, there are easier ways to calculate year to date (YTD). Likewise, the Datarails proprietary formulas are just that: proprietary. You can't tweak them.

Imagine this:

All of your reporting is built on brittle formulas like this. But you want to change some of your reporting templates. Now, instead of self-serving, you have to embark on a project with a Datarails CSM.

So all the time you think you've saved with this new tool gets eaten up in learning how to use it.

What to look for when choosing Datarails alternative

FP&A software should make your life easier. It should save you time, automate repetitive tasks, and eliminate the no-value-add work that burdens many finance teams.

But how do you properly evaluate FP&A software?

Here, we’re going to go over some quick highlights. If you want a more comprehensive checklist, head to our blog.

1. Customization and reporting

Technology should democratize FP&A processes, allowing you to build and maintain reports without the need for consultants. Unlike a tool that spotlights rigid reports with proprietary formulas and complex underlying logic, great FP&A software empowers and augments your existing and preferred workflows. You should be able to spin up your own reports or dashboards and share them with whomever you need, without waiting for consultants or troubleshooting formulas.

2. Compatibility with your and your colleagues' favored work environments

FP&A software should seamlessly integrate with the tools and environments your team already uses. While many FP&A teams work in Excel, other departments might prefer Google Sheets or Excel within Microsoft Teams. When you’re working under pressure, you can’t leave room for mistakes, and software compatibility is one of the best ways to achieve that.

3. User experience

There’s no way of escaping a learning curve when adopting new FP&A software. However, the best tools hide complexity from the user, allowing even non-technical team members to utilize the software effectively. This ease of use means team members can get on board quickly and avoid conflict that can come with extensive training.

4. Quick time-to-value and cost effectiveness

FP&A software should provide quick time-to-value, avoiding long implementation periods and surprise costs. Implementation limbo can be a major burden on teams as it not only wastes money on the new product, it also invites pressure from superiors. We like to say you should plan a vacation, not an implementation, so look out for software that lets you hit the ground running.

5. Robust customer support and documentation

Reliable customer support and detailed documentation can make a significant difference in the effectiveness of your FP&A software. It helps to smoothen the learning curve and digs you out of trouble when things go wrong. Always check online reviews to gauge the experience of real users when the mud hits the fan.

6. AI and automation opportunities

AI and automation materially improve how well your FP&A software performs. They remove manual updates and reconciliations, speed up close and forecast cycles, and reduce errors. Teams should confirm the tool offers one-click refresh, scheduled data loads, and reusable workflows that can run without scripts or consultants.

7. Scalability

Your FP&A software should be able to grow with your business. As your data, departments, and reporting needs expand, the system should still run smoothly without slowing down or crashing. Look for tools that can handle multiple entities, currencies, and users, and make it easy to add new reports, models, or team members without rebuilding everything from scratch.

8. Security

Financial data is sensitive, so the software you choose must protect it. Make sure it includes strong user permissions so only the right people can access specific reports or data. Encryption, secure cloud storage, and regular backups are also essential. Reputable vendors are usually certified under standards like SOC 2 or ISO 27001, which confirms your company’s information stays protected and compliant.

Top Datarails alternatives

While Datarails can be a good option for Excel-based SMBs who don't plan to scale, you should know about the other players in the FP&A industry.

1. Cube

Cube is a spreadsheet-native, AI-powered financial intelligence and FP&A platform that helps companies hit their numbers without having to sacrifice their spreadsheets. Cube helps finance departments work anywhere, integrating natively with both Excel and Google Sheets, so that they can plan, analyze, and collaborate with the ultimate speed and confidence.

Cube also offers agentic AI built for FP&A. It uses governed, up-to-date financial and operational data, keeps insights explainable and traceable, and lets you control what is shared. You can ask questions in Slack or Microsoft Teams in plain English to get faster answers, deeper insights, and clearer whys. With Cube, every AI insight is explainable, traceable, and transparent.

Many high-growth companies (like Masterworks and Unqork) use Cube for all their FP&A needs. Because here's the thing: Cube can do almost everything Datarails does…and then some.

Cube:

- Supports unlimited dimensions — with a cleaner data structure and faster performance.

- Offers AI-driven collaboration across Slack/Teams/Cube Workspace, with a PowerPoint app coming soon.

- Delivers fully customizable dashboards that are easier to maintain — without formula risk or versioning issues.

- Leads G2 for speed to value; customers see ROI in weeks with their own custom setup — not just forced into standard templates.

- Provides purpose-built AI for finance — automating variance analysis, smart forecasting, and natural-language Q&A in Slack/Teams.

- Works natively on PCs, Macs, Excel, and Google Sheets — no complex workarounds, no compromises.

Perhaps even more importantly, Cube was founded by a former CFO. The problems and use cases of FP&A have been baked into Cube since its inception.

Check out all of the 5-star reviews on Capterra.

Sounds like a good fit?

Book your demo with Cube today.

Features:

- Conversational agents let finance ask questions in Slack, Teams, or Cube and receive instant, data-backed answers, no filters or formulas required.

- Smart forecasting builds AI-driven projections from existing data, enabling faster modeling and quick adjustments to assumptions.

- Intelligent mapping translates plain-language logic into structured, error-free data mappings without manual configuration.

- AI-generated insights and narratives surface automatically during reporting cycles, reducing manual prep time and improving clarity across teams.

- Automated data consolidation connects data from numerous sources for automated rollups and drill-downs.

- Endless integrations include compatibility with spreadsheets (Google and Excel), accounting & finance, HR, ATS, billing & operations, sales & marketing, and business intelligence.

- Centralized formulas and KPIs store all your calculations in a central location and manage from a single source of truth.

- Drill down and audit trail features allow users to get straight to the transactions and history behind a single data cell in just one click.

➡️ See all of our features here.

Pros:

- Proper, native Excel integration with all versions of Excel (no coding or formulas needed)

- Standard implementation time that's 5x shorter than the competition

- Intuitive, easy, and customizable reporting

- Simple formulas for making reports

- Has full Mac OS X compatibility

Cons:

- Works best for mid-sized and commercial businesses–it’s not a personal finance app.

- Built for finance professionals and is not a solution for learning FP&A for the first time.

- Pricing (below) is not designed for pre-series A startups.

Pricing: Custom pricing tailored to suit business needs, starting at $30K annually. Get your custom quote.

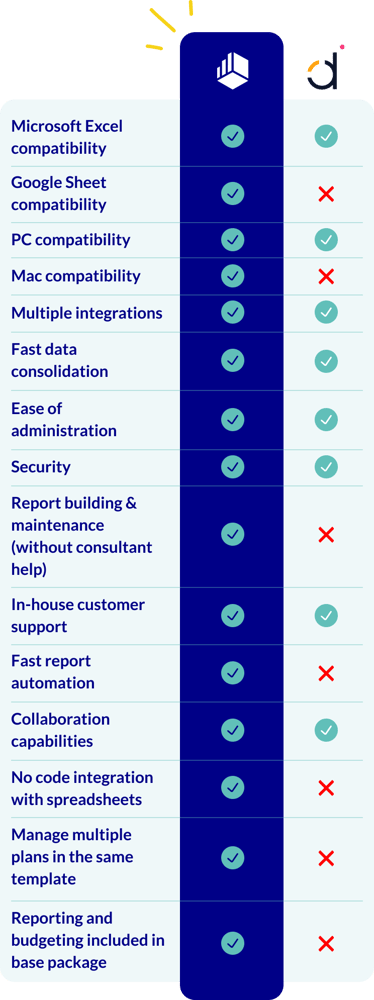

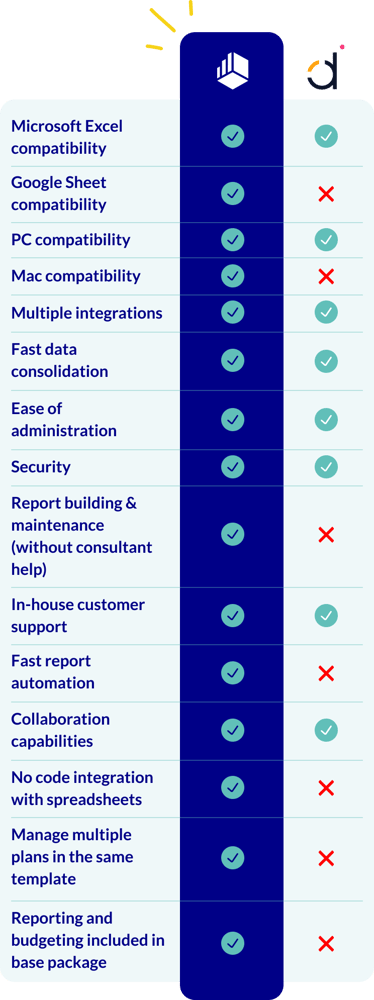

Datarails vs Cube

Cube is a powerful alternative to Datarails for SMBs and mid-market companies, especially for users who need enhanced flexibility across spreadsheet environments. Unlike Datarails, which only supports Excel versions from 2007 onwards, Cube provides full compatibility with Google Sheets and supports both Windows and Mac users seamlessly. Cube’s onboarding process is up to five times faster than Datarails’ implementation, offering a smooth, intuitive user experience that caters to both beginners and advanced users.

While Datarails can meet the needs of many smaller teams, its limitations may become apparent as businesses grow. Cube’s versatility and scalability ensure that companies can continue using the platform as they transition from SMBs to mid-market and eventually to enterprise levels.

Curious to see if Cube is a fit for your organization? Book your demo now.

2. Vena

Vena is a financial planning and analysis software that centralizes budgeting, forecasting, reporting, and consolidation within an Excel-connected interface. It uses defined workflows to assign tasks, collect inputs, track status, and maintain audit trails. The platform includes visual controls, graphical modeling, project budgeting and forecasting, and tools for versioning, permissions, and distribution.

Key Features:

- Offers what-if modeling and statistical analysis to help forecast various scenarios and outcomes.

- Includes graphical data presentation, modeling, and simulation to visualize and interpret data effectively.

- Provides performance metrics and sales trend analysis to monitor and optimize sales performance.

- Supports consolidation and roll-up functions to aggregate financial data across multiple departments or entities.

- Monitors ongoing financial performance against projections.

- Ensures accuracy and consistency in financial documents with propert version control.

Pros:

- Comprehensive analysis allows for data-driven strategic planning.

- Intuitive visualizations enable visual data storytelling.

- Future mobile support improves accessibility and usability.

- Training support helps users get the most out of the tool.

Cons:

Pricing:

Vena’s pricing is not stated on its website; instead, the company provides custom quotes based on each organization’s requirements. However, third-party sources indicate that starting prices are around $5,000

Datarails vs Vena

Datarails provides a secure introduction to FP&A software, making it accessible for many teams. Vena, while also suited for SMBs, usually requires consultant-led implementation to build and manage financial models, often leading to higher setup costs than other out-of-the-box solutions.

Both Datarails and Vena deliver robust Excel integration but lack support for Google Sheets and have limited Mac compatibility.

3. Mosaic Tech

Founded in 2019, Mosaic is a strategic finance platform that creates real-time reporting, budgeting, and planning for better business decision-making. Mosaic allows companies to work in unison in pursuit of organizational goals.

Mosaic consolidates and transforms insights into accessible visuals for stakeholders and management. Like other finance software, Mosaic automates different financial operations to streamline the workflow.

Mosaic's biggest strength is its ability to provide pretty visuals that SaaS companies often want.

Key Features:

- Offers what-if scenarios to explore different financial outcomes based on varying assumptions.

- Enforces access controls and permissions to ensure data security and ser access.

- Enables Ad hoc queries and reporting for custom outputs.

- Provides forecasting and budgeting tools for planning and performance prediction.

- Supports consolidation and roll-up across multiple entities.

- Performs correlation analysis to identify relationships between different financial metrics.

- Builds dashboards for visual, interactive reporting.

Pros:

- Mosaic is easy to use, meaning quick adoption.

- An intuitive user interface (UI) simplifies complex processes.

Cons:

- There’s a slow rollout of new features so you’re not ahead of the curve.

- It has no customization options for graphs and charts, limiting flexibility.

- Mosaic isn’t designed for non-SaaS companies, reducing its applicability across industries.

- It lacks essential integration features, impacting overall functionality.

- Scalability is awkward, posing challenges for growing companies.

Pricing:

Mosaic does not provide any pricing plan information. If you reach out to their sales team, they’ll give you a demo of the software and provide a custom quote.

Datarails vs Mosaic

Both Datarails and Mosaic are tailored for mid-market companies, offering a similar range of tools and features for SMB finance teams. While Datarails can be preferred for its overall platform usability and user experience, Mosaic stands out for smoother initial implementation and responsive customer support.

4. Planful

Planful provides real-time insights into business performance, helping companies identify challenges, seize opportunities, and take proactive action. Built for large companies and enterprises, Planful streamlines complex financial workflows, from planning and budgeting to forecasting and reporting.

With AI and machine learning capabilities through Planful Predict, Planful helps top-level executives, like CFOs and CEOs, to achieve more accurate, faster decision-making.

Key features:

- Generates AI insights via Planful Predict with real-time, data-driven recommendations.

- Produces projections that surface vulnerabilities and growth opportunities.

- Automates financial close reconciliations.

- Consolidates financials for a unified view of company health.

- Enables workforce planning that aligns staffing with business goals.

- Forecasts cash flow based on customizable drivers.

Pros:

- AI enhances planning in finance and operations.

- Fast reporting to multiple stakeholders in and outside of the system.

- The user experience is similar to Excel, which is already widely used.

Cons:

Pricing:

Planful doesn’t make any pricing plan public. You’ll need to reach out to their sales team for a quote.

Datarails vs Planful

Datarails works best for small to mid-sized businesses focused on staying within Excel. Planful is built for large enterprises needing comprehensive performance management and long-term growth support.

In terms of implementation, Datarails is relatively straightforward, while Planful requires a longer setup and often multi-year contracts, fitting larger teams.

5. Prophix

.png?width=464&height=109&name=prophix-logo%20(1).png)

Prophix has been on the market since 1987 offering cloud-based budgeting, planning, forecasting, and reporting solutions. It comes with scenario analysis and what-if modeling, aiding data-driven, strategic decision-making.

With automated workflows and collaboration tools, Prophix uses “cubes” to design a planning model, either for generic planning or personnel planning. Its customization and scalability make it suitable for businesses of varying sizes, and it is available in both cloud-based and on-premises versions, offering flexibility based on IT infrastructure and preferences.

Key features:

- Consolidates financial data from multiple sources into a single model.

- Manages period close tasks and payment tracking.

- Surfaces risks and opportunities with AI-driven insights.

- Extends functionality with Microsoft 365 add-ins.

- Handles intercompany management for entity-level and consolidated views.

Pros:

Cons:

Pricing:

If you’re interested in Prophix, you need to request a demo to get a quote.

Datarails vs Prophix

Datarails and Prophix are largely similar platforms with almost identical features, incorporating cash management, asset lifecycle management, strategic planning, and real-time data.

Prophix is appropriate for organizations of all sizes and industries, while Datarails focuses more on small to medium-sized enterprises. Datarails is tied to Microsoft Excel, which is familiar to most FP&A teams, whereas Prophix is based on its own platform and integrates with Microsoft 365 apps.

6. Anaplan

Anaplan is a cloud-native platform built to help large enterprises make data-driven decisions using real-time information. Designed for complex financial modeling and extensive collaboration, it has tools for creating detailed models, sharing data across teams, and aligning on projects.

It also brings AI and machine learning capabilities to the table, adapting estimations to changing conditions. Companies can simulate scenarios, forecast with precision, and maintain consistent, centralized data for improved decision-making.

Key features:

- Generates adaptive forecasts with machine learning.

- Models scenarios to compare outcomes across strategies.

- Digitizes planning workflows for cross-department coordination.

- Centralizes data in the Anaplan Data Hub for unified planning.

- Projects employee costs for workforce planning.

Pros:

- Links to any number of planning streams through one dashboard

- The UX is intuitive UX and has a good deal of customizability

- Comes with a variety of high-level security methods like encryption, certifications, single sign-on, etc.

Cons:

Pricing:

Anaplan only reveals its pricing after a consultation with their team. That said, Peerspot reports the following pricing:

"The entry-level is anywhere from about $30,000 to $50,000 a year, however, it does go up significantly after that depending on the complexity and how much space you're using."

In other words, most customers can expect to pay significantly more than $50,000 for a basic subscription.

Datarails vs Anaplan

Datarails and Anaplan both offer competitive planning tools, but they target different business sizes and needs. Anaplan is aimed at large enterprises, while Datarails provides a more accessible, Excel-based solution ideal for SMBs and mid-market companies seeking simplicity.

Anaplan’s advanced modeling and scenario planning make it powerful for large-scale use, though Datarails’ focus on ease of use makes it preferable for smaller, agile teams that don’t require extensive customization.

For a full rundown of the top FP&A systems currently on the market, check out our article on Datarails competitors.

Use this Datarails review to find the right FP&A software

While Datarails is generally a decent option for your FP&A needs, the tool's shortcomings and complexity can make it a tough sell for many FP&A teams.

Ultimately, Datarails is aimed at SMBs, Excel-only shops, small (or solo) FP&A teams, and ERP and other source systems natively integrated with Datarails. However, its high customer churn means it doesn’t necessarily live up to the hype.

So if you’re looking for a Datarails alternative, we recommend giving Cube a try. To see how Cube can help you take your finance function to the next level, request a free demo today.

Sources cited:

.png)

.png)

.png)

.png?width=1200&height=627&name=90%25%20of%20FP%26A%20teams%20supplement%20financial%20planning%20systems%20with%20spreadsheets%20(1).png)

.png?width=1896&height=1018&name=Datatails-proprietary-formula%20(1).png)

.png?width=464&height=109&name=prophix-logo%20(1).png)

![Datarails: Competitors, alternatives, reviews & pricing [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Pie%20Line%20Chart.png)