Key takeaways:

- Cash flow management software connects actuals, forecasts, and cash positions in one place so finance teams spot risks early instead of reacting to surprises.

- Tools that integrate directly with your existing systems and spreadsheets give you real-time visibility into cash, which improves forecasting, liquidity planning, and stakeholder confidence.

- The strongest platforms combine FP&A, cash forecasting, and working capital insights so you can plan scenarios, manage runway, and tie cash decisions to strategy, not just survival.

- Fit matters as much as features. The right solution depends on company size, tech stack, and cash flow maturity, from simple forecasting for SMBs to multi-entity, multi-bank treasury for global teams.

Best cash flow management software tools at a glance

Before we dive into the details, here’s a sneak peek of the best cash flow management software on the market today:

- Cube: A spreadsheet-native platform that integrates with Excel and Google Sheets, offering real-time cash flow tracking and automation for streamlined workflows

- Vena Solutions: Combines spreadsheet functionality with cash flow forecasting and reporting tools

- Anaplan: A financial planning platform that models, forecasts, and analyzes cash flow scenarios

- Workday Adaptive Planning: Provides cash flow planning with data and scenario modeling

- Planful: Offers end-to-end financial planning and cash flow analysis with integrations for data unification

- Centage: Tailored for smaller businesses, Centage simplifies cash flow management with visual dashboards and reports

- Abacum: A cash flow tool designed for collaborative financial planning, forecasting, and tracking liquidity

- Causal: Features cash flow forecasting and scenario analysis to support financial planning

- Tesorio: Focuses on cash flow automation, offering features for accounts receivable, payables, and working capital management

- Prophix: Delivers cash flow planning and analysis tools that help businesses identify trends and manage liquidity across operations

- HighRadius: Specializes in accounts receivable automation, providing insights into cash flow and working capital optimization

- Jirav: Combines cash flow planning with budgeting and forecasting to help businesses understand the impact of financial decisions

- SAP Cash Management: A solution for enterprises, SAP Cash Management centralizes cash visibility and liquidity planning

- Kolleno: An accounts receivable and cash management platform that supports cash collection and liquidity tracking

- PlanGuru: Designed for small businesses, PlanGuru includes tools for cash flow forecasting, budgeting, and scenario analysis

- Float: Focuses on cash flow forecasting for small businesses, integrating with accounting software to provide cash visibility and projections

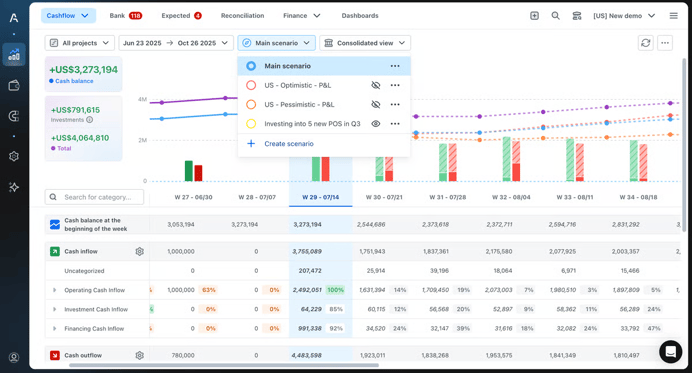

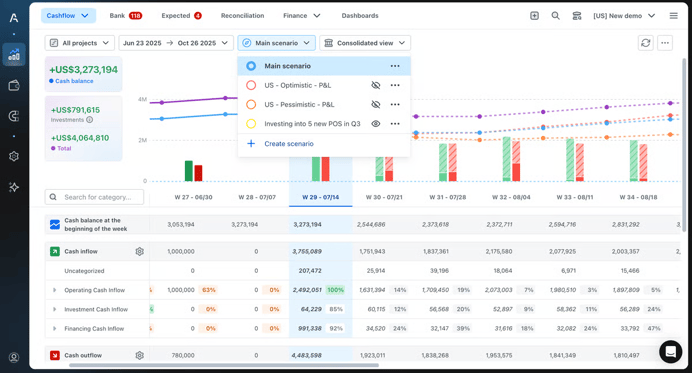

- Agicap: Centralizes accounts payable and receivable, connects with banks and ERP systems, and gives finance teams real-time visibility into cash positions for faster, more reliable decisions

What is cash flow management?

Cash flow management involves tracking and controlling how much cash enters and leaves your business's accounts. Good management helps businesses maintain healthy amounts of working capital and liquidity and sets the foundation for growth and expansion.

Here are some of the typical tasks involved in cash flow management:

- Calculating expenses (cash outflows) and ensuring there is enough incoming cash (cash inflow) to cover them

- Reducing excess cash on hand

- Building cash reserves and rainy day funds

- Double-checking spending and tracking receipts

- Verifying that you're using cash in the best possible way

Financial planning and analysis teams need to monitor, analyze, and optimize their company's cash to make accurate forecasts about the future.

Why is proper cash management important?

Cash management ensures that a business always has the necessary cash to pay its expenses.

Expenses might include:

- Payroll

- Debt repayments and interest on loans

- Bank fees and interest

- Rent and utilities

- Insurance expenses

- PP&E (property, plant, and equipment)

When a business cannot pay its expenses, it goes insolvent, which can lead to a hit to its credit rating, legal actions by creditors, and even liquidation. Good cash management makes companies more secure by minimizing avoidable errors that lead to insolvency.

For FP&A teams, strong cash management is the difference between being profitable on paper and being able to survive the next 6–12 months. Up to 82% of businesses fail due to poor cashflow management. Analysis of startup failures shows a similar pattern, with nearly 2 in 5 failed startups cited as running out of cash rather than running out of ideas.

Liquidity buffers are also thinner than many leaders expect. Research by the JPMorgan Chase Institute found that the median small business holds cash reserves equal to about 27 days of typical outflows, and half of firms operate with fewer than 15 cash buffer days. In volatile markets, that leaves very little room for delayed collections, unexpected churn, or a bad quarter. Cash management gives finance teams a structured way to extend that runway and decide how aggressively they can invest.

At the same time, finance leaders are under pressure to improve visibility. One global survey found that 93% of senior finance leaders experienced avoidable costs in the last three years because cash flow forecasting was inaccurate. A separate pulse survey reports that 58% of CFOs are increasing focus on cash and liquidity forecasting so they can adjust planning faster in a volatile environment.

For FP&A teams, this turns cash management into a core strategic function: connecting real-time data, forecasts, and scenarios so leadership can make decisions with clear sight of liquidity, risk, and runway.

Types of cash flow management software

Cash flow management software is designed specifically to help businesses plan, monitor, and manage the movement of money in and out of the business. This software is crucial for ensuring that a company has enough liquidity to meet its operational needs and avoid financial distress.

These solutions can automatically connect income statement and balance sheet information from your accounting software and organize it into cash flow statements and reports, making it easy to uncover real-time insights into the nuances of your cash flow.

Cash flow software

Cash flow software gives businesses tools to monitor, analyze, and optimize their cash inflows and outflows. These platforms often integrate seamlessly with accounting and financial management tools and send data back and forth.

Cash flow software keeps you ahead of potential liquidity issues, forecasts cash needs, and makes your operations sustainable. Features typically include:

- Automated data consolidation

- Customizable dashboards

- Scenario planning

- Alerts for cash shortages or surpluses

- Integrations with spreadsheets and other financial systems

Cash management software

Cash management software helps businesses control and allocate their funds. These platforms support day-to-day liquidity needs and help you put excess cash to optimal use. They integrate with various financial tools to streamline your treasury operations. Features typically include:

- Payment scheduling and fund transfers

- Fraud detection and compliance tracking

- Tools for automating repetitive tasks

- Real-time tracking of cash balances

- Insights for strategic allocation of surplus funds

Cash forecasting software

Cash forecasting software predicts future cash positions by analyzing historical data, current trends, and business projections. These platforms play a key role in long-term financial planning and help businesses anticipate risks or opportunities.

Like the other two variants, cash forecasting software integrates real-time data for accuracy and consistency. Features usually include:

- Multi-scenario planning and trend analysis

- Predictive analytics for liquidity management

- Integration with accounting systems for data consolidation

- Detailed forecasting reports and visualizations

- Alerts for potential future cash shortages or surpluses

The best cash flow management software tools

New tools are stealing the limelight by communicating better with other apps and allowing finance teams to be more agile. Integrations, automations, and customizations empower finance teams to save time, improve accuracy, and operate in a way that works for them.

Of course, not all tools are the same. To demystify the market, we’re going to look at the top cash flow management platforms, with their key features, benefits, pricing, and more details.

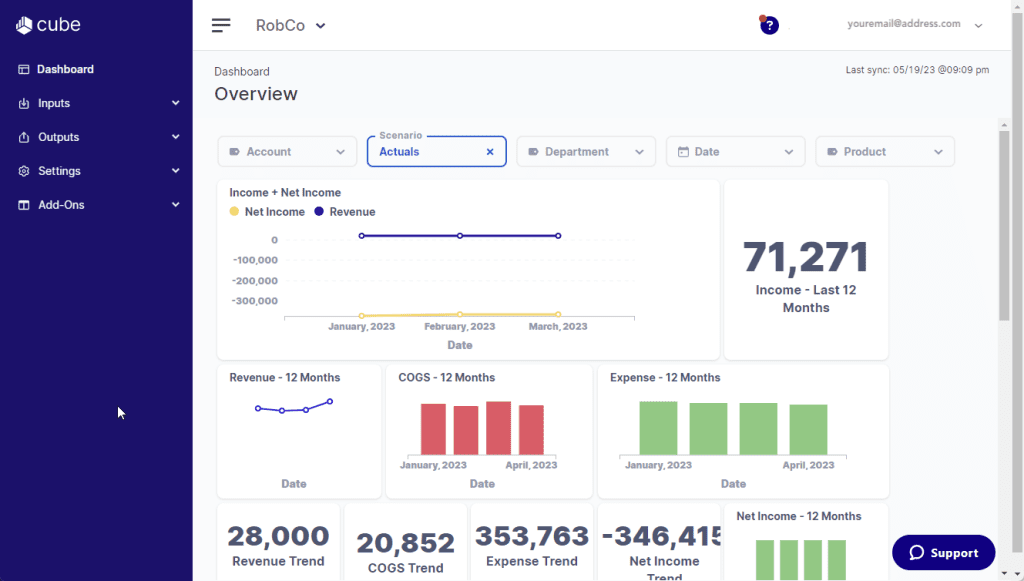

1. Cube

Best for: FP&A teams that want financial intelligence and agentic AI embedded directly in Excel and Google Sheets

Cube is a spreadsheet-native FP&A platform that helps companies hit their numbers without having to sacrifice their spreadsheets. Cube helps retail finance departments work anywhere—integrating natively with both Excel and Google Sheets—so that they can plan, analyze, and collaborate with the ultimate speed and confidence.

Cube enables users to create and manage your direct and indirect cash flow. Users can automatically compile data from various sources, such as sales, expenses, investments, and financing activities, to generate cash flow statements and get valuable insights into a company's financials and quality of earnings.

This platform is the only software that automatically transfers data from any spreadsheet into a multi-dimensional database. By connecting all of your essential data sources to Cube, its intelligent mapping transforms your data into a single source of truth that you can analyze, share, and derive insights from.

Under the hood, Cube is the only platform that automatically transfers data from any spreadsheet into a multi-dimensional database. By connecting all essential data sources, Cube intelligently maps and standardizes information into a single source of truth. The result is financial intelligence that can be easily analyzed, shared across the business, and trusted to support faster, better-informed decisions.

Key features

- Automated data consolidation for a unified view of financial performance across all systems

- Bi-directional Excel and Google Sheets integration so your team can forecast and report in familiar tools

- Conversational AI apps for Slack and Teams that provide instant answers to finance questions in plain English

- Custom reports and dashboards to share insights into your cash flow patterns, cash runway, budgeting, expenses, and more.

- Project future cash flows based on different scenarios to anticipate cash shortages or surpluses and make informed decisions to manage liquidity

- Smart forecasting that uses historical trends and drivers to generate AI-assisted forecasts so teams refresh outlooks quickly and pressure-test new assumptions with less manual work

- Intelligent mapping that converts plain language mapping rules into structured dimensions and hierarchies so changes cascade consistently across entities, accounts, and models

Integrations

To perform advanced cash flow management in familiar environments, Cube seamlessly connects tools like:

- Spreadsheets: Microsoft Excel, Google Sheets

- Accounting and finance tools: Oracle NetSuite, Intuit QuickBooks, Sage Intacct, Xero, PeopleSoft

- HR and ATS tools: ADP, Greenhouse, SAP SuccessFactors, Workday

- Billing and operations: ChargeBee, Zuora

- Sales and marketing workflows: Hubspot, Salesforce

- Business intelligence capabilities: Power BI, MongoDB, Tableau, Microsoft Azure SQL

Don't see what you're looking for? View all Cube integrations.

Pros

- Provides immediate visibility into cash positions so teams can react quickly and avoid liquidity surprises.

- Saves hours of manual work by automatically consolidating financial data across sources.

- Builds confidence in reporting with accurate, audit-ready cash flow statements.

- Helps leaders make smarter investment and spending decisions with reliable forecasting.

- Shortens planning cycles by keeping everyone aligned on the same real-time numbers.

- Reduces risk of errors and compliance issues through built-in controls and clear data governance.

Cons

- Doesn't provide multilingual support as of this article's publishing date

Customer review ratings: Capterra: 4.6/5

Pricing: Cube starts at $30,000 annually, with custom plans to fit the specific needs of your organization.

See detailed pricing.

2. Vena Solutions

Best for: FP&A teams using AI copilots in Microsoft ecosystems

Vena Solutions is a cloud-based financial planning and cash management system that enables financial teams to handle all of their financial data better. This software has many solutions and tools to help facilitate better financial planning, cash flow management, financial reporting, and more.

Key features

- Driver-based modeling to better predict financial outcomes

- AI capabilities to enhance forecasting accuracy with deeper insights

- Workflows that take you through your modeling process step by step

- Central security database with encryption that supports access controls

Integrations

Vena Solutions has a robust array of integrations, pairing with Excel, Dynamics 365 Business Central, and SQL Server and facilitating seamless data handling within the Microsoft ecosystem. It connects with popular accounting and finance platforms such as Oracle, Sage Intacct, SAP, NetSuite, Salesforce, and Intuit QuickBooks. Vena also supports integrations with collaboration tools like OneDrive, SharePoint, and Dropbox, as well as data visualization through Power BI.

Pros

- Provides knowledgeable guidance through a responsive support staff

- Offers flexible reporting options that simplify data analysis

- Enables mobile access so users can work from anywhere

Cons

- Presents a steep learning curve for many users

- Slows down when running large or complex reports in the cloud

- Depends on consultants to build and maintain models

- Limits functionality for Mac users compared to PC users

- Excludes integration with Google Sheets

Customer review ratings: Gartner: 4.5/5

Pricing: Vena doesn’t provide any set monthly pricing information. They offer a 7-day preview and will give you a demo of their software to help you decide if you contact them.

3. Anaplan

Best for: Large enterprises needing AI-driven, cross-functional scenario planning and analysis

Anaplan is a cloud-native cash management app that helps orchestrate better business performance. It’s designed to help businesses of all sizes solve financial-related challenges. Using the suite of tools in the Anaplan platform, users can streamline financial processes and better understand everything from day-to-day cash flow to complex financial solutions.

Key features

- Scenario modeling that analyzes various pathways to understand potential impacts

- Sales and purchase forecasting to align resources accordingly

- Employee cost predictions so you can plan for future employee-related expenses

- Currency-specific risk management to handle fluctuations in currency value

Integrations

Anaplan enhances its capabilities through integrations with Google Sheets and Microsoft 365, Microsoft Excel, and Microsoft PowerPoint, facilitating robust data manipulation and presentation. Anaplan’s integration with Salesforce supports seamless CRM data management, while integrations with Boomi, Informatica, MuleSoft, and SnapLogic enhance data integration across various systems. For advanced analytics, Anaplan integrates with Power BI and Tableau. Additionally, Cloudworks, DocuSign, and Workiva Chains integrations expand their functionality for document management and workflow automation.

Pros

- Links to any number of planning streams through one dashboard

- Offers an intuitive UX with a good deal of customizability

- Enables analysis down to a granular level

- Pulls detailed real-time reports in just a few clicks

Cons

- Demands a steep learning curve for smaller businesses

- Limits Excel integration to an add in that runs on specific machines

- Offers limited report layouts and formatting options

- Forces users to abandon and rebuild existing models

Customer review ratings: Capterra: 4.3/5

Pricing: Anaplan has four different pricing plans, although they do not have any set pricing plans. You’ll need to talk with a member of their team to work out a custom plan that meets your needs.

4. Workday Adaptive Planning

Best for: Enterprises seeking unified financial, workforce and operational planning at scale

Adaptive Planning by Workday is an enterprise-level budgeting and financial planning software. This software facilitates financial planning and collaboration across an entire organization without needing spreadsheets and other manual processes.

You can easily create budgets and forecasts, run scenarios, and track expenses and sales. You can also create custom cash flow schedules and sheets.

Key features

- Comprehensive tools for creating and managing budgets and forecasts

- Workforce planning to reduce uncertainty around employee expenses

- Sales goal planning that aligns with financial plans and forecasts

- Capital planning to track an additional strand of cash flow impacts

- Scenario modeling to evaluate and compare various pathways

- Performance management to assess your achievements against financial goals

Integrations

Workday Adaptive Planning shares standard integrations with Microsoft Excel, and major ERP systems like Oracle, NetSuite, SAP, and Sage Intacct. The platform supports Salesforce for CRM data synchronization and integrates with Microsoft Dynamics (Great Plains), Deltek Vision, Epicor, Plex, and Multiview, providing support across various business functions.

Pros

- Delivers robust cash flow features without relying on spreadsheets

- Provides detailed audit trails that support compliance

- Generates strong financial insights through reporting features

- Visualizes future cash flows with scenario planning and forecasting tools

Cons

- Differs from Excel logic, which increases training requirements

- Lacks compatibility with Google Sheets and limits Excel use

- Extends onboarding timelines significantly

- Prevents users from retaining or enhancing existing models

Customer review ratings: G2: 4.3/5

Pricing: Workday Adaptive Planning does not make any pricing plans public. They offer free trials and demos of their software and will work out a custom quote if you reach out to their team.

5. Planful

Best for: Enterprises needing AI-assisted close, consolidation and continuous planning

Planful is a cloud-based financial planning and analysis platform that is a robust solution for cash flow analysis and continuous planning. The platform is split into structured planning, dynamic planning, consolidation, and reporting. These elements take you through all the FP&A stages you need to get visibility into your financials and make informed decisions.

Key features

- Planful Predict uses artificial intelligence and machine learning for pattern recognition

- Driver-based cash flow forecasting to tweak specific areas of your business

- Financial close management to maintain accuracy and promptness in payment

- Workforce planning to stay on top of your payroll, recruitment costs, and more

- Scenario analysis to compare a range of strategies

- Financial consolidation across multiple entities for more detailed reporting

Integrations

Like most other tools, Planful integrates with Microsoft Excel, Salesforce, Google Sheets, Oracle, NetSuite, and Sage Intacct. Beyond that, you can link up with Google Drive, Microsoft Dynamics GP, Intuit QuickBooks, and less common apps such as Paylocity, Workday, Acumatica, ADP, and Boomi.

Pros

- Delivers flexible templates for budgeting, forecasting, and analysis

- Handles complex reporting requirements effectively

- Automates processes such as scheduling and data syncing to save time

- Offers an interface that feels familiar to Excel users

Cons

- Presents a steep learning curve with limited training support

- Provides limited spreadsheet integrations

- Users must rely on consultants to build and maintain models

Customer review ratings: Capterra: 4.3/5

Pricing: Planful doesn’t make any pricing plan public. You’ll need to reach out to their sales team for a quote.

6. Centage

Best for: Finance teams seeking automated budgets, forecasts, and scenario planning

Centage is a cloud-based intelligent planning, budgeting, and forecasting platform. This software delivers a sophisticated financial intelligence tool that helps organizations of any size better manage their financial data. With clear visibility of financial health and intelligent insights, Centage helps organizations make faster decisions.

This software has a robust suite of financial tools, an intuitive UI, a long list of integrations with other tools, and much more.

Key features

- Budgeting and forecasting to plan future financial performance based on historical data

- Scenario planning to evaluate the impact of various options

- Consolidated reporting for quick analysis of your overall performance

- Workforce planning to manage expenses and needs without any hiccups

Integrations

Centage integrates with a variety of financial platforms including Intuit QuickBooks, NetSuite, Sage Intacct, and Blackbaud Financial Edge NXT. You can run enterprise resource planning through Microsoft Dynamics 365 Business Central and SYSPRO and specialize with Sage 300 Construction and Real Estate.

Pros

- Provides real time data that enables quick reactions to market changes

- Offers high levels of customization for different business needs

- Handles multiple departments and entities effectively

Cons

- Longer implementation timelines and costs

- Difficult onboarding process for non technical users

- Data duplication and deletion errors when integrating or updating

- Limits scalability with fewer features for large organizations

Customer review ratings: Capterra: 4.0/5

Pricing: Centage does not provide any set pricing plans. You can get a quote and see a demo of the software by reaching out to their sales team.

7. Abacum

Best for: Mid-market FP&A teams using AI-native, collaborative planning models

Abacum is an FP&A tool that helps finance teams at mid-market companies create faster revenue forecasts and OPEX breakdowns. They're a cloud-based tool that gets you out of Excel and into their planning platform. It includes AI features such as forecasting, summaries, anomaly detection, and classification to support planning and reporting workflows. Abacum also supports collaborative budgeting and forecasting with templates, approvals, permissions, and scenario planning, plus dashboards and exports for sharing outputs across teams.

Key features

- Revenue planning to forecast and manage incoming cash flow and support business growth

- Headcount planning to assess future workforce needs and costs

- OPEX planning to manage and forecast operational expenses

- Performance management to identify strong areas and those that need more attention

- Investor reporting to communicate financial performance to shareholders

Integrations

Abacum boasts a broad range of integrations from Microsoft Excel and Google Sheets, through NetSuite, Intuit QuickBooks, Sage Intacct, and Xero, all the way to HR apps like HiBob, BambooHR, Workday HR Management, Gusto, and Factorial HR. In terms of data analytics, Abacum integrates with Tableau, Looker, Snowflake, and BigQuery, while Stripe and Chargebee handle billing and subscription management.

Pros

- Features a modern and intuitive user interface

- Enables easy sharing across teams and departments

- Provides a responsive and supportive customer success team

Cons

-

- Requires replacement of existing Excel models

- Offers fewer integrations than competitors

- Demands additional training sessions due to a steep learning curve

Customer review ratings: G2: 4.8/5

Pricing: Abacum does not have transparent pricing. You'll need to contact their Sales team to get more information.

8. Causal

Best for: Startups and SaaS teams building models outside spreadsheets with connected data

Causal lets you build and share financial models with interactive, visual dashboards. It's mostly a modeling and reporting platform geared toward small businesses. It uses plan-English formulae to build models out of variables, making them easier for non-finance folks to understand.

Causal integrates with Excel and Google Sheets but you won't be working in spreadsheets with Causal. Instead, you'll use their UI.

Key features

- AI account analysis and financial model generation for streamlined workflows

- Human readable formulas in plain English for easy understanding by non-experts

- Multi-dimensional modeling to account for more factors

- One-click scenarios to generate quick scenarios evaluating different outcomes

- Cohort modeling to analyze financial data by similar entities

- Built-in currency conversion to manage and convert multiple currencies in financial models

Integrations

Causal integrates with Google Sheets and BigQuery, as well as major HR platforms like Bob, Gusto, and Humaans to get payroll data in one place. For accounting and finance, Causal supports NetSuite, Intuit QuickBooks, Xero, and PostgreSQL, while Salesforce and HubSpot integrations enable efficient CRM data management. Snowflake, Looker, and Puzzle offer advanced data visualization and analysis, and Stripe allows for smooth billing and payment processing.

Pros

- Provides variable based formulas and driver based scenarios

- Delivers dashboards that are easy to share across teams

Cons

- Presents a steep learning curve even with provided documentation

- Slows down performance due to heavy processing requirements

- Scales poorly as models and datasets increase in size

Customer review ratings: G2: 4.6/5

Pricing: Pricing isn't available on their website.

9. Tesorio

Best for: Finnce teams focused on AR, collections, and cash-flow visibility

Tesorio is an "A/R Cash Flow Performance Platform" designed to replace cash flow forecasting and collections processes. Its key value is allowing teams to collect cash faster. Tesorio synchronizes with ERP systems so that nothing slips through the cracks.

Tesorio isn't a complete FP&A platform and gets your cash flow management out of spreadsheets, so that's a consideration for scaling teams.

Key features

- Cash aggregation to consolidate cash flow data from various sources

- Search analysis so you can quickly navigate and analyze financial data

- Unified account reporting that combines accounting data into one handy dashboard

- Risk assessment that evaluates and manages unforeseen circumstances

- Dunning management to automate customer overdue payment reminders

Integrations

Tesorio has an impressive integration list, with Google Sheets handling data manipulation, Intuit QuickBooks for comprehensive accounting capabilities, and Stripe, Sage Intacct, Xero, and NetSuite ensuring robust financial data integration.

Snowflake provides advanced data analytics, while Workday and Blackbaud are for HR and non-profit financial management. It links to Acumatica and PLEX for manufacturing and business management solutions while security and identity management are enhanced with Okta, OneLogin, and Azure integrations.

Pros

Cons

- Struggles with performance on large data sets

- Functions as a specialized tool that lacks broader FP&A support

- Needs further control on what users can import and not import from their systems

Customer review ratings: Gartner: 4.2/5

Pricing: Tesorio requires a demo for pricing.

10. Prophix

Best for: Mid-market organizations standardizing planning, reporting, and close on one platform

Prophix is a cloud-based financial performance platform that helps companies budget, consolidate data, plan, and report. Like many other tools on this list, Prophix is designed to rip and replace the spreadsheet with new software.

Key features

- Financial consolidation that combines data from multiple sources into one place

- Close management to stay on top of payments

- Automations and workflows across the board to streamline repetitive processes

- AI insights that pick up on opportunities and risks you may not notice yourself

- Microsoft 365 add-ins give you a broader spectrum of functionalities

- Intercompany management so you can isolate specific areas or visualize the business as a whole

Integrations

Prophix integrates with the Microsoft suite like many other products on this list. When it comes to ERP systems, it features a detailed list of options such as Acumatica, Deltek, Ellucian, QAD, Sage Intacct, SYSPRO, TOTVS, and Viewpoint.

Pros

- Provides robust consolidation features for easy organizational changes

- Delivers powerful ad hoc reporting capabilities

- Gives ability to setup company structure

Cons

- Extends implementation timelines beyond expectations

- Requires purchase of extra support hours due to consultative support model

- Struggles with limited reporting designs

Customer review ratings: G2: 4.4/5

Pricing: Requires a demo.

11. HighRadius

Best for: Enterprises automating order-to-cash, treasury, and financial close workflows

HighRadius is a fintech enterprise SaaS company that sells AI-based technology to help companies automate their cash management processes. They offer solutions for autonomous receivables and autonomous treasury, optimizing processes across order-to-cash, treasury, and record-to-report cycles.

Key features

- Automated collections and treasury payments

- Cash application management to add efficiencies to your workflows

- Credit management to assess and manage customer credit risk

- Payment gateway for SAP to streamline payment processing

- Anomaly management that lets you identify and manage financial anomalies

Integrations

HighRadius integrates with popular ERP systems like Microsoft Dynamics 365 Business Central, SAP, NetSuite, and Sage Intacct. It also supports HR and financial platforms like Workday and Stripe for streamlined payment processing. In terms of banking institutions, HighRadius connects with major banking institutions such as JPMorgan Chase & Co, Bank of America, BBVA, and Wells Fargo. Additionally, it integrates with Salesforce for CRM, Prophix for financial planning, and logistics providers like UPS, FedEx, Target, and Walmart.

Pros

- Automated bank reconciliations acriss accounts

- Provides continuous global cash visibility

- Maintain rolling short-term cash positions

Cons

- Runs slowly for some users, creating unnecessary delays

- Provides limited accessto support and documentation

- Presents a sleep learning curve that complicates setup and onboarding

Customer review ratings: G2: 4.3/5

Pricing: HighRadius directs you to a consultant who assesses your level of customization before making a quote.

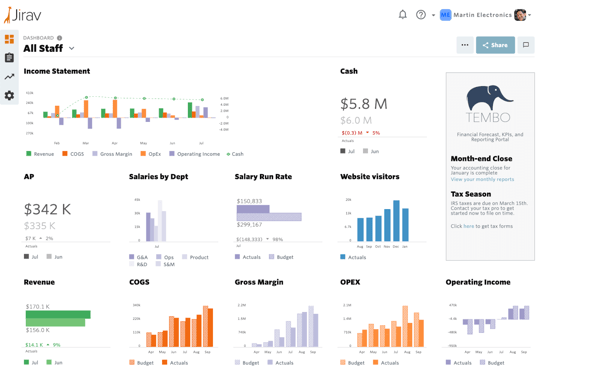

12. Jirav

Jirav is a driver-based planning tool that replaces your Excel model. Jirav has cash flow analysis and forecasting capabilities, so it's an option for teams who want a different approach to their cash management. Jirav is best for small-to-medium-sized businesses that aren't reliant on their Excel models.

Key features

- Industry-specific KPIs to get the most relevant metrics for your company

- Board-ready reporting templates for quicker and clearer cash flow presentations

- Departmental reporting to pinpoint the financial health of specific teams

- Budget vs actual analysis to accurately analyze your performance

- Annual operating plan to develop and manage yearly projections

- Rolling forecasts to give you the most up-to-date information at all times

Integrations

Jirav offers a huge range of integrations covering accounting software like Intuit QuickBooks, Xero, NetSuite, and Sage Intacct, as well as data processing classics such as Microsoft Excel and Google Sheets. For payroll and HR management, Jirav integrates with ADP, Gusto, Paychex, Justworks, BambooHR, Paylocity, TriNet, and UKG, while CRM integrations include Salesforce, HubSpot, and PipeDrive.

Additionally, Jirav connects with data-handling apps like Google Analytics, Tableau, Snowflake, Google BigQuery, Amazon Redshift, Microsoft SQL Server, MySQL, and PostgreSQL. Stripe and Shopify help e-commerce users, while Jira and Zendesk help you organize cash flow management projects.

Pros

- Shares dashboards easily with team members

- Tracks budgets in real time

- Provides granular visibility into financial data

- Creates custom tables for detailed reporting

Cons

- Runs slowly at times

- Provides limited integration options

Customer review ratings: G2: 4.5/5

Pricing: Pricing isn't available on its website

13. SAP Cash Management

Best for: Enterprises centralizing cash positions, liquidity planning, and bank management

SAP Cash Management is part of the larger SAP ecosystem. It supports cash and liquidity management, cash flow forecasting and planning, and bank relationship management within the SAP ecosystem. It centralizes bank account administration with workflow-based processes for opening, changing, closing, and reviewing accounts, along with monitoring bank fees and exchanging information with banking partners. It generates current cash positions using integrated bank connectivity, produces short-term cash forecasts, and supports analysis of actual cash flows alongside medium-term liquidity trends with drill-down to source documents. It also supports AI-enabled liquidity planning, cash pooling automation, bank transfers, and tools to compare historical cash flows against projected and planned cash flows.

Key features

- Bank relationship management to maintain transparency with financial entities

- Cash flow forecasting for planning and presentations

- AI simulations and projections for quicker, more accurate predictions

- Historical comparison and analysis for accurate insights into risks and performance

- Cloud deployment for scalability and flexibility, especially with remote teams

- Real-time visibility of global cash positions

Integrations

Integrations include SAP S/4HANA Cloud, SAP SuccessFactors Employee Central Payroll, and SAP ERP HCM Payroll. SAP Master Data helps you maintain accurate and consistent financial data across the organization, while SAP Concur is great for efficient travel and expense management. That said, the lack of third-party integrations is highly restrictive for most cash flow managers.

Pros

- Integrates seamlessly for organizations already using SAP ERP

- Delivers real time access to accurate cash information

- Provides a centralized single version of the truth with a business-wide view of bank balances and liquidity forecasts

Cons

- Requires high costs and extensive workarounds outside of SAP ERP

- Demands a steep learning curve for those unfamiliar with SAP

- Uses a per-user licensing model tied to contract terms, which can make scaling access expensive across large teams

Customer review ratings: G2: 4.5/5

Pricing: SAP requires you to request a demo before discussing pricing structures.

14. Kolleno

Best for: Organizations managing AR, credit risk, and collections.

Kolleno is a "smart credit control platform" and automated accounts receivable solution for businesses looking to streamline their financial operations. It helps finance teams with payment processing, improved credit control, and accuracy in their accounts.

Key features

- Accounts receivable management

- In-built to-do lists to manage tasks and projects, leaving nothing to fall through the cracks

- Automated task and workflow creation that saves time and streamlines workflows

- AI cash application that learns from your past actions and applies them to current projects

- Real-time interactive dashboards give you a continuous view of your financial health

Integrations

Kolleno streamlines your accounts receivable and cash flow management processes through integrations with payment processing systems like Stripe and GoCardless. It also connects with major accounting software such as NetSuite, Intuit QuickBooks, Microsoft Dynamics 365 Business Central, Xero, and Sage Intacct.

Pros

- Automates many manual tasks like collections and forecasting

- Provides ready made reports that simplify financial tracking

- Uses AI chatbot to diagnose problems

Cons

- Delivers reports can be too simple for advanced needs

- Presents a sleep learning curve with limited documentation

- Requires more robust and customizable reporting tools

Customer review ratings: G2: 4.9/5

Pricing:

- BusinessPay: $80/month

- Business Plus: $650/month

- Enterprise: Custom

15. PlanGuru

Best for: Businesses the want to build dynamic financial forecast

PlanGuru is a planning tool for budgeting, forecasting, and performance reviews for small and mid-sized companies. It integrates with Quickbooks and Excel, making it easy to use and use for cash management. It supports integrated 3-way forecasting across the income statement, balance sheet, and cash flow statement, with 20+ forecasting methods and custom drivers, including non-financial inputs. Users can import historical actuals through general ledger utilities, then run budget vs actual reporting and rolling forecasts on a recurring basis.

Key features

- Budgeting and forecasting to create detailed models

- Automatically solved cash flow statement to reduce time-consuming admin

- In-built financial statement structure to optimize financial reporting

- Quick-glance financial ratios to monitor progress quickly

- Web-based dashboards that display KPIs to you and your clients

Integrations

PlanGuru doesn’t advertise a great deal of integrations. However, it does cover some of the most common, including Microsoft Excel, Xero, and Intuit QuickBooks

Pros

- Incorporates customer feedback into continuous improvements

- Enables quick and easy scenario planning

- Keeps all financials and budget in one place

Cons

- Makes sharing reports difficult

- Lacks integrations with payroll and other systems

- Takes several months to get fully implemented

Customer review ratings: Capterra: 4.2/5

Pricing

- Single Entity: $83/month

- Multi-Department Consolidations: $250/month

16. Float

Best for: Businesses creating cash flow forecasts linked to their accounting system

Float is designed primarily for cash flow forecasting and scenario planning. It integrates with Xero, QuickBooks Online, and FreeAgent accounting software, with real-time data syncing. Float uses this data to display a company’s financial future on detailed forecasts and models so they can make more informed decisions regarding their cash flow.

Float is great for teams that deal with complex project-based financial planning, offering tools to assess outcomes based on varying scenarios.

Key features

- Instant forecasts with real-time data syncing

- Sales pipelining to monitor cash flow at specific stages

- Hiring management to keep control of onboarding and payroll costs

- Project performance tracking at a granular level

- Comparative scenario planning to assess different options

Integrations

Float connects you to a range of accounting, calendar, productivity, and project management tools. Chief among them are the Microsoft and Google suites, but you can also find Intuit QuickBooks, FreeAgent, Xero, Slack, Trello, Asana, and Jira to streamline your cash flow forecasting and management.

Pros

- Delivers visual forecasting that make scenario planning intuitive

- Provides a clean and straightforward interface that makes it easy even for non-experts

- Enables forward and capacity planning

Cons

- Limited reporting capabilities don’t offer the depth that many larger businesses need

- Laser-focused functionality on cash flow and few integrations neglects areas like expense tracking and revenue analysis

Customer review ratings: G2: 4.4/5

Pricing: The pricing depends on your current annual revenuce, but starts at $31/month

17. Agicap

Best for: Finance and treasury teams managing daily cash AP, and AR

Agicap is a treasury management platform that helps businesses monitor cash flow, optimize payments, and improve forecasting. The software centralizes accounts payable and receivable, connects directly with banks and ERP systems, and provides real time visibility into cash positions. With more than 8,000 finance teams using Agicap, the platform focuses on helping organizations make faster and more reliable financial decisions.

Key features

- Provides treasury management tools that deliver real-time cash visibility and future forecasts

- Connects banks and ERP systems to create a single source of truth across financial data

- Automates reconciliation with AI powered matching of bank transactions and invoices

- Creates customizable dashboards and reports for analysis and collaboration

Integrations

Agicap connects directly with global banking systems and ERP platforms to unify data and streamline treasury workflows. The platform supports real time synchronization of customer and supplier data, simplifies reconciliation, and redistributes information across accounting and business tools. Agicap integrates with Xero, QuickBooks, and Sage for accounting, NetSuite and Microsoft Dynamics for ERP, and connects with more than 400 banks worldwide. It also supports two way data sync through API and SFTP, giving finance teams flexibility to continue using their existing systems.

Pros

- Provides complete visibility into daily liquidity and cash forecasts

- Automates payable and receivable workflows to save time

- Connects seamlessly with banks and ERP systems for reliable data

- Delivers intuitive dashboards that simplify reporting and collaboration

Cons

- Limits functionality for highly complex corporate structures

- Presents a learning curve for finance teams new to treasury management platforms

Customer review ratings: G2: 4.4/5

Pricing: Offers personalized demos and pricing.

What Reddit is saying about cash flow software

Reddit accounting users treat Excel as the default starting point for cash flow, but most agree it breaks once you need daily or weekly views across multiple properties or entities. At that stage, manual updates, version chaos, and missing context become a real bottleneck for finance teams.

Across the threads, a few themes keep coming up:

- Excel works, until it doesn’t. Many accountants see spreadsheets as a good starting point, especially when AR and AP stay accurate and you track a 13-week cash flow by property or entity. Once you spend significant time updating and fixing formulas, it usually means the process has outgrown basic spreadsheets.

- Daily and weekly visibility is the breaking point. Commenters say monthly cash views are manageable in Excel, but daily or weekly forecasting across multiple locations quickly turns into a bottleneck. At that stage, teams start looking for tools that connect directly to banks and accounting systems instead of relying on manual updates.

- Structure matters as you scale. As businesses add entities or properties, people stress the need for clear templates, consistent charts of accounts, and a single source of truth for actuals, budgets, and forecasts. Without that structure, version chaos becomes a recurring problem.

- Real estate and rentals add extra complexity. Rentals introduce staggered rents, renovations, and seasonality, so Reddit users recommend separating cash views by property while still keeping a portfolio-level rollup. That layered view helps with both near-term liquidity and expansion decisions.

- Short-term, rolling views are the default. A common pattern is daily cash tracking for the next week, weekly forecasting for the next 13 weeks, and monthly views beyond that. People see this as the minimum setup to keep an expanding business or portfolio on top of upcoming gaps and funding needs.

One FP&A user who rolled out Cube with NetSuite says it “keeps us in Excel but adds structure, live NetSuite sync, and way less version chaos,” and that monthly close, budget vs. actuals, and rolling forecasts became much smoother once Cube sat between spreadsheets and the GL.

Benefits of cash flow management software

Not sure how software can improve your cash flow management? Here are some of the best benefits of using cash management tools:

1. Better visibility into your ending cash balance

Cash flow tools make it easy to see the impact of net income on your cash flow statement.

For example, you buy a new piece of equipment and want to see how its depreciation affects your ending cash balance. Based on the logic you've built into the software, you can expect the status of current and future assets to populate directly on your cash flow statement. With a better view of your ending cash balance, you can immediately assess the financial health of your business.

All of these steps are possible through manual work, but cash flow management software reduces the risk of errors and accelerates the processes so you can monitor your balance and be more agile in reacting to it.

2. Access to real-time data

Accurate, up-to-date cash flow data is at the core of informed financial decisions. Cash flow software integrates with your accounting platform and bank accounts, so every sale, expense, and transfer is fed into one central database. These immediate updates give you a real-time snapshot of your current financial position at any time, even outside of office hours.

Previous cash flow systems would rely on periodic data transfers, rather than immediate updates. Therefore, when speaking to shareholders or superiors, finance teams would need to qualify their figures with projected estimations, leading to confusion and a lack of clarity.

With the best cash flow tools, you can now give an accurate, convincing report of how much cash is flowing into and out of your business at any time.

3. More profitable business decisions

Detailed insights into financial data fuel more profitable business decisions from inventory management to risk mitigation. It’s not just about knowing how much cash is available at a given moment. Automated financial platforms analyze income and expenditure patterns to pinpoint areas that improve profitability. For instance, they can identify the most profitable products or services so businesses can adjust their sales strategies to capitalize on high-margin items.

Cash flow software that integrates with inventory management alerts you to purchase when prices are low and prevents you from overstocking. This dynamic approach to inventory management maximizes your return on investment when compared to less communicative purchasing strategies.

Forecasting features empower businesses to evaluate the financial implications of different decisions. With these insights, you can better mitigate risks and avoid choices that lead to cash shortages or unnecessary stress.

Sure, most finance teams are more than capable of adopting these decisions by themselves. However, cash flow tech sees everything everywhere all at once, getting to the same conclusion with far less investment in time and resources.

4. Efficient use of time and money

For every software innovation like integration, automation, and artificial intelligence, the direction of traffic is the same, increased productivity in a shorter time frame and on a lower budget.

Cash flow management software combines all of these breakthroughs to save hours of manual work and runaway project budgets. They simplify routine but time-consuming tasks like data entry, transaction reconciliation, and report generation, allowing teams to focus on more strategic thinking that adds value to the business.

Automated data flow between apps not only saves time and effort in the short term but also reduces the likelihood of costly errors. And while it’s impossible to completely eliminate mistakes, smart accounting tools significantly impact the extent and frequency of crises.

5. Easier to collaborate

Cash flow software gives finance, accounting, and operations a shared view of inflows, outflows, and timing. Stakeholders review the same dashboards, add comments, and update assumptions without trading versions back and forth. That shared workspace reduces email chains, keeps context in one place, and helps teams align on the same numbers before they make decisions.

How to choose the best cash flow management software

Ease of use

A user-friendly interface tops the list, enhancing adoption and productivity by reducing the learning curve. Essentially, a well-designed tool simplifies your daily operations, rather than adding complications. Usability includes devices too; if you’re often on the go, the ability to access and manage cash flow from your phone is crucial.

Look out for cash flow management software with a clear, intuitive layout with easy navigation. SAP may cover all possible bases, but all those features and customizations are overkill for companies that only need a minor streamlining of their current processes.

Integration capabilities

Seamless integration with existing systems is equally crucial, preventing data silos and ensuring a unified financial ecosystem. Constantly switching between programs can be extremely frustrating when the pressure is on, so ensure your systems sync together easily.

Unless you’re going for an all-in-one platform, check that your cash flow integrates with existing accounting, ERP, and banking software. Real-time data sharing between apps gives you a single source of truth, enhancing reliability and decision-making.

Accuracy and automation

Forecasting capabilities are paramount in financial planning and analysis, and the more accurate your forecasts, the more confidence you have in creating strategies and roadmaps. Integrations will reduce the risk of human error by automatically entering data, but that’s not the end of the story. Workflow automation can standardize recurring tasks like updates, approvals, and report runs so your cash flow process follows the same reliable steps every time.

Error-checking algorithms can flag anomalies, adding another level of accuracy to your reports and forecasts. Many cash flow management solutions also include audit trails that record all data changes so you can easily verify and correct potential mistakes.

Real-time analytics and reporting

The software's ability to provide real-time data access is a game-changer, allowing for agile cash management strategies. When you’re safe in the knowledge that you’ve got accurate information to hand, you can be more decisive, rather than putting off decisions until you can verify your data.

Tools with up-to-date data are ubiquitous now, so you shouldn’t have much trouble finding an application that meets your needs. Where it gets interesting is how they leverage immediate data transfer. Will your real-time updates identify trends, forecast future cash flows, and alert managers to potential cash shortfalls before they become problematic?

Customization and scalability

Customization options are key to tailoring the software to unique business needs. More than tailoring your tool to your way of working, flexible platforms allow you to seamlessly scale as your business expands.

Features like customizable dashboards, adjustable reporting capabilities, and the ability to handle increased transaction volumes all help you avoid frequent upgrades or replacements. Check customer testimonials to see if the company’s claims align with reality.

Cost-effectiveness

Lastly, cost-effectiveness is a fundamental consideration, encompassing licensing fees, implementation costs, and additional expenses. By meticulously evaluating these aspects, businesses can make an informed choice, aligning their cash flow software with both current requirements and future financial success.

Many modern FP&A tools pitch their product through a return on investment calculator. While these are unlikely to be 100% accurate, they at least help you think beyond up-front costs and subscriptions.

Forecasting models

When you compare tools, look at how they actually build a forecast, not just the charts on the homepage. At a minimum, you want support for:

- Short-term, day-by-day or week-by-week views so you can see if cash might tighten in the next 30–90 days.

- A 13-week rolling cash flow that updates as new data comes in, which is the standard many accountants use for planning near-term liquidity.

- Longer-range monthly views that tie into budgets and FP&A roadmaps.

Good forecasting models let you blend history and assumptions. Historical payment patterns, seasonality, and typical DSO / DPO help anchor the baseline. On top of that, you should be able to add driver-based assumptions such as new hires, pricing changes, new locations, or capex plans. The benefit is simple, you see how changes in the plan ripple into your bank balance before you commit.

Multi-bank connectivity and management

Cash flow software should not live in isolation. A strong platform connects directly to your banks and core finance systems so you see the real cash position without logging into five portals and pasting exports into a spreadsheet.

Key things to look for include:

- Multi-bank feeds in one view so you can see all accounts, entities, and currencies in a single dashboard.

- Clear mapping between bank accounts and your GL, so inflows and outflows line up with how you already report.

- Support for multi-entity structures where you can drill into one subsidiary or roll everything up to group level.

- Operational details like user roles, approvals for bank-related changes, and audit trails on who updated what.

When connectivity works well, your short-term forecast builds on real balances and recent movements, not on yesterday’s CSV. It also supports daily treasury tasks like rebalancing cash across accounts, spotting idle balances, and checking that expected receipts and payments actually landed.

Scenario planning tools

Scenario planning is where cash flow software earns its keep. You want tools that let you test decisions before you live with them. For example:

- “What happens to cash if DSO slips by 5 days across the portfolio?”

- “Can we add headcount next quarter without dipping below our minimum cash threshold?”

- “How does a rent increase, new facility, or slower pipeline change our 13-week outlook?”

Look for features that let you:

- Clone your base forecast into best, base, and downside scenarios without rebuilding everything.

- Change key drivers (revenue, churn, payment terms, hiring plans, capex) and see the impact on cash in the same view.

- Compare scenarios side by side so finance and leadership can align on a plan instead of debating separate spreadsheets.

- Attach notes, assumptions, and approvals so each scenario has context, not just numbers.

Cash flow planning looks different for every business type

Cash flow tools all work with the same basic logic, yet the questions you ask and the views you need shift a lot by business model. It helps to start with where your revenue comes from, how predictable it is, and how complex your banking and entity structure has become.

Software and subscription companies

Subscription businesses care about recurring revenue, churn, and renewals as much as cash in the bank. You need cash flow views that line up with:

- Monthly and annual contracts, upgrades, and downgrades

- Card payments, invoices, and collections for different tiers

- Churn and renewal patterns that affect future inflows

The right setup will connect cash flow views to MRR, ARR, and retention so you can see how pipeline, renewals, and expansion deals change the cash picture, not just revenue on the P&L.

Global enterprises

Large companies juggle multiple entities, currencies, and banks. Cash flow planning here is as much about control and governance as it is about pure visibility. Typical needs include:

- A group view that rolls up many subsidiaries plus drill-downs by region or entity

- Short-term cash positions for each bank and currency

- Rules and approvals for intercompany movements and sweeps

SMBs and growing teams

Smaller teams usually start in Excel with a single-entity view. The breaking point arrives when:

- You add locations, products, or headcount and the model keeps changing

- You want daily or weekly views, not just a month-end check

- Version control and manual updates eat a big part of someone’s week

For these teams, the priority is clean data coming in, a clear short-term forecast, and a setup that can grow without turning into a second full-time job. That often means a 13-week cash view tied to the accounting system plus simple scenarios for hiring, new projects, and debt.

Industry-specific businesses

Different sectors carry different cash stresses, even at the same revenue level:

- Manufacturing and construction deal with long lead times, deposits, retainage, and inventory that ties up cash.

- Retail and ecommerce feel seasonality, returns, and payment delays from marketplaces and processors.

- Services and agencies rely on milestones, retainers, and utilization, so timing of invoices and staffing decisions matter more than physical inventory.

- Real estate and rentals care about unit-level cash views, renovations, vacancies, and debt service across properties.

Cash flow planning works best when it mirrors these realities. The more your views match how money actually moves in your business, the easier it is to spot gaps early and decide what to adjust: terms, spend, hiring, or investment timing.

How to measure the ROI of cash flow management software

If you are going to invest in cash flow software, you need a clear way to prove it is paying off. The easiest path is to define a small set of metrics before implementation, then track how they change over the next 6 to 12 months.

Here are practical metrics finance teams usually monitor:

- Days Sales Outstanding (DSO): Watch how your DSO changes after you roll out new workflows and visibility tools. Track both the overall DSO trend and the portion of receivables that sit past 60 or 90 days so you can see if cash is coming in sooner or still getting stuck.

- Time spent on cash tasks: Measure how many hours per week go into forecasting, reconciliations, collections follow-up, and bank portal checks before and after implementation. This shows labor savings and delayed hiring.

- Forecast accuracy: Compare forecasted vs actual cash balances at 7, 30, and 90 days. Over time, good tools tighten that gap so you trust the forecast enough to make hiring, financing, and investment decisions.

- Working capital and cash buffers: Track changes in working capital (AR, AP, inventory where relevant) and the size of your cash buffer. Many teams see they can hold a smaller buffer once they trust real-time visibility, which frees cash for growth.

- Collections and payment behavior: Watch collection cycle length, dispute rates, and the percentage of invoices that are current vs overdue. You can also track promise-to-pay follow-through where your team logs expected payment dates.

- User adoption and automation rate: Track how many users log in, how often they use the tool, and how many tasks (emails, reminders, allocations, reconciliations) now run automatically instead of by hand. High adoption is a leading indicator that ROI will sustain.

Typical benchmarks finance teams look for

Results vary by company size and complexity, but many teams aim for ranges like:

- DSO improvement of 10 to 30 days over the first year

- Reduction in manual time on forecasting and collections in the 60 to 80 percent range

- Forecast accuracy improving to 80 to 90 percent within a 30-day window

- Working capital gains of 5 to 20 percent, depending on how much was locked in slow collections or large buffers

If you want external proof points, you can link to public case studies where finance teams report concrete changes in DSO, forecasting time, and collections productivity after adopting cash flow platforms.

Choose the right cash flow management software for your business

Cash flow management doesn’t need to be a challenge or a chore. Referencing this list is a great place to start to enhance your existing financial tools with sophisticated analytical and forecasting features.

If you want to keep working in Excel and Google Sheets while adding more structure, Cube supports cash flow reporting with a connected planning model that ties actuals, forecasts, and scenarios together.

Cube brings agentic AI into a spreadsheet-native FP&A platform, so finance teams can use AI for analysis while keeping ownership of the narrative. With Cube, finance teams can run multiple scenarios across different plans, compare outcomes, and use dashboards to review headcount data in a single view for org design and budget discussions.

These teams focus on standardized cash reporting, policy compliance, and liquidity across regions, so forecasting and bank connectivity need to support that structure.

Want to learn why our customers trust Cube for cash flow management? Book a free demo today to see the benefits for yourself.

.png)

.png)

.png)

![17 best cash flow management software tools [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Dashboard%20Sheet.png)