What is balance sheet reconciliation?

A balance sheet reconciliation is where a company's assets, equities, and liabilities are double-checked and verified to be in alignment.

You fix any mistakes and reconcile the balance sheet if a number is wrong or not in the right place.

Think of it like a guitar: to get the best sound, you need to tune it every once in a while. The same is with accounts. They need regular reconciliation, or ‘tuning’, to ensure the big financial picture is accurate.

To illustrate, say you had a $500 payment received from a client, but an error on their part meant you only received $50. This would appear as an error when you’re going through the accounts.

Why is balance sheet reconciliation important?

A balance sheet account reconciliation gives a snapshot of what money is coming in, flowing out, and what’s left in the bank.

It’s essential to keep it regularly updated because if something’s out, by even one figure, it can throw off the big financial decisions business leaders make.

A reconciled balance sheet has a waterfall effect on other parts of the business and improves financial reporting. Some of the other areas where reconciling the balance sheet comes into play are:

Decision-making

Regularly reconciling the balance sheet means a business can be confident in its decisions without facing financial problems later. Expansion, investment, and growth all rely on the finances being tip-top.

Take, for example, a burger joint looking to franchise. It needs to know whether its planned growth is sustainable by accurately showing any debts, liquid cash, and other assets.

This picture will dictate whether it will open three or five new restaurants next year.

Fraud

Despite our best efforts, we can’t keep an eye on what all employees are up to. Some bad apples might take the opportunity to steal money from accounts, or goods from warehouses.

Account reconciliation can help track totals and spot if anything’s missing when it shouldn’t be. If the bank statements say one thing and the ledger says another, then it’s time to investigate.

Risk and compliance

Ever been audited? Then you’ll know you need up-to-date accounts for the process. A reconciled balance sheet also helps with managing risk in the business.

For instance, if a business has outstanding credit card debt that it didn’t know about, this can affect the spending budget for the next financial year. The company can mitigate the risk by cutting budgets to pay for the surprise debt.

What should balance sheet accounts look like?

A balance sheet should always have three sections: assets, liabilities, and owner's equity. These are the fundamentals of working out any financial position.

From there, the balance sheet will look different to each company’s needs. Most will have accounts receivable and accounts payable, any debt, and cash in the bank. You might need supporting documents, like receipts, financial statements, or a loan repayment schedule.

Want to see all this in action? Here’s an example of a reconciled balance sheet. Imagine it’s a start-up tech company with some modest fixed assets and liabilities, but it is doing well. Their accounts are fully reconciled in the example below.

Don’t forget the golden rule of accounting: assets = liabilities + equity. Below, we’ve highlighted in red which numbers should be the same.

| Account |

Starting balance |

Money in |

Money out |

Ending balance |

| ASSETS |

|

|

|

|

| Cash |

$5,000 |

$2,000 |

$500 |

$6,500 |

| Accounts receivable |

$10,000 |

$3,000 |

$1,500 |

$11,500 |

| Inventory |

$15,000 |

$5,000 |

$2,500 |

$17,500 |

| Prepaid expenses |

$1000 |

$500 |

$200 |

$13,000 |

| PPE |

$100,000 |

$20,000 |

$10,000 |

$110,000 |

| Total |

$131,000 |

$30,500 |

$14,700 |

$146,800 |

| LIABILITIES |

|

|

|

|

| Accounts payable |

$8,000 |

$2,000 |

$1,500 |

$8,500 |

| Accrued expenses |

$2,000 |

$1,000 |

$500 |

$2,500 |

| Long-term debt |

$50,000 |

$5,000 |

$2,500 |

$52,500 |

| Total |

$60,000 |

$8,000 |

$4,500 |

$63,500 |

| EQUITY |

|

|

|

|

| Common stock |

$25,000 |

$5,000 |

$0 |

$30,000 |

| Retained earnings |

$30,000 |

$38,800 |

$7,500 |

$53,300 |

| Total |

$55,000 |

$43,800 |

$7,500 |

$83,300 |

| Liabilities and equities total |

$115,000 |

$51,800 |

$12,000 |

$146,800 |

If the liabilities and equity don't match the same figure as the assets, there’s a problem. Going through each transaction line by line will determine the issue. Once the discrepancy is rectified, everything should match up.

It’s worth noting this is a fairly simple recipe for success, per se. Bigger companies will have more needs to meet. For example, our fictional tech company starts to scale up and develops customer bases in Europe and Asia. Great!

But here’s the rub: the marketing budget is then upped for those new markets, bank accounts are needed for money in different jurisdictions, and new investors come into the business. Balancing the books gets increasingly complicated as the organization grows.

The balance sheet reconciliation process

Now you understand the fundamentals of reconciliation, it’s time to get down to business. Here’s a step-by-step on how to do balance sheet reconciliations manually.

Gather supporting documentation

To start, you’ll need the general ledger and any information source to help cross-check balances. These could include invoices, a bank statement, or receipts. Check your chart of accounts to make sure you're not getting anything.

You'll need more supporting information if you have multiple accounts to reconcile. This is easier if you’re reconciling your accounts monthly or quarterly.

Cross-check the data

Compare each line on the balance sheet and check it with your supporting evidence. You can move to other balance sheet accounts if it matches up.

If it doesn’t, note the issue and look into it once you’ve finished cross-checking.

Investigate any differences

If you have a discrepancy on the balance sheet, look at the supporting evidence to see what might have gone wrong. Typical mistakes look like human errors, bank errors, and missing transactions.

A consistent pattern of errors suggests fraud or crime and needs remedying immediately. Senior stakeholders and investors may need to be alerted if the situation is serious.

Make your adjustments

Now it’s time to fix the error by making any necessary changes. You may need to add in missing transactions, fix debt figures that were slightly off, or contact the bank to get an updated statement from them.

Once everything is aligned, the closing balances should now all match up. Time to grab a beer!

How often should you reconcile balance sheet accounts?

The regularity of the reconciliation process depends on the company. Monthly balance sheet reconciliations are recommended, though more complex businesses may need weekly or daily checks.

Smaller companies will sometimes opt for annual reconciliation. This isn’t recommended for a few reasons: errors and potential fraud go unnoticed for longer.

Let’s say the imaginary tech company from earlier waits until the end of the year to close the books. An employee makes an error in how many laptops were purchased for new employees on the company credit card, adding an extra zero by mistake.

When all the extra laptops turned up, the employees just figured they were all getting an upgrade.

This puts the account balances on the company’s balance sheet out by thousands, but it’s only noticed at the end of the financial year. Investors and stakeholders aren’t happy. Had the start-up committed to monthly reconciliation, it would have noticed the significant debt much earlier in the year to rectify the issue.

That's why balance sheet integrity is so important.

How to simplify the balance sheet reconciliation process

Feeling overwhelmed with the reconciliation process each month? There are ways to make everything more efficient each month. From simple regular reviews to the world of software designed to make your life easier, reconciling the balance sheet doesn’t need to be arduous.

Simplify where possible

When a company scales quickly or merges with another business, this can lead to duplicating accounts and an overly complicated balance sheet. The best step is to step back and think about how to simplify things.

It’s worth looking over your entire reconciliation process to see if there are any ways time or resources could be saved. Perhaps data is coming in from two different sources that could be merged, or another source isn’t all that relevant.

Streamlining your reconciliation process will reward you with a simpler, more accurate picture of your business’s finances. Plus, your finance team will be thankful!

Get account reconciliation software

Mistakes happen, especially in complex accounts. Unfortunately, it’s not always simple to find the anomalies. This can make closing the books a pretty time-consuming process.

Account reconciliation software removes much of the labor associated with balance sheet reconciliation, especially for larger businesses. Many manual tasks can be automated, and the results are more accurate. Trust us, your accounting department will thank you for the investment!

These programs allow finance teams to concentrate on other important tasks while the software balances the books.

Improve your data input

Your data is like the foundations of a house. If the foundations aren’t up to scratch, the house will need repairs and start to fall apart. If the foundations are strong, the house will last for decades without being fixed up.

The quality of your data is crucial for a balance sheet. Making sure everything is as accurate and complete as possible, having a data management system, and keeping data up-to-date will improve the quality.

Conclusion

Know you know all about balance sheet reconciliation.

You know how and why to reconcile balance sheet accounts.

And you know how to make make the process even faster.

...but it's still a lot of manual work.

And that's where Cube comes in.

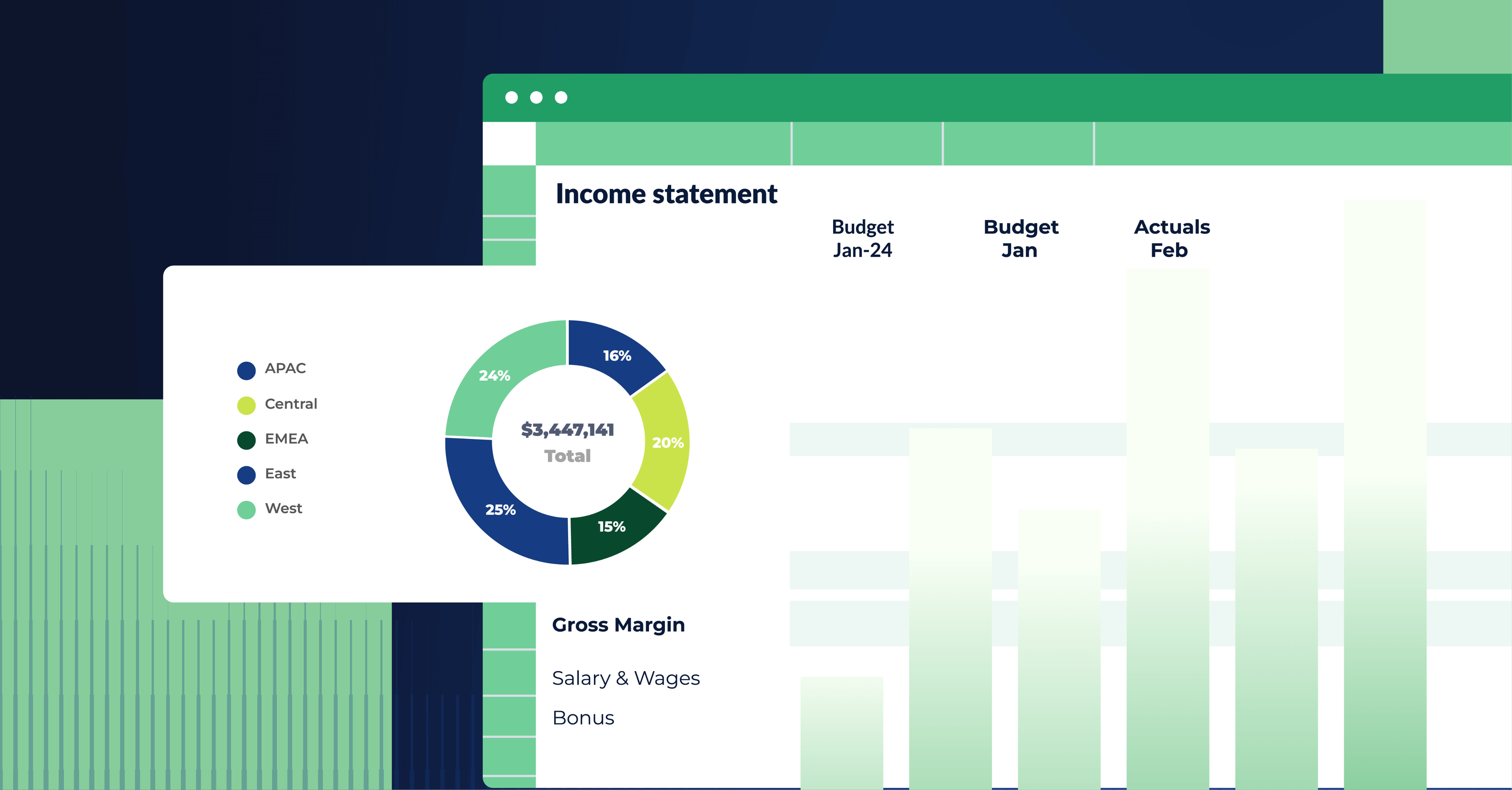

Cube is the first spreadsheet-native FP&A platform that connects with all of your source systems and maintains your data integrity.

So the next time you need to reconcile your balance sheet, you don't need to worry about whether you're matching up-to-date data with up-to-date data.

Request a free demo to learn more.

.png)

.png)