Key takeaways

- Today’s finance teams spend the majority of their time preparing the data for analysis and have limited time to deliver the insights that drive the business forward.

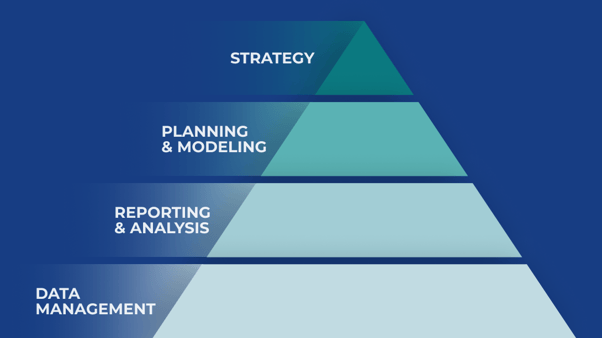

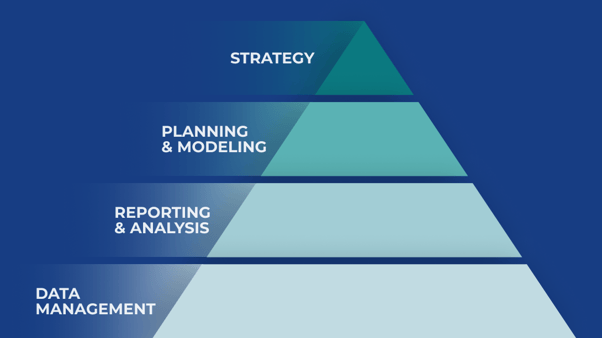

- The Strategic Finance Hierarchy of Needs is a framework designed to help finance teams partner with the business and help shape the future.

- Similar to Maslow’s hierarchy of needs, one needs to master the foundation (data management) before achieving higher-order tasks (strategic finance).

The Finance department.

For decades, these words have conjured images of enormous spreadsheets, lengthy reports, and meticulous expense tracking—essential functions that kept businesses running, but only sporadically drove their strategic direction.

But in today's shifting landscape of greater uncertainty, new technologies, and a more data-centric finance function, this limited view is now obsolete.

The most successful organizations recognize their finance function as a partner capable of helping guide critical business decisions.

The modern finance team doesn't just report what happened; they help shape what comes next.

Getting lost in data

Too often, the finance team gets stuck in a tactical role, managing transactions and reconciling data, preventing them from evolving into a more strategic business partner. Easier said than done. Modern finance teams still spend more than 70% of their time on tactical or manual work.

Climbing the Strategic Finance Hierarchy of Needs—one layer at a time

How can CFOs guide their teams through the evolutionary leap from data wranglers to strategic partners?

Introducing: the Strategic Finance Hierarchy of Needs.

At its foundation is the data—a finance team’s bread and butter—followed by reporting and analysis, planning and modeling, and finally, strategy. Successful teams must master each layer before advancing to the next.

This approach functions in two ways for finance leaders:

- A diagnostic tool to help pinpoint where your organization is today.

- A roadmap for what comes next, layer by layer.

Using this framework isn't just about implementing new software—it's about alignment.

Finance transformation is not just a new system. It involves building the right team, managing the right processes, and layering in the right technology to tie it all together.

This approach requires building from the ground up. Even the best-formatted reports are useless if the underlying data is wrong, and forecasts are misleading if the reporting isn’t sound.

The story you tell is only as good as the underlying data. You can go fast, but you can’t skip steps.

The Strategic Finance Hierarchy of Needs in action

The Strategic Finance Hierarchy of Needs is a powerful diagnostic tool for helping teams audit their current state and assess progress across each layer. A CFO leading their team through this process might follow a playbook like the one outlined below.

1. Build a foundation of trusted data

Data is the bedrock of strategic finance—and errors can lead to inaccurate reporting, misleading forecasts, and a lack of trust and insights. To build a strong, accurate foundation, start with a thorough audit of data integrity to answer fundamental questions like:

- Is our data properly governed?

- Is our data correctly structured?

- Is our data clean and correct?

To strengthen and manage your foundation, you need more than just access to data—you need data readiness: data that’s consolidated, complete, consistent, and easily accessible when it’s needed. That means defining a single source of truth, standardizing how data flows in and out of systems, and establishing clear ownership across the organization. Set up document naming conventions, and implement automated checks to catch errors—like missing GL codes or inconsistent hierarchies—before they turn into reporting issues.

At this stage, your raw data sources should be managed outside of a spreadsheet, because a spreadsheet is not a database. You don’t need multimillion-row Excel sheets that crash every time you open them.

But building a strong foundation is about more than just the data—getting the right people matters too. This means assigning data owners.

Organizations with the strongest data practices have clearly defined ownership. Someone needs to be specifically accountable for data governance or integrity, and that ownership is a key driver of success. It’s not just about implementing technology—it’s about aligning people, processes, and systems.

2. Reporting that drives action

Once your data is solid, the next step is to build the right reports for the right audience at the right time. This includes spotting patterns that explain what’s happening, like unexpected variances, budget misses, or shifts in customer behavior. These patterns help you catch issues early and tell a clearer story about performance.

Using a standard template for budget vs. actuals by team will help to keep reporting consistent and easy to digest, while automation reduces errors and frees your team to focus on what really matters: helping the business understand why the numbers look the way they do.

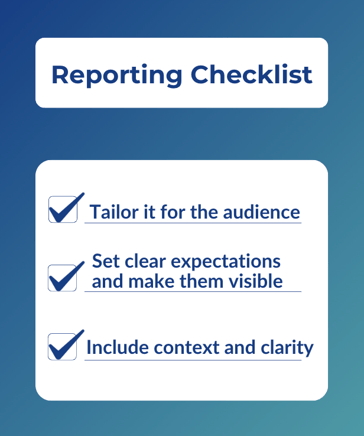

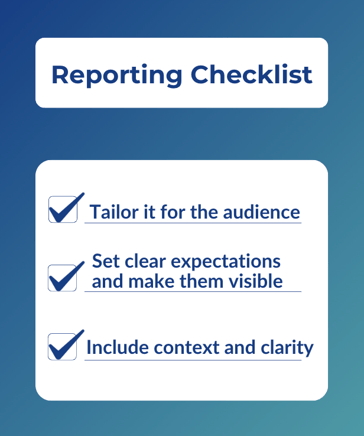

Reporting is more than just producing numbers—it’s about making them useful:

- Tailor it for the audience. Reporting isn’t just for the finance team; it’s for the business. This means tailoring what you share to your audience. Executives want headlines and big-picture takeaways. Department leads want what’s relevant to their goals. Tailoring communication to the audience helps ensure the right people see (and understand) the right information at the right time.

- Set clear expectations and make them visible. A well-orchestrated reporting process starts with clear communication and shared timelines. Build a finance calendar with defined deadlines and deliverables so other teams know when to expect your reports and how to act on them.

- Include context and clarity. Numbers alone don’t drive action—context does. Executive summaries and reporting notes should be used to explain variances, why they happened, and what this means for other teams. This helps stakeholders understand whether something needs their attention or is just business as usual—like calling out higher marketing spend from a campaign launch or slower sales from seasonality.

Internal communication matters—down to the smallest details. Experienced finance professionals understand that the data needs to be presented in a way that commands the reader's attention. Otherwise it's another overlooked report.

For example, if a CEO opens a report full of raw figures with no context or insight, they might miss something critical. The better version? A clear, simple report with red/yellow/green markers and a bold callout like “Marketing spend up $50K due to new campaign launch—within budget”, and a short summary at the top highlighting key drivers. This may seem like a minor adjustment, but many teams fail to communicate this way. It’s the same data with a very different impact.

3. Future-proof with a plan for different outcomes

In fast-changing markets, finance teams play a critical role in preparing the business for whatever comes next. This means thinking beyond a single plan and building flexible, easy to update models that account for a wide range of outcomes.

Thanks to technology, scenario planning doesn’t have to be a manual, time-intensive exercise. Finance teams can use automation and AI to generate a wider variety of potential scenarios that adjust to real-time changes—testing assumptions, modeling outcomes, and identifying risks and opportunities at scale.

But more isn’t always better. The real value comes from human judgment: knowing which scenarios matter most, which ones to prioritize, and how to guide the business through uncertainty. AI can do a lot more heavy lifting than early technology could. Finance leaders still have to set the direction.

From foundation to transformation

Climbing the Strategic Finance Hierarchy of Needs takes effort—but it’s worth it. It starts by asking hard questions about your data, your processes, and your team. It requires honesty, clear communication, and the patience to work through growing pains.

The things that cause you pain now will cause you pain through the transformation. But you will get out the other side.

And on the other side? A modern finance function—built on a strong foundation of people, process, and technology—ready to lead the business forward.

.png)

.png)