Transforming from report-builders to strategic partners

The role of finance teams is undergoing a fundamental shift. They’re no longer simply report-builders, but navigators, steering the ship with strategic foresight.

But why is this change so critical?

Well, businesses now operate in an arena where change is constant, and the terrain is unpredictable. Market conditions, customer preferences, and competitive landscapes evolve in the blink of an eye.

In this whirlwind of change, companies need more than just a balance sheet; they need a compass—a means to foresee shifts, understand implications, and make decisions that position them for success. That's where finance teams come in, evolving beyond their traditional roles to become strategic leaders who not only manage numbers but also influence the future.

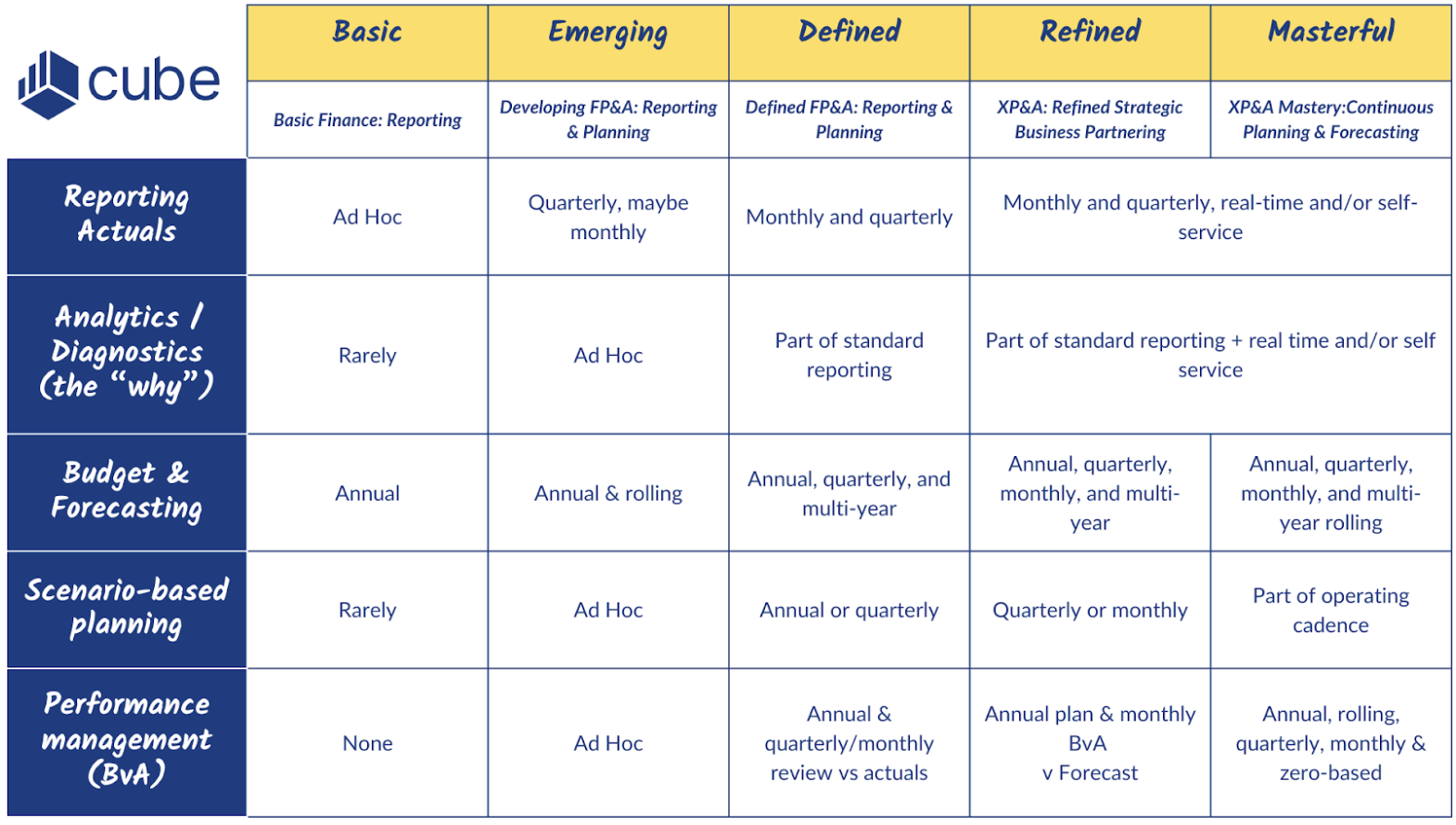

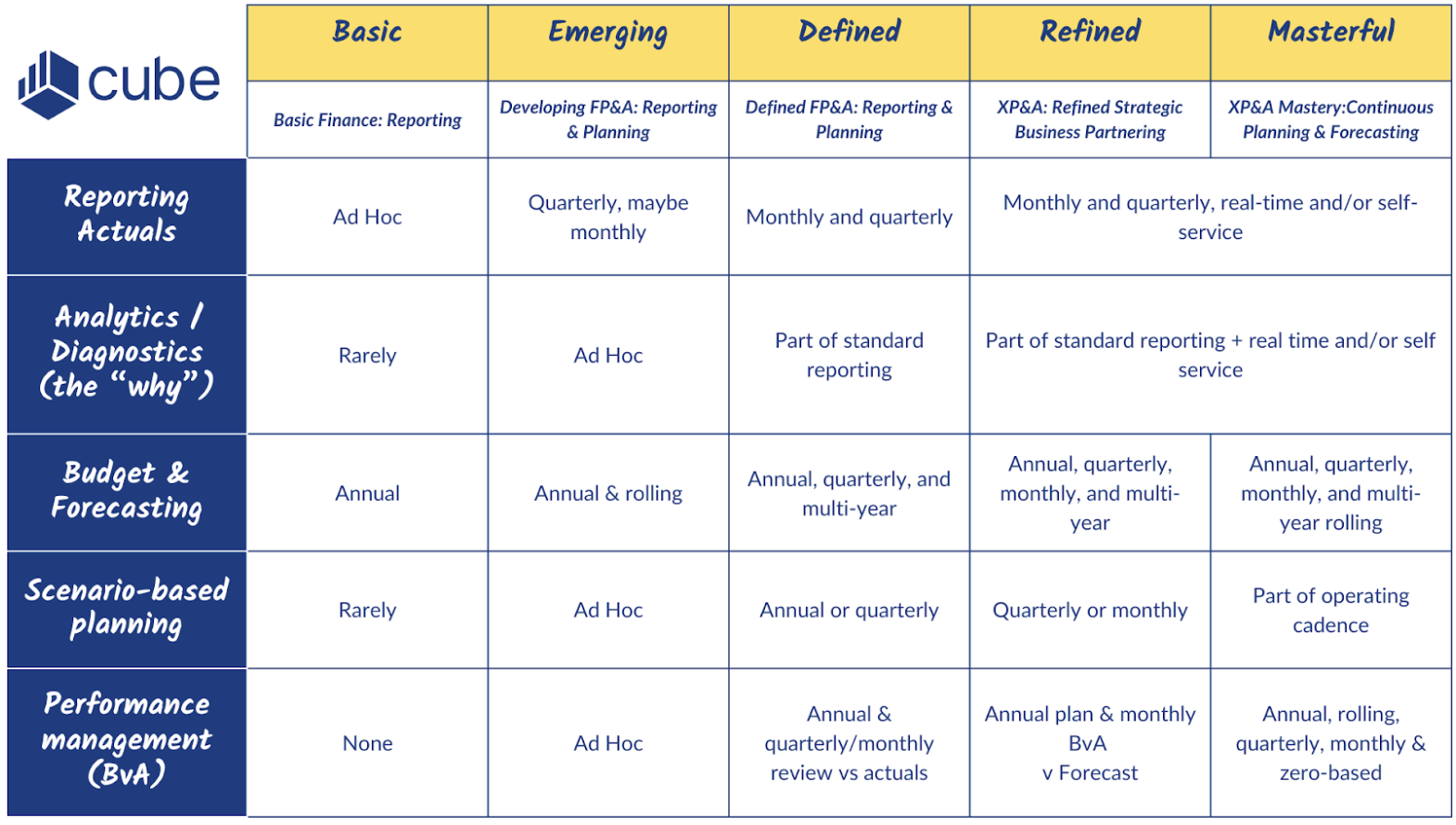

Cube’s FP&A maturity model recognizes the journey finance teams must undertake to transform from data guardians to insightful strategists. It offers a structured path, highlighting which capabilities to build and what milestones to achieve as teams grow and scale over time.

Understanding Cube's FP&A maturity model

Cube’s FP&A maturity model, known as the Finance Acceleration Framework™️, lays out a clear path from basic to advanced financial operations, outlining five specific stages of development: Basic, Emerging, Defined, Refined, and Masterful.

%20(3).png?width=774&height=567&name=Reporting%20Actuals%20(Pinterest%20Pin)%20(3).png)

1. Basic

Here, finance teams start with fundamental processes—primarily focused on simple reporting and reacting to events. They rely on basic or even non-existent financial models, which are often static and isolated from other business functions.

2. Emerging

At this stage, teams recognize the need for improvement and begin automating tasks and implementing rudimentary planning practices. There’s a growing emphasis on forecasting, but methods remain basic, and the finance function is not yet seen as a strategic partner within the business.

3. Defined

Organizations here have established more structured financial processes, with regular reporting schedules and clearer communication lines with stakeholders. They start to employ driver-based models for more accurate forecasting, bringing more value and beginning to influence strategy.

4. Refined

Advanced FP&A teams operate efficiently, using well-defined, driver-based models that offer real-time insights. There’s a strong emphasis on collaboration, and the finance function is integral to strategic planning, working closely with different departments to drive business performance.

5. Masterful

At the pinnacle, finance teams are not just partners but leaders in business strategy. They use sophisticated, fully automated models for continuous forecasting and planning, deeply influencing company direction with data-driven insights. Financial processes are seamless, comprehensive, and pivotal to decision-making across the enterprise.

Each step in the Finance Acceleration Framework™️ is crucial, building on the former to achieve a more integrated, strategic approach to finance. The journey through these stages is not just about enhancing technical capabilities, but also shifting the finance team's role from a support function to a central hub of strategic business planning.

To get a better understanding of what it takes to progress from one phase to the next, let’s explore each step in greater detail.

People: Evolving the FP&A team

.png?width=1280&height=318&name=Basic%20(5).png)

The real engine behind finance transformation? The people. The journey from basic number-crunching to savvy financial strategizing is all about how your team grows and changes.

In the beginning, you might have one person wearing all the finance hats. Think of them as your all-around go-to who juggles everything from accounting to financial planning. It works for a while, but as your business grows, you'll see the need for a change—because one pair of hands just isn’t enough.

That’s when things start to shift. You bring in more folks, and each one has a particular set of skills. Some are whizzes with forecasting; others are pros at analyzing the numbers and spotting trends. It's no longer a one-person show; it's a team effort, pooling knowledge to guide smarter business decisions.

But the real game-changer comes when your finance team starts stepping up as business partners. They’re not just part of the conversation; they’re starting it. They’re the ones with the insights and advice that shape big-picture strategies. And for that, they need to know more than just numbers. They need a solid handle on what makes the business tick.

Growing your FP&A team isn't just about getting more help. It involves nurturing a group of people who can steer the business forward. It's about moving from solo survival mode to thriving together, mixing finance know-how with real-world business understanding. That’s when you know your company isn’t just growing—it's maturing.

Process: Streamlining financial operations

.png?width=1280&height=386&name=Basic%20(6).png)

In the early stages, FP&A teams often rely on basic systems. They're juggling simple financial models and lots of manual tasks. It's all in an effort to keep the wheels turning, but it's far from efficient. Mistakes happen, and pulling reports can feel like a scramble every single time.

As teams recognize the need for change, they start introducing automated tools to handle repetitive tasks. This shift is a game-changer. It's not just about cutting down on grunt work, but freeing up the team's time. Now, they can focus on the kind of financial analysis that offers actual insights, instead of just plugging in numbers.

With more reliable systems, things begin to transform. The team adopts sophisticated methods for forecasting and performance management. Reporting that used to be a rough guide becomes a precise tool. Now, the team isn't just tracking numbers; they're providing the kind of clear, accurate information that company leaders need to make informed decisions.

When advanced processes are in place, the FP&A function becomes a powerhouse. We're talking about real-time data analysis and strategic forecasting that takes market conditions into account. The team can spot opportunities for the business, flag potential risks, and offer solid guidance on future moves.

The journey from manual chaos to streamlined operations means FP&A teams go from reacting to the latest financial crisis to strategically navigating through challenges. They're not just report providers; they're valuable advisors, using sharp insights to guide the company's financial health and growth.

Model: transitioning to driver-based models

.png?width=1280&height=282&name=Basic%20(4).png)

In the beginning, many FP&A teams work with what they have, which might be overly simplistic models or, in some cases, no real models at all. They're trying to forecast the future of the business based on past events, like trying to drive while looking only in the rearview mirror. It's all guesswork and gut feelings, making financial planning feel like a gamble.

The first big shift comes when teams start building their forecasts around business drivers. These are the real-world factors, like sales volume or production output, that actually influence financial results. This approach is a breath of fresh air because it ties predictions to what's happening on the ground in the business, making forecasts more realistic.

But understanding the business drivers isn't enough on its own. As the team gets more advanced, they start building these drivers right into their financial models. This step is where things get more reliable because the models now react to changes in actual business conditions. Forecasts automatically adjust based on current data, helping the team avoid surprises and giving them confidence in their projections.

Eventually, the financial models become highly sophisticated, working in real-time and using automation to instantly translate the latest business data into up-to-date forecasts. Now, the FP&A team has its finger on the pulse of the business. They see trends as they're emerging and can predict outcomes based on different scenarios.

This journey, from guesswork to driver-based modeling, is transformative. It means FP&A teams are working with live, forward-looking information, not just static, backward-looking data. They become instrumental in strategy discussions, offering insights that aren't just numbers but valuable business intelligence that can guide the company's strategic decisions.

Planning: Shifting from annual to continuous planning

.png?width=1280&height=357&name=Basic%20(7).png)

Initially, teams might only update their plans once a year—a strategy that often leads to outdated goals and missed opportunities. It's not that they don't want to plan more effectively; they're simply bogged down by manual processes, making frequent updates an overwhelming task.

The game changes when FP&A teams start to break free from these rigid cycles. It begins with embracing more frequent planning sessions. Instead of an annual marathon, planning becomes a series of sprints with quarterly or even monthly updates. This shift doesn't just mean more work; it's a whole new way of thinking. It's about staying ready, being flexible, and ready to pivot based on new information.

But more frequent planning is just part of the story. The real transformation is in how these plans are made. It's no longer a top-down process, where the higher-ups set targets and everyone else follows suit. Instead, it becomes a collaborative effort, engaging people from different departments and even inviting input from outside the finance team. This approach ensures a variety of perspectives, making the plans more robust and grounded in the realities of the business.

Then comes the part where planning gets even smarter. Advanced FP&A teams adopt a continuous approach, adjusting plans on the fly as new data comes in. It's a dynamic process, keeping pace with market trends and internal changes. This adaptability means companies can seize opportunities or dodge threats much faster than an annual plan would allow.

This journey from static to continuous planning is all about making the company nimble and proactive. When planning is agile and collaborative, it's easier to stay ahead of the competition and navigate through whatever the market throws your way. It turns financial planning from a predictive chore into a strategic asset, a constant beacon that guides the company forward, come what may.

Cadences: improving reporting and analytics

In finance, having a structured approach to reporting and analysis is crucial. It's all about making your data work for you.

In the beginning, at the Basic level, financial reporting is a bit of a patchwork: it's all about actuals, which are historical data. The problem? This information is always looking backward, not forward. Analytics and forecasting are rarely done, and when they are, it's usually a rushed, ad-hoc process right before important meetings or decisions.

As we move to the Emerging stage, things get a bit more structured. Reporting starts to happen more regularly, maybe even monthly if you're really on the ball. But it's still a reactive approach. Budgeting and forecasting might extend to a rolling process, giving a slightly longer horizon to look ahead. Scenario planning is still an 'only-when-needed' task, and performance management against budgets (BvA - Budget vs. Actuals) is sporadic.

Reaching the Defined level changes the game. Regular reporting includes both financials and key performance indicators (KPIs), offering a more holistic view of where you are versus where you should be. Quarterly, and even multi-year forecasts become standard, providing a clearer path for the road ahead. Scenario planning starts to happen regularly, aiding more proactive strategy development.

In the Refined stage, you're not just keeping pace; you're setting the pace. Reporting is a mix of monthly and quarterly, with real-time access for those need-to-know-now moments. It's not just about having data; it's about understanding it. Analytics are embedded in reports, providing the 'why' behind the numbers. Forecasting becomes an art, blending historical data with real-time insights to predict future trends accurately. Scenario planning is more frequent, and performance management is a consistent rhythm that keeps everyone aligned and accountable.

At the Mastery stage, you're in the driver's seat. Everything is real-time, with self-service access to data whenever and wherever you need it. You're not just reporting on the numbers; you're telling the story behind them and shaping the narrative. Budgets and forecasts are rolling, adjusting to the business's ebbs and flows, and scenario planning is part of the daily dialogue, ensuring you're prepared for whatever comes your way.

This journey through the cadences isn't just about improving processes, it's about shifting mindsets—from reactive to proactive, from guessing to knowing, and from uncertainty to confidence.

Best practices for evolving your FP&A team

As your FP&A team progresses through these pivotal stages of development, here are some best practices to ensure smooth, effective transitions and set your team up for operational excellence:

Prioritize professional development

Encourage continuous learning within your team. From online courses and workshops to certifications in relevant fields, bolstering your team's expertise is invaluable. Consider setting aside a budget for educational resources.

Leverage technology

Streamlining operations isn't just about reducing manual workload, but enabling your team to dive into more strategic, high-level tasks. Invest in advanced software solutions (like FP&A software) that automate tedious tasks and provide deeper insights through data analytics.

Foster a collaborative culture

Transitioning to a more sophisticated model requires input from various departments. Cultivate an environment where interdepartmental communication is the norm, not the exception. Regular meetings, team-building activities, and collaborative platforms can enhance communication.

Encourage forward-thinking mindsets

Promote a culture of forward-thinking. Engage your team in scenario planning sessions that anticipate various market conditions and consumer trends. Encourage them to devise proactive strategies, not just reactive ones.

Enhance data literacy

As your team moves toward more advanced models and analytics, their understanding of data should also deepen. Conduct training sessions on data interpretation and strategic application, ensuring your team can leverage data for insightful, effective decision-making.

Adopt continuous improvement

The finance landscape is ever-evolving, and resting on your laurels can mean getting left behind. Encourage feedback and continually reassess your strategies and tools. Your team should always be in pursuit of better practices, efficiency, and more strategic foresight.

Conclusion: transform your finance team

Cube's FP&A maturity model is more than a benchmarking tool; it's a catalyst for transformation, turning finance teams into strategic business partners capable of driving significant organizational impact.

By understanding where your team currently stands on the maturity ladder, you can identify areas for improvement, adopting a systematic approach to evolve your operations strategically.

Want to learn how Cube can help you on this journey? Request a free demo today.

.png)

.png)

%20(3).png?width=774&height=567&name=Reporting%20Actuals%20(Pinterest%20Pin)%20(3).png)

.png?width=1280&height=318&name=Basic%20(5).png)

.png?width=1280&height=386&name=Basic%20(6).png)

.png?width=1280&height=282&name=Basic%20(4).png)

.png?width=1280&height=357&name=Basic%20(7).png)