What is a company's free cash flow?

At its core, FCF represents the cash a company is able to generate after accounting for the money spent on maintaining and expanding its asset base. This metric is the difference between the cash generated by a business through its operations and the capital expenditures necessary to sustain or expand the business.

Here's the formula for calculating free cash flow:

Free Cash Flow (FCF) = Operating Cash Flow − Capital Expenditures (CapEx)

Unlike net income, which can be influenced by various accounting practices and non-cash items, FCF provides a clearer picture of the actual cash available. This is vital for mid-sized companies because it highlights the liquidity available for strategic investments, debt repayment, or even distribution to shareholders.

While operating cash flow focuses solely on the cash transactions related to core business operations, FCF encompasses a broader view, including the company's investments in its future growth. It's a solid indicator of your company's financial health, providing a more accurate representation of the cash available for strategic moves.

For FP&A leaders, FCF is a vital metric. It's not just about knowing the current cash position, but understanding your company's ability to generate cash in the future, which ensures sustainable growth and financial stability.

Why is free cash flow important for FP&A leaders?

FP&A leaders can make more informed decisions about budgeting, forecasting, and allocating resources by closely monitoring FCF. It provides a clear picture of the cash available for strategic initiatives without relying on external financing. This level of financial clarity is crucial for effective planning, enabling leaders to prioritize investments, manage debt, and plan for future growth sustainably.

FCF is also central to company valuation and making informed investment decisions. It's a key input in various valuation models, such as the Discounted Cash Flow (DCF) method, which helps in determining the present value of an expected stream of future cash flows. For mid-sized companies, where investment decisions can significantly impact the trajectory of growth, understanding and analyzing FCF trends is vital. This analysis helps FP&A leaders assess the company's ability to generate cash and, consequently, its attractiveness to investors and its market value.

Tips for analyzing free cash flow

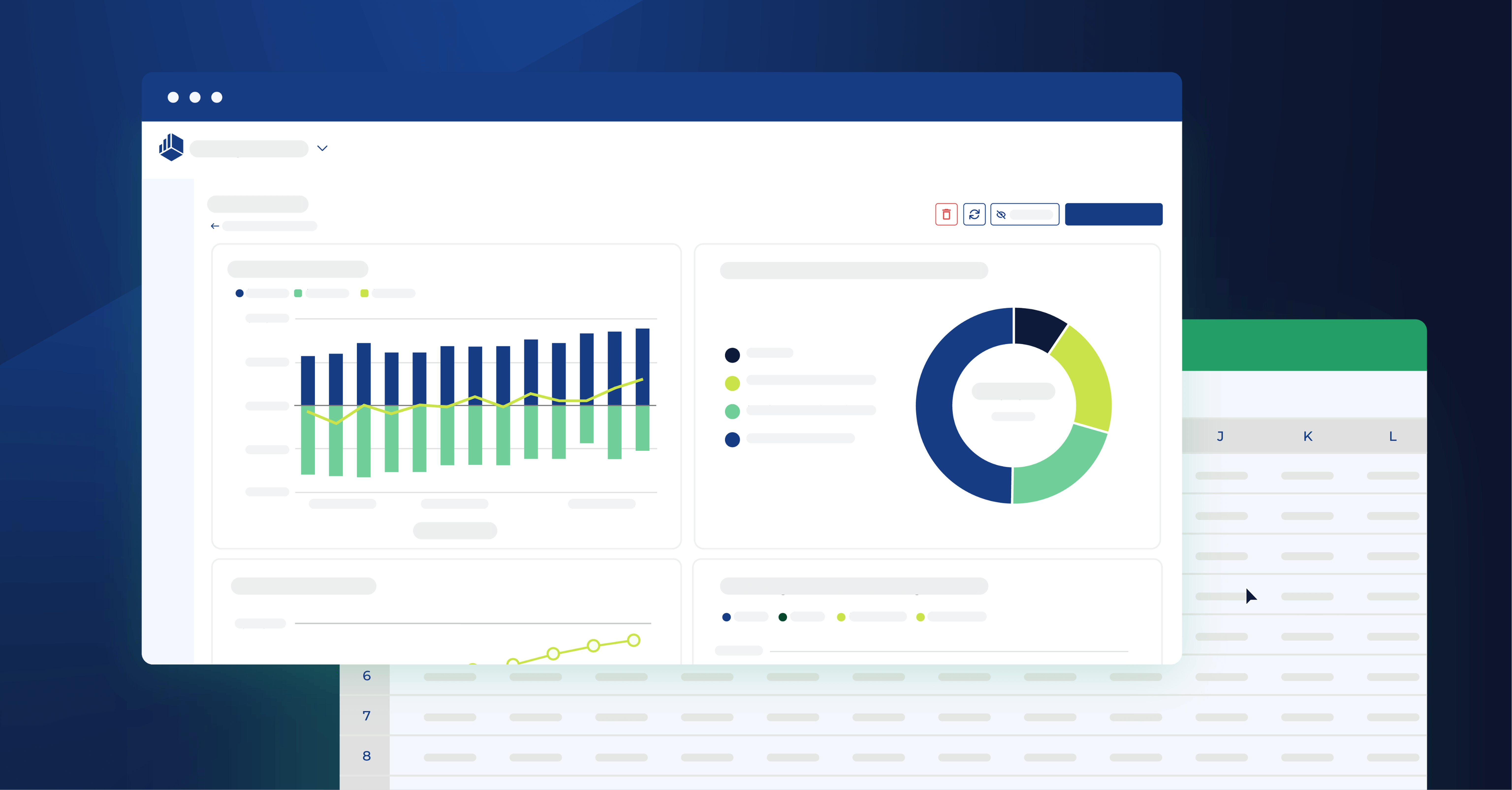

Analyzing FCF can be straightforward and insightful. Start with the basics: use your company's FP&A software to track FCF regularly. This software is key because it simplifies and automates the process, making sure you get accurate, up-to-date figures. The best FP&A software should include easy-to-read dashboards for key metrics like FCF and tools for forecasting future trends. This helps you keep a close eye on your company's financial health and make smart decisions quickly.

To get a clear picture, compare your FCF over different periods. Simple tools like looking at how FCF changes from month to month (trend analysis) or comparing FCF against total sales (ratio analysis) can provide valuable insights. This helps you understand not just the state of cash flow but also its direction and pace.

Changes in FCF are normal, but it's important to understand why they happen. A decline in FCF could be due to increased spending on new projects or challenges in managing day-to-day cash flow. An increase might signal cost-saving measures are working or your team is becoming more efficient. If your business experiences seasonal variations, this will naturally reflect in your FCF. Recognizing these patterns helps in making informed decisions and in explaining financial performance to your team and higher-ups.

Here are some quick tips for maintaining a healthy FCF:

- Watch your spending: Be mindful of how much your department spends, especially on big-ticket items. Align spending with your department's and company's priorities.

- Efficient cash management: Focus on how quickly your team handles receivables and payables. Efficient management here can free up cash.

- Cost control: Regularly review your department's expenses. Even small cost savings can positively impact overall FCF.

- Support revenue growth: Collaborate with sales and marketing teams to identify ways your department can contribute to revenue growth.

- Stay informed: Keep up with the company's financial forecasts and plans. Understanding the bigger financial picture helps in making better departmental decisions.

Your role in analyzing and contributing to a healthy FCF is crucial. It's about understanding and influencing the financial trajectory of your department and, ultimately, the entire company. By keeping these points in mind and applying them in your role, you can make a significant impact on your company's financial performance and health.

Leveraging free cash flow for strategic growth

Leveraging FCF efficiently is key for mid-sized companies looking to expand. One effective strategy is to channel FCF into areas with the highest growth potential (e.g., investing in expanding into a new geographic market that has shown a strong demand for your products or services).

Another approach could be enhancing your digital infrastructure, a move that can streamline operations and open up new online revenue streams. These targeted investments, financed through FCF, can drive substantial business growth without the burden of additional debt.

Balancing reinvestment, debt reduction, and shareholder returns

Striking the right balance in the use of FCF is crucial. Reinvestment in the business should be weighed against the benefits of debt reduction and providing returns to shareholders.

For instance, if a company has high-interest debt, using FCF to pay down this debt can improve financial stability and reduce interest expenses. On the other hand, if the company’s debt is manageable, reinvesting in business areas with high ROI potential or returning a portion to shareholders as dividends can be more beneficial.

Regularly reviewing your company's debt levels, investment opportunities, and shareholder expectations is essential for making informed decisions on FCF allocation.

Using FCF to gain a competitive advantage

FCF can also be used in innovative ways to gain a competitive edge.

One strategy could be investing in research and development to create new products or improve existing ones, keeping the company ahead of competitors. Another method is to acquire smaller startups or technologies that can add value to your current offerings, quickly boosting your company’s capabilities and market position.

Additionally, using FCF to fund employee training programs or enhance workplace technology can increase productivity and employee satisfaction, leading to better service and product quality.

Free cash flow: biggest challenges (and how to solve them)

Free Cash Flow (FCF) is undeniably a valuable resource for any company, serving as a financial lifeline that enables various strategic initiatives. However, the effective management and enhancement of FCF can be especially challenging for mid-sized companies.

Here are some of the most common challenges they face and how to solve them:

1. Irregular cash flows

Irregular cash flows are a frequent challenge for mid-sized companies. Seasonal variations in revenue, economic downturns, or market fluctuations can disrupt cash flow predictability. To address this challenge, you can:

- Implement cash flow forecasting: Develop cash flow forecasting models to anticipate periods of cash surplus or shortfall. This allows for proactive annual planning and resource allocation.

- Build cash reserves: During periods of surplus cash flow, set aside reserves to cushion against irregularities. These reserves can serve as a financial buffer during leaner times.

2. Unexpected expenses

Unexpected expenses can strain FCF, impacting financial stability. To mitigate the impact of unforeseen costs, you can:

- Establish contingency Funds: Allocate a portion of FCF to contingency funds that specifically cover unforeseen expenses or emergencies. This ensures that such expenses don't disrupt planned investments or operations.

- Enhance risk management: Strengthen risk management practices to identify potential risks and liabilities early. This proactive approach can help minimize unexpected financial shocks.

3. Substantial capital expenditures

Large capital expenditures are often necessary for growth but can strain FCF. To manage these demands effectively, you can:

- Prioritize investments: Evaluate capital expenditure projects carefully, prioritizing those with the highest return on investment. This ensures that FCF is allocated to projects that contribute significantly to growth.

- Consider financing options: Explore financing options, such as equipment leasing or vendor financing, to spread the financial impact of capital expenditures over time and preserve FCF for other purposes.

4. Impact on financial stability and strategic growth

The culmination of irregular cash flows, unexpected expenses, and significant capital expenditures can jeopardize financial stability. To mitigate these risks and foster strategic growth, you can:

- Diversify revenue streams: Explore opportunities to diversify revenue sources, reducing reliance on a single revenue stream that may be subject to fluctuations.

- Optimize working capital: Continuously optimize working capital by managing accounts receivable, inventory, and accounts payable efficiently. This can free up cash for strategic purposes.

How to influence executive decisions with FCF data

As an FP&A leader, you play a pivotal role in translating financial data into actionable insights that drive strategic decision-making within your organization. That said, with its direct connection to your company's financial health and ability to support growth, FCF data is a powerful tool for you to influence executive decisions.

Let's explore how you can leverage FCF data to shape and inform high-level strategic choices.

1. Providing financial clarity

FP&A leaders are great at distilling complex financial information into clear and concise reports. By presenting FCF data in an easily understandable format, you can provide executives with a snapshot of your company's financial stability and capacity for investment.

Visualizations, trend analyses, and key performance indicators (KPIs) related to FCF can offer executives a comprehensive view of your company's cash flow dynamics.

2. Supporting strategic initiatives

FCF data helps executives evaluate the feasibility of strategic initiatives. FP&A leaders can demonstrate how available cash can fund expansion, research and development, or market penetration efforts.

By aligning FCF insights with strategic objectives, you're empowering executives to make informed choices about resource allocation and investment priorities.

3. Mitigating financial risks

FP&A leaders can use FCF data to identify potential financial risks and advise on risk mitigation strategies. By highlighting scenarios where FCF may be at risk due to factors like declining sales or unexpected expenses, you enable executives to proactively address these challenges.

Sensitivity analyses can illustrate how different risk scenarios may impact FCF, allowing executives to make contingency plans.

4. Influencing capital allocation

Decisions regarding capital allocation are central to a company's strategic direction. FP&A leaders can provide insights into how FCF can be allocated for debt reduction, share buybacks, dividend payments, or capital investments.

By presenting the trade-offs between these options, you're guiding executives in making choices that align with shareholder expectations and long-term financial goals.

5. Long-term planning and scenario analysis

FP&A leaders can use FCF data to develop long-term financial projections and conduct scenario analysis. This allows executives to assess the impact of various strategies on FCF over time.

By presenting a range of potential outcomes, you're helping executives make decisions that consider both short-term objectives and long-term sustainability.

6. Communicating impact

Effective communication is key to influencing executive decisions. FP&A leaders must articulate how FCF data relates to broader business objectives and the potential impact of decisions on the company's financial health.

You can use storytelling techniques to convey the narrative behind the data, making it more relatable and compelling for executives.

Conclusion: figuring out free cash flow

FCF is vital for a company's financial health, especially for mid-sized firms aiming for stability and growth. By effectively managing FCF and making informed decisions, FP&A leaders become pivotal in steering their companies toward financial strength and smart strategies.

Want to learn how Cube can help you get there? Request a free demo today.

.png)

.png)