What is Mosaic FP&A software?

Mosaic is a cloud-based financial intelligence platform offering a suite of tools designed to enhance visibility into business operations. At its core, Mosaic aims to streamline the financial planning process, making it more intuitive and less time-consuming.

The platform brings together critical financial data from various sources, including ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), HRIS (Human Resources Information System), and billing systems. By consolidating this information, Mosaic provides a comprehensive view of an organization's financial health through dynamic dashboards and robust reporting tools.

The pros of using Mosaic for FP&A

With features designed to integrate financial and operational data and assist in strategic and financial planning, it's worth considering how this tool could fit into the workflow of finance teams and aid in their decision-making processes.

Here are some of the specifics of what Mosaic offers and its potential advantages:

1. Comprehensive budgeting tools

Mosaic's analytics and planning platform offers a comprehensive suite of budgeting tools. By aggregating and analyzing data from various sources, these tools provide a granular view of an organization's financial health. They support revenue and expenditure forecasting, helping teams construct a detailed budget that aligns with their strategic objectives.

The platform's ability to monitor actual spending against budgeted figures allows for quick identification of variances, ensuring that financial planning remains on track. For strategic finance teams, this means they can anticipate future cash flows and create financial forecasts with greater accuracy, manage funds more efficiently, and make informed decisions that contribute to the company's overall financial stability and growth.

2. Data visualization tools

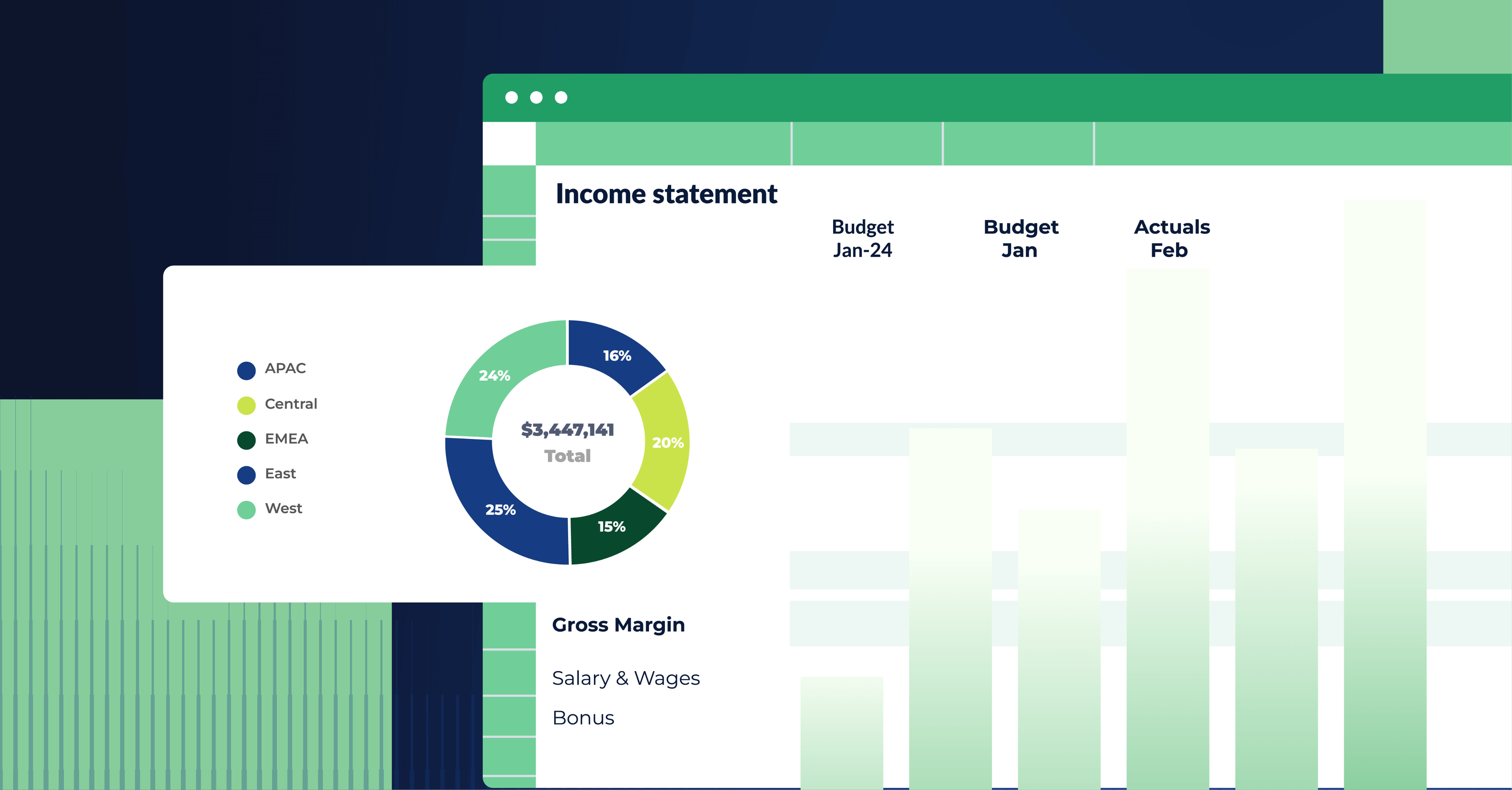

Mosaic's advanced data visualization tools are designed to distill complex financial data into accessible and compelling visual formats.

With intuitive dashboards, statistical graphs, and charts, FP&A professionals can easily identify and interpret financial trends and patterns. This not only simplifies the process of analyzing large datasets but also enhances the communication of financial insights to stakeholders who may not have a background in finance.

The ability to visualize financial data in various formats is particularly beneficial for presenting information in board meetings, investor briefings, and inter-departmental discussions, making it a valuable feature for finance teams looking to build consensus and drive strategic initiatives.

3. Real-time version control

The version control feature in Mosaic ensures all users are working with the most up-to-date financial information. Since data changes frequently in finance, having access to real-time analytics is crucial.

This feature prevents discrepancies and confusion that can arise from using outdated data, fostering a unified understanding of the financial picture across the organization.

For FP&A professionals, this means they can trust the accuracy of the data they are using for reporting, analysis, and decision-making, leading to more effective and timely financial management.

4. Automated budgeting formulas

Mosaic's automated budgeting formulas streamline the financial planning process by performing complex calculations. This automation saves FP&A professionals from the tedious task of manually crunching numbers, reducing the risk of errors and freeing up time for more strategic activities.

These formulas can help estimate direct and indirect costs, operating and non-operating revenues, and other financial metrics crucial for constructing a robust budget. The efficiency and precision offered by these automated tools mean that finance teams can produce reliable forecasts and plans more quickly, enhancing the organization's agility in responding to market changes.

5. Flexible custom reporting

Custom reporting is a significant feature in Mosaic, allowing users to craft financial reports that meet the unique needs of their organization.

FP&A professionals can edit and combine data from various departments to create comprehensive reports that provide a holistic view of the company's financial performance. This flexibility is key in addressing the specific concerns of different stakeholders, whether they are department heads requiring detailed cost analyses or executives looking for high-level summaries.

6. Streamlined financial planning

Mosaic equips finance teams with essential tools for dynamic financial modeling and what-if scenario analysis. Its user-friendly interface allows for the creation of detailed financial models, essential for strategizing and understanding potential risks and returns.

What-if scenario planning is a significant asset, allowing teams to anticipate the financial outcomes of various market changes. This readiness is crucial for quick strategic shifts in unpredictable markets.

Agile forecasting further enhances Mosaic's planning capabilities. It promotes regular forecast updates, ensuring that financial projections stay aligned with real-world data. This iterative approach aids in maintaining accuracy and equips management with timely insights for swift decision-making.

The cons of using Mosaic for FP&A

Like any tool, Mosaic FP&A may not be the perfect fit for every company or scenario. Here are some of the challenges and limitations that users might encounter:

1. Extended implementation period

While Mosaic promises a seamless integration, some users have reported that the setup and implementation process can take longer than expected, often extending over several months. This protracted period can delay the anticipated benefits of the platform.

2. SaaS-centric orientation

Mosaic has been developed with a clear focus on serving companies operating with a Software as a Service (SaaS) business model. This specialization means that its tools and metrics are tailored to the needs of SaaS businesses, potentially limiting its applicability and effectiveness for organizations operating outside of the SaaS sphere. Non-SaaS businesses might find that the platform does not fully support their unique operational needs.

3. Steep learning curve

New users often encounter challenges while learning to navigate Mosaic's platform. The complexity of its features can require a significant investment of time and effort, with some users spending hours or even days to become proficient. This steep learning curve can be a hurdle for teams looking to quickly adopt and leverage the platform's capabilities.

4. Integration difficulties and limitations

Integrating Mosaic with other tools and systems can be a complicated process. Users have reported that importing data into Mosaic and integrating it with existing systems can be time-intensive, which might hinder the efficiency of financial operations.

Additionally, for finance pros who are accustomed to working in Excel or Google Sheets, it's worth noting that Mosaic's platform currently doesn't offer integration with either. This gap can create friction and potentially result in manual data entry or error-prone import/export processes.

5. Limited metric customization

Some users have expressed difficulties in tailoring Mosaic's back-end data to suit their specific business needs. The platform comes with a set of fixed metrics, and deviation from these can be challenging. This lack of flexibility in metric customization can be limiting for businesses that require bespoke reporting and analytical capabilities.

6. Restricted data export formats

Mosaic's limitations on data export formats can be restrictive. Users have limited options when it comes to exporting data, which can complicate the sharing and interpretation of financial insights among employees and stakeholders. In today's data-driven business environment, the ability to export data in various formats is essential for effective communication and decision-making.

Conclusion: do the pros outweigh the cons?

Mosaic FP&A software brings a lot to the table for finance leaders, especially those in SMBs looking for a comprehensive, intuitive, and scalable solution. However, it’s crucial to consider the potential challenges, such as integration concerns and cost implications. Finance leaders should thoroughly evaluate Mosaic against their unique company needs.

Want to learn how Mosaic alternatives like Cube might better serve your requirements? Request a free demo today.

.png)

.png)

![Vena software review: Pros, cons, and top alternatives [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Pie%20Chart.png)