What is Salesforce integration in FP&A?

Salesforce integration within FP&A is more than just a technical linkage; it's a strategic lever that opens up a world of possibilities for financial professionals.

At its heart, this integration process taps into the Salesforce platform's vast reservoir of data, including real-time data capture sales activities, customer interactions, and market dynamics, all of which are crucial for accurate financial planning and analysis.

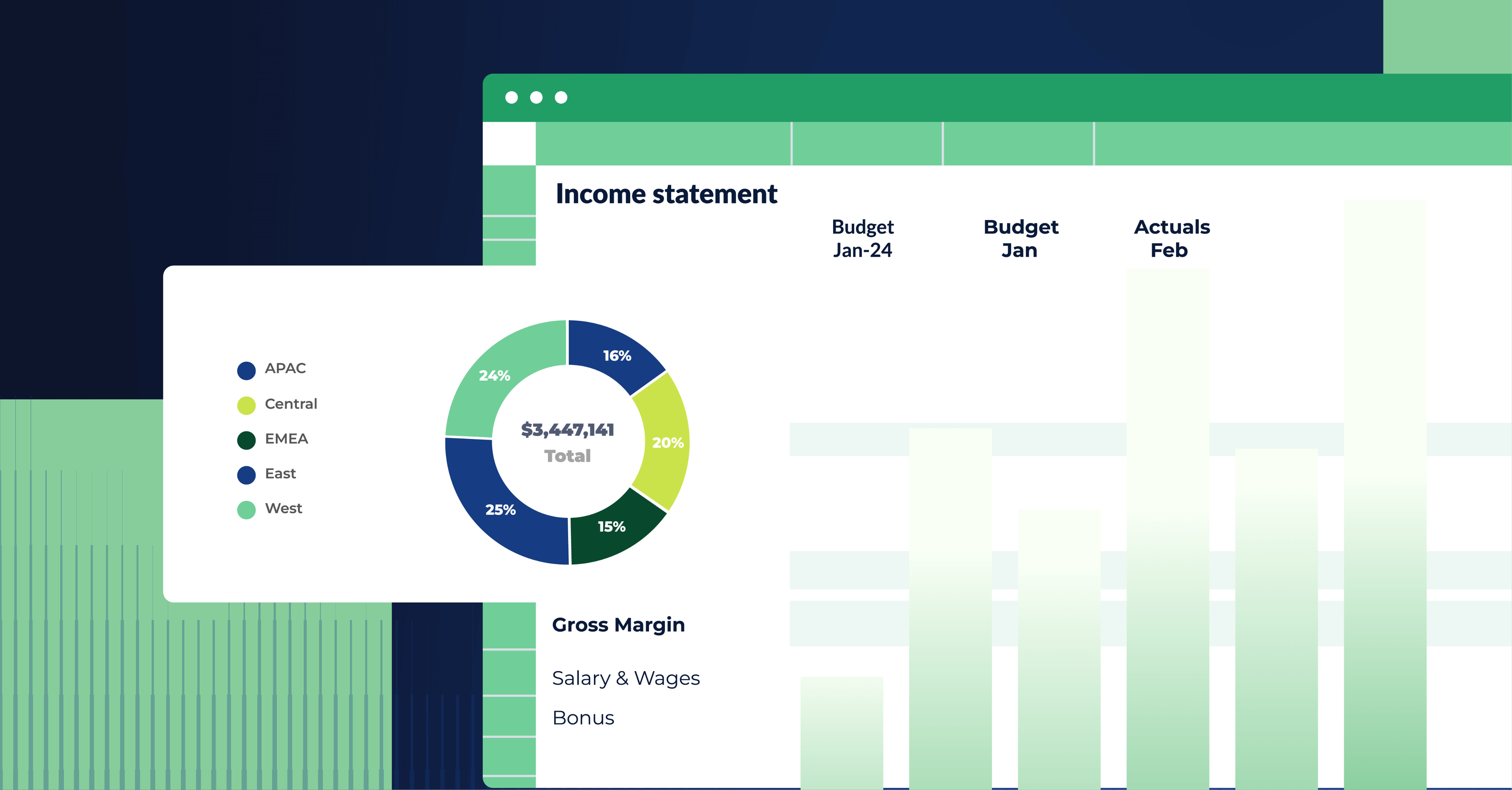

The Salesforce user interface and platform facilitate an effortless flow of data into FP&A systems, allowing for advanced analytics, customizable dashboards, and automation of budgeting and forecasting processes. This seamless integration with external systems ensures that financial plans are not only based on historical data but are also reflective of current market realities and customer behaviors.

Through this same integration architecture, sales data from Salesforce dynamically updates revenue forecasts in FP&A systems, aligning financial planning with current sales trends and customer behaviors.

Salesforce data in FP&A: an in-depth exploration

One of the most significant impacts of Salesforce CRM integration is the enhanced ability to perform detailed data analysis and visualization.

Data visualization techniques enable FP&A professionals to access and analyze information from various sources within Salesforce, such as sales performance, customer feedback, and market trends, without the need for complex data warehousing solutions. This deep dive into data supports a more granular approach to financial planning and analysis.

For instance, by analyzing sales data in real-time, finance teams can identify which products or services are performing well and adjust budget allocations accordingly. Similarly, customer feedback gathered through Salesforce can inform more customer-centric financial strategies.

Integrating Salesforce data with FP&A software: top benefits for FP&A teams

Salesforce integration capabilities with FP&A software significantly benefits FP&A teams and enhances their strategic role within the organization.

Here are some of the key benefits FP&A teams can expect following Salesforce integrations:

1. Deeper financial insights

With Salesforce integration, FP&A teams gain access to a wealth of sales and customer data, enabling more nuanced financial analyses and projections. This depth of insight supports more informed strategic decision-making, aligning financial planning closely with business realities.

2. Enhanced forecasting precision

Real-time data from Salesforce improves the accuracy of financial forecasts. FP&A teams can adjust forecasts with current sales trends and customer interactions, resulting in more reliable budgeting and financial planning.

3. Streamlined reporting processes

Automated data flow from Salesforce to FP&A systems simplifies reporting. FP&A teams can generate comprehensive reports more quickly, freeing up time for analysis rather than data compilation.

4. Increased agility in financial planning

The immediate availability of sales and customer data enables FP&A teams to be more agile in their financial planning. They can swiftly respond to changes in the business environment, adjusting financial strategies as needed to maintain or enhance business performance.

5. Greater operational efficiency

Automation of data collection and integration processes reduces manual effort and the potential for errors. This efficiency allows FP&A teams to focus on higher-value activities, such as strategic analysis and advisory roles.

6. Collaborative strategic planning

Salesforce platform integration facilitates closer collaboration between the FP&A team and sales departments. This synergy ensures that financial planning is fully informed by the frontline experiences and expectations of the sales team, leading to more aligned and effective strategic plans.

7. Customized financial modeling

FP&A teams can integrate Salesforce and leverage data to create customized financial models that reflect the specific dynamics of their business. These models can directly incorporate sales forecasts, customer acquisition costs, and other critical metrics from Salesforce, providing a more accurate and dynamic tool for financial planning.

8. Improved data governance

Integrating Salesforce with FP&A systems enhances data governance, as data flows through defined, secure channels. This integration ensures that financial data is accurate, up-to-date, and compliant with relevant regulations, supporting robust financial management practices.

Navigating the integration process: best practices and tips

A successful Salesforce integration with your FP&A and billing system doesn't just happen; it requires a deliberate approach, meticulous planning, and ongoing management. Here are some best practices and tips to ensure a smooth integration.

1. Develop a clear integration plan

Start with a detailed roadmap that outlines your objectives, key milestones, and timelines. Identify which data needs to be integrated and how it will be used within the FP&A system to support financial planning and analysis.

2. Involve key stakeholders

Ensure that all relevant parties, including IT, finance, revenue operations, and sales teams, are involved in the point-to-point integration from the outset. Their input can provide valuable insights into the integration's requirements and potential challenges.

3. Ensure thorough system testing

Before going live, conduct comprehensive testing to identify and resolve any issues. This testing should cover data accuracy, synchronization processes, and the performance of customized features.

4. Effective data synchronization

Implement robust data synchronization mechanisms to ensure that the FP&A system reflects real-time data from Salesforce. This might involve setting up automated workflows to update financial forecasts and reports as new sales data comes in.

5. Maintain data integrity

Establish protocols for data validation and cleaning to maintain the accuracy and reliability of the information within your FP&A tracking system. Regular audits can help identify and correct any discrepancies.

Customizing Salesforce integration for enhanced financial insights

Tailoring the Salesforce integration to meet your organization's specific needs can significantly enhance the value it brings to your FP&A processes. Consider these customization strategies for optimal insights.

- Custom dashboards and reports: Design dashboards and reports that align with your key financial metrics and goals. Salesforce's customizable features allow you to focus on the data that matters most to your business, enabling quicker, more informed decisions.

- Predictive modeling and forecasting: Leverage Salesforce data to build predictive models that can forecast future sales trends, customer behavior, and market dynamics. These insights can be instrumental in shaping your financial strategies.

- Segmentation for targeted analysis: Use Salesforce to segment data by product, region, customer type, or other criteria. This enables more targeted financial analysis, helping identify growth opportunities or areas requiring attention.

FP&A and Salesforce integration: use cases and benefits for specific industries

Customizing Salesforce integration to meet the specific needs of various industries can significantly enhance the value and effectiveness of FP&A processes.

By leveraging the robust features of Salesforce tailored to unique industry challenges and opportunities, businesses can achieve greater operational efficiency, improved financial forecasting, and more strategic decision-making capabilities.

Here’s how different sectors can benefit from tailored Salesforce integration with the FP&A platform:

- SaaS/Software: Monitoring KPIs like MRR and CLV through customized Salesforce dashboards enables SaaS companies to adapt strategies to market demands swiftly.

- Healthcare: Integrating Salesforce enhances patient relationship management, service efficiency, and financial planning in healthcare services by providing insights into patient interactions and treatment outcomes.

- Business Services: For business services firms, customizing Salesforce provides comprehensive client and project insights, optimizing service delivery and profitability through enhanced client relationship management and service delivery metrics tracking.

- Financial Services: Salesforce integration offers real-time customer behavior insights, investment trends, and regulatory compliance tracking for the financial services industry, enabling better risk management and investment decision-making.

- Real Estate: Real estate companies benefit from real-time tracking of market trends, property management, and client relationships, enabling informed investment decisions and portfolio management through customized property valuation and rental income forecasts.

- Manufacturing: Manufacturers can streamline supply chain operations, manage inventory levels, and monitor production efficiency, enhancing operational and financial performance through supply chain analytics and demand forecasting.

Measuring the ROI of your Salesforce and FP&A Integration

To effectively measure the ROI of integrating Salesforce with your FP&A systems, consider the following key performance indicators (KPIs):

- Forecast accuracy: Baseline and measure the improvement in forecast accuracy by comparing historical variances before and after Salesforce integration. This can highlight the impact of real-time data integration on financial planning.

- Operational efficiency: Quantify time savings in financial reporting and budgeting processes. Track how the automation of data entry and the reduction in manual reconciliation tasks free up time for value-added analysis.

- Strategic decision-making: Evaluate the impact on strategic decision-making by assessing how the integration has improved the speed and quality of decisions. Consider the role of enhanced data insights in shaping business strategies and driving growth.

Conclusion: mastering Salesforce integration

Integrating Salesforce with FP&A systems offers unparalleled advantages for FP&A leaders. By leveraging detailed strategies and best practices, FP&A teams can use Salesforce integration to drive business success, improve operational efficiency, and foster a culture of data-driven decision-making across industries.

For further insights into enhancing FP&A through integration, explore these additional resources on forecasting and selecting the right FP&A software for your organization. You may also want to check out external resources, such as articles from Salesforce, to complement this guide.

Want to learn how Cube integrates seamlessly with Salesforce and can take your finance function up a notch (or two... or three)? Request a free demo today.

.png)

.png)

![Vena software review: Pros, cons, and top alternatives [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Pie%20Chart.png)