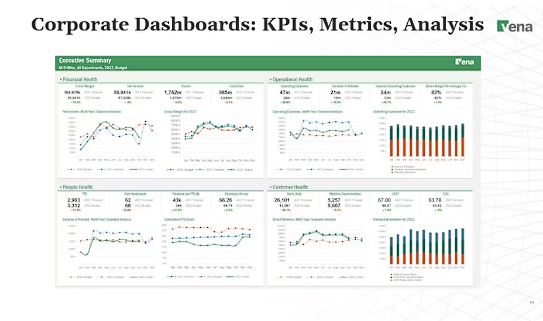

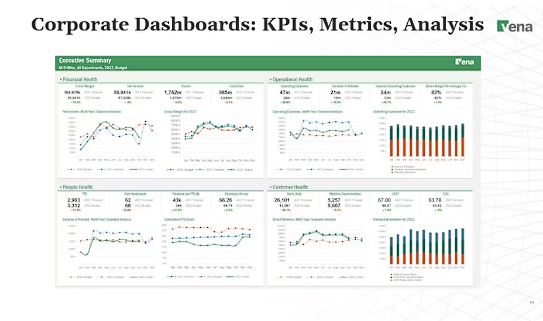

Vena Solutions' key features and capabilities

Vena is an Excel-native FP&A platform designed for finance teams that want advanced planning capabilities within their familiar Microsoft ecosystem. It supports core FP&A processes like budgeting, forecasting, and reporting while keeping everything connected inside Excel.

Recent updates have expanded its functionality—like Vena Copilot, an AI assistant that helps teams analyze data and surface insights faster, and a no-code PowerPoint add-in for creating live, auto-updating presentations. Vena also introduced ad hoc reporting tools, making it easier to compare internal numbers with external data sources directly inside Excel.

[Source]

Pros of Vena

- Excel-based interface: Keeps teams in Excel, which lowers the learning curve for spreadsheet-heavy workflows.

“It takes care of not having to roll over Excel files.” - verified user

- Efficient data synchronization: Facilitates collaboration and data sharing among multiple users.

“It goes through approvals and ensures everything is accurate, and seen by the right people” - verified user

- Drill-down functionality: Allows users to explore data at a more detailed level, offering deeper insights and understanding of financial numbers.

“Vena has a drill down function that allows us to see entries on the account level.” - verified user

- Customizable templates: Provides preconfigured templates that can be tailored to save time and provide flexibility in reporting and analysis.

“The templates are great, really handy.” - verified user

Cons of Vena

- Excel-only environment: Not compatible with Google Sheets or other spreadsheet tools, limiting flexibility for mixed or modern teams.

“Since Vena is based on Excel, you will inherit all the limitations of Excel with it.” - verified user

- Fragile to change: Once set up, it’s easy to break reports or workflows by accident. Most teams rely on Vena specialists to make updates safely, which adds cost.

“You are still writing extensive formula that can be difficult to troubleshoot and audit.” - verified user

- Steep maintenance curve: Customizations require ongoing support or training, especially for new users who didn’t build the original model.

“Don't expect the platform to be intuitive or you can do anything on your own from the first time. It is a steep, a really steep learning curve.” - verified user

- Long implementation timeline: Getting started with Vena can take several months, delaying time to value and tying up internal resources.

“After a nine month implementation, we ultimately decided to stop the process after spending countless hours on it.” - verified user

Understanding both the strengths and limitations of Vena is crucial for finance leaders in making an informed decision that aligns with their organization's specific FP&A requirements and goals.

Vena Solutions software pricing

Vena doesn’t disclose pricing publicly. However, they do offer two core plans that give a general idea of what to expect feature-wise. Implementation and onboarding services are typically sold separately and can impact total cost significantly, depending on the complexity of your setup.

The Professional Plan is Vena’s base-level offering and includes:

- Access to the full Vena platform

- Vena Copilot

- A dedicated Customer Success Manager

- Standard support

- Access to the Vena customer portal

The Complete Plan includes everything in the Professional Plan, plus:

- Vena Insights, advanced reporting and dashboards

- Premium support

- A sandbox environment for safe testing and experimentation

- Expert managed services to help with complex model building and ongoing optimization

It’s a good idea to factor in both the software cost and the cost of ongoing support or internal maintenance, especially if your team will rely heavily on customized reports or models.

Vena customer reviews

G2 verified user score: 4.5/5

Capterra verified user score: 4.5/5

Software Advice verified user score: 4.5/5

“Vena does a great job at organizing your data into a simple database format. Your data can be complex, but with Vena, it's easy to draw it down and organize it into ways that make sense. FP&A is now easier and our processes sped up.” - verified user

“It's an overwhelming amount of things to learn. The only real thing I have disliked thus far is that when I have an issue and reach out to VENA help it takes so much time to hear back from anyone and it's all through email. By the time they get back in touch with me I can't even recall what's going wrong much less create the issue again on demand.” - verified user

“I am not sure where to start with what I dislike about the platform but I almost want to say everything. Vena is designed from the ground up to be a complicated platform. Don't expect the platform to be intuitive or you can do anything on your own from the first time. It is a steep, really steep learning curve.

If you are an experienced Vena user, it takes you anywhere between 30 min for easy reports to a few days to set up a report, FPA model or budget..” - verified user

Top Vena alternatives

Let’s look at the top Vena alternatives that offer different strengths depending on your team’s size, systems, and flexibility needs.

1. Cube

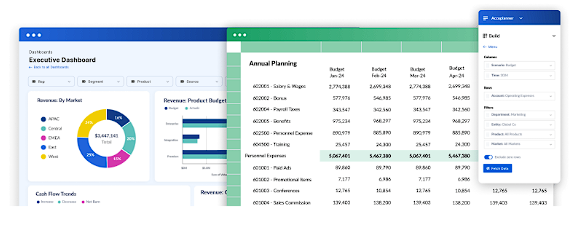

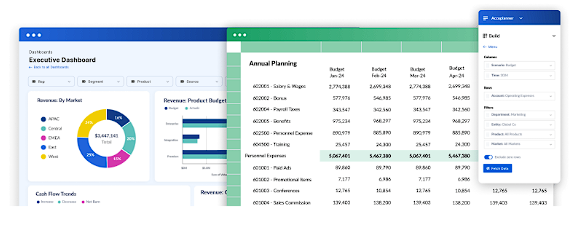

Cube is a spreadsheet-native FP&A platform that helps teams hit their numbers without giving up the spreadsheets they already use. It can connect Excel, Google Sheets, Cube native spreadsheets to live financial data so you can build reports, run forecasts, and model scenarios without copy-pasting numbers across files.

FP&A professionals self-serve with Cube—meaning no consultants, no fragile templates, and no hidden code. Teams can pull in ERP or CRM data, create custom dashboards, and run “what-if” scenarios directly inside their spreadsheets. Cube also includes AI-powered insights and variance analysis to help users catch issues early and adjust plans quickly.

Most teams go live in under 90 days with support from Cube’s in-house onboarding team, and adoption is fast—even for non-finance users—thanks to its intuitive, no-code reporting tools.

Pros:

- “The implementation process was very efficient. In two weeks our company was up and running with Cube thanks to the support team.” - verified user

- “One of our favorite things is it's compatibility with Google Sheets. Our organization is primarily on GSuite, so this helped move our team away from excel based reporting and into GSheets which was compatible with the org.” - verified user

Cons:

- “There are also some nuances to using the software that are only discovered through trial and error.” - verified user

- “Data refresh over multiple tabs could be improved” - verified user

Key features:

- Works natively inside Excel and Google Sheets so teams can build and update reports without switching tools.

- All data is stored and processed in the cloud, making it easy to collaborate across teams and access reports from anywhere.

- A detailed audit trail tracks every change, supporting data governance and reducing reporting errors.

- Cube is model-agnostic, meaning teams can structure their models however they work best without rigid templates or code dependencies.

- Connects to ERPs, CRMs, and other source systems to create a single source of truth across departments.

- The drag-and-drop dashboard and report builder makes it easy to visualize key metrics without writing formulas or relying on IT.

- AI-powered insights help flag anomalies and improve forecasting accuracy over time.

- Teams can run multi-scenario planning models to test different business assumptions and make confident decisions quickly.

Customer reviews:

Vena vs Cube

- Requires no specialists, while Vena often depends on external support due to its use of proprietary scripts and complex configurations.

- Makes updates easy, while Vena’s setup is more fragile and harder to change without risking broken reports or disrupted workflows.

- Works across more platforms, including Excel, Google Sheets, and native Cube spreadsheets, while Vena remains Excel-only.

- Delivers faster time to value, with most teams fully onboarded in under 90 days—compared to Vena’s longer implementation process.

- Offers a lower learning curve, making it easy for non-technical users to create and update reports.

Pricing and suitability: Cube offers transparent pricing with unlimited users and full access to all features. Explore all pricing.

2. Anaplan

Anaplan is a sophisticated, web-based application for agile planning and forecasting, offering real-time data access and collaborative features for decision-making. It's particularly suitable for larger enterprises, providing tools for complex modeling and scenario planning.

Pros:

- “This software is very easy to understand” - verified user

- “Anaplan has the ability to support a very large data set” - verified user

Cons:

- “This software doesn't go well with the high integration functions and doesn't offer a wide range of event workflows.” - verified user

- “The code base is hard to master, making uploading changes into Anaplan difficult and time consuming.” - verified user

Key features:

- Streamlines processes for effective corporate performance management.

- Data hub acts as a central repository for planning data.

- Compensation plan modeling analyzes the financial impact of employee performance plans.

- In-memory processing enables quick scenario modifications.

- Driver-based forecasting uses advanced analytics for accurate forecasts.

Customer reviews:

Comparison with Vena:

- Offers more comprehensive in-memory processing and advanced scenario modeling.

- Limited Excel integration capabilities.

- Less user-friendly in terms of report layout and formatting.

Pricing and suitability:

- Three tiers: Basic, Professional, and Enterprise, with varying capabilities.

- Best for larger enterprises with robust IT support for implementation.

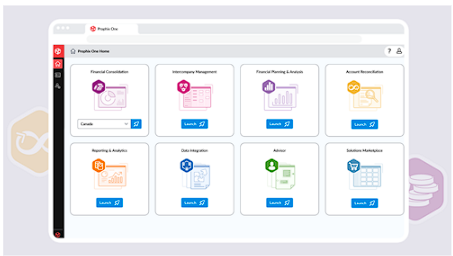

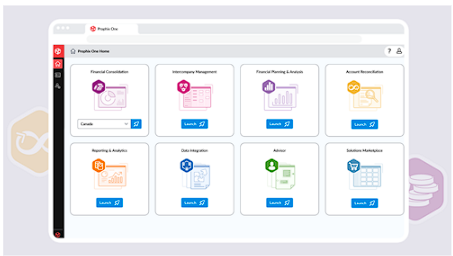

3. Prophix

Prophix is a versatile financial management software designed to enhance financial consolidation, budgeting, analysis, planning, and reporting. With its spreadsheet-style interface, it caters well to finance teams seeking to streamline their FP&A processes and make informed decisions based on robust financial data.

Pros:

Cons:

- “It requires quite a bit of technical/consultancy time to get the integration setup and maintain the software due to the complexity of the implementation.” - verified user

- “One of the main challenges we encountered was its steep learning curve” - verified user

Key features:

- Allows for comprehensive financial forecasting and investment decision-making.

- Enables the creation of graphical representations of financial data for easier analysis.

- Automates cycles like budgeting and reporting, enhancing efficiency.

- Identifies irregularities in financial data to mitigate risk.

Customer reviews:

Comparison with Vena:

- Outperforms Vena in automation capabilities and risk mitigation through anomaly detection.

- May fall short compared to Vena in data visualization and ease of use for those with limited technical expertise.

Pricing and suitability:

- Pricing information is private but reportedly aligns with industry standards.

- Best suited for companies looking to automate and replicate slow, manual FP&A processes with pre-built functionality.

4. Planful

Planful is a financial planning and performance management software, designed to provide real-time performance data to help users identify issues, opportunities, and improve overall performance. It's tailored for larger companies with substantial FP&A teams looking to extend their influence beyond finance.

Pros:

Cons:

- “As a beginner, understanding how to create dimensions, cross-check figures, and design report views is quite challenging.” - verified user

- “Not enough training resources online to do self guidance.” - verified user

Key features:

- Simplifies access to financial statements and reports.

- Speed up FP&A processes with pre-built templates.

- Streamlines the progression of financial planning tasks.

- General Ledgers assist in tracking transactions and maintaining compliance.

- Offers visibility into cash positions and allows for adjustments based on key drivers.

Customer review:

Comparison with Vena:

- Outperforms Vena when it comes to providing a wide range of pre-built templates and managed workflows.

- May fall short compared to Vena in its ability to improve collaboration.

Pricing and suitability:

- Pricing details are private, but it is reportedly more expensive than average

- Best for larger companies with extensive FP&A teams aiming to broaden their operational influence.

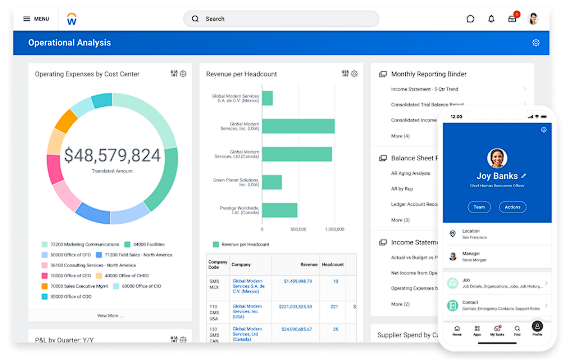

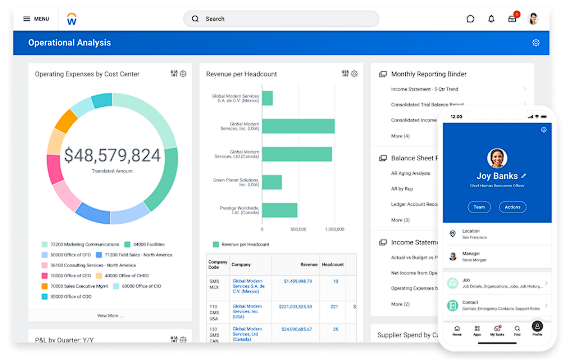

5. Workday Adaptive Planning

Workday Adaptive Planning is a comprehensive tool that facilitates forecasting, budgeting, and modeling, with a focus on integrating financial and HR data for deeper insights. It’s particularly well-suited for large enterprises seeking a transformative FP&A solution that encompasses both financial and "people" data.

Pros:

Cons:

- “The cost is high for a small organization.” - verified user

- “The visuals are also basic compared to other tools.” - verified user

Key features:

- Embedded machine learning automatically detects anomalies, aiding in timely plan adjustments.

- Elastic Hypercube Technology provides a powerful engine for business modeling and analysis.

- Robust security measures ensure data protection with encryption and compliance standards.

- Allows running multiple scenarios for informed decision-making.

Customer reviews:

Comparison with Vena:

- Outperforms Vena by offering machine learning capabilities and unlimited scenario modeling.

- May fall short compared to Vena in flexibility to maintain or enhance existing models.

Pricing and suitability:

- Offers customized pricing packages based on features, company size, and user types.

- Ideal for large enterprises looking for a comprehensive, company-wide FP&A tool that goes beyond traditional finance functions.

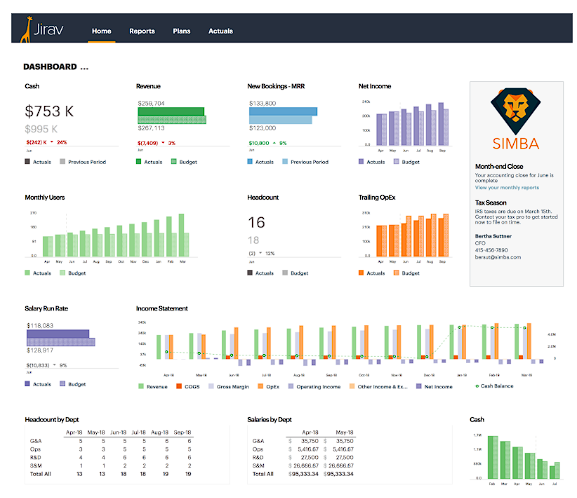

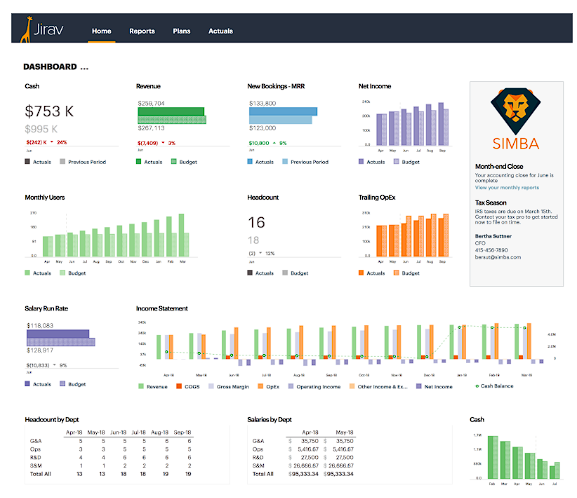

6. Jirav

Jirav is a cloud-based business planning software designed to support FP&A teams in creating forecasts, reporting financials, and modeling future business activities. Ideal for small businesses and accounting firms, Jirav offers a suite of tools that grow with an organization, addressing the increasing complexity of expanding businesses.

Pros:

Cons:

- “I struggle with the way they have their staff planning set up because I have to reimport an Excel every month with all the changes.” - verified user

- “There is not enough granularity in security settings to allow me to share certain information easily” - verified user

Key features:

- Offers customizable dashboards for visualizing both financial and non-financial data.

- Enables extended cash flow forecasting for up to 60 months.

- Automates key financial reports, saving time otherwise spent on spreadsheets.

- Simplifies the creation and management of operating plans and budgets with driver-based modeling.

Customer reviews:

Comparison with Vena:

- Outperforms Vena by offering cloud-based, shareable dashboards and streamlined report package automation.

- May fall short compared to Vena in processing speed and the variety of data visualization options.

Pricing and suitability:

- Controller Essentials: Starts at $50/month

- CFO Enterprise: Starts at $150/month

- Best for small businesses and pure accounting firms requiring modern planning and modeling tools that can scale with growth.

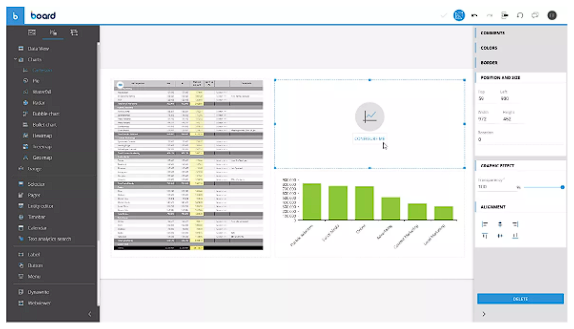

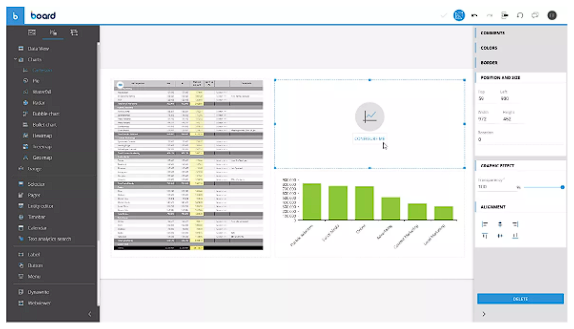

7. Board

Board is an enterprise FP&A platform that handles budgeting, forecasting, capital planning, and reporting. It connects data from different departments like finance, operations, and strategy so teams can model outcomes, track performance drivers, and adjust plans in real time. They aim themselves toward large or fast-scaling organizations.

Pros:

Cons:

Key features:

- Runs real-time scenario modeling to evaluate the impact of key business changes

- Automates repetitive planning workflows to speed up cycles and reduce manual effort

- Simulates value driver shifts using built-in analytics and AI-powered forecasting

- Supports capital and resource planning across multi-year projects with real-time input

Comparison with Vena:

- Board markets itself as an all-in-one alternative to spreadsheets, while Vena keeps users inside Excel with an add-in model

- Excel-heavy teams may find Board less intuitive than Vena’s spreadsheet-native approach.

Customer reviews:

Integrations: Board can integrate with many popular platforms including Microsoft Excel, PowerPoint, and Word.

Pricing and suitability:

- Pricing is not publicly available

- Best for enterprises that need a centralized platform to align financial, strategic, and operational planning

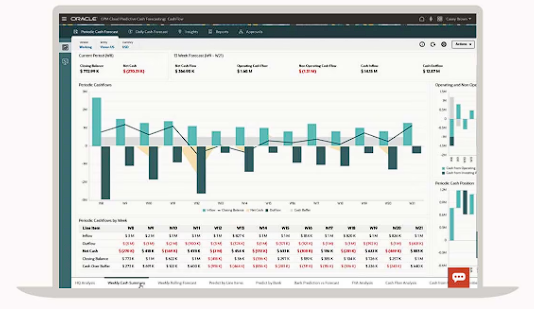

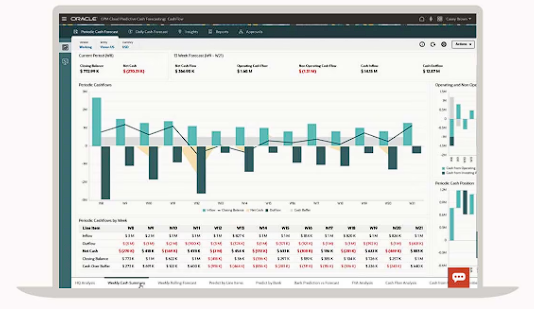

8. Oracle

Oracle offers its Fusion Cloud ERP, which is an enterprise-grade planning platform for financial management, procurement, project planning, and risk oversight. It uses built-in AI to automate routine finance processes, surface real-time insights, and support strategic decision-making at scale. Users can track expenses, reconcile accounts, optimize procurement, and manage financial risk.

Pros:

- “One integrated solution for all applications.” - verified user

- “ERP is a SaaS solution that stays current with quarterly upgrades” - verified user

Cons:

Key features:

- Automates accounting, payables, and asset tracking

- Aligns budgets with project resources using built-in forecasting, scheduling, and billing tools

- Monitors and enforces audit controls using AI-powered risk management workflows

- Delivers predictive analytics with prebuilt KPIs, trend tracking, and embedded visual dashboards

Comparison with Vena:

- Oracle is made for companies already running NetSuite ERP, offering a more seamless same-vendor flow that Vena can’t match out-of-the-box.

- Teams not on NetSuite may face extra integration work, while Vena’may be simpler for mixed-system environments

Customer reviews:

Integrations: The Oracle Cloud Infrastructure integration services connect with platforms like Salesforce, SAP, Shopify, and Snowflake.

Pricing and suitability:

- Pricing is not publicly available.

- Best for global enterprises and large organizations with complex finance, compliance, and operational planning needs that require a fully integrated ERP suite.

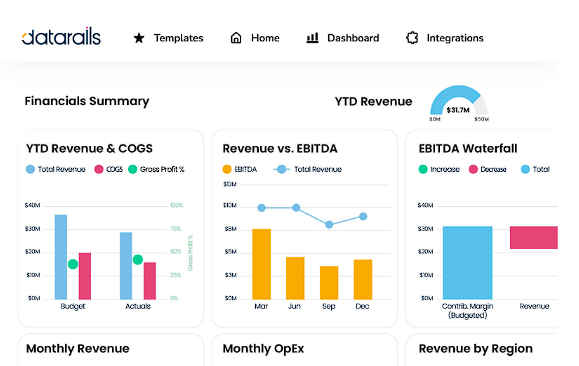

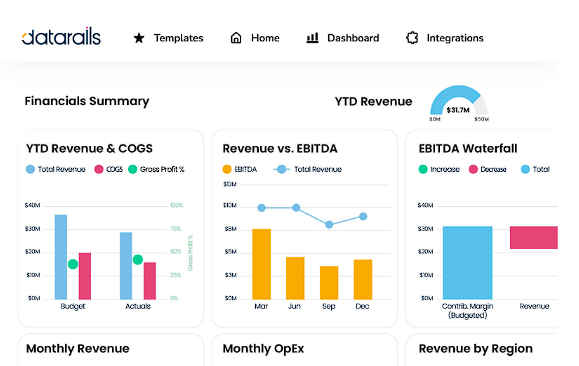

9. Datarails

Datarails is an AI-powered FP&A platform that helps finance teams stay in Excel while automating everything around it. With its FinanceOS interface, users can continue using their existing spreadsheet models while accessing real-time data consolidation, automated reporting, and intelligent dashboards. The built-in AI assistant, Genius, can generate instant answers, run ad hoc reports, and fulfill last-minute requests using natural language.

Pros:

- “Datarails offers a great way to cleanly show concise data that can be drilled down into.” - verified user

- “It interfaces very well with Microsoft Excel and NetSuite” - verified user

Cons:

- “It requires a fair amount of initial onboarding and support to fully understand the platform and customize it to your needs.” - verified user

- “We find DR a little slow when refreshing and synchronizing all the sheets.” - verified user

Key features:

- Automates data consolidation across ERPs, CRMs, and spreadsheets

- Runs real-time financial reporting and month-end close workflows

- Keeps finance teams in Excel with 100% spreadsheet compatibility

- Visualizes KPIs instantly with dashboards and drill-down capabilities

Comparison with Vena:

- Datarails allows users to pull in Excel models, but it isn’t fully integrated like Vena, which keeps all workflows inside the spreadsheet.

- Datarails focuses on consolidation and collaboration, while Vena focuses more on advanced budgeting and drill-down analytics.

Customer reviews:

Integrations: Datarails supports 200+ integrations, in addition to its connection with Excel, like HubSpot, QuickBooks, and Shopify.

Pricing and suitability:

- Pricing is not publicly available.

- Best for small to mid-sized companies that want to modernize their FP&A without leaving Excel.

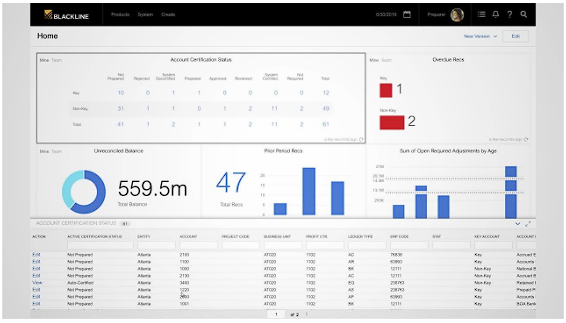

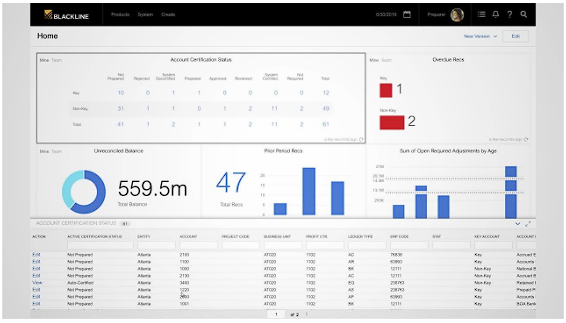

10. BlackLine

BlackLine offers a financial operations platform to help large enterprises automate and centralize their accounting processes. It offers an end-to-end suite for record-to-report, invoice-to-cash, and intercompany workflows, all managed from its unified Studio360 platform. Finance teams use BlackLine to eliminate manual reconciliations, reduce audit risk, and accelerate monthly close cycles using AI-powered automation.

Pros:

- “It automates many of the tasks that typically take a lot of time” - verified user

- “It is created specifically for the accountant's mind.” - verified user

Cons:

- “Different modules may take too long to connect their data during work.” - verified user

- “The user experience is a bit clunky at times.” - verified user

Key features:

- Automates reconciliations, journal entries, and statement generation

- Centralizes invoice-to-cash operations across credit, billing, collections, and cash forecasting

- Uses AI to surface anomalies and deliver insights across the close and cash cycle

Comparison with Vena:

- BlackLine focuses on financial close workflows like transaction matching and audit trails, whereas Vena is primarily an Excel‑native FP&A platform.

- Teams looking for more integrated budgeting, planning, and analysis in Excel might favor Vena.

Customer reviews:

Integrations: Blackline users can connect to software and cloud partners like Google Cloud, Microsoft Dynamics, and CoStar.

Pricing and suitability:

- Pricing is not publicly available.

- Best for enterprises who want to use AI for their close and AR processes.

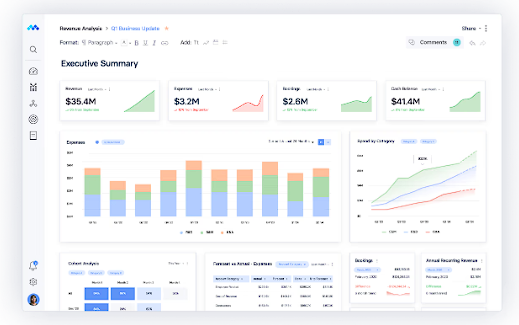

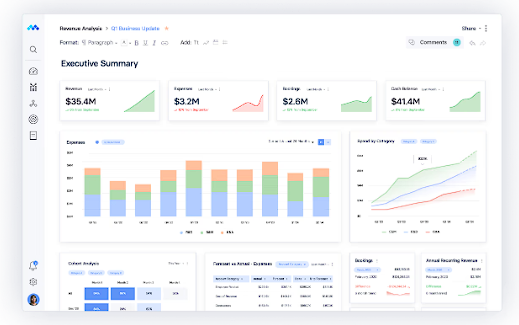

11. Mosaic Tech

Mosaic is an FP&A platform that connects live data from your ERP, CRM, HRIS, and billing systems. Finance teams use it to plan headcount, forecast revenue, and track cash flow. Mosaic comes with 150+ prebuilt metrics and an AI assistant called Arc to simplify financial reporting and help teams answer strategic questions quickly.

Pros:

- “Real time updates make dashboarding and reporting quite simple.” - verified user

- “Mosaic has a very clean interface.” - verified user

Cons:

- “There is definitely a learning curve with regards to creating formulas and linking the elements of a financial model.” - verified user

- “The flexibility with graphical views are limited.” - verified user

Key features:

- Automates reporting and consolidations using 150+ prebuilt metrics and custom KPIs

- Runs headcount, revenue, and cash flow planning

- Enables collaborative budgeting by letting department leads submit plans directly

- Uses Arc AI to summarize trends and deliver instant answers for board prep or ad hoc analysis

Comparison with Vena:

- Mosaic works via its own platform rather than inside Excel.

- Users score Mosaic higher for support quality (9.5 vs. Vena’s 9.0).

Customer reviews:

Integrations: Users can integrate with multiple ERPs, CRMs, and billing software like QuickBooks, HubSpot, Stripe, and more.

Pricing and suitability:

- Comes in 3 plans: Analytics, Foundation, and Growth—although pricing is not publicly available.

- Best for SMBs that want to access real-time metrics and collaborative planning without hiring extra analysts.

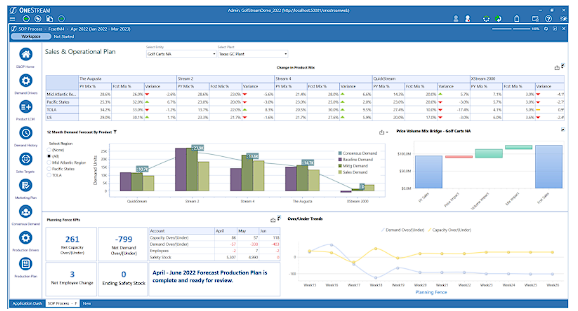

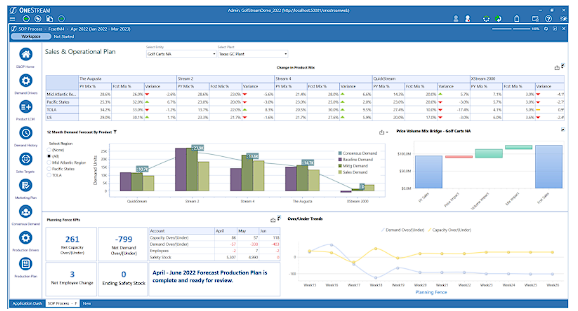

12. One Stream

OneStream is a CPM and FP&A platform that helps finance teams automate planning, consolidation, and reporting. It uses AI-powered tools for scenario modeling, tax provision, account reconciliation, and ESG reporting. Their AI can also surface insights for gross margin, EBITDA, and cash flow.

[Source]

Pros:

- “OneStream is an extremely versatile platform.” - verified user

- “You can do almost anything if you try hard enough.” - verified user

Cons:

- “Big learning curve to set up the system and to train new users.” - verified user

- “It is time consuming and can be complex to set up customizations.” - verified user

Key features:

- Runs automated close and consolidation processes

- Automates account reconciliation and transaction matching

- Supports global compliance standards including US GAAP, IFRS, SOX, and ESG frameworks

- Delivers live insights with drill-down dashboards, currency translation tools, and AI-powered variance detection

Comparison with Vena:

- OneStream replaces spreadsheets with a central data model, dashboards, and an optional Excel add-in, Vena keeps finance teams working directly inside Excel.

- OneStream’s core strength is automating close, consolidation, and reconciliation end-to-end, Vena offers close management but focuses more on planning, budgeting, and reporting.

Customer reviews:

Integrations: OneStream offers direct integration with any open GL/ERP or other source system.

Pricing and suitability:

- Pricing is not publicly available.

- Best for medium-sized businesses and enterprise finance teams looking for an all-in-one platform to streamline close processes and scale forecasting and planning with AI.

Key considerations in selecting Vena alternative for FP&A

Selecting the right FP&A software is a crucial decision for finance professionals. It's not just about picking a tool; it's about choosing a solution that aligns with your organization's goals and processes.

Here are key considerations to keep in mind when assessing Vena and its alternatives:

Determine organizational needs and priorities

Start by assessing your company's specific needs. What are your primary financial processes and pain points? Does your team need more robust forecasting, detailed reporting, or better data consolidation? Understanding these requirements will guide you in selecting a software that addresses your unique challenges.

Consider scalability and integration with existing systems

The software you choose should not only meet your current needs but also grow with your organization. Consider its scalability in terms of handling larger data sets, more complex scenarios, and a growing user base. Equally important is its ability to integrate seamlessly with your existing systems, whether it’s your ERP, CRM, or other business intelligence tools, to ensure a cohesive workflow.

Evaluate user experience and support services

A user-friendly interface can significantly impact adoption rates and overall satisfaction with the software. Look for intuitive navigation, customizable dashboards, and clear reporting capabilities. Additionally, consider the level of customer support provided. Responsive and knowledgeable support can be invaluable, especially during the initial implementation phase and for ongoing troubleshooting.

Consider the total cost of ownership and ROI

Beyond the sticker price, consider the total cost of ownership, which includes implementation, training, maintenance, and any additional services required. Weigh these costs against the potential return on investment (ROI) the software can offer through time savings, accuracy improvements, and enhanced decision-making capabilities.

By carefully evaluating these aspects, you can choose an FP&A software that not only fits your current financial workflows but also supports your strategic goals and contributes to the overall growth of your organization.

Choose the best Vena Solutions alternative needs

Choosing the right FP&A software is a strategic decision that goes beyond mere feature comparison. It's about finding a solution that aligns with your organization’s specific needs, scales with your growth, and offers a seamless user experience while providing a worthwhile return on investment.

Want to learn why a solution like Cube may be the right fit for your organization? Request a free demo today.

.png)

.png)

![Vena software review: Pros, cons, and top alternatives [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Pie%20Chart.png)

![Vena software review: Pros, cons, and top alternatives [2024]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Lines%20Chart.png)