7 things you need to do to get your budget approved

Navigating the nuances of budgeting can be challenging. As you prepare to make your case, consider these seven pivotal steps that can significantly increase the likelihood of your budget gaining the green light.

1. Ensure alignment with key business objectives and strategic goals

Budgeting is about more than allocating every dollar—it's about doing it in the most effective way possible. After all, what's the point of a budget if it doesn't get you closer to reaching your company's goals?

To get stakeholders on board and transform your proposed budget into an approved budget, it's crucial to ensure your budget is in alignment with strategic goals. To do this, you'll need to:

- Think long-term. What are your business's long-term goals, beyond the budget period? Get leadership involved in the budgeting process from the start to make sure annual budgets fit the overall business plan.

- Utilize zero-based budgeting. Budgets don't have to be an extension of last year's budget—after all, priorities can change. The zero-based budget model involves creating budgets from scratch, meaning they can be purpose-built to align with strategic goals.

- Track key performance indicators (KPIs). Tracking KPIs is critical for evaluating whether your budgets are effectively meeting goals. Which KPIs you track will depend on business objectives. For example, if the goal is to build up customer loyalty, you'd watch for increases in customer lifetime value (CLV). If it's to boost profit margin, you'd look at the average cost of goods sold (COGS) and/or customer acquisition costs (CAC).

2. Communicate with departments heads

The best budgets ensure each piece of the company works together. Go beyond finance teams and involve different departments in the budgeting process to see what their concerns are. This communication will alert you to problems you may have overlooked.

With a clear view of how departments affect one another and the company, you can optimize departmental budgets to match strategic goals.

This concept fits perfectly with zero-based budgeting. A department may not need as much money as it needed last year. For instance, maybe R&D is less important during this budgeting period since the product they were working on is ready to go. That means you can shift some of that money to marketing initiatives, driving consistent revenue growth through sales.

3. Utilize forecasts

There's a little paradox in the budgeting process: while budgets depend on future circumstances, you're making them now. While it would be ideal if we could see into the future, solid forecasts are the next best thing.

Begin with your operating budgets

Operating budgets are all about revenue and expenses of the day-to-day. You'll want to forecast these before you start creating plans for expansion and building your master budget.

Forecasting revenue means sales forecasts. Here, it's logical to start with past data—how much did you sell last year? Are you implementing any changes to prices or features, or expecting major market shifts? Consider how these new factors will affect your previous performance baseline. If you experience cyclical demand, don't forget to incorporate seasonal budgeting.

The best way to build sales forecasts is with real-time data. This way they'll be continuously updated, making it easy to save money on holding costs and avoid stockouts.

Speaking of costs, there are two main types: fixed and variable. The difference lies in how they relate to sales.

- Fixed costs don't change based on how many sales you're making. This makes them a lot easier to forecast than variable costs.

- Variable costs do change based on sales. So, you'll want to base your variable cost projections (and your budget) on solid, data-backed sales forecasts. Getting variable expenses as tight as possible frees up excess capital that can be used to target business objectives. Refine your forecasts with information from past budgets (e.g., where did you deviate, and why?). Then, perform variance analysis to improve future budgets.

Forecast cash flow

Understanding cash flows is also crucial for the budgeting process. Cash flow forecasts help you optimize the timing of fixed and variable payments against strategic investment. With accurate forecasts, you'll never risk running out of liquidity.

4. Justify large costs

So, we've got operating expenses down. Now, we get into larger costs—the ones that push the company in the right direction, like wind into sails.

How do you justify these large corporate investments? First, lay out the objectives of the expense. Why is it necessary? How does it align with company goals? Why is it better than a different option?

There's no better way to justify one expense over another than with capital budgeting. Capital budgeting is all about cash flows. Through market research and forecasts, you can show how a specific investment will generate more money than other avenues.

Lay out the individual expenses of the project (i.e., direct/indirect costs, staffing, equipment, etc.). Set up a specific timeline and establish periodic reviews to reassure stakeholders that funds are being used effectively.

5. Prepare for risk

As great as traditional budgets are, there's a limiting factor: they lack flexibility. If a wrench gets thrown into your operations, you might not be able to pivot fast enough to avoid major, company-wide damage.

To prevent this, it's important to build in flexibility through contingency planning. Contingency planning involves assessing the likelihood of certain risks, then building contingency reserves (essentially, emergency funds).

Depending on your industry, some risks are more likely than others. For example, if you depend heavily on supply chains, ask how interruptions to those supply chains would affect you. If you're an international company, you'll want to account for exchange rate risk. How could large positive or negative fluctuations affect your budget?

Incorporate scenario modeling to answer these questions, and utilize rolling forecasts. In contrast to a one-and-done, static forecast, rolling forecasts adjust based on new data. Using them means you won't be committed to a specific budget if an unexpected scenario occurs.

6. Ensure efficiency and data accuracy with tools and technology

Your budgeting process relies on forecasts, and forecasts rely on data. What better way to collect data than automatically?

Doing things manually can be a massive time-sink. Software-based automation guarantees you're recording data as it's generated and ensures it's clean, bypassing the risk of flawed forecasts (and flawed budgets).

If you're using rolling forecasts, automation helps immensely with achieving a real-time view, as there won't be any delays in actually recording the data.

The right software also helps you track KPIs, so you can make adjustments as necessary.

7. Make a clear, compelling case

Finally, we come to the actual presentation. On the face of it, you’re talking about something dry—so how can you make budgets more exciting?

The best way is to explain how it's going to help the short- and long-term goals of the company. However, some financial topics can be pretty complex, especially for anyone who doesn't work in finance.

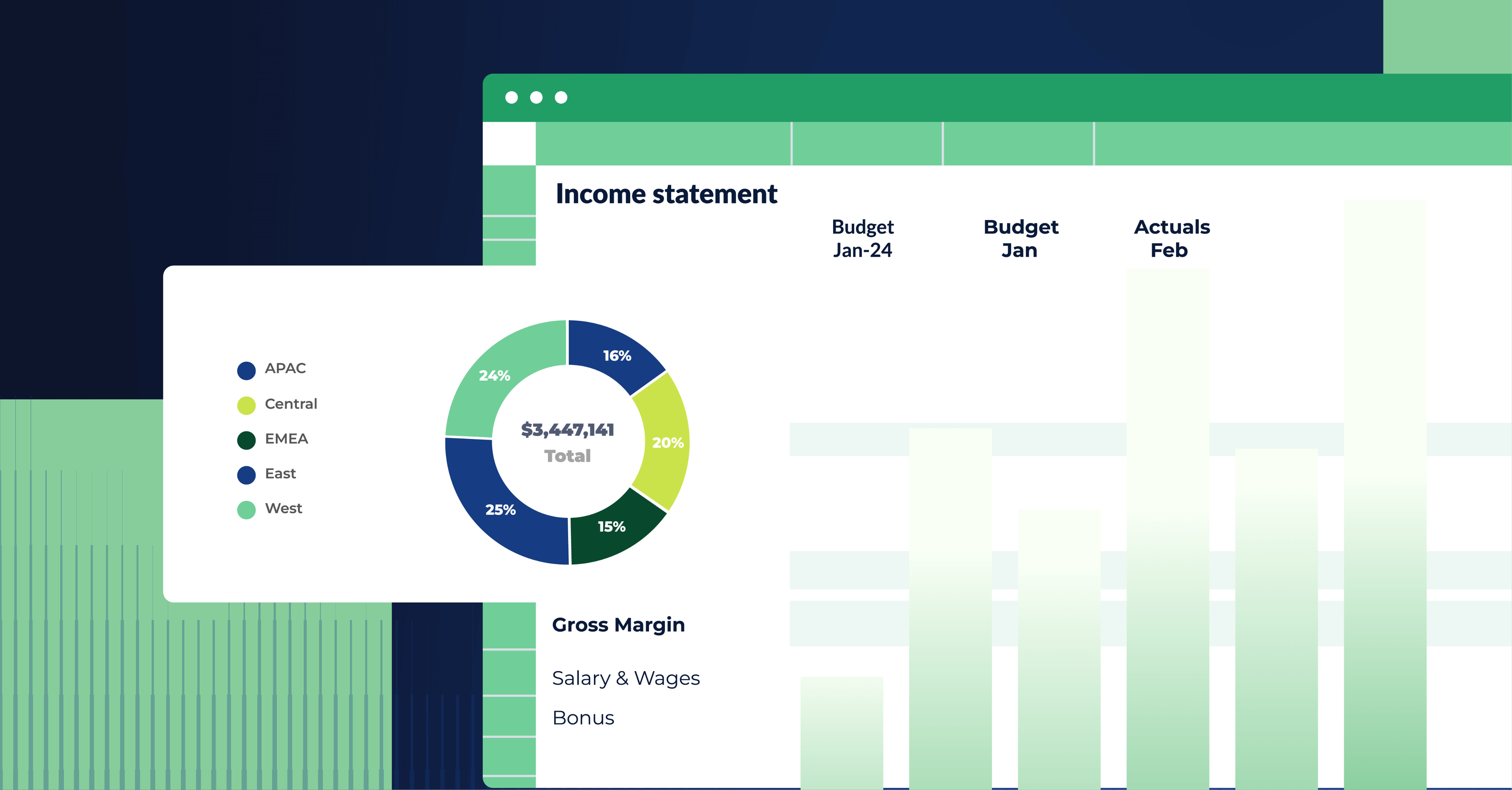

Data visualization tools, such as dashboards, can help make it easier for stakeholders to understand the information you're presenting. They allow you to demonstrate how the different aspects of your budget work together, what KPIs they target, etc.

You should be prepared to answer specific questions. For example, stakeholders may ask you:

- How did you arrive at your figures?

- Will we need to make new hires?

- How can we fund these capital expenditures without burning down our balance sheet?

Visualizations can help you provide powerful, succinct answers to these questions and obtain stakeholder buy-in.

Best practices for getting your budget approved

Now you know what it takes to get your budget approved, but you may be wondering: is there anything else you can do to help make your case?

As a matter of fact, there is. Here are a few additional best practices to consider to make your budget proposal as appealing as possible:

1. Embrace adaptability in budgeting

In an ever-changing business landscape, a rigid budget can become obsolete quickly. By remaining adaptable, you position your budget to pivot according to business realities and economic shifts.

For example, consider a company that had a fixed budget for traditional marketing but then saw an abrupt shift in its audience's behavior toward digital channels. By being flexible, they could reallocate funds from traditional to digital marketing mid-year to maximize returns.

A flexible budget is more likely to get approved because it demonstrates a company's proactive adaptability to real-time market changes, optimizing resource allocation and mitigating risks.

To ensure flexibility, regularly review the budget on a quarterly basis, and adjust allocations based on recent performance metrics and emerging opportunities.

2. Lean on data-driven insights

Data-driven decisions are more reliable and justifiable. Using analytics ensures that your budget decisions are grounded in actual performance and realistic projections.

For example, if a retail business analyzes its sales data and notices a growing trend in online sales, it can then allocate more funds to enhance its online platform for the next year.

Be sure to regularly review historical data, and consider using advanced techniques like predictive modeling to forecast future trends.

3. Prioritize transparency

Transparency builds trust. When stakeholders understand the rationale behind budget decisions, they're more likely to support them.

For example, let's say a department head is requesting a significant budget increase. By being transparent about the tools, methodologies, and data behind this request, you can clearly show stakeholders why this increase is essential.

To ensure transparency, it's helpful to document every aspect of your budgeting process. When presenting your budget, provide a detailed breakdown of how figures were arrived at and the data sources and methodologies employed.

4. Ensure compliance

Regulatory compliance is non-negotiable. A budget that doesn't adhere to legal and industry standards can result in financial penalties and harm the company's reputation.

For example, let's say a pharmaceutical company needs to allocate funds for specific clinical trials and research to gain approval for a new drug. If they fail to comply, it can lead to legal issues and lost opportunities for the company.

To prevent issues, keep yourself updated on industry-specific regulations. Before finalizing your budget, cross-check with a legal or compliance team to ensure all regulatory requirements are met.

5. Continually educate and train teams

A well-informed team can make more accurate budget forecasts and understand the importance of adhering to the budget.

For example, when trained on modern digital tools and techniques, a sales team might provide a more accurate forecast of potential sales, helping in more effective budget allocation.

Consider conducting regular training sessions for different departments to address specific areas of improvement and ensure teams are equipped with the latest knowledge and tools.

Conclusion: getting the green light

Effective budgeting is more than just columns of numbers—it's about crafting a clear, strategic vision backed by data and insight. By mastering these seven steps, you can position your budgets for approval, ensuring your plans align with both short-term needs and long-term goals.

Want to learn how Cube can help you make the most compelling case possible? Request a free demo today.

.png)

.png)