Product

Solutions

Resources

Company

About Cube

Explore our vision and team

Careers

Help shape the future of FP&A

In the News

Cube featured in top publications

Security

Enterprise-grade, cloud security

Newsletter

.png)

A newsletter for finance pros—by finance pros. Get practical, strategic finance insights from those who’ve been there—straight to your inbox.

Convert

Multicurrency

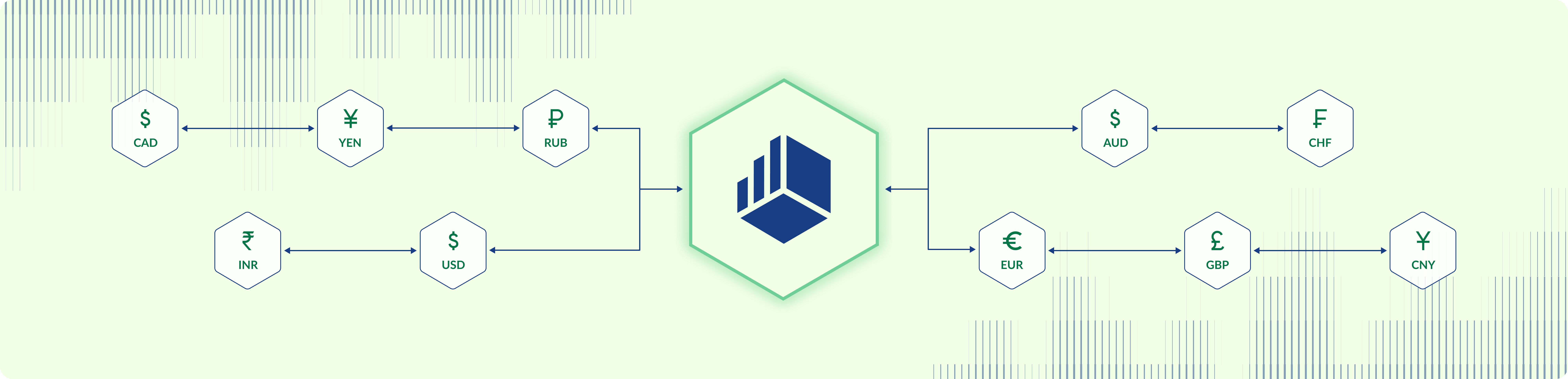

Unparalleled flexibility for global finance teams. Plan across regions, track vendor payments in local currencies, or consolidate financial reports, all powered by Cube's enterprise-grade reliability.

SEAMLESS GLOBAL FINANCIAL OPERATIONS

Ultimate Currency Flexibility

View data in any currency instantly, with real-time, accurate conversions.

Localized Planning & Budgeting

Teams can plan in local currencies while Cube handles consolidations for reporting.

Adaptable to Any Structure

Cube flexes to your unique organizational hierarchy and currency requirements.

.png)

Key Capabilities

Flexible Currency Switching

Switch between any currency instantly: view actuals in USD, plan in EUR, and analyze variance in GBP, all from the same dataset without rebuilding reports.

Local Currency Planning

Enable international teams to plan in their local currencies while automatically consolidating to parent entities, maintaining accuracy and customization.

Multi-Currency by Subsidiary

Handle complex cases like varying exchange rates for the same currencies pairs across subsidiaries—ideal for companies with acquisitions or hedging strategies.

Flexible Hierarchy Management

Adapt to any organizational structure, from simple parent-child relationships to complex multi-tiered hierarchies with different base currencies at each level.

Dynamic Rate Management

Configure FX rates by period, account, or subsidiary with the flexibility to override rates for specific scenarios or maintain different rates for different business purposes.

Results from teams who got their data under control

Now with Cube, we spend more than half our time on strategic work—partnering with the business instead of cleaning up the numbers.

James Mann

CFO

We went from drowning in data to delivering insights our executive acts on.

Stuart Ferguson

CFO

What is multicurrency planning in Cube?

How does Cube support global teams with multicurrency planning?

Can Cube handle different exchange rates for the same currency pair?

What are the benefits of multicurrency planning?

Does Cube automatically update foreign exchange rates?

How does Cube consolidate global data for reporting?

What use cases does Cube support with multicurrency planning?

Can I customize exchange rate logic in Cube?

Is Cube suitable for companies with complex corporate structures?

How does Cube compare to Excel or Google Sheets for multicurrency planning?

Still have questions?

.png)