Reliable accuracy

Seamless data integration

Stop updating spreadsheets one cell at a time. Cube automatically pulls live financial data from your ERP, CRM, and other sources so your budgets, forecasts, and reports are always accurate and up to date.

Product

Solutions

Resources

Company

About Cube

Explore our vision and team

Careers

Help shape the future of FP&A

In the News

Cube featured in top publications

Security

Enterprise-grade, cloud security

Newsletter

.png)

A newsletter for finance pros—by finance pros. Get practical, strategic finance insights from those who’ve been there—straight to your inbox.

Easily build and analyze budgets, track expenses across departments, and forecast cash flow so your business stays financially healthy and ready for what’s next.

It's time to make FP&A the hero your company needs.

Loved by finance pros at

Quickly spot where to allocate funds, where to cut costs, and which investments drive the biggest returns.

Model different financial scenarios, adjust forecasts in seconds, and instantly see how changes impact future cash flow and expenses.

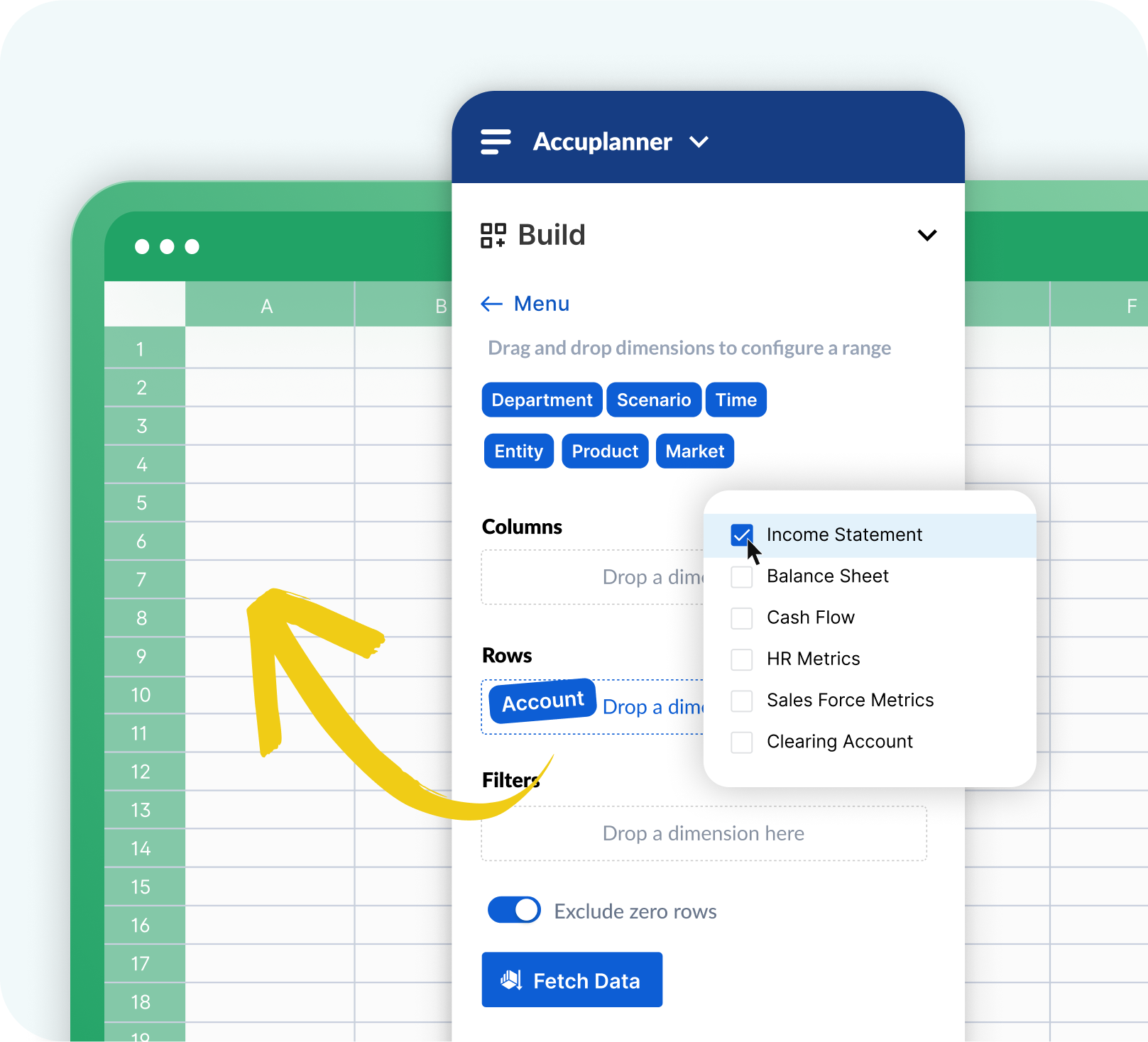

Work in your existing Excel or Google Sheets, but with enterprise-grade AI running calculations, automating reports, and keeping your numbers perfectly organized.

Take our quick assessment and find out the answer, plus access resources to optimize your processes and enhance financial planning and analysis.

Stop updating spreadsheets one cell at a time. Cube automatically pulls live financial data from your ERP, CRM, and other sources so your budgets, forecasts, and reports are always accurate and up to date.

Let AI handle the number-crunching so you can focus on the big picture. Cube’s AI analyzes data trends, detects spending risks, and automatically updates budgets and forecasts all on it’s own.

.png)

.png)

.png)

Get out of the data entry weeds and into the strategy. Sign up for a free demo of Cube today.

Business budgeting software helps you plan, manage, and track your company’s finances—essentially how much money you’re making, spending, and saving. It automatically updates your budget and helps you adjust allocations when business conditions change.

For example, imagine you're running a small business and you’re tracking how much money you make and how much you spend on things like supplies or salaries. Instead of manually adding numbers into a spreadsheet every month, budgeting software does it for you and shows you if you’re on track or need to adjust your spending.

The best budgeting method depends on how your business is organized and how decisions are made. Two common ways to approach budgeting are top-down and bottom-down budgeting.

If you're running a small business with a small leadership team, top-down budgeting might be faster and more efficient to enforce. But if your business is larger and departments have different needs, bottom-up budgeting ensures everyone’s voice is heard.

The best business budgeting software for enterprises does more than just track bills on a spreadsheet. It streamlines financial planning, enhances forecasting, and ensures teams can make smarter, data-driven decisions. The most effective solutions:

For SMBs and enterprises looking for budgeting software that integrates with existing tools, automates complex reporting, and helps finance teams make smarter decisions, consider Cube. Cube takes the complexity out of budgeting so your team spends less time on spreadsheets and more time driving business growth.

Budgeting software helps you track income, expenses, and forecast future financial needs. You would use this for setting financial goals, allocating resources, and tracking if you’re staying on track with your financial plans.

For example, if you're a small business owner, budgeting software will help you set your monthly budget for salaries, supplies, and rent, and track how you’re doing compared to your plan.

FP&A (financial planning and analysis) software is a more advanced tool that goes beyond typical budgeting to make strategic financial decisions. It includes financial scenario forecasting, annual planning, and advanced analysis to help finance teams make smarter long-term financial plans and evaluate business performance.

For example, if you're looking to expand into a new market, FP&A software helps you model how the costs of hiring new staff and setting up operations will affect overall profitability.

By providing data-driven insights and forecasts, strategic finance enhances decision-making accuracy. It enables proactive management of financial resources, identifies growth opportunities, and mitigates risks, thereby optimizing financial performance.

The best strategic finance software covers more than simple reporting. It integrates, analyzes, and drives smarter decision-making. The best solution:

For those looking for strategic finance software that integrates with familiar spreadsheets, provides enterprise-grade insights, and helps you plan with confidence, consider Cube. It helps finance teams of all sizes move beyond traditional FP&A and into smarter strategic finance.

Strategic finance and FP&A (financial planning & analysis) are related but not the same. FP&A focuses on budgeting, forecasting, and analyzing financial performance to support short-term business goals. Strategic finance builds on this, using advanced modeling, scenario planning, and AI-driven insights to proactively guide long-term decision-making.

For example, FP&A teams might create a quarterly budget, track spending, and adjust forecasts to stay aligned with financial plans. Strategic finance teams take a broader approach—running multi-scenario models to assess market shifts, evaluate expansion opportunities, and optimize resource allocation so the business can anticipate challenges and make smarter strategic moves.

Strategic finance focuses on aligning financial decisions with long-term goals. For example, let’s say a company wants to expand into a new market. A strategic finance team would use FP&A software, like Cube, to analyze the costs of entering the market, forecast potential revenue, and evaluate whether the investment aligns with the company’s growth objectives.

They might also run scenarios to assess the risks of expansion under different economic conditions. This strategic finance approach makes sure decisions are financially sound before moving forward.

Finance focuses on managing day-to-day financial operations like tracking expenses, processing payments, and preparing reports. Strategic finance goes further, using data-driven insights to anticipate risks, optimize resources, and drive long-term growth.

For example, while finance ensures the company stays within budget, strategic finance models the impact of major decisions like acquisitions, expansions, or pricing changes before they happen. Finance looks at past performance, but strategic finance leverages predictive analytics to shape future opportunities.