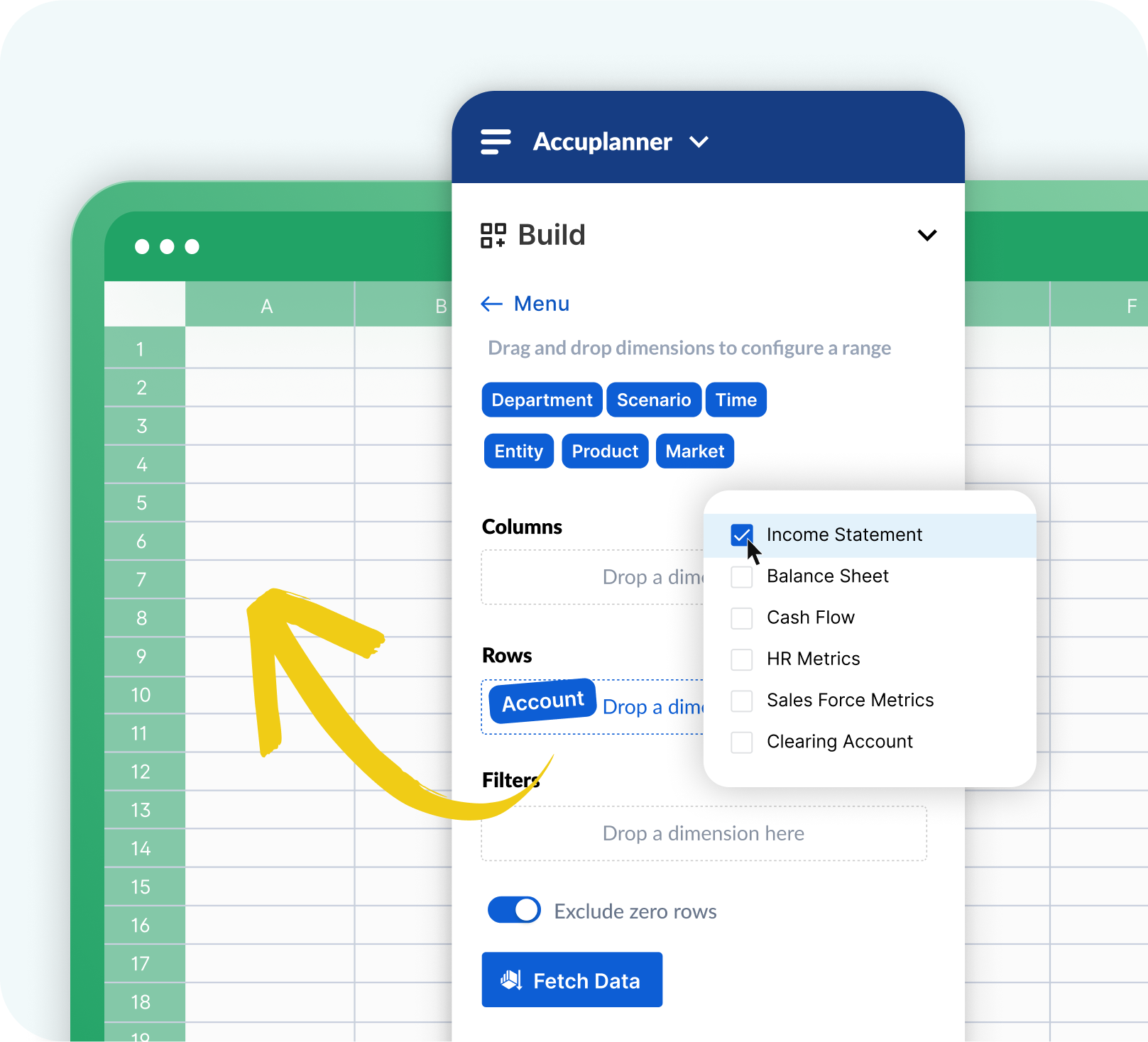

Spreadsheet-friendly

Keep the spreadsheets you love

Access enterprise-grade FP&A functionalities without leaving Google Sheets or Excel. Cube connects your existing templates to real-time data so you can refresh reports, build ad-hoc analyses, and actualize plans in minutes—no coding required.

.png)

.png)

.png)

.png)