Executor vs. strategic leader: What's the difference?

Before we dive into embracing a strategic mindset, it's helpful to understand the fundamental differences between an executor and a strategic leader.

Executors:

- Focus on tasks: Executors are primarily concerned with completing specific tasks and ensuring that daily operations run smoothly. Their work is often transactional, with a focus on immediate results. A financial analyst is one example of an executor on the FP&A (financial planning and analysis) team.

- Take a reactive approach: Executors tend to respond to problems as they arise. They are skilled at managing crises and ensuring short-term goals are met.

- Prioritize operational efficiency: Executors are great at optimizing processes and improving efficiency within existing frameworks. Their goal is to maximize productivity and minimize errors with their technical skills.

Strategic leaders:

- Focus on vision: Strategic leaders, on the other hand, are driven by a long-term vision. They look beyond immediate tasks and consider the broader impact of their decisions on the organization's future. The CFO position is just one example of a strategic leader in finance.

- Take a proactive approach: Instead of merely reacting to issues, strategic leaders anticipate challenges and opportunities. They develop strategies to navigate and leverage these for the company’s benefit.

- Prioritize innovation and growth: Strategic leaders prioritize innovation and seek out growth opportunities. They are not just focused on maintaining the status quo but on driving the organization towards new horizons.

As a CFO, you are expected to provide more than just operational support—you are a key player in shaping the company’s strategy and ensuring its long-term success. That's why shifting from an executor to a strategic leader is essential for anyone hoping to become a CFO. You can contribute at a higher level, influence major business decisions, and drive the company towards its goals.

How to transition from executor to strategic leader

To successfully transition from an executor to a strategic leader, you must undergo a complete transformation in how you think and approach your role. Here are a few key tips to help you gain these leadership skills:

1. Embrace a strategic mindset

Adopting a strategic mindset means seeing the bigger picture and understanding how your actions today shape the future of your organization. Rather than reacting to events, you're proactively driving the company toward its long-term goals.

Here’s how you can strengthen your strategic thinking skills:

-

Think long-term: Shift your focus from immediate tasks to long-term goals. Understand how your financial strategies align with the company's overarching objectives and envision the business's future.

For instance, instead of just closing the books each month, consider how the financial data can inform future investments in technology or product development. Ask yourself, "How will this decision impact the company five years from now?" This perspective helps you make more informed, impactful decisions that drive lasting success.

-

Drive business growth: Go beyond traditional financial management and contribute to initiatives that drive business growth. This means understanding market trends, customer needs, and the competitive landscape.

For example, if you're aware of a growing market trend towards sustainability, you might advocate for investments in green technologies or partnerships with eco-friendly suppliers. By aligning your financial insights with strategic business initiatives, you can help steer the organization toward new opportunities and innovative solutions.

-

Prioritize innovation: Innovation is key to gaining a competitive edge, so be open to new ideas and support initiatives that push the boundaries. This could mean implementing new financial technologies like AI-driven analytics to improve forecasting accuracy.

2. Develop key leadership skills

Becoming a CFO demands strong leadership skills. As a strategic leader, it's up to you to inspire and guide your team, communicate effectively with stakeholders, and make informed decisions that drive the organization forward.

Here are the key areas to focus on:

-

Communication: Effective CFOs are excellent communicators who can translate complex financial data into clear, actionable insights for non-financial stakeholders.

To improve your communication skills, start by practicing clarity in your everyday communications—break down complex financial concepts into simple terms and avoid jargon. Engage in storytelling by using real-world examples to make your data more relatable. Seek feedback after presentations to refine your approach and ensure your message is understood.

-

Decision-making:

Strategic leaders excel at making informed decisions based on data analysis and risk assessment. To enhance your decision-making skills, regularly analyze current trends and forecast future scenarios using tools like predictive analytics.

When faced with major decisions, consult with industry experts or mentors for additional insights. Practice weighing financial risks and opportunities by conducting thorough market research and considering potential outcomes for different scenarios.

-

Collaboration:

Collaboration is essential for a strategic leader because it ensures alignment across the organization. To create a collaborative environment, meet with leaders from other departments regularly to understand their needs and challenges. Encourage cross-functional projects that require input from various teams to ensure alignment with broader business objectives.

For example, when developing a budget for a new product launch, work closely with the marketing team to ensure financial strategies support the initiative’s goals. Promote open communication and teamwork to break down silos and make sure everyone is working toward a common goal.

3. Gain broad business acumen

As a CFO, you need to have a comprehensive understanding of how different functions within the organization operate and how they contribute to the overall strategy. This knowledge is necessary to make informed decisions that support the company’s long-term goals and ensure financial strategies are aligned with broader business objectives.

Here’s how you can broaden your business knowledge:

-

Gain industry expertise: Stay updated on industry trends, emerging technologies, and regulatory changes. Consider investing in ongoing education through courses, certifications, and professional networks. Regularly read industry publications and attend relevant webinars to stay in-the-know of the latest developments in the finance field.

-

Understand the business model:

Dive deep into understanding your company's business model and how different functions contribute to its success. Spend time with different teams to learn about their roles and challenges. For example, understanding the product development lifecycle can help you make better financial decisions that support innovation and growth.

-

Conduct competitor analysis:

Analyze competitors and market trends to identify potential threats and opportunities. This involves studying competitors' financial reports, market strategies, and customer feedback. By understanding what your competitors are doing, you can develop strategies to differentiate your company, capitalize on market opportunities, and strengthen risk management.

4. Build a strong professional network

Networking is vital for career advancement and becoming a strategic leader. A strong professional network can provide valuable insights, support, and opportunities that are crucial for your growth. Here’s how to build and maintain a strong professional network:

-

Join industry associations: Participate in organizations like the Association for Financial Professionals (AFP). Attend conferences, webinars, and networking events to meet other professionals and stay updated on industry best practices.

For example, attending an AFP conference can provide opportunities to learn about the latest trends in FP&A, as well as connect with peers who share similar challenges and goals.

-

Seek mentorship: Look for mentors within and outside your organization who have successfully navigated the path to becoming a CFO. Likewise, mentor others to build a reputation as a leader in the field.

For instance, having a mentor who has transitioned from an FP&A role to CFO can offer valuable advice and insights on navigating the path. Additionally, mentoring junior finance professionals can enhance your leadership skills and establish you as a trusted advisor in the industry.

-

Building and maintaining relationships: Networking isn’t just about making connections; it’s about maintaining and nurturing those relationships over time. Regularly check in with your contacts, share relevant information, and offer support when needed. This ongoing engagement helps create a strong, supportive network that can provide assistance and opportunities when needed.

5. Demonstrate strategic impact

Highlighting your achievements demonstrates your value and positions you as a strategic leader within the organization—both great things for an aspiring CFO. Here’s how you can start demonstrating your strategic impact:

-

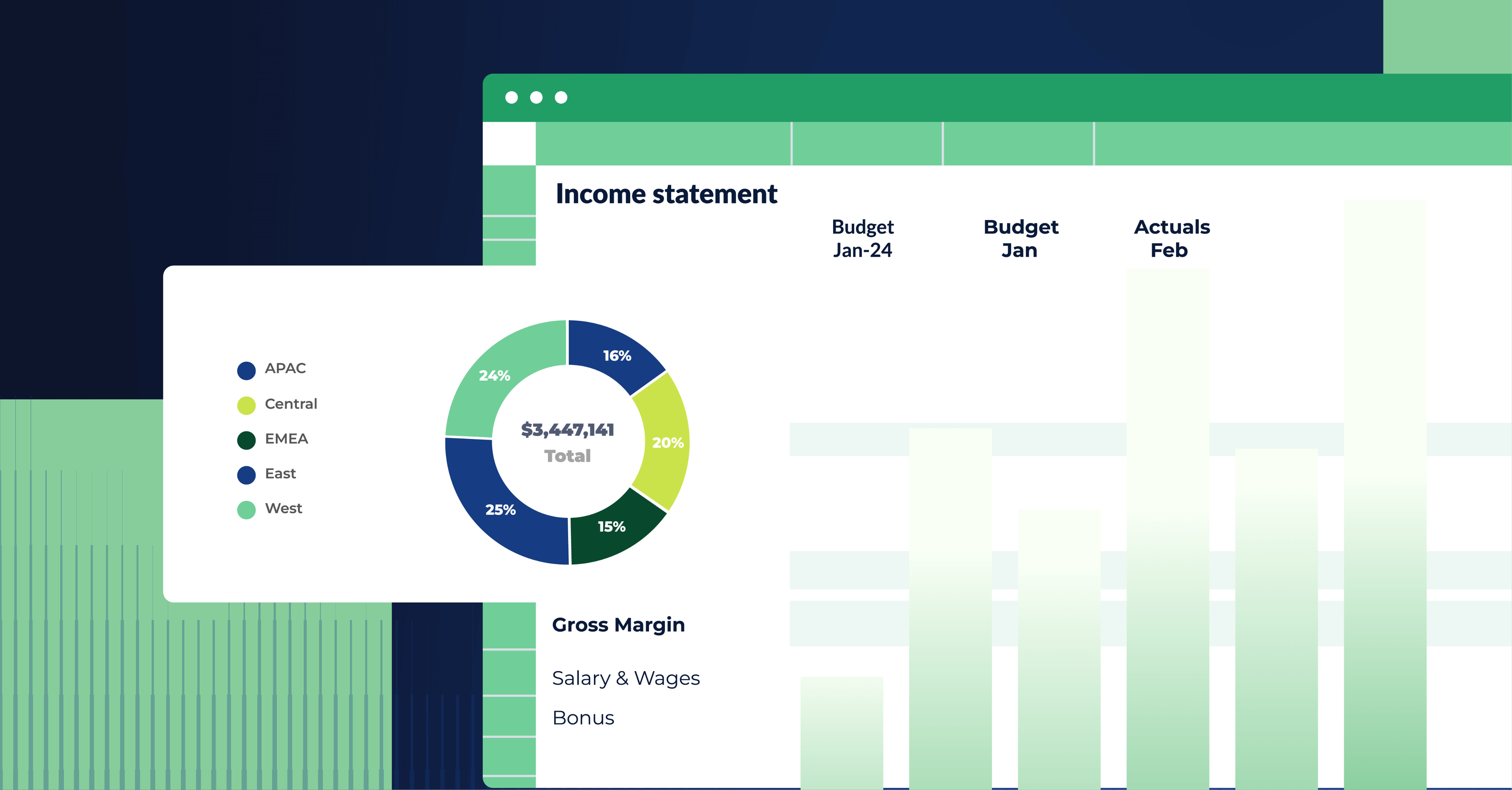

Drive efficiency: Implement process improvements and cost-saving initiatives that have a measurable impact on the company’s bottom line. For example, introducing FP&A software can reduce processing time and errors, leading to significant cost savings. Document these improvements and their financial impact to showcase your ability to drive operational efficiency.

-

Support growth: Lead projects that contribute to revenue growth, such as market expansion, mergers and acquisitions, or product development. For instance, if you led the FP&A for a successful market entry, highlight how your strategic insights and risk assessments contributed to the project’s success. This shows you can drive growth and create value for the company.

-

Communicate results: Effectively communicate your strategic impact to stakeholders. Use data and clear narratives to show how your initiatives align with the company’s long-term goals and contribute to its success. Prepare comprehensive reports and presentations that highlight key metrics, milestones, and outcomes of your strategic projects.

For example, preparing a detailed presentation on how a new financial strategy improved cash flow and supported business objectives helps stakeholders understand and appreciate the value you bring to the organization.

Top traits of a strong strategic leader

Ever wondered what sets a CFO apart? Successful CFOs share some key traits that make them stand out. Here are the top qualities that define a strong strategic leader:

- Visionary thinking: Strong strategic leaders have a clear vision for the future and the ability to see the big picture. They can anticipate market trends and industry shifts, and they develop strategies that align with long-term business goals. This forward-thinking mindset helps guide the company toward sustained success.

- Decisiveness: Strategic leaders are confident and decisive, able to make informed decisions quickly and effectively. They analyze data, consider risks and opportunities, and then take decisive action. This decisiveness inspires confidence in others and drives momentum within the organization.

- Adaptability: The ability to adapt to changing circumstances is crucial for strategic leaders. They remain flexible and open to new ideas, adjusting strategies as needed to respond to evolving market conditions or organizational challenges. This adaptability ensures the company remains competitive and resilient.

- Strong communication: The best leaders can clearly articulate their vision, strategies, and the rationale behind their decisions to various stakeholders. They use storytelling to make complex financial data relatable and understandable, ensuring everyone is aligned and motivated.

- Collaborative mindset: Collaboration is essential for driving cohesive strategies across the organization. Strategic leaders build strong relationships with other departments, encourage teamwork, and break down silos. This collaborative approach ensures that financial strategies support and enhance broader business objectives.

- Innovative thinking: Strong strategic leaders prioritize innovation and encourage creative problem-solving. They are not afraid to challenge the status quo and explore new technologies, processes, or business models. This innovation drives growth and keeps the organization ahead of the competition.

- Integrity and accountability: Integrity and accountability are fundamental traits of a strong leader. They lead by example, maintaining high ethical standards and taking responsibility for their actions. This builds trust within the organization and creates a culture of transparency and accountability.

- Emotional intelligence: Emotional intelligence enables leaders to understand and manage their own emotions and those of others. This trait helps them build strong relationships, navigate complex interpersonal dynamics, and lead with empathy and understanding. It’s essential for creating a positive and productive work environment.

Cultivating these traits will help you better manage the transition into a strategic leadership role, positioning you as a strong candidate for the CFO position and preparing you to drive significant impact within your organization.

Pitfalls to avoid as an aspiring CFO

As you transition from an executor to a strategic leader, it’s important to be aware of common pitfalls that can hinder your progress. Here are a few to watch out for:

- Focusing solely on numbers: While financial metrics are important, concentrating exclusively on the numbers can prevent you from seeing the bigger picture. Avoid getting bogged down in details and ensure you consider strategic implications and broader business impacts.

- Neglecting communication: Poor communication can undermine your efforts to lead strategically. Focus on clear, concise, and compelling communication to ensure your message is understood and valued by all.

- Resisting change: Avoid sticking to outdated methods or being overly cautious. Embrace innovation and be open to new approaches and technologies that can drive the company forward.

- Ignoring team dynamics: A lack of attention to team dynamics can lead to inefficiencies and conflict. Avoid isolating yourself or your department. Keep your eyes and ears open to ensure you’re aware of—and addressing—the needs and challenges of other teams within the organization.

Conclusion: lead with confidence

Making the leap from executor to strategic leader is essential for aspiring CFOs. By embracing these key traits and strategies, you’ll be well on your way to driving significant impact within your organization.

Ready to see how Cube can help you elevate your financial leadership? Schedule a demo today and take the first step towards transforming your career.

.png)

.png)