How CFOs are transitioning from number-crunchers to strategic leaders

The CFO role is no longer limited to financial operations. Instead, today's CFOs are playing a pivotal role in driving business growth, guiding decision-making, and shaping the overall strategic direction of organizations.

Here are a few key ways CFOs are making this transition:

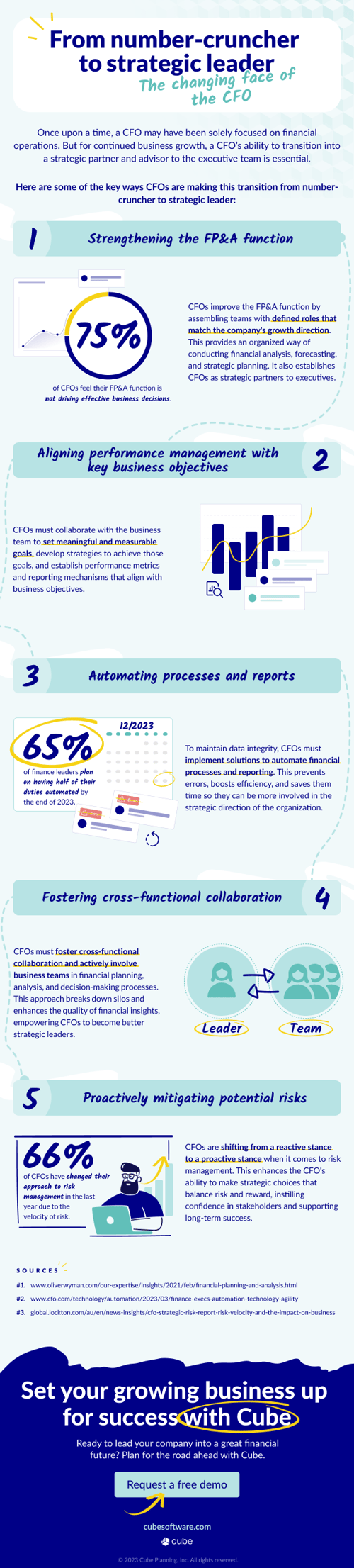

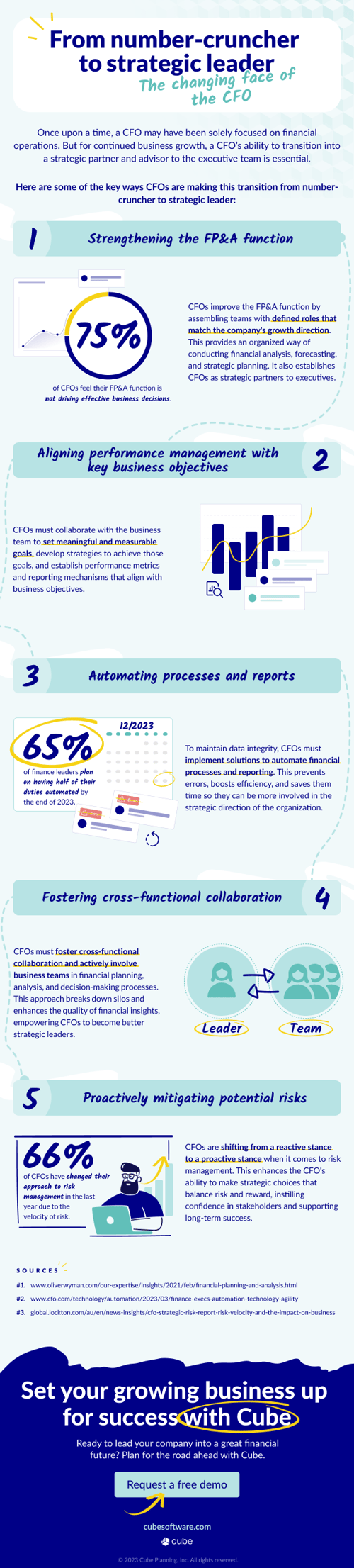

1. Strengthening the FP&A team

Strengthening the Financial Planning and Analysis (FP&A) team is a strategic business move for the CFO, as it:

- Enhances financial decision-making

- Supports strategic planning

- Aligns financial objectives with business goals

- Improves risk management

Investing in the development and capabilities of the FP&A team sets the stage for long-term success and effective financial leadership within the organization.

Additionally, by assembling an FP&A team with defined roles that align with the company's growth direction, the CFO can leverage the team's focused expertise, optimize resource allocation, ensure adaptability, and gain access to strategic insights.

This, in turn, empowers CFOs to make more informed decisions, drive strategic initiatives, and provide valuable financial insights to the executive team, solidifying their role as strategic leaders within the organization.

2. Aligning performance management with key business objectives

By aligning performance management with key business objectives, CFOs ensure that the FP&A function and the broader organization are focused on driving outcomes that directly contribute to strategic success.

This alignment:

-

Clarifies the role of the FP&A team in supporting strategic objectives. By setting performance metrics that are closely tied to key business goals, the CFO communicates the specific expectations and contributions required from the FP&A function. This clarity allows the CFO to shift the team's focus from solely generating financial reports to actively engaging in strategic discussions and decision-making processes.

-

Enables the CFO to establish accountability within the FP&A team. By linking individual and team performance to strategic outcomes, the CFO creates a framework that encourages ownership and responsibility for driving results. This accountability empowers the CFO to delegate more strategic responsibilities to the FP&A team, freeing up time for the CFO to engage in higher-level strategic initiatives.

-

Supports the CFO in becoming a trusted strategic advisor to the executive team. By leveraging the FP&A team's insights and analysis, the CFO can provide meaningful financial context and recommendations during strategic discussions. The availability of performance data tied to strategic goals allows the CFO to present informed perspectives, demonstrate the impact of financial decisions, and influence the strategic direction of the organization.

3. Automating processes and reports

Automation streamlines repetitive and time-consuming tasks, freeing up the CFO's time and resources.

CFOs can automate financial processes such as data collection, consolidation, and reporting by leveraging technology solutions and tools. This automation not only reduces manual errors but also allows the CFO to focus on more value-added activities, such as interpreting financial data, identifying trends, and analyzing key performance indicators.

Enhanced data accuracy is another key benefit of automation. Eliminating manual data entry and manipulation minimizes the risk of human error and improves the reliability and integrity of financial data. Accurate and consistent data becomes the foundation for insightful analysis and meaningful reporting, which then equips CFOs with reliable and trusted information they can relay to the executive team.

CFOs can set up automated reporting processes that generate real-time or near-real-time financial information. This timely availability of data empowers the CFO to respond quickly to emerging trends, shifts in market conditions, or operational challenges, allowing for more agile decision-making and proactive strategic adjustments.

Ultimately, by leveraging technology to automate routine tasks, CFOs can devote more time to strategic initiatives, add value to the organization's strategic goals, and facilitate data-driven decision-making at the executive level.

4. Fostering cross-functional collaboration

By fostering cross-functional collaboration, CFOs create an inclusive and integrated approach to financial planning and analysis.

Involving stakeholders from various departments, such as sales, marketing, operations, and HR, allows the CFO to gain a deeper understanding of the organization's overall goals, challenges, and opportunities. This collaborative effort ensures financial planning aligns with the broader business strategy and supports decision-making that considers the holistic needs of the organization.

Actively involving business teams in financial planning and decision-making processes brings diverse perspectives and expertise to the table. Tapping into the knowledge and insights of cross-functional teams presents the CFO with opportunities to gain valuable insights into the financial implications of strategic initiatives, market trends, and operational changes.

This collaborative approach enriches the quality of financial analysis, allowing CFOs to provide more accurate and informed recommendations to the executive team.

Plus, when business teams are actively involved in financial planning and decision-making, they develop a sense of ownership over the financial outcomes of their respective areas. This engagement increases accountability and encourages teams to align their actions with strategic objectives, driving overall organizational performance.

5. Proactively mitigating potential risks

CFOs are transitioning from a reactive stance to a proactive stance when it comes to risk management.

By closely monitoring market conditions, industry trends, and internal factors, CFOs can identify emerging risks and develop strategies to address them proactively. This proactive risk management approach allows CFOs to stay ahead of potential disruptions and seize opportunities that align with the organization's strategic objectives.

This shift also enhances the CFO's ability to make informed and strategic choices. Analyzing risk factors and their potential impact allows CFOs to evaluate trade-offs and make decisions that optimize risk and reward. This approach not only protects the organization from unnecessary exposure but also enables the pursuit of strategic opportunities that carry calculated risks.

Additionally, a proactive risk management stance instills confidence in stakeholders, including the executive team, investors, and creditors. CFOs enhance transparency and credibility by demonstrating a proactive approach to identifying, managing, and communicating risks.

This transparency builds trust with stakeholders, reassuring them that the CFO is taking necessary actions to protect the organization's financial well-being. As a result, stakeholders gain confidence in the CFO's ability to make sound strategic decisions.

Best practices for becoming a strong strategic leader

There are several best practices CFOs should consider to continue strengthening their strategic muscles and become more effective business leaders over time:

1. Develop a strategic mindset

A strategic mindset allows CFOs to think beyond financial data and understand the broader implications of business decisions. To develop a strategic mindset, CFOs should:

-

Seek mentorship or guidance from experienced strategic leaders within or outside the organization to gain insights and learn from their experiences.

-

Regularly review and analyze industry reports, market research, and competitive intelligence to identify emerging trends, potential disruptions, and strategic opportunities for the organization.

-

Embrace a growth mindset by being open to new ideas, challenging assumptions, and continuously seeking improvement and learning opportunities in both personal and professional aspects.

-

Continuously reflect on the financial implications of strategic choices and their alignment with the organization's long-term objectives, assessing risks and potential outcomes to shape strategic decision-making.

2. Build strong relationships

Effective strategic leadership relies on collaboration, influence, and trust. By building strong relationships with key stakeholders, such as executives, department heads, and business partners, CFOs can foster open communication channels, gain support for their strategic initiatives, and effectively influence decision-making processes.

Here are a few ways CFOs can build strong relationships:

-

Proactively engage with key stakeholders by scheduling regular meetings or touchpoints to discuss their objectives, challenges, and expectations.

-

Seek opportunities for cross-functional collaboration by participating in interdepartmental projects or initiatives that foster teamwork and mutual understanding.

-

Actively listen to the concerns and feedback of team members and stakeholders, demonstrating empathy and a genuine interest in their perspectives.

-

Establish open lines of communication by providing regular updates, sharing relevant information, and encouraging two-way dialogue.

-

Attend industry events, conferences, or networking opportunities to connect with peers, industry experts, and potential business partners, fostering professional relationships.

3. Enhance business acumen

Enhancing business acumen equips CFOs with the knowledge and skills to make strategic financial decisions, collaborate effectively with cross-functional teams, communicate financial insights to non-financial stakeholders, and proactively navigate the business landscape.

Here are a few ways CFOs can enhance business acumen:

-

Engage in continuous learning by reading industry publications, attending webinars or seminars, and participating in professional development programs focused on business strategy and industry trends.

-

Develop a habit of regularly reviewing and analyzing financial statements, industry reports, and market research to understand the broader business landscape and identify potential opportunities or risks.

-

Seek opportunities to learn from executives or leaders in different functional areas to gain exposure to their decision-making processes and understand how their roles contribute to the overall business strategy.

-

Actively seek feedback from colleagues, superiors, and stakeholders to gain insights into areas for improvement and continuously refine business acumen skills.

4. Sharpen communication skills

Strong communication skills empower CFOs to effectively convey financial insights, actively contribute to strategic discussions, inspire teams, and build strong relationships with stakeholders.

Here are a few ways CFOs can sharpen their communication skills:

-

Research professional development opportunities focused on communication skills, such as workshops, courses, or coaching sessions. These programs can provide practical techniques for effective verbal and written communication, including presentation skills, storytelling, and active listening.

-

Practice delivering financial insights and recommendations to non-financial stakeholders in a clear and concise manner. This can involve simplifying complex financial information, using visual aids to enhance understanding, and adapting the communication style to the audience.

5. Learn to balance short-term and long-term goals

As a strategic leader, a CFO needs to go beyond focusing solely on immediate financial outcomes and consider the long-term implications of their decisions. By striking a balance between short-term financial performance and long-term value creation, CFOs can make informed trade-offs and allocate resources effectively.

Here are a few ways a CFO can do this:

-

Develop a comprehensive financial planning process that incorporates both short-term targets and long-term strategic objectives. This involves setting annual financial goals aligned with the strategic plan, regularly reviewing progress, and making adjustments as necessary to ensure alignment with long-term goals.

-

Implement robust financial forecasting and scenario analysis techniques that consider both short-term performance and long-term implications. This allows CFOs to assess the potential impact of various scenarios on financial outcomes, enabling more informed decision-making that balances short-term needs with long-term objectives.

-

Communicate the importance of balancing short-term and long-term goals to key stakeholders, including the executive team, board of directors, and investors. By clearly articulating the rationale and benefits of this approach, CFOs can build support and alignment among stakeholders, fostering a long-term mindset and strategic decision-making throughout the organization.

Conclusion: strategize for success

The role of the CFO is evolving from being solely focused on number-crunching to becoming a strategic leader and trusted partner to the executive team.

This transition is driven by the need for CFOs to provide valuable insights, drive decision-making, and contribute to the overall strategic direction of the organization. As CFOs continue to adapt and evolve in their roles, they are poised to play a pivotal role in shaping the future success and growth of their organizations.

Want to learn how Cube can help CFOs make this transition and set their business up for success? Request a free demo today.

.png)

.png)