Key takeaways on learning FP&A

- FP&A certifications help financial planners and analysts become better communicators and expert advisors.

- They can also lead to career advancement and salary increases.

- Most certifications include education and work requirements.

Why learn FP&A?

Learning financial planning and analysis, or FP&A, is more than just crunching numbers. It's about peering into the future using financial and non-financial insights and then steering today's decisions in the right direction to hit those future goals.

FP&A experts dive deep into budgeting, forecasting, and performance analysis, providing the vision needed to guide their companies forward. This critical function blends analytical rigor with strategic foresight, ensuring businesses are not just prepared for what's ahead but are actively shaping their future.

The journey through an FP&A career can take you from an analyst to CFO, each role bringing its own challenges and rewards.

The six major FP&A job levels include:

- Analyst: An entry-level role focused on collecting and analyzing financial data

- Senior analyst: An experienced analyst who handles complex analysis and mentors more junior folks

- Manager: Oversees a team of analysts and takes responsibility for planning and executing financial projects

- Director: A senior-level executive who oversees strategies, policies, and the financial health of an organization

- VP: A high-level executive in charge of broad organizational strategies, focused on optimizing performance and profitability

- CFO: The Chief Financial Officer is the top financial position in a company and is responsible for all financial planning, risk management, record-keeping, and financial reporting to the board of directors

As you climb this ladder, the importance of beefing up your skill set cannot be overstated.

Certifications and targeted courses are your best allies here, acting as milestones that mark your growth and readiness for the next challenge. From financial modeling to annual planning, there’s a wealth of learning opportunities designed to pave your path forward.

What are FP&A courses?

Financial planning and analysis courses are educational programs aimed at improving the skill set and employability of professionals. Subject matter includes general topics such as budgeting, forecasting, and financial modeling, as well as specific areas like ad hoc reporting, variance analysis, and driver-based planning.

FP&A courses are often self-paced so participants can study alongside their current job. They vary in complexity, from introductory lessons aimed at career changers to advanced modules for seasoned analysts seeking promotion.

What are FP&A certifications?

FP&A certifications are written proof that you have successfully completed an FP&A course. It’s a formal confirmation of your financial planning and analysis skills so it distinguishes your profile in the job market. Certifications from accredited institutions are valued most highly–often where you learn can be as important as what you learn!

To keep you up to date, some certifications require you to take refresher courses when financial practices and technologies evolve.

Best FP&A certifications and courses

Choosing the right FP&A course and certification for you depends on personal preferences around cost, course content, start dates, institutional prestige, and more.

Let's dive into some of these courses and certifications that can help you excel in FP&A.

AFP: FP&A Credential (FPAC)

.png?width=600&height=320&name=fpac-credential%20(1).png)

The FPAC credential is offered by the Association of Financial Planning and Analysis (AFP). It's a self-paced and online program, requiring about 80-100 hours of work. This certification is made up of two parts.

To be eligible, you must:

- Pay the enrollment fees

- Meet the education requirements (a bachelor’s degree or track to graduating within two years)

- Agree to comply with the AFP Standards of Ethical Conduct

- For Part II, have already passed Part I or be approved for an Exam Part I waiver, such as a CMA, CPA, CTP, or CFA credential

Candidates must also fulfill work experience requirements, including at least 35 hours per week. At least 50% of the work must involve performing or supervising the following tasks:

Pricing for AFP members: $1,025 for early deadlines and $1,125 for standard prices

Pricing for non-members: $1,420 for early deadlines and $1,520 for standard prices

Why get the FPAC? This course is the standard of excellence in financial planning and analysis and provides a baseline understanding of the fundamentals of a great FP&A program.

NYIF: Certificate of Corporate Finance

-png.png?width=600&height=321&name=certificate-corporate-finance-nyif%20(1)-png.png)

The Certificate of Corporate Finance from NYIF consists of 60 hours of live, online instruction. It covers financial statement analysis, forecasting, management accounting, corporate credit analysis, corporate finance, business valuation, project valuation, and mergers and acquisitions. You'll also have the opportunity to engage in case studies and group projects.

NYIF also offers introductory professional certificates, including:

- Capital Markets Professional Certificate

- Financial Accounting Professionals Certificate

- Credit Risk Analysis Professional Certificate

- Corporate Finance & Valuation Methods Professional Certificate

- Online Professional Certificate in Valuation

- Project Finance, and the Public-Private Partnership Professional Certificate: Online

Pricing: $1,545

Why get this FP&A certification? This certification is great for individuals who are in investment banking, corporate finance, or sales and trading.

CFI: Certified Financial Modeling & Valuation Analyst (FMVA)

-png.png?width=600&height=315&name=fmva-from-cf%20(1)-png.png)

The (FMVA) Program helps financial professionals learn financial modeling skills, streamline a budgeting and forecasting process, or improve competency levels across the entire accounting and finance spectrum.

This certification includes 12 core financial modeling and valuation courses and three electives. To earn the certification, you’ll need to receive a 70% or above on the FMVA® final exam.

You can take optional prep courses to prepare for the program, including:

- Accounting Fundamentals

- Reading Financial Statements

- Excel Fundamentals - Formulas for Finance

- Corporate Finance Fundamentals

- Math for Corporate Finance

- Capital IQ Fundamentals

- Macabacus Fundamentals

Pricing: $297 - $847/year, depending on the plan

Why get this FP&A certification? The CFI is more affordable than others on this list and opens doors to careers in equity research, corporate development, private equity, FP&A, and investment banking.

Wall Street Prep: Financial Planning and Analysis Modeling (CFPAM)

.png?width=600&height=303&name=fpamc%20(1).png)

The CFPAM curriculum covers budgeting, forecasting, detailed operating models, and project management topics. Your knowledge will be put to the test through case studies and projects. Upon completion, you'll receive a digital certificate from Wall Street Prep.

Trainees can take the CFPAM© Exam for 24 months from the enrollment date. Those who complete the exam and score above 70% will receive the certification. The exam is online and covers the most difficult concepts taught in the program.

Pricing: $499

Why get this FP&A certification? The CFPAM is a globally recognized certification worth 31 CPE credits that can be used to maintain certifications and keep you up-to-date on important core FP&A skills and extended project management.

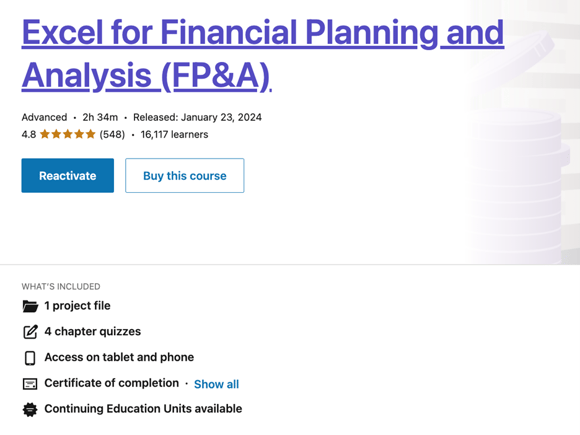

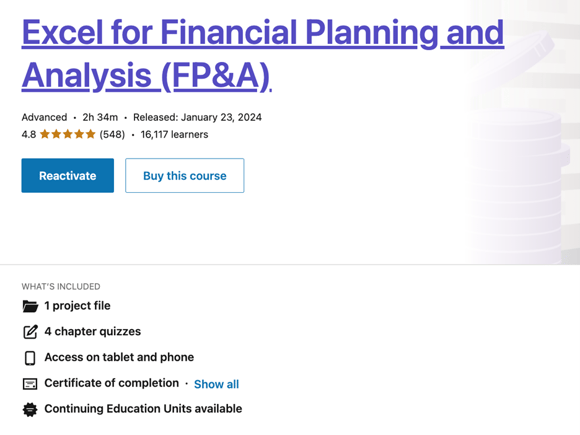

LinkedIn Learning: Excel for Financial Planning and Analysis (FP&A)

This LinkedIn Learning certification is a short course of just over 2.5 hours that helps you develop the Excel skills that modern corporate financial analysts need. Approved by the PMI Authorized Training Partner Program, it covers industry-standard analytical tools like dynamic data tables, ranges, and arrays.

The course is taught by FP&A expert and CFO Trainer, Carl Seidman. Carl consistently receives reviews praising his enthusiasm and ability to break down complex formulas into manageable and engaging lessons.

Pricing: $39.99, or free with a $19.99/month LinkedIn Learning subscription

Why get this FP&A certification? This course is a quick and affordable way to enhance your Excel skills, crucial for any FP&A role.

Harvard Business School Online: Financial Analysis for Manager

-png.png?width=600&height=332&name=hbs%20(1)-png.png)

Harvard Business School Financial Accounting certification consists of 7 modules and takes about eight weeks to complete. The course covers the basics of financial accounting, including preparing the three financial statements (balance sheet, cash flow statement, and income statement), analyzing financial statements, and calculating and interpreting critical ratios.

The course is taught by V.G. Narayanan, a Jr. Professor of Business Administration at Harvard Business School.

Pricing: $1,750

Why get this certification? If you are an FP&A professional looking to brush up on your accounting skills, this is a good course to dig into. It digs deeply into preparing the three financial statements.

Financial Modeling Institute: Certified Financial Modeler (CFM)

-png.png?width=600&height=313&name=cfm%20(1)-png.png)

The Certified Financial Modeler is a professional certification for financial analysts. The FMI curriculum covers topics in Excel, financial modeling, and valuation. You will also get hands-on experience with building financial models. The CFM is one of the levels of the FMI program. You must complete an introductory course and three levels. The levels are

- Advanced Financial Modeler (AFM)

- Chartered Financial Modeler (CFM)

- Master Financial Modeler (MFM)

You have to take a four-hour online exam through each level. To pass the exam, you must score 70% or higher. Then, you will receive a digital certificate from the Financial Modeling Institute. The program is best for FP&A, investment banking, and consulting individuals. To achieve accreditation, you have to complete the application form. Application reviews are by a peer group of 3-5 financial modelers who form the Committee.

Pricing: $695

Why get this FP&A certification? The CFM helps those who already have the Advanced Financial Modeler accreditation to prove they have more sophisticated modeling to superiors and interviewers.

CFA Institute: Chartered Financial Analyst (CFA) Program

-png.png?width=600&height=339&name=cfa-institute%20(1)-png.png)

The Chartered Financial Analyst (CFA) Program is a professional credential for financial analysts. The CFA Program teaches you the skills that will help you advance your career.

To earn the CFA credential, you must pass Levels I, II, and III exams. The test includes investment tools, valuing assets, portfolio management, and wealth planning.

You need to meet the following enrollment requirements:

- Bachelor's degree, be an undergraduate student or 4,000 hours of work experience

- Have an international travel passport

- Take exams in English

- Meet the professional conduct admission criteria

- Live in a participating country

Pricing:

- One-time enrollment fee for all levels: $350

- Level I early registration: $990

- Level I standard registration: $1,290

- Level III early registration: $1,090

- Level III standard registration: $1,390

- Rescheduling fee: $250

Why get this FP&A certification? The CFA has a sliding scale of complexity, making it ideal for beginners to advance their career prospects with a format and teaching style they’re familiar with.

The FP&A Guy: Best Practice FP&A Course

Get hands-on advice from a veteran through FP&A Guy's Best Practice FP&A Course. Learn tried and true methods for storytelling, influencing, budgeting, and report preparation through a case study approach.

This course is designed for accountants looking to gain practical FP&A experience, finance professionals with limited FP&A experience, and FP&A Professionals looking to brush up on best practices.

The course is broken down into four modules:

- Session 1: FP&A Overview & Analytics That Drive Insights

- Session 2: Best Practices in Budgeting & Forecasting

- Session 3: Management Reporting & Best-in-Class Data Visualization

- Session 4: Business Partnering, Storytelling & Influencing

Pricing: Inquire for more details.

Why get this FP&A certification? The FP&A Guy provides a short, very accessible course for early-stage FP&A workers to hone their skills in a fun, friendly setting.

Benefits of learning FP&A through FP&A courses

The following are the benefits of taking up FP&A courses and certification:

1. Stay up to date with industry changes

The finance industry is evolving with new technologies, regulations, and economic conditions. FP&A certifications cover financial planning and analysis basics and the industry changes you should know.

You might learn performance reporting in a new tool or improve your forecasting know-how with the newest techniques and best practices in the financial planning & analysis industry.

2. Cover gaps in your training

While you may have had extensive education and work experience, there are always new techniques and strategies to learn. Taking a course can help fill in any gaps in your skillset.

Likewise, if you're looking to transition into a different finance position like FP&A or corporate strategy, an FP&A course or certification can give you the skills to facilitate the career shift.

3. Apply for more senior roles with bigger salaries

Getting a certification takes time, energy, and hard work. Demonstrating that commitment to your team could qualify you for raises and salary increases.

If you’re starting out, additional certifications can help you stand out from other candidates and may land you a higher starting salary.

4. Network with your peers and teachers

Working through FP&A certifications and courses provides the opportunity to work with some of the most influential people in the industry.

You can join new communities and attend exclusive events, like the annual Certified FP&A Professional Summit. These educational experiences allow you to enhance your skill set and build a professional network that can lead to future career advancements.

Other financial analyst certifications that offer a different angle

The previous FP&A courses cover similar curriculums that cover a wide range of financial skills. But they’re not for everyone. If you’re looking for something more specific, take a look at these examples of other certifications.

Certified Financial Planner (CFP)

-png.png?width=600&height=311&name=cfp%20(1)-png.png)

The CFP® certification is a financial planning certification by the CFP Board. As part of the CFP® certification, CFP® professionals commit CFP Board to act as fiduciaries when providing financial advice to a client.

To earn the CFP® designation, individuals must complete a college or university program. You also need at least 6,000 hours of work experience or 4,000 hours of apprenticeship experience in financial planning.

Pricing: Application fee $200. Annual fee $355.

Institute of Business & Finance: Certified Fund Specialist (CFS)

-png.png?width=600&height=296&name=cfs%20(1)-png.png)

Certified Fund Specialist (CFS) is a certification by the Institute of Business & Finance (IBF). To earn the CFS designation, individuals must pass an examination and have a bachelor’s degree or 2,000 hours of work experience. The IBF offers a variety of online and in-person courses to help candidates prepare for the CFS exam.

Pricing: $1,365

Association of Government Accountants (AGA): Certified Government Financial Manager (CGFM)

-png.png?width=600&height=313&name=cgfm%20(1)-png.png)

The CGFM designation is a certification by the Association of Government Accountants. To earn the CGFM designation, individuals must pass three examinations on Governmental Environment, Governmental Accounting, Financial Reporting, and Budgeting & Control.

Candidates must have a bachelor’s degree from a college or university to take the CGFM exams.

Pricing: $80 for AGA members, $36 for student members, $109 for nonmembers

Certified International Investment Analyst (CIIA): The CIIA Diploma

-png.png?width=600&height=296&name=ciia%20(1)-png.png)

The CIIA is a financial analysis certification offered by the CFA Institute. It’s primarily for investment professionals who work in or with emerging markets. To earn the CIIA title, individuals must pass three introductory and two final exams.

Candidates must have three years of professional work experience to take the exam and a membership in a participating national or regional society.

Pricing: Societies administer their own fees

Investment & Wealth Institue: Certified Investment Management Analyst (CIMA)

-png.png?width=600&height=335&name=cima%20(1)-png.png)

The CIMA certification is a certification by the Investment Management Consultants Association (IMCA). It’s for financial analysts, investment consultants, wealth management professionals, and financial planners. To earn the CIMA certification individuals must have at least three years of experience working in investment management and pass the CIMA exam.

You must earn at least 40 continuing education (CE) credits every two years to keep your credentials. You must also complete the annual compliance requirements.

Pricing:

- Application fee: $995

- Initial certification fee: $395

- Exam retake fee: $225

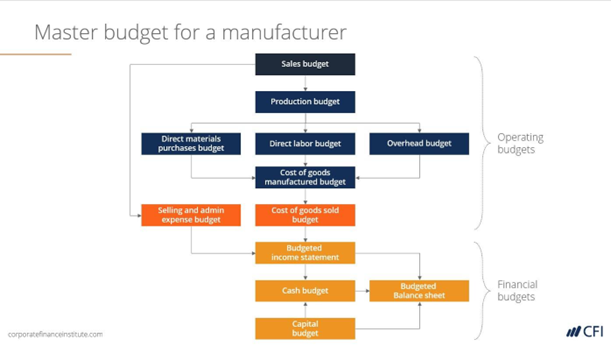

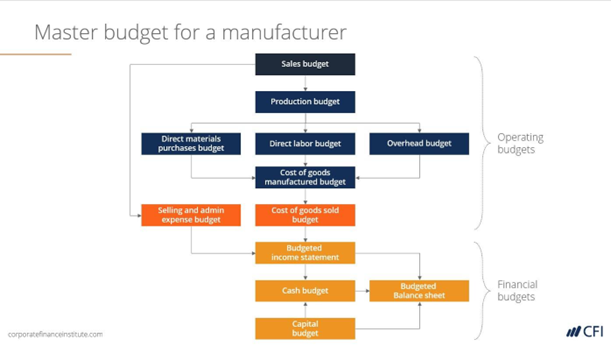

Corporate Finance Institute (CFI): Budgeting & Forecasting Course

CFI’s Budgeting & Forecasting Course teaches financial managers the budgeting and forecasting cycle. It covers how to create a disciplined culture of budgeting as well as accounting tools, techniques, and best practices.

The course is 100% online and takes around seven hours to complete at your own pace. It is just one part of the Financial Modeling & Valuation Analyst (FMVA)® Certification, which you can access through the CFI Self-Study package.

Pricing: $497/year

Who should take FP&A courses?

Any finance professional looking to refine their skills, prepare for a higher role, or stay updated with the latest generation of tools and practices should consider taking FP&A courses.

Curriculums target a range of ability levels so there is a course for every stage of a career in finance.

FP&A analysts

Entry-level FP&A professionals can learn and solidify FP&A fundamentals like financial forecasting, budgeting, and analysis.

It can also help flesh out their resume for the next stage in their career. Employers often look for individuals with the latest knowledge and certifications and advanced training can open the door to promotion and career growth.

FP&A senior analyst

Experienced FP&A analysts typically enroll to refine their existing abilities, explore more complex analytical techniques such as variance analysis, and learn managerial skills to enhance their technical profile.

Certifications can also help analysts develop their strategic thinking by understanding how their work impacts the larger business objectives and how to align financial plans with corporate strategy.

FP&A director

Directors overseeing entire departments take FP&A courses to reinforce financial best practices and master the latest techniques. They can also be an opportunity to build on their leadership skills, including communication, problem-solving, and strategic thinking.

The more they learn, the better they can adapt to dynamic and disruptive markets.

CFO

Chief Financial Officers are well-versed in even the most advanced accounting principles, so they may take FP&A courses to stay ahead of the latest trends and tech in FP&A. By immersing themselves in these courses, CFOs can ensure alignment with the continuously evolving financial landscape.

To continue making informed strategic decisions, the learning curve never ends.

Is getting an FP&A certification worth it?

FP&A certifications and courses take time and effort. But, they can help advance your career and keep your financial planning and analyst skills sharp.

If you find a certification that works for your time and budget, they are definitely worth it.

However, learning the theory won’t improve your career unless you have the right tools to put it into practice.

Cube helps FP&A professionals work smarter, faster, and with confidence. Our cloud-based software helps finance teams work anywhere—we integrate natively with both Excel and Google Sheets—so they can plan, analyze, and collaborate with the ultimate speed and confidence.

Ready to take your financial planning and analysis to the next level?

Book a free demo of Cube’s FP&A solution.

.png)

.png)

![Learn FP&A: The 15 Best FP&A Certifications and Courses [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Pie%20Line%20Chart.png)

.png?width=600&height=320&name=fpac-credential%20(1).png)

-png.png?width=600&height=321&name=certificate-corporate-finance-nyif%20(1)-png.png)

-png.png?width=600&height=315&name=fmva-from-cf%20(1)-png.png)

.png?width=600&height=303&name=fpamc%20(1).png)

-png.png?width=600&height=332&name=hbs%20(1)-png.png)

-png.png?width=600&height=313&name=cfm%20(1)-png.png)

-png.png?width=600&height=339&name=cfa-institute%20(1)-png.png)

-png.png?width=600&height=311&name=cfp%20(1)-png.png)

-png.png?width=600&height=296&name=cfs%20(1)-png.png)

-png.png?width=600&height=313&name=cgfm%20(1)-png.png)

-png.png?width=600&height=296&name=ciia%20(1)-png.png)

-png.png?width=600&height=335&name=cima%20(1)-png.png)