Prophix software: an overview

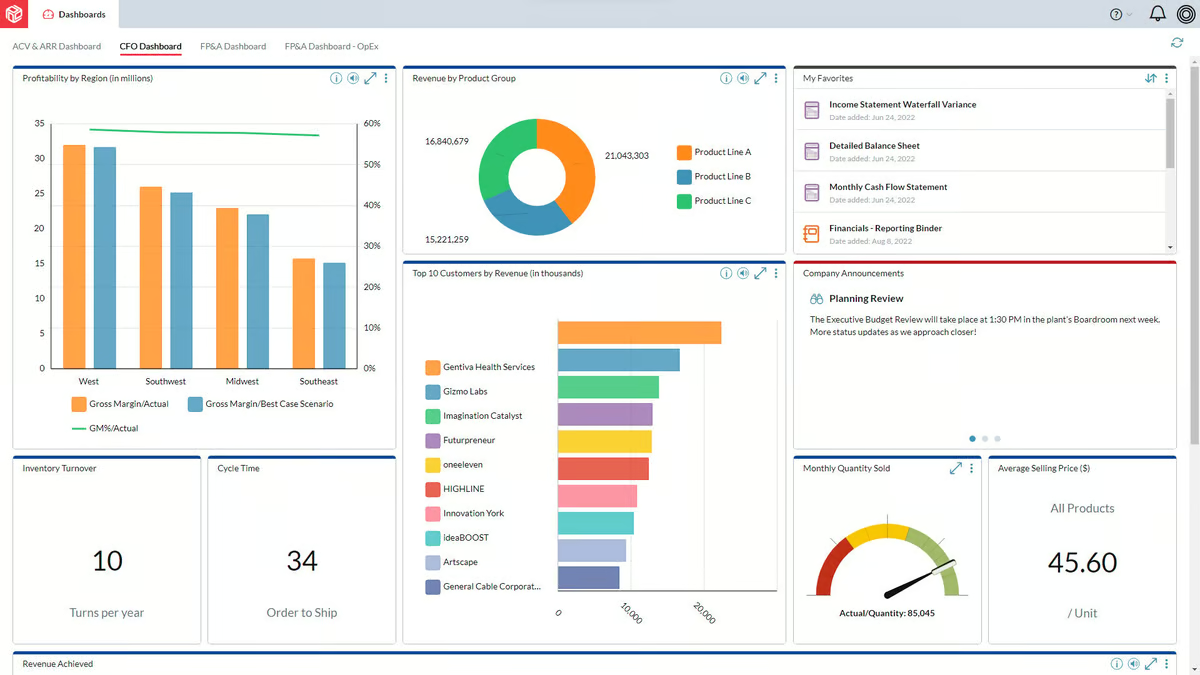

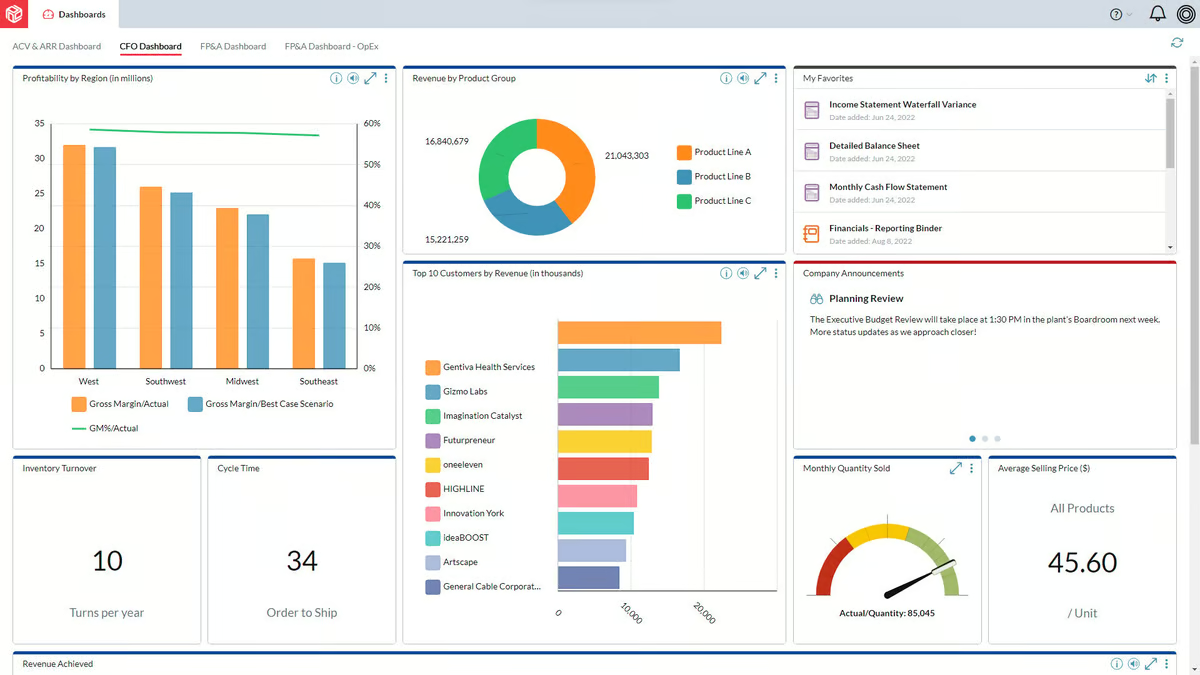

Prophix (Source: G2)

Prophix (Source: G2)

Prophix is a financial management software that facilitates financial consolidation, budgeting, analysis, planning, and reporting. The software offers a spreadsheet-style interface for analyzing financial data and organizing information.

The software allows for easier cash flow management, balance sheets, and income statements, and offers data analysis tools. Prophix also offers forecasting options, what-if analysis, and modules for saving personnel records, such as salary, medical expenses, and tax calculations.

Key features

- Financial modeling capabilities: Build and analyze financial models to forecast future financial performance and make investment decisions.

- Data visualization tools: Create charts, graphs, and other visual representations of financial data.

- Workflow and automation: Set up cycles like budgeting, forecasting, and reporting with the necessary dependencies to allow the next step of your process to be started automatically once its predecessors have completed.

- Anomaly detection: Quickly discover outliers in close data and reduce financial risk and fraud.

- Report insights: Create meaningful reports and empower stakeholders to self-serve with access to a consistent narrative surrounding your business’s most important data.

Integrations

The software is designed to integrate with other business systems, such as ERP and CRM systems. However, It’s best for those not using many other tools since customers note that integrations can be complicated.

Pricing

Prophix software kept their pricing information private, but sources say the platform matches the industry average.

Pros: What are Prophix's strengths?

Companies that have implemented Prophix have mentioned a few key strengths. These include:

Versatility

One of Prophix's standout strengths is its versatility. Users appreciate the software's ability to report on virtually anything, making it a powerful tool for companies with diverse data needs.

“This is [a] powerful and flexible software that can report on almost anything!” says one G2 user. “It can pull data from multiple sources and compile, present, and analyze it in an almost infinite number of different ways.”

With Prophix, users can create detailed and customizable reports that cater to their unique business requirements. This flexibility ensures that executives and team members can quickly access and interpret the most relevant data without getting bogged down by extraneous information.

Plus, Prophix's capability to integrate data from multiple sources means that users can build comprehensive reports that reflect a holistic view of their business operations. This integration helps companies stay agile in responding to market trends and emerging data.

User-friendly interface

One of the major advantages of Prophix is its user-friendly interface.

“Prophix is user-friendly and intuitive enough for the non-tech savvy end user, yet powerful and flexible enough for creating robust, dynamic models and reports,” shares one G2 user.

This balance makes Prophix accessible to a wide range of users within an organization. Non-technical team members can navigate and use the software without a steep learning curve, allowing them to contribute to data analysis and reporting effectively. At the same time, finance professionals and data analysts can leverage its advanced features to build complex models and detailed reports.

The intuitive design ensures that users can quickly learn how to use Prophix, reducing the time spent on training and increasing overall productivity.

Customer support

From the initial sales process to ongoing support, Prophix ensures that users receive comprehensive and attentive service. The implementation team helps businesses seamlessly integrate the software into their existing systems, minimizing disruptions and ensuring a smooth transition. Consultants provide valuable insights and guidance, helping users to fully leverage Prophix's features to meet their specific needs.

“The sales, implementation, consulting, and customer success teams are all extremely capable and friendly,” notes one G2 user.

The customer success team is dedicated to ensuring long-term satisfaction and success with the platform. They are readily available to answer questions, address concerns, and provide ongoing support to help users maximize the value of their investment.

Cloud-based accessibility

One of Prophix's standout features is its cloud-based accessibility. This allows users to access their financial reports anytime, anywhere.

“[Prophix is] cloud-based for users to be able to access their financial reports. No more emailing out several different files to different users,” highlights one G2 user.

All team members can access up-to-date financial information in real-time, ensuring everyone is on the same page. Users can simply log in to the platform to view, edit, and share reports, making collaboration more efficient and streamlined.

The cloud-based nature of Prophix also enhances security and reliability, as data is stored and managed in a secure environment. Regular backups and updates ensure that the information is always protected and accessible, giving users peace of mind.

Cons: What are Prophix's weaknesses?

Now that we've gone through Prophix's strengths, let's unpack some of its weaknesses for a more well-rounded view.

Dashboard limitations

While Prophix offers a wide range of powerful features, there are areas where it could improve. One such area is the dashboard editing functionality, which some users find lacking in comparison to Excel’s formatting capabilities.

“One thing that could be improved is dashboard editing functionality. It lacks formatting features that Excel has,” notes one G2 user.

Users have mentioned that while Prophix dashboards are functional and useful, they miss the advanced formatting options available in Excel. This can make it challenging to customize the appearance of dashboards to meet specific aesthetic or organizational preferences. Enhanced formatting features would allow users to create more visually appealing and easily interpretable dashboards, which could significantly improve the overall user experience.

Slow processing time

“The product struggles with processing assumptions entered to build forecast or budgeted balance sheets and cash flow statements," notes one G2 user. "Users are required to find creative ways to reduce the processing time, which can lead to increased manual work required."

This issue means that users often have to find workarounds to manage their forecasts and budgets effectively. These creative solutions can increase the amount of manual work needed, detracting from the software’s overall efficiency and potentially leading to errors. Addressing this processing challenge would significantly streamline the workflow and reduce the manual effort required, making Prophix more efficient for complex financial planning tasks.

Complicated report-building

One area where Prophix could improve is in the intuitiveness of its report-building and editing capabilities. Users have found the process to be less straightforward than expected.

“Building reports isn't intuitive and it isn't easy to make changes to reports,” notes one G2 user.

This lack of intuitiveness can lead to frustration, especially for users who need to frequently create and modify reports. The difficulty in making changes can slow down the reporting process, making it more time-consuming and less efficient. Enhancing the user interface to make report building and editing more user-friendly would greatly benefit those who rely on Prophix for their financial reporting needs.

Key points to consider when selecting FP&A software

Choosing the right FP&A software is a critical decision that can significantly impact your organization's financial management and planning capabilities. Here are some key points to consider:

- Ease of use: The software should be user-friendly and intuitive, allowing both tech-savvy and non-tech-savvy users to navigate it with ease. A steep learning curve can hinder productivity and delay the benefits of the software.

- Integration capabilities: Ensure the software can seamlessly integrate with your existing systems and data sources. This includes ERP systems, CRM platforms, and other databases. Good integration minimizes data silos and ensures smooth data flow across the organization.

- Scalability: Consider whether the software can grow with your business. It should be able to handle increasing amounts of data and complexity as your organization expands.

- Customization and flexibility: Look for software that offers customization options to meet your specific needs. This includes the ability to create personalized dashboards, reports, and financial models. Flexibility in data modeling and analysis is also crucial for adapting to changing business requirements.

- Performance and speed: The software should be capable of handling extensive data sets without significant slowdowns. Efficient processing times are essential for timely decision-making.

- Collaboration features: Effective FP&A software should facilitate collaboration across departments. Features such as shared dashboards, real-time data updates, and collaborative planning tools can enhance teamwork and data accuracy.

- Support and training: Consider the quality of customer support and the availability of training resources. Responsive support teams and comprehensive training materials can help your team get the most out of the software.

- Cost and ROI: Evaluate the total cost of ownership, including licensing fees, implementation costs, and ongoing maintenance expenses. Compare this with the expected return on investment (ROI) in terms of improved efficiency, accuracy, and strategic insight.

- Security: Ensure the software adheres to robust security standards to protect sensitive financial data. Look for features such as data encryption, user access controls, and regular security updates.

- User reviews and testimonials: Research user reviews and testimonials to get a sense of real-world experiences with the software. Platforms like G2 can provide valuable insights into the strengths and weaknesses from the perspective of actual users.

Conclusion: Is Prophix right for your business?

Choosing the right FP&A software involves careful consideration of many factors. While Prophix offers a range of features, it has its drawbacks—making it important to explore alternatives that may better suit your business needs.

Cube Software, designed with user-friendliness and seamless integration in mind, could be the solution you're looking for. Cube provides a more intuitive and efficient platform for your FP&A needs.

Want to learn more about how Cube can start helping you improve your financial operations and drive better business outcomes? Request a demo today.

.png)

.png)

![Top Pigment competitors & alternatives [2026 reviews]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Pie%20Dashboard.png)

![Pigment software review: Pros, cons, and top alternatives [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Bars%20Pie%20Chart.png)