Product

Solutions

Resources

Company

About Cube

Explore our vision and team

Careers

Help shape the future of FP&A

In the News

Cube featured in top publications

Security

Enterprise-grade, cloud security

Newsletter

.png)

A newsletter for finance pros—by finance pros. Get practical, strategic finance insights from those who’ve been there—straight to your inbox.

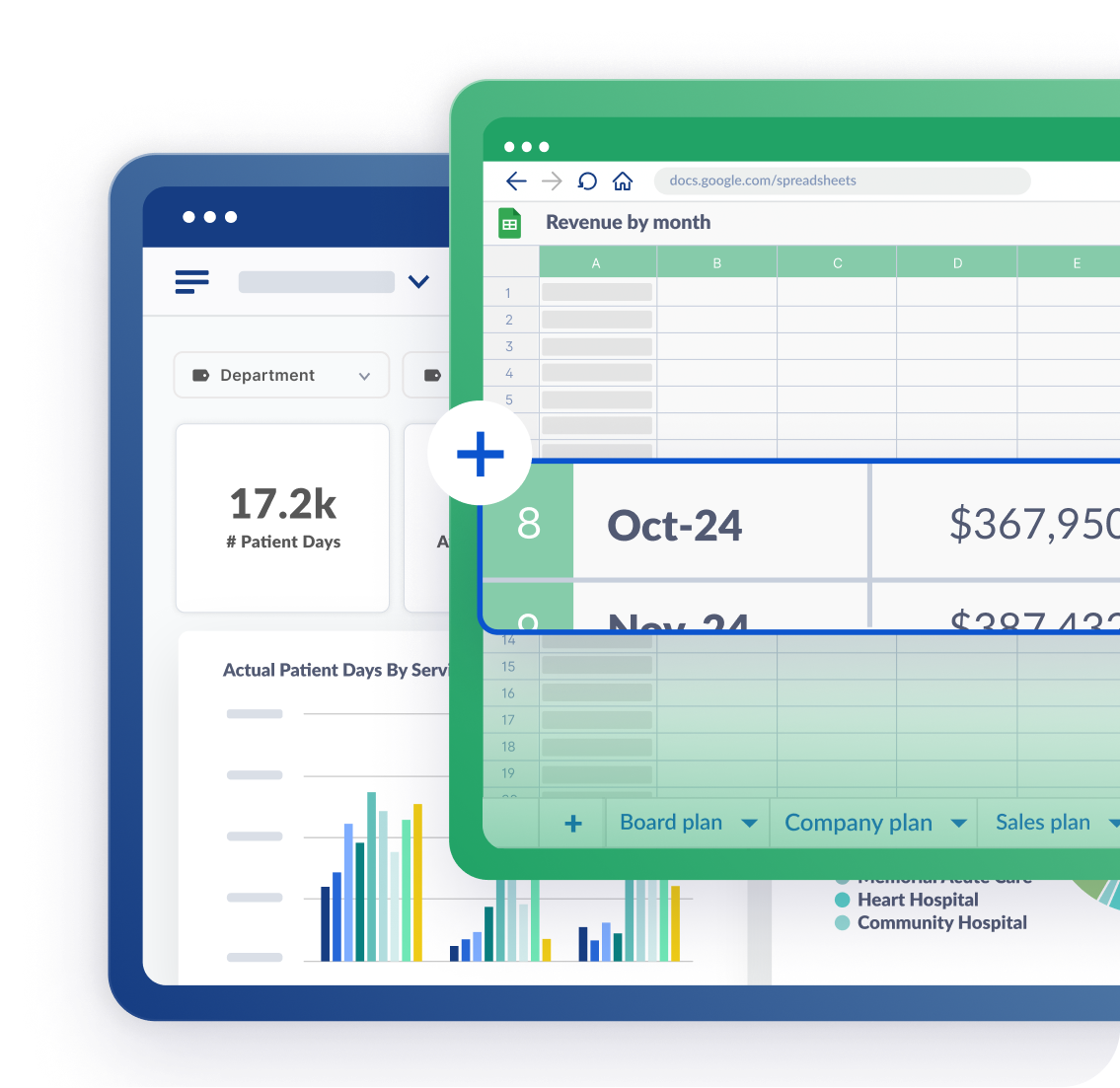

Budget software for nonprofits

Support your mission with nonprofit budgeting and forecasting software

Track donations, grants, and fundraising while allocating every dollar efficiently for maximum impact. Cube simplifies budgeting, reporting, and forecasting so nonprofits stay organized, transparent, and financially strong—without leaving Excel or Google Sheets.

-

Loved by these nonprofits

-

-

-

-

-

Manage your budget to improve mission impact

Funding growth

Budget every dollar so you can expand your programs, reach more people, and sustain long-term growth.

Save time

Automate budgeting tasks so you can minimize manual work, speed up workflows, and get relevant insights fast.

Secure data

Customize security controls so you can protect every bit of sensitive financial data.

A platform that checks all the boxes

-

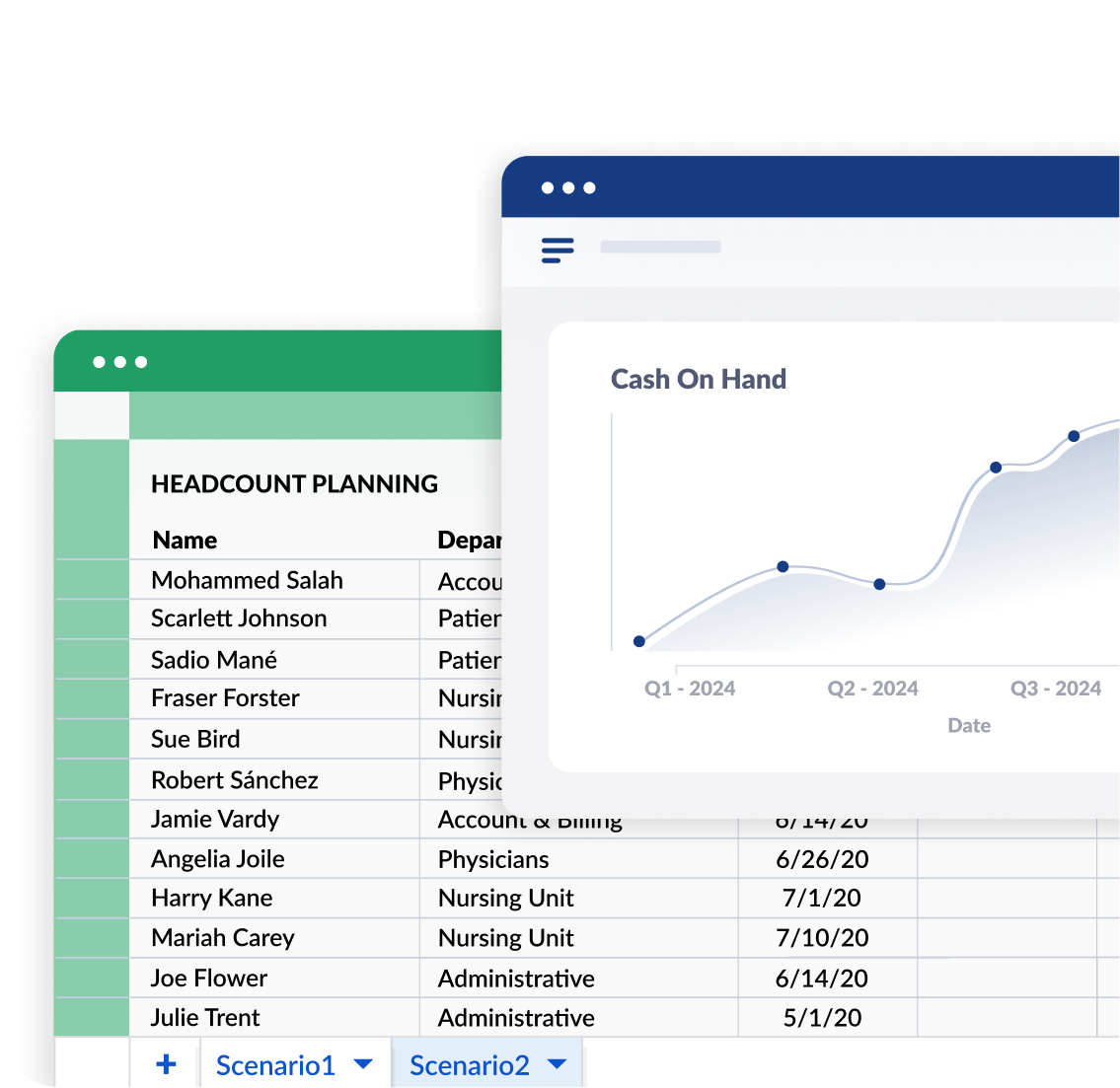

Planning & Modeling

-

Reporting & Analytics

-

Strategic Finance

Plan your next move with precision

Fast track your planning cycle time and be prepared for what's next.

Report with agility and accuracy

Accelerate data-driven decisions by automating your most repetitive tasks.

Adjust on the fly

Support the business in making strategic data-driven decisions to stay on track and pivot as needed.

Lauren O'Connor, Director of FP&A

I'm really happy with the overall flexibility of the system, and the ability to have transactional and operational data all in one place! As [Cube] is based in Excel, it is easy to look at things in different ways to quickly analyze data or change the drivers of your forecast.

Strengthen your nonprofit’s impact with Cube

FAQs on budget software for nonprofits

-

What is budgeting software?

+Budgeting software helps nonprofits plan, track, and manage their finances without manual work slowing them down. It automates calculations, consolidates data, and generates reports instantly so organizations always know where their funds should be going.

Nonprofits use business budgeting tools to forecast funding, allocate resources efficiently, and keep their programs financially sustainable all while avoiding the hours it takes to fix formulas or juggle multiple spreadsheets.

-

What is the best budgeting software for nonprofits?

+The best budget software for nonprofits does more than track expenses and donations. It simplifies planning, enhances forecasting, and improves financial transparency. The most effective solutions:

- Eliminate manual processes with automated data consolidation, variance reporting, and real-time financial insights.

- Provide advanced planning and modeling for annual budgets, multi-scenario forecasting, and break-even analysis.

- Automate compliance-ready financial reports with customizable dashboards, fund tracking, and centralized formulas & KPIs.

- Seamlessly integrate with existing tools like Excel, Google Sheets, accounting software, and donor management systems to keep workflows smooth.

- Support multi-currency reporting for nonprofits managing funding across different regions.

For nonprofits looking for budgeting software that integrates with Excel and Google Sheets, delivers enterprise-grade financial insights, and helps organizations make smarter financial decisions, consider Cube. Cube automates nonprofit budgeting so finance teams can spend less time on spreadsheets and more time driving impact.

-

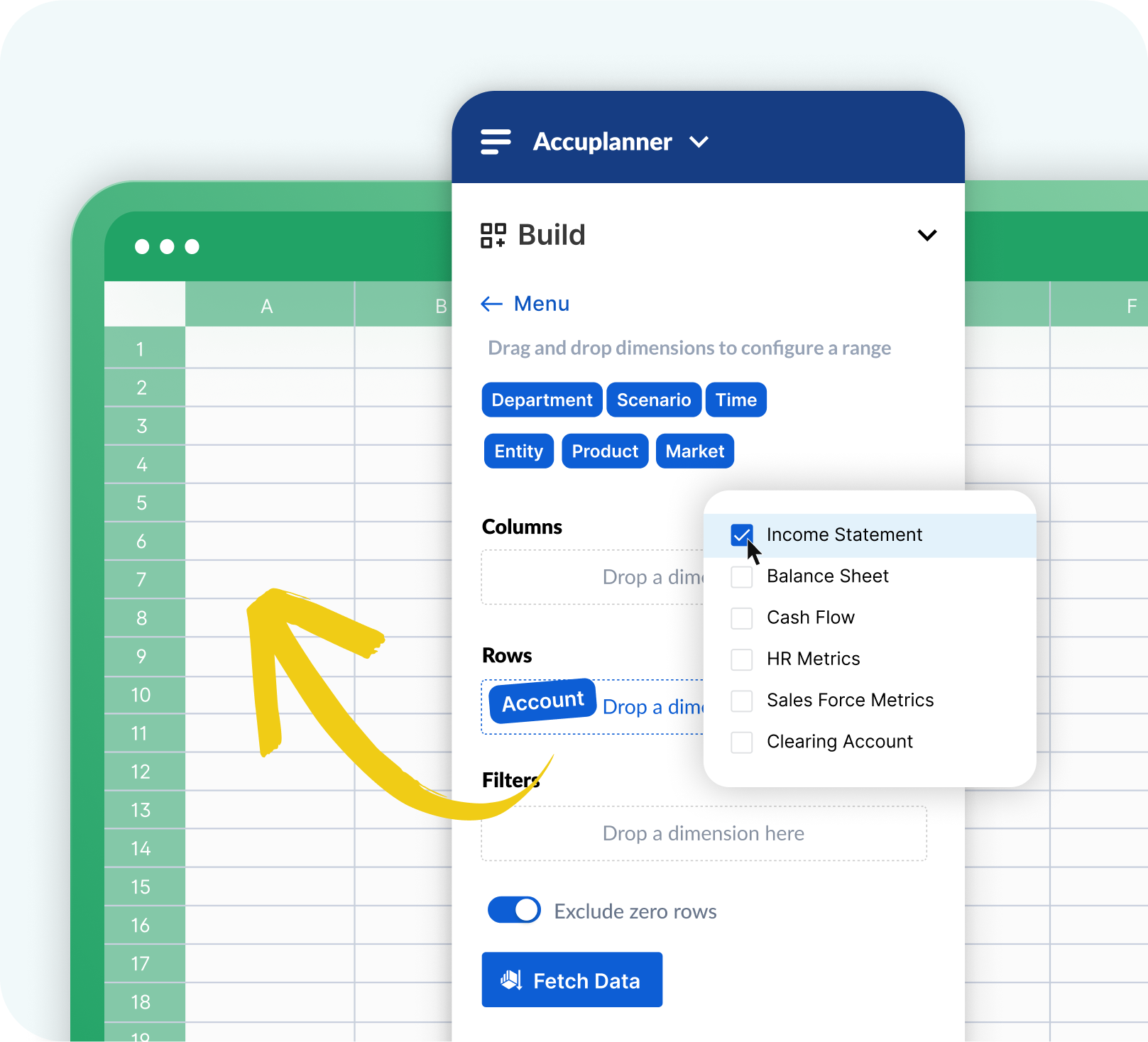

How do nonprofits prepare financial statements?

+It’s easy to prepare financial statements with Cube’s budget software for nonprofits. You can generate accurate, audit-ready reports in just a few steps:

- Connect Cube to your spreadsheets, accounting software, and financial systems.

- Choose from income statements, balance sheets, or cash flow reports.

- Customize your report by programs, funding sources, or grant cycles.

- Cube automates calculations and generates any financial models and reports you need.

- Export your financial statement for your team, board, or donors.

-

What is the difference between budgeting and accounting software for nonprofits?

+Both budgeting software and accounting software help nonprofits manage their finances, but they serve different purposes.

- Budgeting software helps nonprofits plan where their funds should go. It’s used to forecast event costs, grant distributions, and annual spending limits to ensure every dollar is allocated efficiently.

- Accounting software records where the funds actually went. It tracks donations received, expenses paid, and financial transactions to ensure reporting accuracy.

For example, a nonprofit might use budgeting software to plan how much to spend on an upcoming fundraising event, while accounting software records the actual expenses once payments are made.

-

What is the difference between budgeting, forecasting, and planning?

+Budgeting, forecasting, and planning work together to help nonprofits manage their finances, in distinct ways:

- Budgeting helps set spending limits to ensure funds are allocated responsibly and nothing goes to waste.

- Forecasting predicts how different financial decisions will play out based on trends and current data.

- Planning is the big-picture strategy that ties budgeting and forecasting together to guide long-term decisions.

For example, a nonprofit may budget for an upcoming program, forecast how different funding scenarios will impact operations, and plan whether expanding the program is financially sustainable.

-

How can nonprofit budgeting software help cut down on admin work?

+Budgeting software for nonprofits can help cut down your admin work by:

- Syncing data automatically instead of manually updating spreadsheets.

- Generating reports instantly without spending hours formatting numbers.

- Reducing human errors with built-in calculations.

-

How do I choose the best budgeting software for nonprofit organizations?

+Here’s what to look for when choosing the best budgeting software for your nonprofit organization:

- Flexible budgeting so you can adjust program budgets in real time as funding changes.

- Smart forecasting so you can model different scenarios and plan for grant shifts or donation changes.

- Fund tracking and compliance so you can keep restricted and unrestricted funds organized for transparency.

- Automated reporting so you can generate real time dashboards and reports for audits, donors, and board meetings.

- Seamless integrations so you can connect Excel, Google Sheets, accounting platforms, and donor management tools without extra manual work.

Cube checks all these boxes, helping nonprofits simplify financial management, save time, and make smarter budgeting decisions.

-

What financial software for nonprofits does Cube offer?

+Cube offers financial planning and analysis (FP&A) software that helps nonprofits simplify financial management with tools for:

- Budgeting and forecasting: Track financial goals, allocate resources, and adapt as funding changes.

- Scenario planning: Model different funding outcomes and prepare for economic shifts.

- Automated reporting and analytics: Generate compliance-ready reports for stakeholders and track performance in real time.

- Customizable dashboards: Visualize key financial metrics and monitor fund performance.

- Centralized formulas and KPIs: Works with consistent, up-to-date calculations across all team members.

- Integrations: Sync Cube with Excel, Google Sheets, accounting software, donor management systems, and more.

- Multi-currency support: Manage funding across different countries.

.png)