What is net working capital?

Net working capital, or working capital, is a financial metric that gives businesses a quick snapshot of their current assets versus current liabilities. By calculating net working capital, companies can understand how much is in the tank to cover any short-term costs.

Essentially, it’s a short-term view of how much cash it has to cover an emergency. If a meteor was to hit a company’s office and they had a positive working capital, they could cover the reconstruction work. If they had negative working capital, it’s remote working for everyone.

Net working capital has many uses, such as benchmarking against other companies, working out efficiency rates, and signaling if a business is ready to grow.

Pretty useful, right?

But to determine your company’s net working capital figure, you need to understand the yin-and-yang of current assets and liabilities. Let’s get into it.

What are current assets?

A current asset can be converted into cash on next year's balance sheet. Some examples are accounts receivable, inventory, prepaid expenses, and, of course, cash.

As for a business with a more complex structure, like a publicly listed company, current assets may include marketable securities, short-term investments, and intercompany receivables.

What about current liabilities?

Like short-term assets, current liabilities are any financial obligations expected to settle in the next 12 months. This could include any company's short-term debt, accrued expenses, accounts payable, or due income taxes.

Some current liabilities larger companies might have on the books are employee benefits liabilities (if they have an extensive benefits program) or unsecured debts like commercial papers.

Why net working capital is important

Got the basics of net working capital down?

Great. Here's why an accurate and up-to-date figure is essential to a finance team’s arsenal.

Liquidity position

What if every debt the company had suddenly needed repaying? That’s an unlikely scenario, but that’s where working capital comes in handy: liquidity management.

By monitoring the working capital, a CFO can determine the balance of assets compared to liabilities and make sure there’s enough money to stay afloat should disaster strike.

Working capital management

The business's net working capital figure also indicates how efficiently a company’s operations run. This metric can therefore give some steer on what could be optimized, such as inventory levels or payments on account.

When it comes to efficiency, you want the sweet spot: negative working capital could signpost to issues with short-term financing or not collecting customer payments quickly enough.

"Too much of a good thing" is true with positive working capital. When it’s excessive, the company might make too many advance payments or hold onto too much cash that could be put to better use elsewhere, like invested back in the organization.

Company growth

Net working capital is like the ‘fun money’ in a personal budget you get to spend on whatever you like (within reason). It can drive sustainable growth in the company, like R&D, expanding into new markets, and even M&A.

A healthy net working capital is also needed to exploit those unexpected business opportunities. Need to pour some funds into guerilla marketing after a celebrity endorses your product? Then you want enough liquidity to capitalize on the moment.

Stakeholder confidence

A company’s net working capital can be a temperature gauge for external parties. Lenders want to know if a business can repay its debts on time, whereas investors will be keen to see returns on their money, which a decent working capital can help.

A ‘good’ net working capital depends on the industry, company size, growth trajectory, and operations. The retail industry usually has a lower net working capital because a lot of inventory is needed. It wouldn't make sense to compare its working capital figure to a tech company with lower inventory and larger cash balances.

Net working capital’s limitations

So, we’ve established the net working capital figure is crucial in determining a business's short-term liquidity position.

But that doesn’t make it a perfect insight into a company’s financial workings.

Here’s why.

Context is everything

Net working capital is one figure in a sea of financial calculations. It’s therefore vital to look at a business’ bigger picture before forming an opinion on its finances.

It’s a great short-term, rolling figure to give a snapshot of a company's liquidity. But it doesn’t consider long-term assets and liabilities, the scale of the company, or the broader economic context.

Lack of context is the downfall of net working capital.

Subjectivity

Some current assets and short-term liabilities are clear-cut, but others are murkier. For instance, a company may have some marketable securities down as current assets, but intending to hold them for over a year takes them out of the equation.

Deferred revenue can affect the cash flow, while any debts extending past a year would also skew the figures. In turn, this makes comparisons with competitors less reliable.

Impact of non-operating items

A few situations where non-operational windfalls or changes can skew net working capital. For instance, a one-off financial event like an acquisition or tax break would distort the net working capital.

Case in point: if a company sold off some property and there was an influx of cash available, this one-off situation would obscure the true operations and efficiencies behind the final figure.

Restructuring, seasonal fluctuations, and currency fluctuations are other examples of how these outside factors could affect the net working capital’s accuracy.

What’s the net working capital formula?

Thankfully, the formula to calculate net working capital is simple:

Net working capital = Current assets - Current liabilities

This is a rolling figure over a 12-month period, so you can often run the net working capital calculation to get a snapshot of a company's financial health.

But it helps to see all this in context, so keep reading.

Simple example

We’ll use an old business idea to talk through this concept: the humble lemonade stand.

A young entrepreneur with a mind for business sets up a successful lemonade stand business.

Here’s a list of their current assets:

- Cash: $200

- Inventory: $150 (lemons, sugar, cups, and straws)

- Accounts receivable: $50 (a couple of the neighbors have an IOU and promised to pay later)

- Total: $400

As for the current liabilities:

- Accounts payable: $100 (money owed to the fruit supplier)

- Short-term loan: $50 (their parents loaned some money to expand the lemonade stand)

- Total: $150

Using the handy working capital formula from earlier, here’s the final figure:

Current assets ($400) - current liabilities ($150) = Net working capital ($250)

The net working capital figure here is healthy enough to expand the lemonade stand to another part of the neighborhood, serve more thirsty customers, and cover unexpected expenses, like a sudden craving for limeade.

Positive net working capital demonstrates good management of the business's cash, inventory, and receivables. This budding entrepreneur needs to keep on top of their net working capital to ensure the lemonade stand stays financially viable, but things are looking good.

How to calculate net working capital

You might have guessed already with the simplicity of the net working capital formula, but calculating this figure is as easy as 1, 2, 3.

We’re simplifying it here - larger companies will have more diverse current assets and liabilities to factor in. But the core principles remain the same.

Add up current assets

The first step is to look at anything that falls under the company's current assets on the balance sheet. This counts as anything that could be converted into cash equivalents or used in the next 12 months.

You can find everything about current assets on the balance sheet or financial statements. Once you have all the line items, add them together to arrive at the total current assets.

Add up current liabilities

Now it’s time to do the same for the current liabilities. Look at the company's balance sheet and relevant financial statements to ensure nothing like short-term obligations or accrued expenses are missed.

Adding up these values will give you the total current liabilities.

Calculate net working capital

Once you have everything you need, subtract the current liabilities from the current assets to arrive at the net working capital figure.

Job done.

It’s worth noting software can keep this figure up-to-date on your behalf. As long as it’s got accurate data, you can leave the daily calculations to a program so you can focus on the bigger things.

How to improve net working capital

If your company’s working capital isn’t so hot, you might have some operational problems dragging it down.

But there are some ways to improve the figures. Here are some typical issues and solutions companies run into.

Improve payments collection

A simple and often efficient way to improve the net working capital figure is to improve the accounts receivable or payments owed from customers.

This can look like introducing a more stringent vetting process for new clients, a more effective invoicing workflow, or offering early payment discounts.

Once the accounts receivable improve, this will reduce the overall current liabilities figure.

Manage inventory

Having too-much or not-enough inventory for a business can wreak havoc on the net working capital.

Optimizing inventory levels with methods like implementing an inventory tracking system or revisiting product lines that result in slow-moving inventory could effectively answer negative net working capital issues.

Refinance debt

Where possible, refinancing short-term debt that’s pushing the net working capital into the negative can work to fix the gap.

As long as the new terms for financing are favorable in the long run, this can be a more straightforward way to improve the net working capital figure without putting pressure on the rest of the business.

Refine operating procedures

Are your company’s operations working as well as they could be? Any inefficiencies can affect the net working capital, so it’s worth occasionally reviewing these.

Renegotiating supplier contracts, adjusting employee schedules, and investing in technology to reduce human errors are all ways in which operational efficiency can be achieved. These, in turn, can improve cash flow and lower the current liabilities figure.

Delay non-essential expenses

If a payment isn’t time-critical and won’t impact operations immediately, then these may be able to be pushed back to a later date to increase the working net capital.

Take a ‘mend and make do’ approach. Perhaps putting off buying new equipment or refurbing the office can wait until the cash flow improves. Introducing a more stringent business travel policy could help to save money. These small things add up to create a positive net working capital figure.

Conclusion

Now you know all about net working capital.

But did you know there's an easier way to grab your actuals and historical data?

You can use Cube.

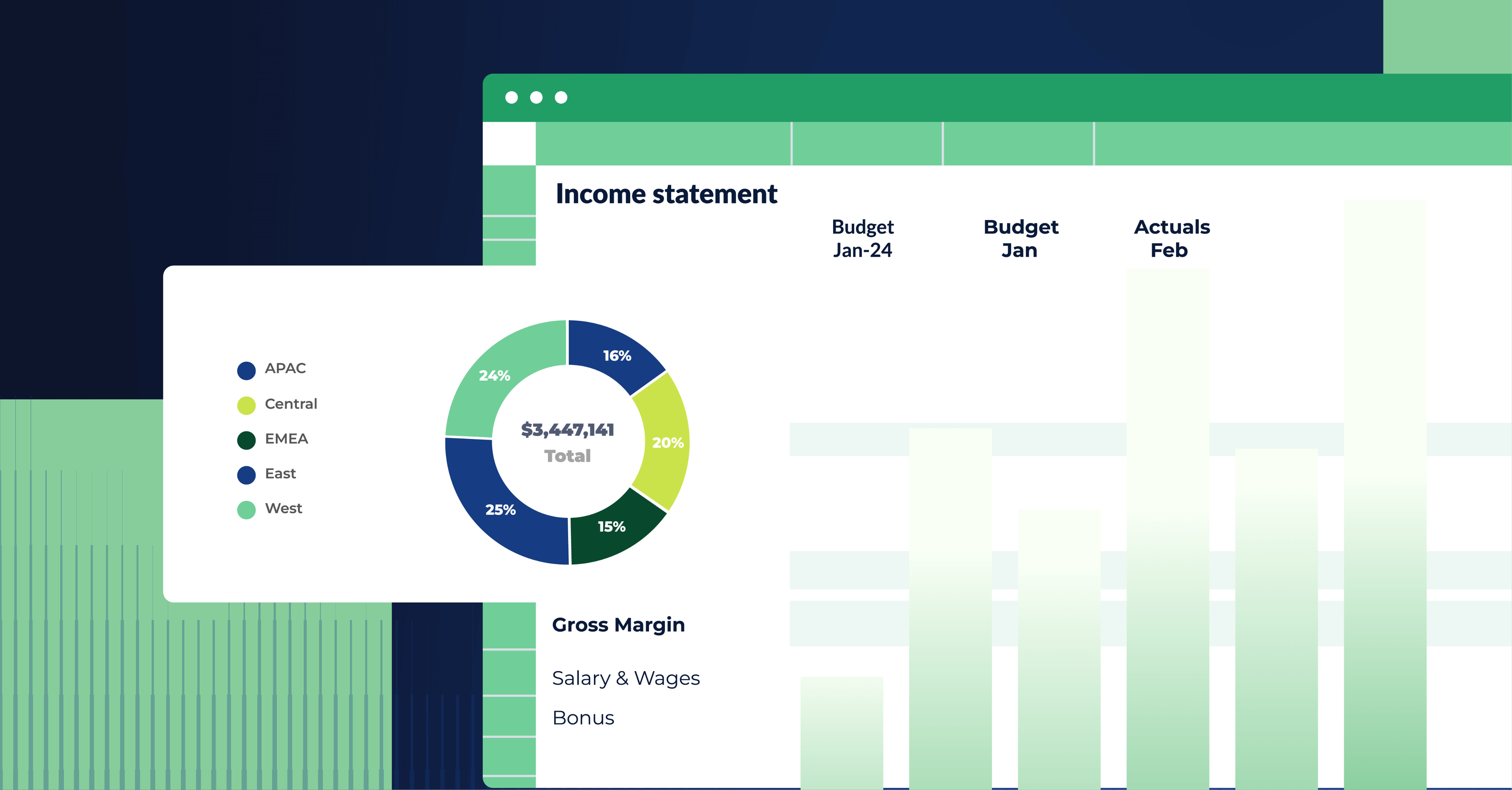

Cube is spreadsheet-native FP&A software that connects with all of your source systems.

Your ERP and GL, your HRIS or CRM.

And it organizes and cleanses that data for you so when you one-click fetch it into Excel, it's ready for your analysis.

Sound intriguing? Click the image below to request a free demo today.

.png)

.png)