What is discounted cash flow?

Simply put, discounted cash flow determines the attractiveness of an investment. It shows the net present value of future cash flows to assess the investment's worth today.

Unlike other valuation techniques, discounted cash flow considers how the value of money changes over time. Essentially a dollar you received today could change value year over year.

To appreciate the usefulness of discounted cash flow, it’s key to look at it as both a science and an art. Let’s break down what that means and how you can incorporate it into your next valuation.

The science behind discounted cash flow: Calculating discounted cash flow

Discounted cash flow includes several elements that contribute to the valuation process.

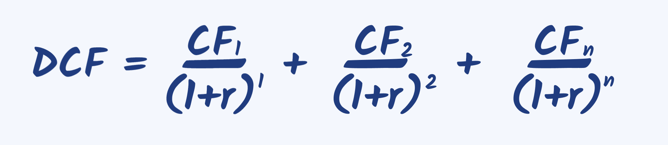

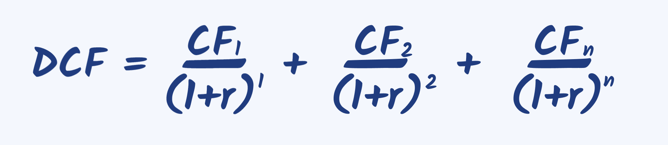

The formula for discounted cash flow aggregates cash flows across time periods. To calculate discounted cash flow across additional years, you’d use the following formula:

To break this down further:

- DCF: Discounted cash flow

- CF1: The cash flow for year 1

- CF2: The cash flow for year 2

- CFn: The cash flow for additional years (3, 4, etc.)

This formula makes it possible to make more informed decisions about the lifecycle of a particular investment. Let's consider a practical example of using the discounted cash flow formula to value a potential investment in a real estate property.

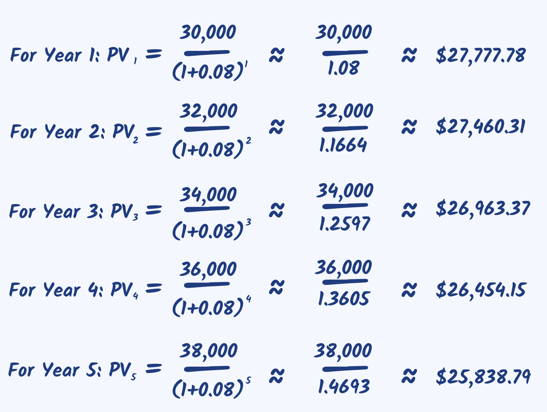

1. Estimate future cash flows

Suppose you're considering investing in a rental property. After careful analysis, you estimate the following annual cash flows over the next five years:

- Year 1 (CF1): $30,000

- Year 2 (CF2): $32,000

- Year 3 (CF3): $34,000

- Year 4 (CF4): $36,000

- Year 5 (CF5): $38,000

2. Determine the discount rate

The discount rate for real estate investments normally reflects the property's risk and the investor's required rate of return. Here, let's assume a discount rate of 8%.

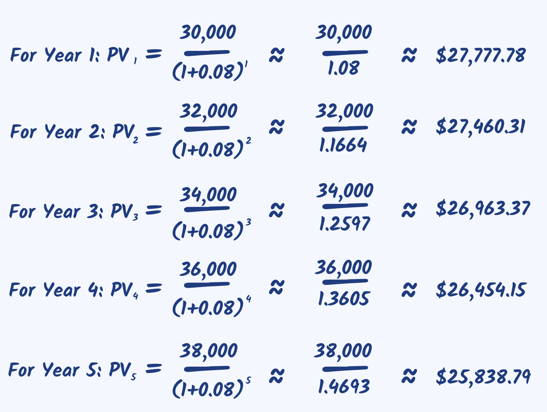

3. Apply the discounted cash flow formula

Now, we can calculate the present value of each cash flow using the discounted cash flow formula (see above). Substitute the given cash flows and discount rate:

4. Calculate the total present value

Summing up the net present values of all cash flows gives us the total present value:

Total PV = PV1 + PV2 + PV3 + PV4 + PV5

Total PV = $27,777.78 + $27,460.31 + $26,963.57 + $26,454.15 + $25,838.79

Total PV = $134,494.60

The present value of the future cash flows from this real estate investment is $134,494.60. This value represents the “worth” of the rental income over the next five years, considering the value over time and any associated risks.

This is a pretty simple example of how to apply discounted cash flow, but gives you a good foundation for what this process could look like.

The art of discount cash flows: Judgment & assumptions

It’s not all about formulas when it comes to discounted cash flows. You also need a delicate balance of judgment and assumptions.

At the heart of discounted cash flow lies the reliance on assumptions about future cash flows and discount rates. These assumptions are important and can massively sway a resulting valuation.

For finance and FP&A leaders, this requires an awareness of the inherent uncertainties and variabilities involved. Quantitative data can provide a solid foundation, sure, but qualitative judgment adds depth and context. This blend of both ensures a more nuanced approach to valuation.

It’s also important to recognize the limitations of discount cash flow (and, honestly, any valuation method). Discounted cash flow is not a "crystal ball" into your financial future, but more a tool that offers greater insight into information available now. Keep this in mind, and remember to make future refinements to your assumptions based on evolving circumstances and events.

As with most circumstances in life, it’s all about striking the right balance—a delicate balance between the science of financial analysis and the art of thoughtful judgment. It's an ongoing process that requires agility, adaptability, and a willingness to challenge assumptions to pursue more accurate and insightful valuations.

Resource allocation 101: Budgeting and discounted cash flow

Budgeting and discounted cash flow analysis are interconnected because budgeted cash flows often serve as inputs for discounted cash flow models. Budgets estimate future revenues, expenses, and capital expenditures, which are essential for forecasting cash flows in discounted cash flow analysis.

Discounted cash flow analysis also informs the budgeting process by providing insights into the potential financial impact of investment decisions on future cash flows and overall organizational value.

Combining discounted cash flow analysis in the budgeting process can help your business make better decisions about resource allocation, prioritize investments based on their expected returns, and align budgetary goals with long-term strategic objectives.

While budgeting and discounted cash flow analysis serve different purposes within financial management, they are used to optimize resource allocation and enhance decision-making. Two great tools in your toolbox!

12 strategies for enhanced discount cash analysis

Now that we've dug into key formulas and definitions every finance pro should know, let's go one level deeper.

Empowered with insights into discounted cash flow, finance and FP&A leaders can refine their valuation techniques through practical strategies. Here are 12 different strategies to enhance discount cash flow analysis.

1. Developing detailed cash flow projections

Developing detailed cash flow projections involves looking at historical data and forward-looking insights. You can create a more comprehensive forecast of cash inflows and outflows if you look at past performance and future market trends. Specifically, this allows you to understand and recognize specific patterns and trends.

This approach helps businesses anticipate fluctuations, mitigate risks, and capitalize on opportunities.

2. Carefully selecting and justifying the discount rate

Choosing the appropriate discount rate is really everything when it comes to discounted cash flow analysis. Why? Well, it directly impacts the valuation outcome.

Everything from inflation to economic growth to opportunity cost needs to be considered when determining your discount rate. For example, a higher discount rate = higher risk and inflation expectations… leading to a lower present value of future cash flows. Learn how to justify your chosen discount rate by assessing your investment's risk profile, market conditions, and prevailing interest rates.

Transparency breeds credibility—and transparency in the selection process creates confidence in stakeholders and gives greater credibility to the valuation.

3. Accurately determining terminal value (TV)

Terminal value (TV) signifies an asset or business residual worth beyond a foreseeable period, where projecting future cash flows becomes murky or uncertain. And this is why accuracy is so imperative.

Accounting for terminal value requires careful consideration of factors such as long-term growth rates, market saturation, and competitive dynamics.

Using appropriate methods, such as the perpetuity growth model or exit multiple approaches, you can derive a more realistic estimate of terminal value, ensuring the completeness and accuracy of the valuation.

There are a lot of factors to consider here, so do your homework.

4. Perform sensitivity and scenario analysis (where appropriate)

You always want to consider a valuation from multiple angles.

Performing sensitivity analysis and scenario analysis is critical to assess the viability of a valuation under different conditions.

Sensitivity analysis involves examining how changes in key assumptions or inputs impact the valuation results, helping identify critical drivers of value and potential sources of uncertainty.

Scenario analysis takes this a step further by evaluating valuation outcomes under different plausible scenarios. By testing a model's sensitivity to different variables and scenarios (recessions, changes in supply chains, etc), you can make more informed decisions and better understand associated risks.

5. Maintain consistency and transparency in assumptions

Want to build trust and credibility during the valuation process? Be consistent and transparent. Documenting key variables and their rationale ensures clarity and facilitates communication with stakeholders.

Consistent application of assumptions across different scenarios and periods promotes comparability and reliability of the valuation results. Financial professionals have a great responsibility to present all their cards on decision-making with the facts.

6. Regularly update and review your discounted cash flow model

Your models should always reflect new information and market conditions. This will require you to refine your assumptions over time. Markets can change swiftly and world events have a bigger sway on economics than ever before with our global economy. Be vigilant by making necessary periodic revisions to your valuation model.

Incorporating new data, adjusting forecasts, and refining assumptions based on market developments ensure the relevance and accuracy of the analysis. Additionally, ongoing review and validation of the model's performance against actual outcomes help identify areas for improvement and enhance the reliability of future valuations.

7. Test, test, and test again

It isn’t enough to build your discount cash flow model and walk away. Validation comes from comparing your model’s predictions with actual outcomes over time. Testing will allow you to identify biases, errors, and maybe even some limitations.

Again, your goal is all about transparency, clarity, and confidence in building financial models. By adhering to best practices and maintaining high-quality assurance standards, analysts can instill confidence in the reliability of the discounted cash flow model and the credibility of the valuation results.

8. Choose the right forecasting period

It’s easy to “get ahead of yourself” with discounted cash analysis. That’s why choosing the right forecasting period is critical to align your projections with the asset/business/project’s lifecycle and market dynamics. You want the forecasting period you choose to capture relevant trends, but not capture excessive uncertainties that create more uncertainty.

Simply put, your forecast horizon should be extended for long-term investments to capture growth opportunities and operational changes. On the flip side, short-term investments or investments with perhaps a high probability of volatility should have a shorter forecasting period. Recognizing this will eventually become instinctual, but is key to revisit with various valuations.

9. Benchmark against peers and industry standards

Comparison might be bad in life, but good in business. Benchmarking against your peers and industry standards provides better context for interpreting valuation and identifying outlying oddities.

By comparing KPIs, such as financial ratios, growth rates, and valuation multiples, against industry benchmarks and competitors, you can assess the attractiveness of the investment opportunity in a better light. Benchmarking helps highlight areas of strength and weakness, identify industry trends, and evaluate the competitiveness of the business.

10. Be direct and accurate with your shareholders

Shareholders rely on key technical guidance in their decision-making. However, articulating these technical insights in an effective way to make informed recommendations can be challenging.

One of the most important skills a finance professional has is communicating findings based on an audience’s level of expertise and interest. The ability to create visual aids and compelling financial dashboards helps convey complex information in a digestible and approachable format. Not everyone will speak in numbers in the way you do after all!

Working closely with stakeholders to get feedback will foster greater collaboration and get buy-in on proposed recommendations. And, of course, the more your stakeholders understand the facts and data, the more informed their decisions will be.

If you’re looking to get a front-row seat into the minds of a CEO or board member on data-sharing and decision-making, check out the webinar recording below. In this session, Christina Ross, serial CFO and current CEO of Cube, and Michael Brown from Battery Ventures will share strategies for creating a concise and compelling quarterly board meeting deck that builds confidence with board members.

11. Stay informed of market trends and regulations

Whether it’s subscribing to newsletters/financial reports/publications or having CNBC on TV rotation, being informed is key. How many times have you heard people say “unprecedented times” in the last four years? Ugh.

The point is that markets fluctuate. And you need to be on the lookout for those factors including economic trends, technological advancements, and regulatory changes, which can impact the valuation of assets/businesses/projects.

Monitoring trusted sources of information allows financial professionals to stay ahead of emerging trends and anticipate potential shifts in market dynamics. Proactively adjusting assumptions in response to changing conditions lets analysts maintain relevant and accurate analyses for stakeholders.

12. Use tools and resources to enhance your cash flow analysis

You can’t do it on your own. Having the right tools to perform more accurate and detailed analyses will be necessary in your field.

Advanced software programs and financial modeling tools can automate repetitive tasks, reduce errors, and facilitate scenario analysis. This will give you more confidence in the results you share with your stakeholders and help you uncover hidden patterns in large datasets better than you could on your own. Plus, with the introduction of predictive modeling and machine learning, incorporating and dissecting external research such as industry databases, reports, etc. becomes that much easier.

If you’re looking to build confidence in your discount cash flow models and easily create compelling dashboards for your stakeholders, we’d love to chat. Click below to get started.

Conclusion

Discounted cash flow analysis is a powerful tool in a finance professional's toolkit. It helps make sense of complex valuations and creates more confidence around investments with stakeholders.

Here’s a recap of what we discussed and how to move forward:

- Master the essentials: Understand discounted cash flow’s role and basics for valuing investments effectively.

- Integrate with strategy: Combine discounted cash flow insights with budgeting to align investments with long-term goals.

- Enhance your analysis approach: Implement actionable strategies like detailed projections and transparent assumptions.

- Stay agile and informed: Adapt to market changes and refine assumptions regularly for accurate valuations.

.png)

.png)