Key takeaways:

- Annual planning software helps finance build yearly plans, link targets to budgets, and update forecasts without manual spreadsheets

- The best tools offer scenario planning, rolling forecasts, role-based controls, and integrations with ERP, HR, and CRM systems

- Built-in workflows, version control, and audit trails keep ownership clear, connect plans to live actuals, and speed reforecasts

What is annual planning software?

Annual planning software helps finance teams build, manage, and update the company’s yearly plan without having to juggle disconnected spreadsheets. It centralizes budgets, headcount plans, and revenue targets, then connects them to live actuals, allowing you to track performance and make adjustments.

Annual planning software often includes the following capabilities:

- Driver-based budgeting and forecasting: Link revenue, headcount, and OPEX to operational drivers

- Scenario and sensitivity modeling: Compare base, upside, and downside cases and test key levers

- Scenario planning without limits: Switch between versions instantly and compare scenarios without losing context

- Headcount and workforce planning: Plan roles, salaries, start dates, and benefits with approval workflows

- Organized bottoms-up planning: Let budget owners contribute at the line-item level with real-time rollups

- Templates that flex with you: Build input templates that match how teams work, standardize where needed, and stay flexible elsewhere

- Clear workflows and full visibility: Assign tasks, track changes, and keep teams accountable with real-time audit logs

- Workflow and access controls: Set user and role-based permissions so teams stay focused and secure

- Data integration and live sync: Sync ERP, HRIS, CRM, and data warehouses; connect Excel and browser sheets with two-way updates

- Rolling forecasts: Extend visibility beyond the fiscal year and refresh outlooks on a set cadence

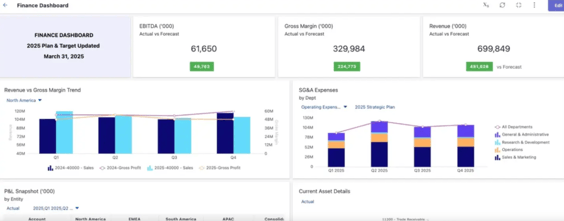

- Reporting and dashboards: Share variance analysis, KPI scorecards, and board-ready views

- Audit trails and versioning: Track who changed what, when, and why to preserve plan integrity

The best annual planning software

From scenario planning to workflow automation and ERP integrations, the best annual planning software helps FP&A teams model faster, collaborate in one place, and keep plans tied to live actuals.

Below, you’ll find the top platforms, along with their features, pros, cons, and pricing notes, to help you choose the right fit. We selected these tools by reviewing feature depth, spreadsheet support, ERP/HR/CRM integrations, security, implementation time, pricing transparency, vendor documentation, and recent user reviews on trusted third-party sites.

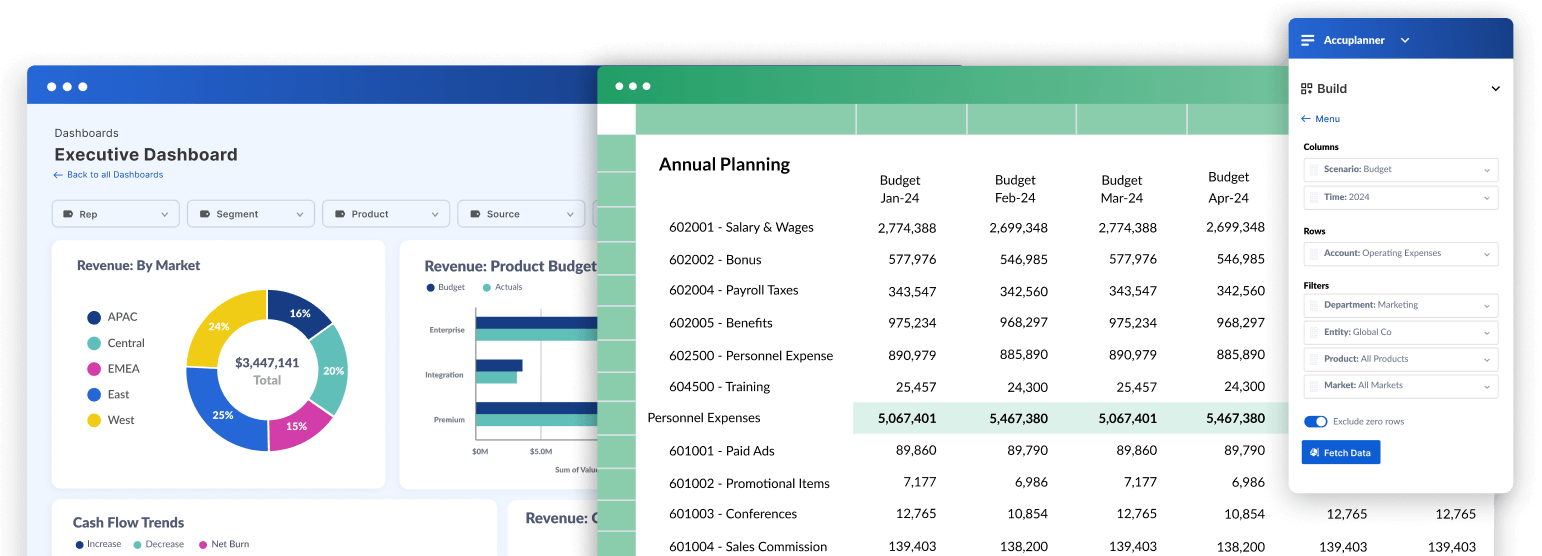

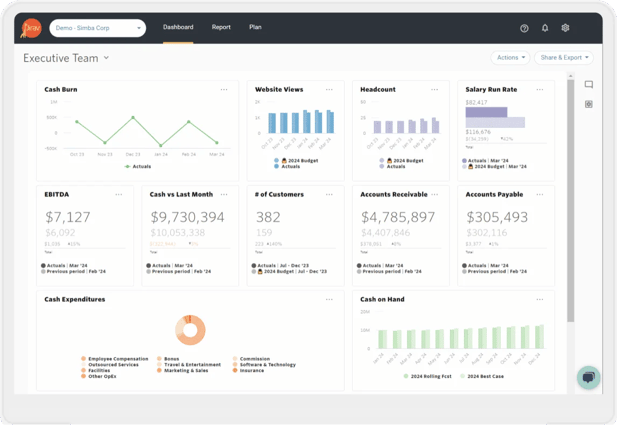

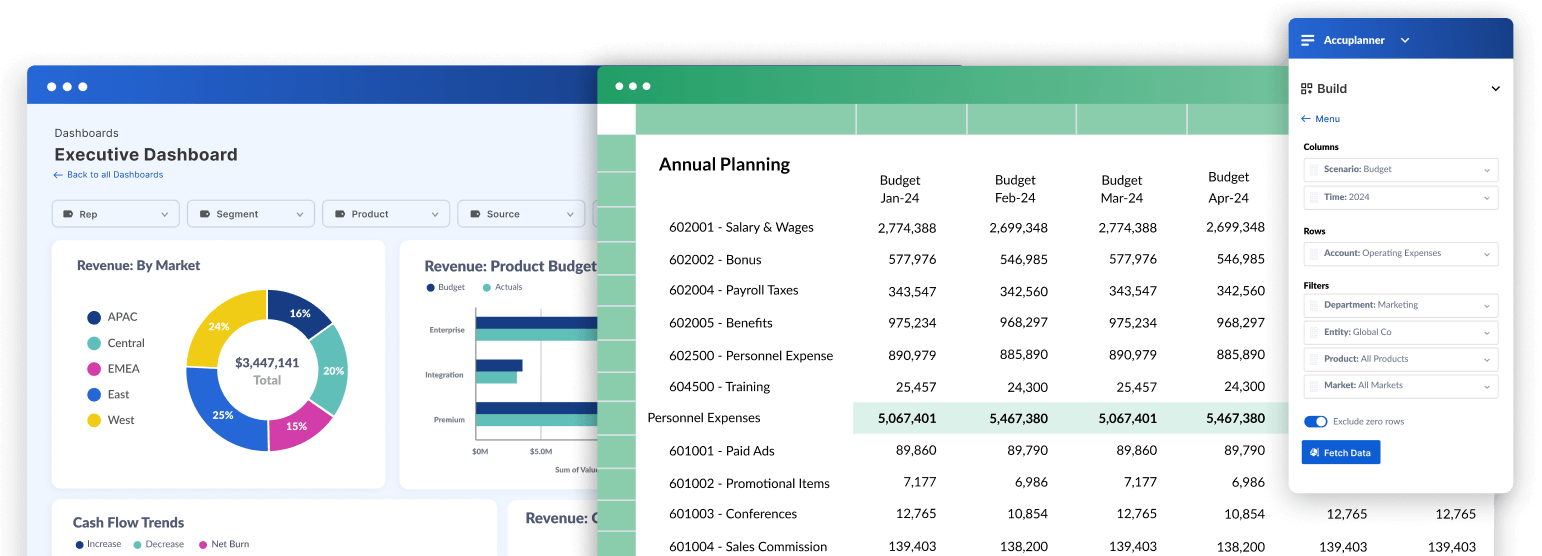

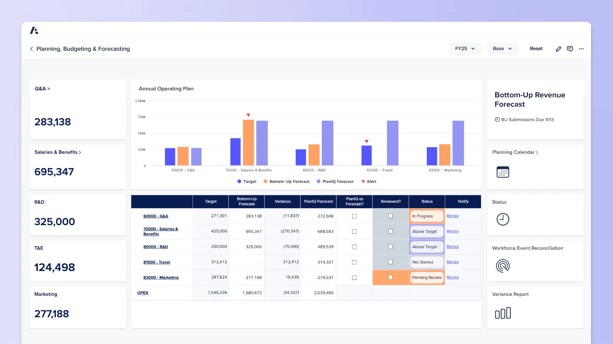

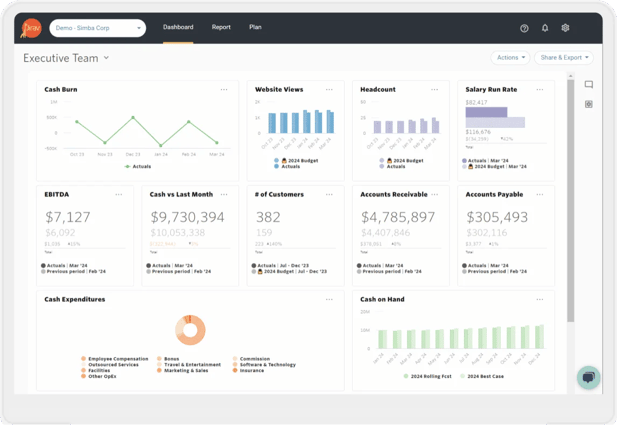

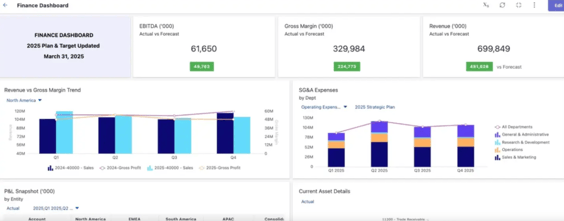

1. Cube

Cube is a spreadsheet-native, AI-powered FP&A platform that helps companies hit their numbers without having to sacrifice their spreadsheets. Cube helps retail finance departments work anywhere, integrating natively with both Excel and Google Sheets, so that they can plan, analyze, and collaborate with the ultimate speed and confidence. Cube seamlessly connects your financial and operational data, giving finance teams the ability to plan smarter and react faster. Cube allows finance teams to set ownership, control access, and eliminate version chaos, ensuring updates flow smoothly across departments. With Cube, annual planning becomes a coordinated effort that keeps everyone aligned and focused on the numbers that matter most.

Cube includes agentic AI built for FP&A. It uses governed, up-to-date financial and operational data, keeps insights explainable and traceable, and lets you control what is shared. You can ask questions in Slack or Microsoft Teams in plain English to get faster answers, deeper insights, and clearer whys behind variances.

Features:

- Scenario planning without limits: Instantly switch between budget versions and compare scenarios without losing track of context

- Multi-scenario analysis: Model and compare upside, downside, and base cases to understand financial impact and prepare for different outcomes

- Smart access: Assign permissions by role so teams see only what matters to them, keeping focus and security intact

- Conversational AI in Slack and Teams: Ask questions in plain English and get instant answers within your workflow

- Clear workflows, full visibility: Assign tasks, track changes, and keep contributors accountable with real-time audit logs showing who did what, when, and why

- Organized bottom-up planning: Allow budget owners to contribute line-item detail with real-time rollups that stay aligned across the business

- Customizable dashboards: Build dynamic dashboards tailored for executives, department heads, or board-level reporting

- Drilldown and audit trail: Click into any number to see transaction-level detail, supported by built-in version history and audit logs

- Centralized formulas and KPIs: Store logic and key metrics in one place to ensure consistency and accuracy across reports

Pros:

- Integrates seamlessly with Google Sheets and all versions of Excel (no coding or formulas needed)

- The implementation team guides quick deployment, while other software can eat up months of onboarding time

- If ever needed, Cube offers knowledgeable support from deep experts in the FP&A and tech landscapes

- Allows for extensive, quick data collection, quality assurance, and laser-sharp analysis without human error

- Includes built-in agentic AI for FP&A that provides explainable, traceable insights grounded in governed data, with plain-English Q&A in Slack and Microsoft Teams

Cons:

- Doesn't provide multilingual support as of this article’s publishing date

Learn more about Cube

2. Anaplan

Anaplan is a connected planning platform that unifies people, data, and models in one interface. Users can build scenario-driven plans, orchestrate processes with workflow, and publish management reports across finance, supply chain, sales, and HR. The platform includes a web UX, mobile access, and extensions for Microsoft 365 and Google Sheets.

Features:

- Custom pages and management reporting: Create structured pages and board-ready reports within the web UX

- Workflow and process orchestration: Embed next steps, assignments, and approvals directly in planning processes

- Microsoft 365 and Google Sheets extensions: Pull Anaplan data into Excel or Sheets for ad-hoc analysis and reporting

Pros:

- Provides flexible modeling with connected data sources

- Supports real-time what-if analysis and scenario updates

- Integrates with enterprise systems, Excel, and Google Sheets in a low-code environment

Cons:

- “The tool lacks some essential features that could help developers and users build and utilize the tool more effectively and fully leverage its potential. Lack of versioning, partial promotions, multifilter, or long rollback times are some of the most missing features.” User review

- “Anaplan's Reporting Suite has vastly improved over the last year, however, when compared to reporting centric systems such as Tableau, it still leaves much to be desired. Specifically, the Management Reporting suite needs work to become an operable alternative to standard reporting methods.” User review

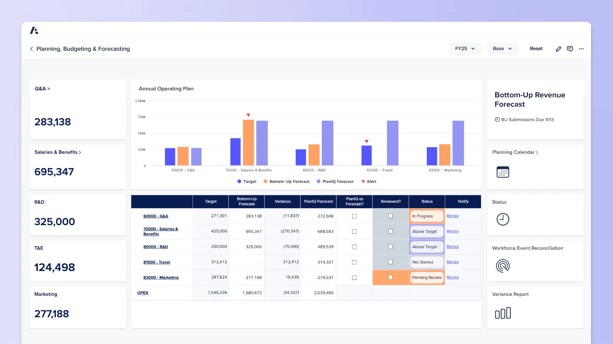

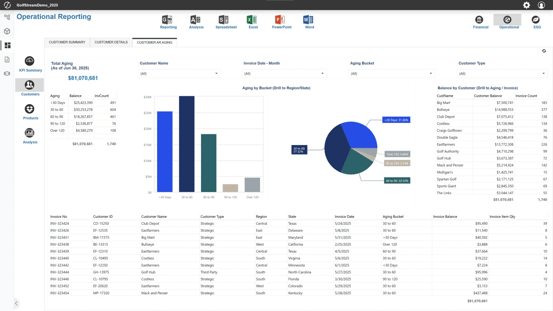

3. OneStream

OneStream is an FP&A platform that unifies actuals, budgets, rolling forecasts, and operational plans on a centralized model. Finance teams run driver-based planning, real-time scenarios, and what-if modeling with guided workflows and drill-through. The platform adds embedded AI, automated variance insights, and AI Agents to accelerate forecasting, anomaly detection, analysis, and cross-function collaboration.

Features:

- AI-augmented forecasting and analysis: Apply embedded AI for forecasting, automated variance insights, and anomaly detection

- Governance and expansion: Enforce security and compliance, eliminate reconciliations, and adds new models and domains

- Unified planning model: Connect actuals, budgets, rolling forecasts, and operational plans on one platform with guided workflows and drill-through

Pros:

- Runs driver-based, top-down, and bottom-up planning with scenario analysis

- Integrates with Excel, PowerPoint, and Power BI

- Applies AI for forecasting and automated variance insights

Cons:

- “There are certain times in Excel where the OneStream plug in doesn't work and it can be difficult to locate specific items.” User review

- The budget and forecast process could be further improved by allowing the same GL setup in SAP to be brought into OneStream. This way, we will be able to analyze using the existing breakouts (UD2/UD4) and also via specific GLs for easier comparison of actual vs forecast. User review

4. Jedox

Jedox is a financial planning and analysis software that integrates P&L, balance sheet, and cash flow data into one model. Users can automate data aggregation and use Excel with an add-in for input and reporting. It leverages AI for forecasting and insights, and runs centralized or decentralized analysis with real-time access.

Features:

- JedoxAI (AIssisted Planning): Use machine learning to support forecasting, anomaly detection, and guided insights

- Modeling and collaboration: Build shared models, manage roles and permissions, and coordinate workflows across teams

- Integration and automation: Connect ERPs, HR, CRM, and data warehouses; automate data loads and transformations

Pros:

- Transitions between P&L, balance sheet, and cash planning in one workflow

- Forecasts with live accounting data and compares actuals to forecasts

- Automate consolidation across subsidiaries and groups

Cons:

- “One area that could be improved is tracking changes within the tool, as it’s not as intuitive as it could be, making it harder to see what’s been adjusted and when. Additionally, setting up custom reports and dashboards requires a decent amount of training to get right.” User review.

- “The method of expanding from summary to detailed in the reports is clunky. Would be nice if I could select the option to show all detailed rather than having to select each heading.” User review

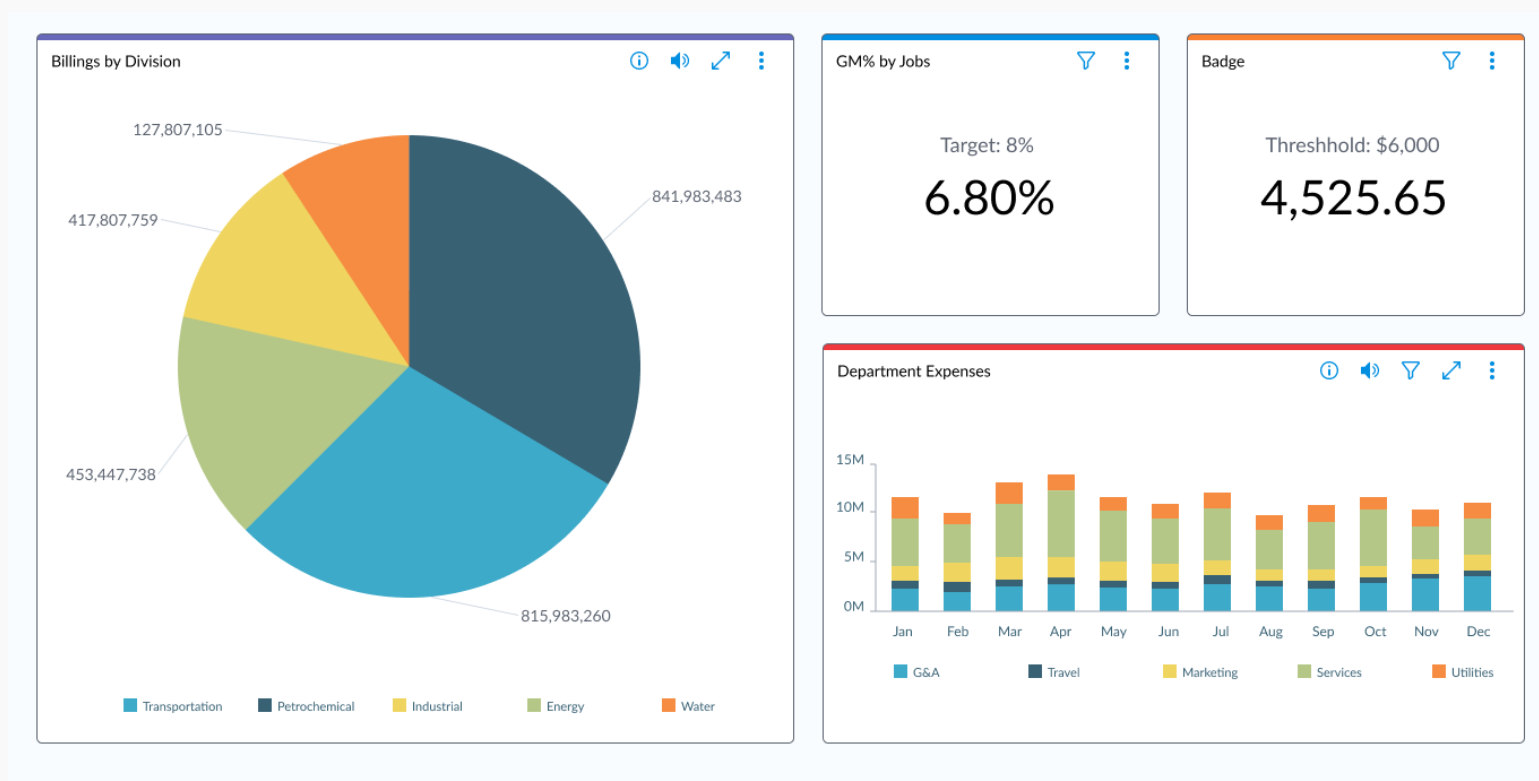

5. Jirav

Jirav unifies forecasting, budgeting, reporting, and dashboards in one platform. Users build models across the balance sheet and cash flow, and run scenarios and rolling forecasts using actual data. The platform leverages Intelligent Forecasting for AI projections

Features:

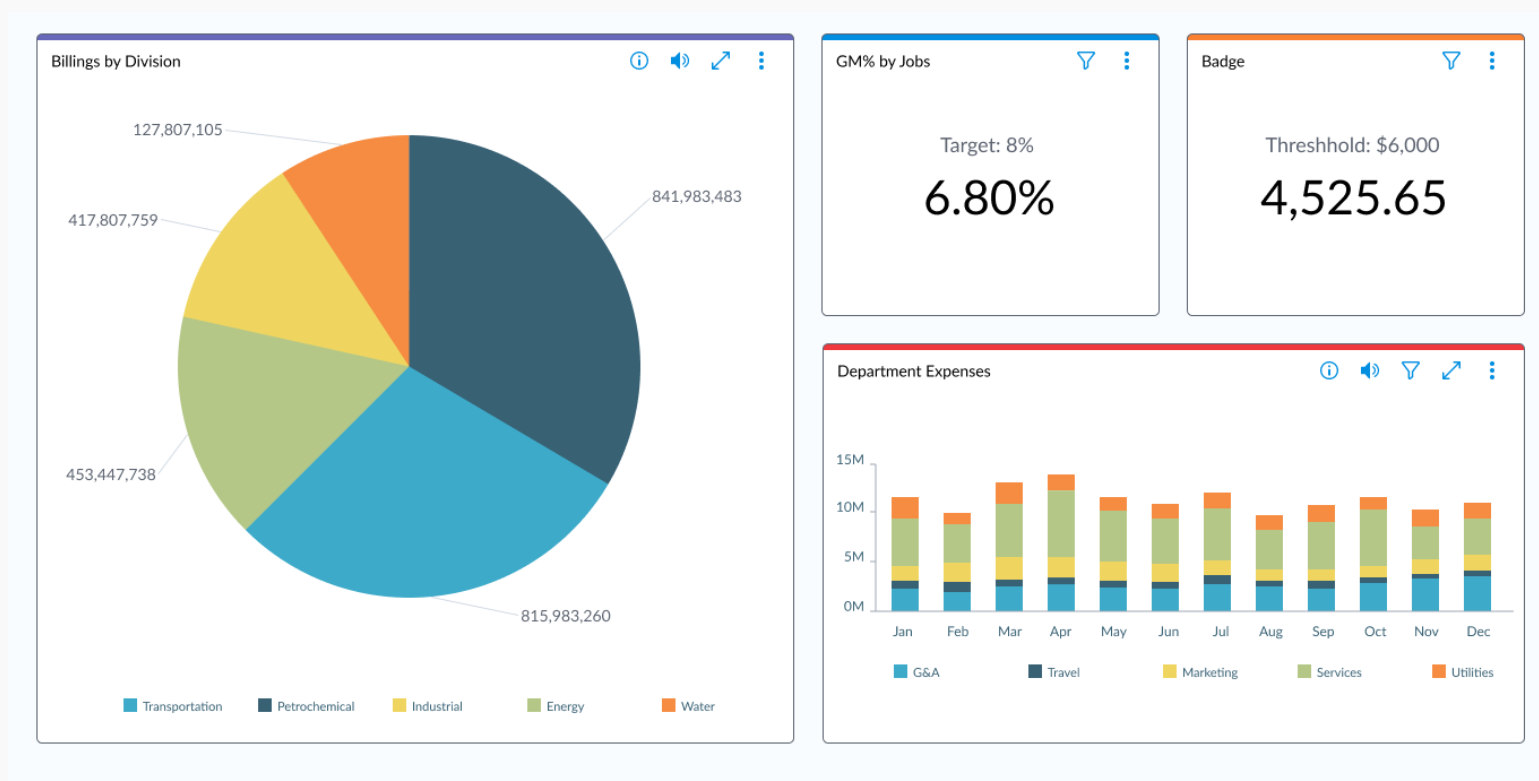

- Reporting and analytics: Build financial reports, analyze variances, and track KPIs with dashboards

- Planning, budgeting, forecasting: Forecast from historicals, set targets, or build bottom-up drivers

- Data management: Import and manage historical accounting data

Pros:

- Track workflow and process completion and sync with financial data.

- Build repeatable reports and give divisions visibility into results.

- Include cash flow on executive reports and link capital budgets to cash projections.

Cons:

- “Jirav definitely has a learning curve and it would probably be best utilized by an in-house full time person at an organization that has the capacity to continually update it. Specifically, it is time consuming to learn the drivers and how they work, and learn some of the nuances of the software such as the staffing table and how to best use it efficiently. We also encountered some challenges when using Jirav such as maintenance to the software while we were using it, although it sounds like this should not be an issue in the future. Lastly, our company's leadership team/investors need to be able to review a financial model in google sheets so we had to spend a lot of time exporting Jirav reports to excel/csv and then back into google sheets, it would be nice if there was a simpler way to do this.” User review

6. NetSuite Planning and Budgeting

NetSuite Planning and Budgeting combines budgets, forecasts, scenarios, and reporting in a single model, and syncs data from NetSuite ERP. Finance teams build revenue, OpEx, and workforce plans, use trending financial statements, and work in Microsoft Office and Google Sheets via Smart View. The platform features AI-powered predictive planning and IPM insights for monitoring trends and variances.

Features:

- Driver-based planning: Plan income, balance sheet, and cash flow with drivers

- Budgeting and forecasting: Run budgets and rolling forecasts

- Office integrations: Build and refresh reports in Microsoft Office and Google Sheets via Smart View

Pros:

- Deliver reporting with financial statements, custom reports, dashboards, tags/dimensions, and audit trails

- Offer customization, workflows, role-based access, and data import/export

- Automate processes with visual workflows and event triggers

Cons:

- “The biggest challenge we faced was training during implementation. The system is powerful, but without clear and thorough training upfront, it can feel overwhelming to new users. Even now, one of our biggest struggles is navigating the different levels of support—figuring out who to contact for help or how to get quick answers when we run into issues is often frustrating. Additionally, the reporting system, while flexible, has been difficult for many of our users to learn and use effectively.” User review

- “Biggest downside to NetSuite is the report writing. It is complicated and a bit convoluted that even our most experienced admin has to spend a fair amount of time with trial and error before getting the data sets needed. I took a class on this from NetSuite themselves, and while it was very informative and did give me a better idea on how the process is meant to work, it was too simplified. Since every company is highly customized to fit their needs, the class did not translate too well back in the office.” User review

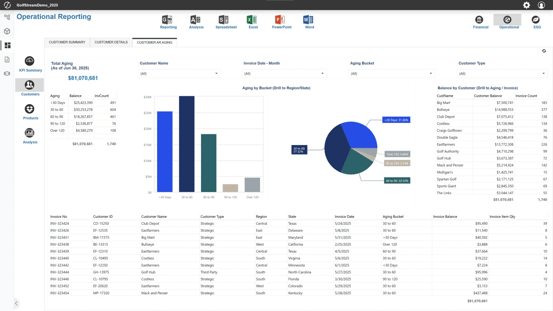

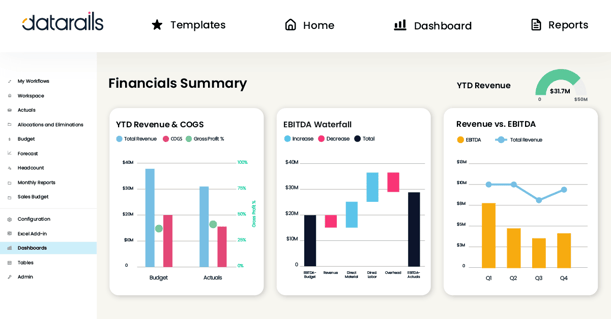

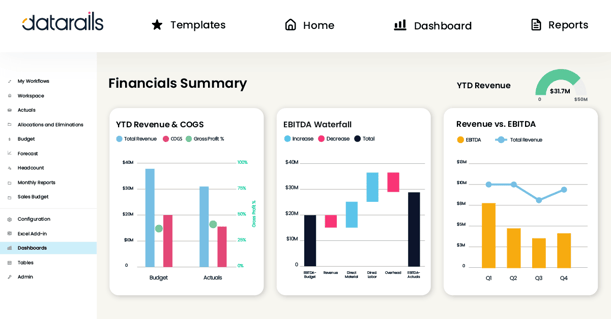

7. Datarails

Datarails is a financial planning and analysis platform that integrates data from spreadsheets, ERPs, CRMs, HRIS systems, and banks into a centralized environment. Finance teams can automate consolidation, reporting, budgeting, forecasting, and scenario modeling while continuing to use their existing Excel models. The platform also includes AI-powered analysis, dashboards, and web-enabled workflows to support planning and collaboration.

Features:

- Automated financial reporting: Generate P&L, balance sheet, and cash flow statements by consolidating data from multiple systems

- Planning, budgeting, and forecasting: Manage collaborative workflows, track versions, and create dashboards for future projections

- Scenario modeling and analysis: Build and compare different business cases with integrated data and drilldown capabilities

Pros:

- Excel-native interface with web-enabled workflows

- Automates data consolidation, reporting, and planning across sources

- Supports live reporting, dashboards, and scenario modeling

Cons:

- “The initial setup and learning curve is difficult, and I don't believe the training videos are as helpful as they could be. This is because how you map your data is up to you, meaning that, whilst the possibilities are seemingly infinite, understanding how to get there could take you years to learn how to effectively use it. I also would not say it's a very intuitive system, and you have to make a lot of mistakes before truly understanding how to use it effectively. I also dislike the way they integrate with Xero and how it shows so many journal entries that were deleted or adjusted. This has all meant I do not spend as much time with it because the time it would take to learn, design, implement, and test new reports is significantly more than continuing with the way we currently do it.” User review

- “When it comes to dashboards, there are some limitations in building them. We are still using some Excel built-in charts and our custom-made dashboards, but hopefully, we are trying to switch completely to Datarails.” User review

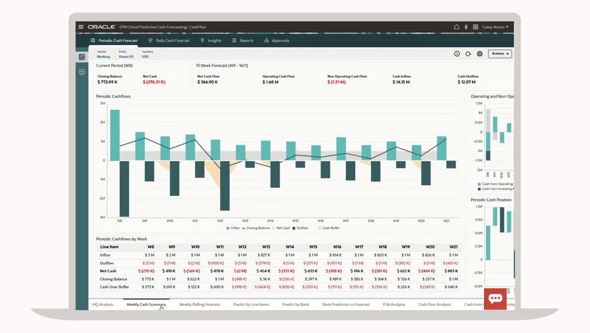

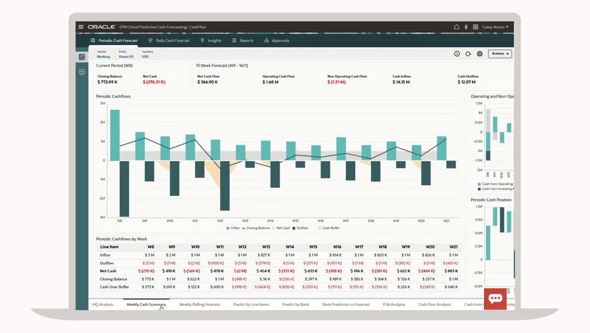

8. Oracle Cloud EPM

Oracle Cloud EPM enables users to build driver-based plans, run free-form what-if and Monte Carlo simulations, and align strategy with the impacts on income, balance sheet, and cash flow. The platform includes predictive planning and IPM for anomaly detection, plus modules for cash forecasting, workforce, capital, and project planning.

Features:

- Automated cash management: Automate collection of data streams and view cash position from one place

- Financial statement modeling: Tie plans to income, balance sheet, and cash flow and model operational cash

- Workforce planning: Plan compensation by employee or job code with drivers and HCM integrations

Pros:

- Leverages blended forecast methods

- Models cash flow using cash drivers

- Generates predictions for future bank balances

Cons:

- “The difficulty of obtaining reports and the time taken to access data as there are other programs in which data access is easier, faster and convenient for all users.” User review

- “Typically requires more IT involvement than previous generation Oracle EPM offerings.” User review

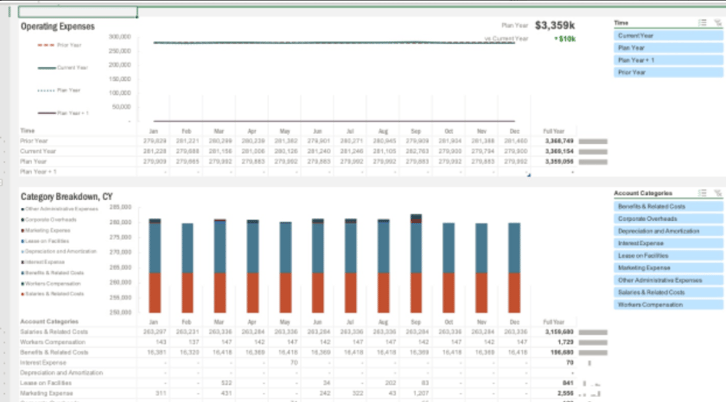

9. Planful

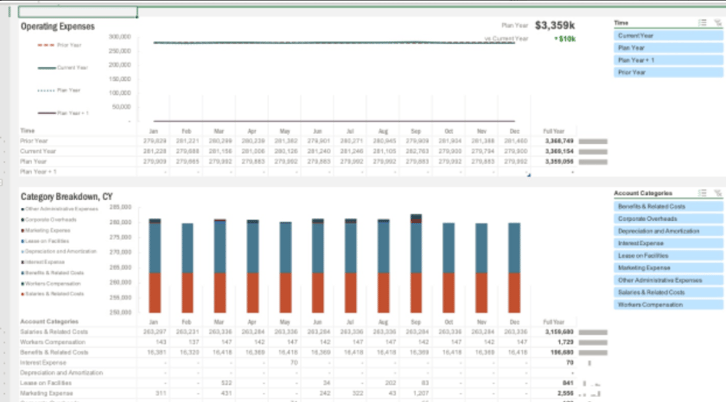

Planful is a financial performance management platform for FP&A that unifies planning, close, consolidation, and reporting in one system. Teams centralize data, build driver-based plans, run scenario analysis, and create financial reports with drill-through. The platform supports spreadsheet-style planning and seamlessly integrates accounting and finance into a continuous workflow.

Features:

- Reporting: Create ad-hoc and structured reports with reusable sets and built-in drill-downs

- Pre-built financial intelligence: Stores, categorizes, and presents data based on accounting properties

- Rolling forecasts: Configure rolling 12-month forecasts with substitution variables and update scenarios

Pros:

- Integrate with ADP Workforce Now, Deltek Costpoint, and Sage Intacct

- Manage forecasting and actuals across multiple projects

- Update projections in real time and compare to actual costs

Cons:

- “The biggest issue I’ve run into with Planful is that some of the setup and customization can be a bit rigid. For example, if a reporting structure or planning template doesn’t quite fit how we manage grants or contracts, it takes some work to get it adjusted. Also, the integration with our other systems wasn’t as seamless as we hoped initially — though that’s improved over time. It’s a powerful tool, but you need to invest time up front to make it really work for your needs.” User review

- “The user maintenance section, you have to go into a drop-down menu to edit most things. This does not work well when on a mobile device. With users across multiple time zones, people often get locked out after hours. I cannot uncheck the locked button from my phone, which would allow me to unlock someone in seconds. Now I have to log back in on a computer to do it. I wish there was a better way to do this.” User review

10. Prophix

Prophix is a platform that integrates financial and operational planning. Users model large datasets and complex calculations, run scenarios, integrate data into projections, and add workforce planning. The platform includes the Prophix Infinix engine and AI and machine learning for predictive forecasting and analysis.

Features:

- Integrated planning: Combine financial and operational planning and feed integrated data into projections

- Margin analysis: Analyze product-level margins in real time

- Workforce planning: Plan staffing costs and integrate workforce models as the company scales

Pros:

- Track workflow and process completion, and sync with financial data

- Use modules for account reconciliation, intercompany management ,and ESG reporting

- Consolidate data and build repeatable, distributable reports

Cons:

- “The reporting designs are limited, which is a huge challenge and concern.” User review

- “While the flexibility is great, my experience has been that it requires quite a bit of technical/consultancy time to get the integration setup and maintain the software due to the complexity of the implementation. The customer support has also, in my experience, been a bit slow to respond.” User review

11. Vena

Vena enables users to build budgets, forecasts, and what-if models, run workflows, and create financial and variance reports with drill-through. It includes Vena Copilot for agentic AI, permissions and audit trails, as well as add-ons for workforce, capital, and agile planning.

Features:

- Workflow: Leverages workflow to distribute templates by departments, controls submission and review processes

- Central Database: Integrates with your source systems and aggregates your data

- Variance reporting: Inserts actuals from the source system into templates for variance reports

Pros:

- Loads data from HRIS systems such as ADP, Workday, and Bamboo

- Imports Excel, CSV, and Flat Files into software

- Integrates general ledger data from ERPs such as Sage Intacct, and Microsoft Dynamics into templates

Cons:

- “It can feel a little slow when too many people are editing at once. Also, setup took longer than we expected since we had to build things from scratch.” User review

- “Implementation times can be too long. We have done one, and now doing another implementation, but it’s a very time-consuming activity.” User review

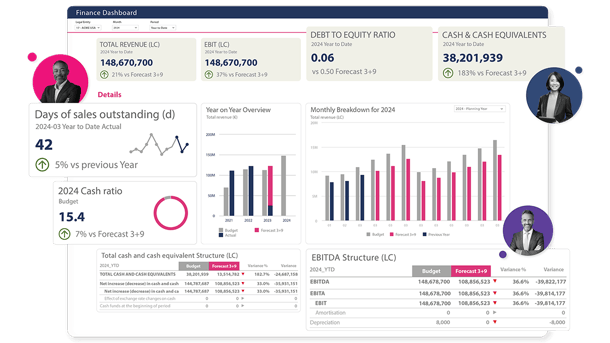

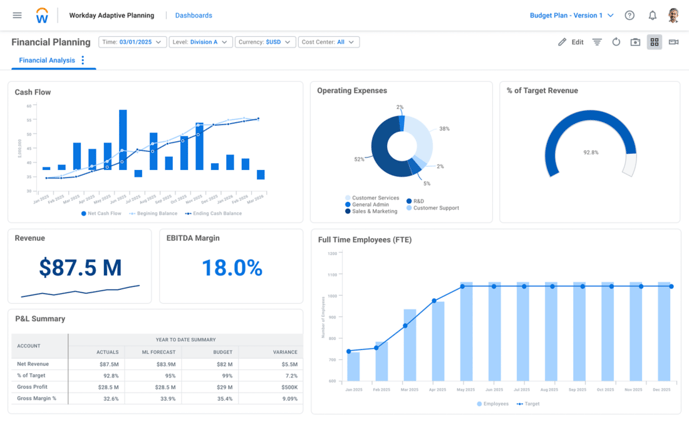

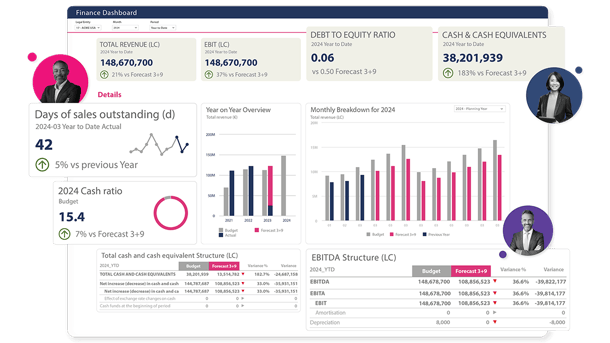

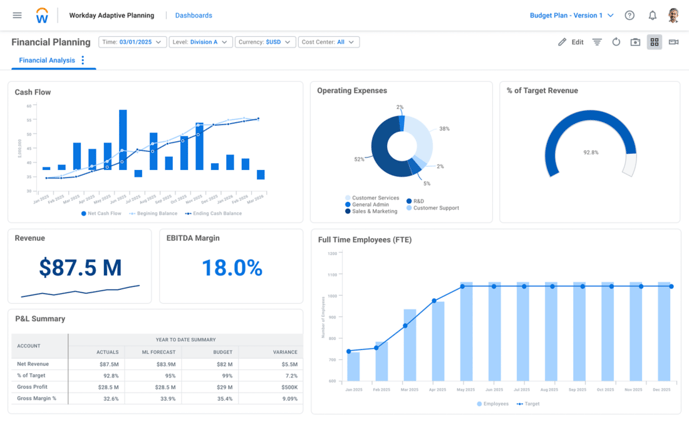

12. Workday Adaptive Planning

Workday Adaptive Planning connects planning, budgeting, forecasting, reporting, and analytics in one platform. Teams build driver-based plans, run rolling forecasts and what-if scenarios with real-time data, and model across finance and operations. The platform provides a unified model, scenario planning, and dashboards with Microsoft 365 and Google Workspace integrations.

Features:

- Reporting and dashboards: Drill into data, view variances, and refresh visuals in real time

- Consolidation and planning: Use a unified source for close, consolidation, and planning

- Forecasts and scenarios: Run rolling forecasts and scenario planning

Pros:

- Use AI Assistant and Predictive Forecaster for forecasting and analysis

- Connect planning, budgeting, forecasting, reporting, and analytics in one platform

- Manage processes with workflow and task tracking

Cons:

- “There is a very steep learning curve to using it - UI is not intuitive for beginners, and revenue modeling is still easier and more efficient to do in Excel. If you use an implementation partner, be careful about who is selected and be careful to create a setup that will not require ongoing outside expert help to maintain.” User review

- “Formulas and calculations can be tricky to manage. You need one or two administrators who have a strong knowledge of these, as well as triggers. Finding a clear learning path of the product that does not result in additional charges. Taking an accelerated class on formulas and having to pay for it or pay a consultant is not a solution when we already pay for the product. Dashboards are not user-friendly, each tile needs to be manually updated with dates. There are no features to select dates for an entire dashboard tab.” User review

Key features to look for in strategic planning software

Here are some features you should look for when choosing a strategic planning software:

Tracking tools

Tracking tools are important because they show finance teams how performance compares to the plan. By linking KPIs and variances to specific budgets and owners, they clearly identify where results are strong and where you need to take action.

They also help identify trends early. Instead of waiting until month-end, teams can see shifts in revenue, expenses, or headcount as they occur and adjust forecasts immediately.

Goal setting

Goal setting connects high-level strategy to day-to-day execution. It ensures that financial targets, budgets, and operational drivers all align with defined outcomes. This feature also creates accountability by assigning ownership and deadlines to specific goals.

That way, everyone involved in the planning process knows what their responsibilities are.

Task management

Task management keeps the planning process organized. It allows finance teams to assign owners, set due dates, and track progress across budgets and forecasts. This ensures accountability and prevents critical tasks from slipping through the cracks.

Flexible views

Flexible views enable finance teams to analyze data from different perspectives without having to rebuild reports. Whether by department, product, scenario, or time period, this flexibility accelerates reviews and ensures everyone works from the same set of numbers.

Collaboration

Strategic planning is rarely done in isolation. Finance teams need to work with business partners, share assumptions, and align on forecasts. Built-in collaboration keeps everything in one place, reduces back-and-forth, and makes the review process more efficient.

Automation and integration

Automation and integration enable direct connections between planning tools and ERP, HR, and CRM systems. By automatically pulling in actuals, they reduce manual uploads and errors, keep data current, and make it easier to trace numbers back to their source.

Data-driven insights

Data-driven insights are a key feature because they turn raw numbers into clear signals for action. The software should highlight trends, outliers, and the drivers behind results. This makes it easier to compare assumptions with actuals and see what changed. Finance teams then adjust models and forecasts based on evidence, not guesswork.

By showing which levers matter most, the tool helps prioritize decisions that move the plan. That keeps efforts focused and measurable.

Choose the best annual planning software for your business

Annual planning isn’t just about a yearly budget, it’s about aligning targets, headcount, and cash with strategy. Teams need a solution that ties plans to live actuals, supports scenario modeling, and keeps everyone working from the same numbers.

Choose a platform that connects planning, reporting, and collaboration in one workflow. With the right tool, FP&A teams can model cases, assign ownership, track status, and update forecasts without leaving the spreadsheets they already trust.

Whether you are preparing for a board cycle or coordinating department budgets, Cube gives you the clarity, control, and flexibility to plan with confidence.

Book a demo to see Cube in action.

.png)

.png)

![Best annual planning software for finance teams [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Dashboard.png)

![13 best variance analysis software [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20file.png)

![12+ Best FP&A software for small businesses [2026]](https://www.cubesoftware.com/hubfs/Cube%20website%20-%202026/Blog%20Post%20-%20Featured%20Images/Featured%20-%20Sheet%20Lines%20Chart.png)